Energy Markets Update

In this newsletter, we cover the factors you need to know impacting US energy markets as well as news about the temporary halt on the SEC's climate reporting mandate, tech companies dominance in renewable energy procurement, PJM's capacity concerns, and MISO's transmission plans. We also want to thank our departing colleague and contributor, Max Gotillot. After 2 years in Boston, Max will be returning to Paris to work for Flexcity, another Veolia company that specializes in demand response and grid balancing across the European market. Godspeed, Max!

Table of Contents

- Gas & Power Update

- Temporary Halt on SEC Climate Reporting Mandate

- Tech Companies Dominate Renewable Energy Procurement Space

- Funny Numbers: Where Will the Capacity Come From?

- MISO's Long Term Transmission Plan

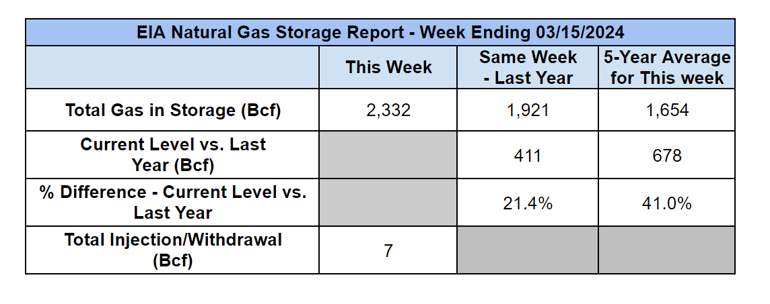

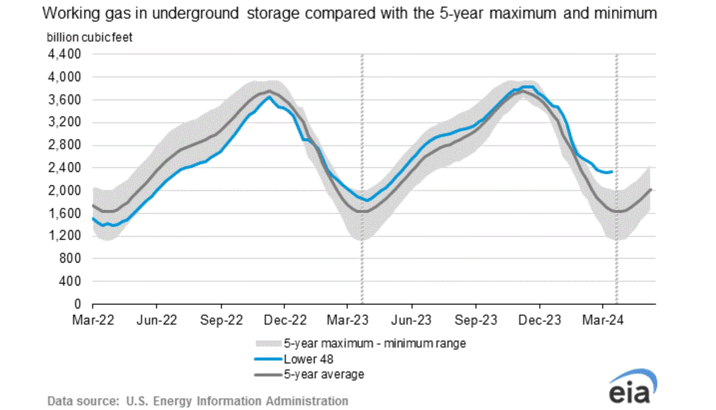

Weekly Natural Gas Inventories

The US Energy Information Administration reported last week:

- 7 Bcf increase in US natural gas storage

- 50.0 Bcf the five-year average withdrawal for March

- 2,332 Bcf total US natural gas in storage last week

- 21.4% higher than last year

- 41.0% higher than the five-year average

US Energy Market Update

A summary of recent changes and important information about the US energy markets.

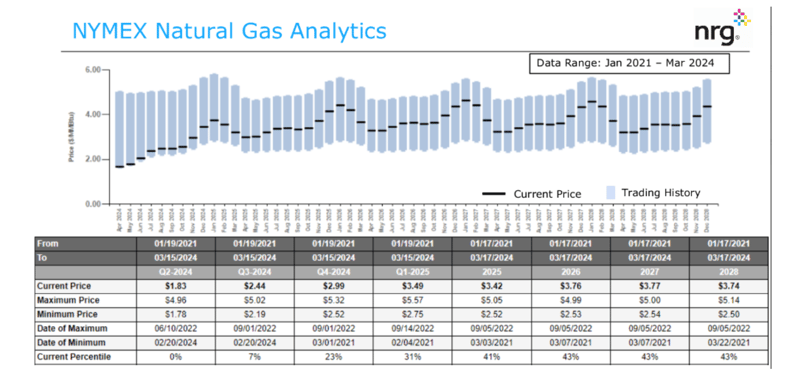

- In late February and early March, a barrage of news emerged that major gas producers planned to shut-in supply in order to sway markets higher. This did lift prices some, however indices found stable ground through the middle of March as players await more data to support the next breakout.

- Gas production has declined by about 3% over the last couple of weeks, however fundamentals remain bearish for gas and power markets – warm weather, hefty gas inventories, stable supply.

- Most analysts expect that the large cushion of gas in storage, now 41% above the 5-year average, will begin to deflate as we move into Spring; however this could take some time and continue to weigh on prices.

Natural Gas Forward Markets Three-Year Trading Range

Source: NRG & CME Data

- The 680 bcf storage surplus in the US should be considered in parallel with the 230 bcf storage in Canada–which is also nearing record highs.

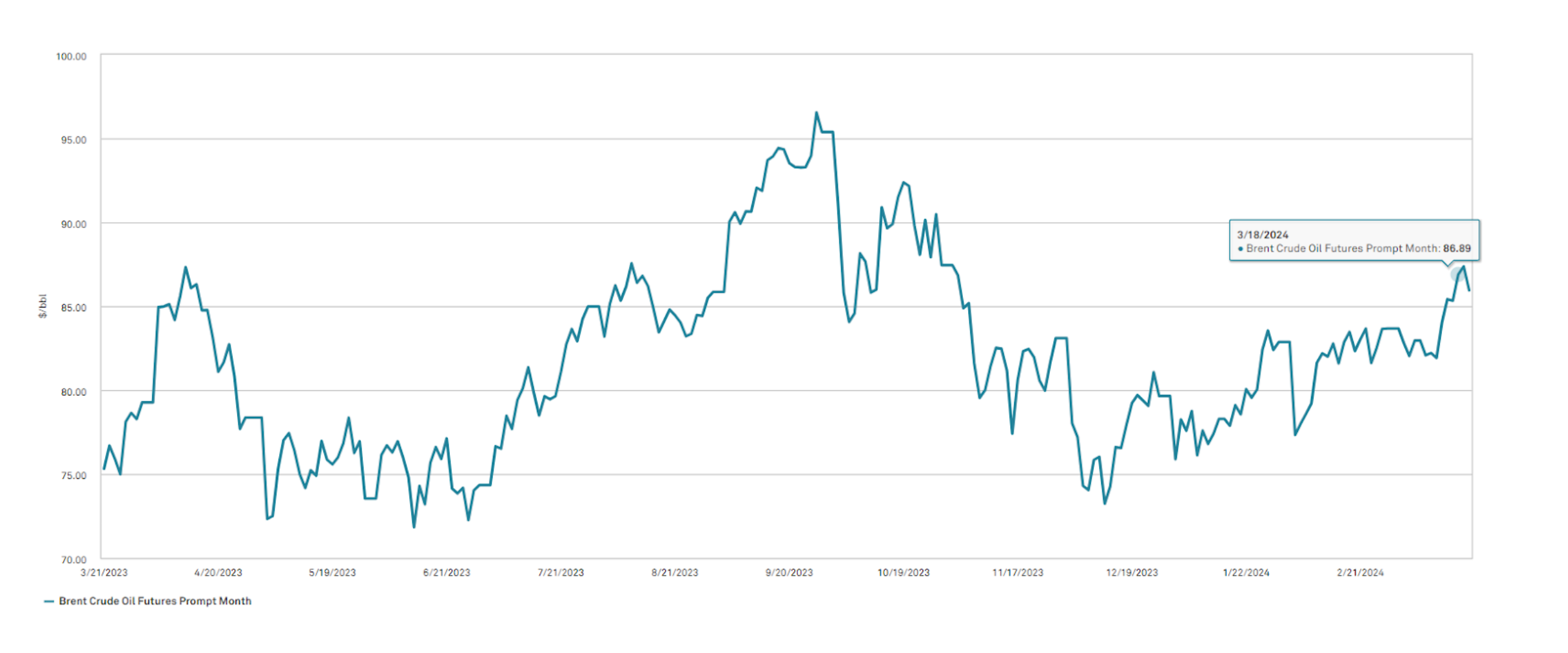

- Oil markets continued to pick up momentum in March, reaching a high of $87 bbl this week. Strengthening demand in China and widespread Ukranian drone attacks on Russian refineries are some of the primary drivers.

Crude Oil Prompt Month Prices

Source: S&P Global Market Intelligence

- Orsted and Eversource, owners of the South Fork Wind project, announced completion of the twelfth and final turbine about 35 miles off the coast of Montauk, NY. The 130 MW project is the largest offshore wind project completed in the US and it will soon commence power sales to the Long Island Power Authority. In 2017, LIPA signed a 20-year PPA with an average price starting at 13.7 cents per KWh and escalating at 2% per year. Orsted and Eversource have since scrapped further development of their offshore wind business activity in North America.

- In early March, stakeholders in New England ISO voted to adopt new interconnection standards that should help clear backlogs and bring new energy projects to market faster. The major changes will put in place a “first ready, first served” system, which should prioritize projects that are commercially ready for impact assessments and interconnection milestones.

- A federal appeals court overturned FERCs approval of a PJM motion to “throw out” results of its 2024/2025 capacity auction, during which a modeling error led to an anomalous windfall to generators. If upheld, this will result in exceptionally high capacity prices in Delmarva Power South, a zone that includes parts of Delaware, Maryland and Virginia.

Temporary Halt on SEC Climate Reporting Mandate

Liberty Energy's appeal temporarily halts the SEC's new climate disclosure mandate.

- Upstream oil and natural gas company Liberty Energy Inc. petitioned the US Court of Appeals following the SEC’s new climate reporting order issued on March 6.

- This puts a temporary halt on the SEC’s new mandate. However, the SEC noted reporting on emissions will not commence until 2027, giving the company ample time to avoid the “immediate economic hardship” it cited.

- With the temporary halt likely to be lifted soon and 19 other states suing the SEC in regional circuit courts, the agency’s plan to phase in climate disclosures in fiscal year 2025 could be delayed.

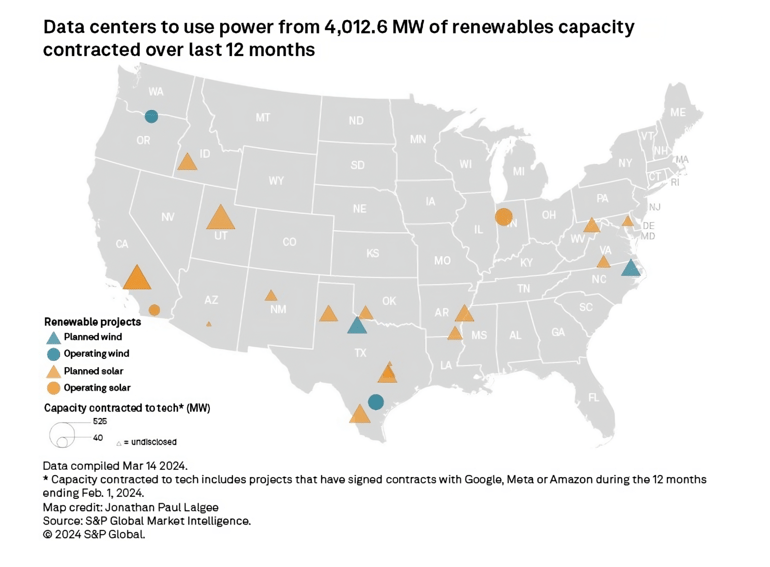

Tech Companies Dominate Renewable Power Purchase Agreement Space

Tech and datacenter companies have been the largest contractors of renewable power purchase agreements.

- As mentioned in a recent newsletter, recent growth in tech and artificial intelligence has driven a significant increase in the number of datacenters within the US. Due to the large power requirements at these around-the-clock facilities, their growth has profound implications on the buildout of the electric grid and on emissions. Most large tech companies are both highly profitable and eager to bolster their public image, so they’ve also been buying up renewable energy facilities at a staggering rate.

- To date, an estimated total of 93.5 GW of renewable energy has been contracted by US companies.

- Big Tech companies Amazon, Meta, and Alphabet, have each contracted 28 GW, 10.5 GW, and 9.5 GW, respectively, to date. Over the past 12 months alone, data centers procured an additional 4 GW of renewable energy capacity to power their facilities.

- According to S&P, tech and telecom companies account for nearly 97% of the top 10 US corporate renewable energy offtakers, by cumulative contracted capacity.

Source: S&P Global Market Intelligence

- As denoted in the graph above, Texas has continued to emerge as a center for renewable energy development and corporate contracting. Texas accounted for 3.9 GW of 9.1 GW renewable capacity procured by U.S. companies in the past 12 months.

- The state’s favorable regulatory environment, cheap land, cheap labor, and federal tax credit incentives make Texas a promising location for renewable energy development and corporate buyers. Ohio and Virginia’s renewable generation presence is also expected to grow with rising tech and datacenter demand within those states.

- Of the renewable developers supplying renewable energy to corporate buyers, AES Corp contracted the most renewable energy for datacenters. The supplier entered renewable power agreements for its 1 GW solar-plus-storage projects in Southern California with Amazon, and an additional long-term supply agreement in Virginia to Alphabet’s Google.

- Recent announcements from NuScale power, a developer of Small Modular (nuclear Reactors (SMR), indicate that datacenters are increasingly considering nuclear as a means for securing long term power. The around-the-clock production profile of nuclear reactors is conceptually a good fit, but the 10 year development cycle may not be a fit for bilateral procurement models.

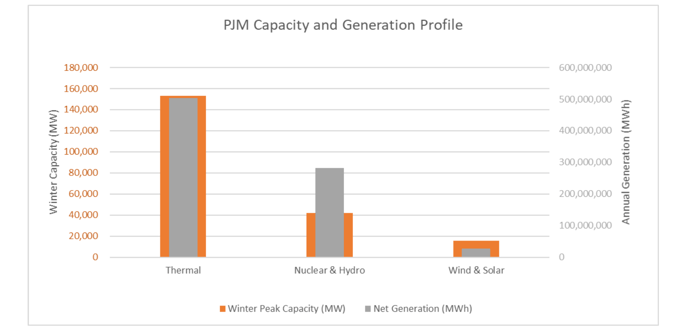

Funny Numbers: Where will the Capacity Come From?

PJM will lose an alarming amount of thermal generation resources in the coming years, without clear means of replacement.

- In its annual State of the Market briefing released last week, the independent Market Monitor of the country’s largest electric grid, PJM Interconnection, cautioned that the region could lose between 24 GW to 58 GW of thermal resources by 2030, or 12% to 30% of installed capacity, without clear means for replacement.

- Under the most dire scenarios, the Mid-Atlantic grid would be plagued by substantial rate increases and widespread deterioration of reliability.

- The prospective retirements of thermal plants include:

- 4.3 GW of scheduled retirements.

- An estimated 19.6 GW of retirements for regulatory reasons before but mostly during 2030 – this is largely tied to the EPA’s proposed rule that would limit emissions from power plants.

- As much as 33.8 GW of retirements for economic reasons based on anemic forward capacity prices from 2024 through 2026.

- The Market Monitor states that 54.2 GW of capacity was actually retired in PJM from 2011 to 2023, however, a majority of this capacity was replaced by natural gas fired generation during the same period. The natural gas power plant era now seems to be coming to a slowdown, if not a discrete end, and the Market Monitor is unequivocal in its concerns that renewables as they stand now can replace significant amounts of power, but not capacity.

- The overarching concern at PJM is valid. If thermal plants are to be retired for renewables, we must install 2X the capacity just to get comparable energy out. We would likely need to install another 1-2X the capacity value in storage resources, aka batteries, to meet reliability standards.

Source: PJM Data From EIA 860 Forms

Source: PJM Data From EIA 860 Forms

- And this week, the grid operator in New England published its own Regional Electricity Outlook, wherein it stated that it may require annual investment in new transmission of between $620M to $1 billion for the next 30 years to support the clean energy transition. NEISO expects this would be required to reach a peak of 51-57 GW in 2050.

- ISO New England’s current peak is about 28 GW and ratepayers fork out about $2.7B per year on transmission costs, which is about 30% of total wholesale electricity costs. It’s very possible that this rate base could double in the next 15+ years, and that’s just the transmission side of the equation. With offshore wind costs now surpassing $200 per MWh levelized on the most recent procurement rounds, a self-contained system could become extremely costly.

- While striking a tone of optimism and collaboration, ISO-NE clearly has some major concerns about where it is going to get its power in the future. New England is energy constrained from both an electrical transmission and gas pipeline perspective.

- The reading between the lines, NEISO is counting on pulling increasing volumes of power from Canada and adjacent grids in the future. Similar to the forecast scenario outlined for PJM, the lower power factors associated with renewable energy projects implies that significant increases in capacity will need to be added. Even so, the NEISO will likely become more reliant on interconnections with adjacent grids during peak periods of the demand.

MISO Tees Up Phase 2 of Long-Range Transmission Plan

Midcontinent Independent System Operator (MISO) reveals next steps for its region-wide transmission infrastructure plan.

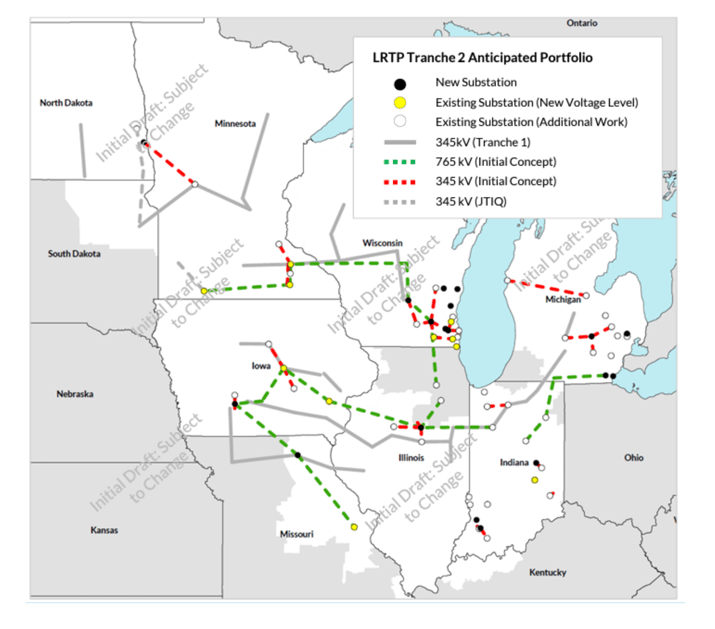

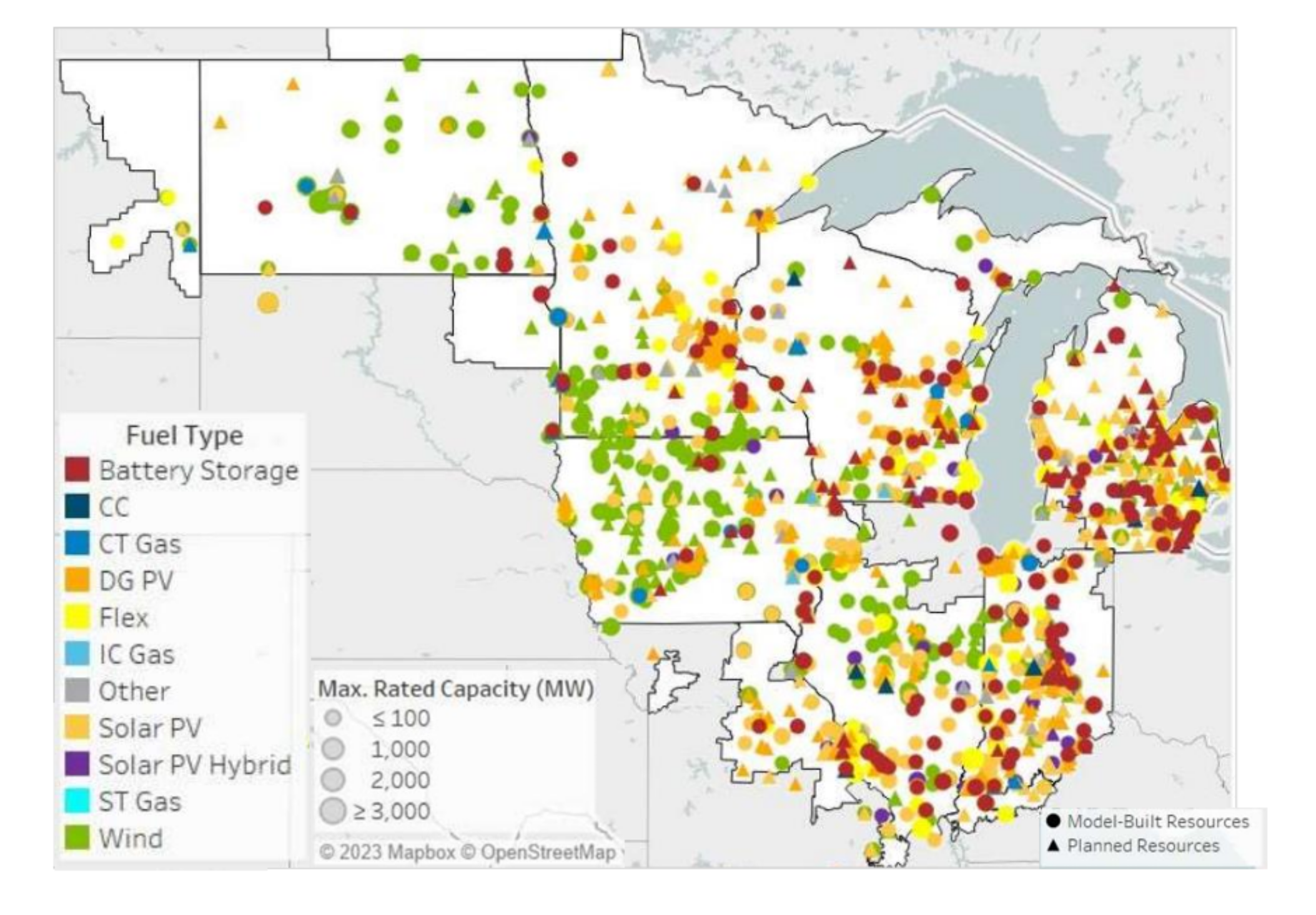

- Earlier this month MISO shared an initial draft proposal for Tranche 2 transmission solutions, which is the second phase of their Long Range Transmission Planning (LRTP) effort. The Tranche 2 portfolio aims to meet the long-term needs of the MISO region and enable future resource plans.

- The anticipated cost for Tranche 2 is between $17 - $23 billion, and it focuses on developing transmission solutions to support load growth by generation fleet changes and extreme weather events threatening electric reliability.

MISO Long Range Transmission Planning Map

Source: MISO

Source: MISO

- The portfolio includes 765 kV lines to address increasing load growth and changing resource mix, reducing right-of-way permitting needs, and addressing environmental concerns (see map below).

Built and Planned Resource Mix

Source: S&P Global Market Intelligence

- MISO anticipates recommending the final portfolio to the Board of Directors later this year, balancing the need for urgency with developing least-regrets solutions.

Natural Gas Storage Data

Source: EIA

Source: EIA

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.