Energy Markets Update

In this newsletter, we cover the factors you need to know impacting US energy markets as well as news about the SEC mandating climate-related reporting, Con Edison's demand response program, New England's capacity auction, Massachusetts' new solar incentives, Biden's FERC nominees, and the expansion of battery storage.

Table of Contents

- Gas & Power Update

- SEC Adopts Rules to Standardize Climate-Related Disclosures

- Enrollment Window for Con Edison’s Demand Response Programs Opened March 1

- ISO New England Forward Capacity Auction Results

- MA Passes Solar Net Metering Reforms

- Biden Administration Proposes 3 New FERC Nominees

- US Battery Storage Capacity Surges in 2023, Pipeline Set to Reach 128 GW

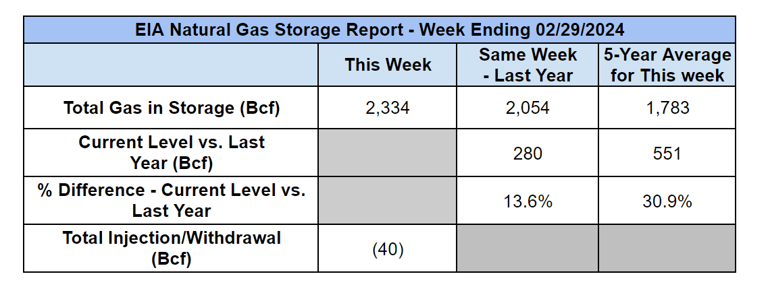

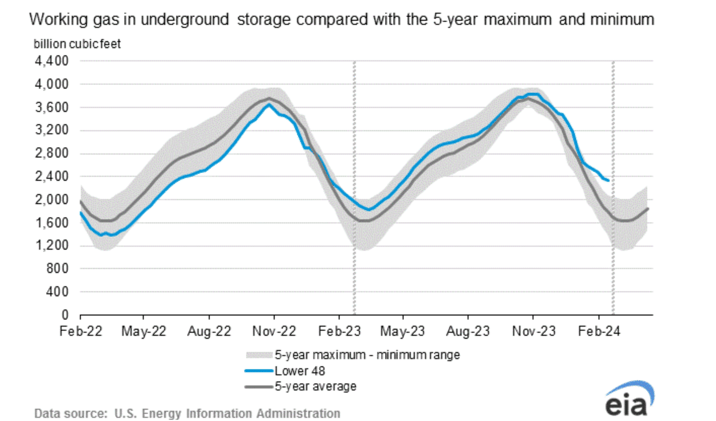

Weekly Natural Gas Inventories

The US Energy Information Administration reported last week:

- 40 Bcf decrease in US natural gas storage

- 50.0 Bcf the five-year average withdrawal for March

- 2,334 Bcf total US natural gas in storage last week

- 13.6% higher than last year

- 30.9% higher than the five-year average

US Energy Market Update

A summary of recent changes and important information about the US energy markets.

- Gas and power markets found additional support on the news that yet another gas producer, EQT, intends to cut production amid anemic natural gas prices.

- On Monday, the largest gas producer in the US announced that it had curtailed about 1 Bcf/d over the past week. EQT provided guidance that it will maintain this lower level at least through March. The driller joins a handful of other producers that have recently provided guidance of lower production or cuts in capex; Comstock, Coterra, Antero, and last week, Chesapeake.

- The market response was as expected; the balance of 2024 surged 4-5% earlier in the week, although we have seen declines of 2-3% in the past 24 hours.

- The continuation of remarkably mild weather has maintained an overall bearish course for the market. This winter may emerge as one of the warmest in decades, so for the time being, the impact of production cuts has thus far been muted.

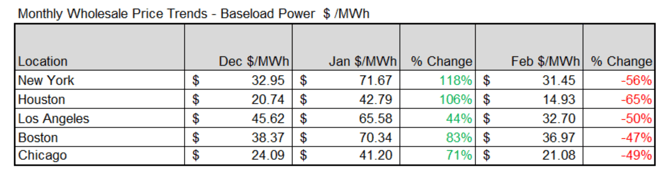

- Power prices reached near record lows in February, trading about 50% lower than in January across the board. The Chicago region in particular is having one of the cheapest winters in recent memory. Go (market) Bears!

Low February Regional Power Prices

Source: ISO Data

- FERC approved a slight delay (35 days) of the 2025/2026 capacity auction in PJM. The auction will take place in July, only a few years behind schedule (sic).

- Developers of a Federally-backed 1,200 MW clean energy transmission line from Quebec into New England have indefinitely paused the project.

- This is a serious blow to New Englanders seeking refuge from the region’s reliability woes forecasted towards the end of the decade. The decision by National Grid to kill the Twin States Clean Energy Link now leaves the region with only one transmission line to Quebec planned or under construction -- the New England Clean Energy Connect (or NECEC).

- Making matters worse for New England, the Maine state legislature has been considering a prohibition on the use of eminent domain for transmission projects. Maine has not historically played so nicely with the rest of New England on transmission issues–the state nearly killed NECEC by legislative inaction and then by ballot initiatve. After bering overturned in the courts last year, project costs ballooned due to the delay and were ultimately picked up entirely by Massachusetts ratepayers. The benefits to the region, including Maine, will be substantial. Thank you Massachusetts ratepayers.

- If the Maine legislature prohibits eminent domain, it will further add to the challenges and costs associated with bolstering reliability in the New England region.

- In a major reversal, the EPA has backed off one of the more controversial elements of its proposed GHG Emissions Draft Rule, which would have held existing power plants to nearly impossible emissions standards. Instead, the EPA proposes to enforce its standards on new assets only. This is a developing story that we will cover in future blogs.

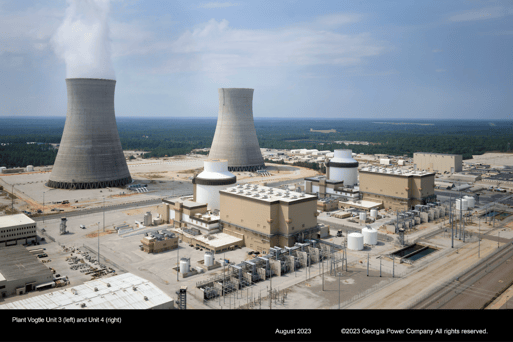

- Vogtle Nuclear Unit 4 interconnected with the electric grid behind Georgia Power this past week. It follows Vogtle 3, which became operational in July 2023, Watts Bar II (a TVA project) in 2016, Watts Bar I in 1996, and Sequoyah Station Unit 2 (also TVA) in …wait for it....1981!

- It’s been a bumpy road for nuclear power in the USA. The two Vogtle units are more than 7 years behind schedule and 120% over budget, with a total cost exceeding $35 billion. Nonetheless, the two units will add 2,200 MW of clean power to the grid. We will cover the current state of the US nuclear industry and aspirations for its newest pressurized water reactor design, the AP1000, in a future blog.

Vogtle Nuclear Power Plant

Source: Georgia Power Company

SEC Adopts Rules to Standardize Climate-Related Disclosures

The SEC will begin mandating Scope 1 and Scope 2 emissions reporting for many public companies.

- Yesterday the Securities and Exchange Commission adopted new rules that will standardize how publicly traded companies disclose information about climate risks, actions, and carbon accounting.

- Chair Gensler stated “the rules will provide investors with consistent, comparable, and decision-useful information, and issuers with clear reporting requirements.”

- Some of the notable requirements include:

- Mandated Scope 1 (direct) and/or Scope 2 emissions (electricity) for larger filers wherein emissions are deemed to be “material”, as well as an assurance report at the limited assurance level for many filers. This reporting requirement will be phased in. Notably, it does not require disclosure of any Scope 3 emissions (indirect and value-chain emissions) or any accounting for smaller companies.

- A standardized assessment of climate-related risks that have had or are reasonably likely to have a material impact on the business.

- A detailed assessment of the capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events.

- Specified disclosures regarding a registrant’s activities, if any, to mitigate climate-related risks and a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements.

- The new rules will become effective in 60 days.

Enrollment Window for Con Edison’s Demand Response Programs Opened March 1

Con Edison's two demand response programs are accepting enrollments for the next delivery year.

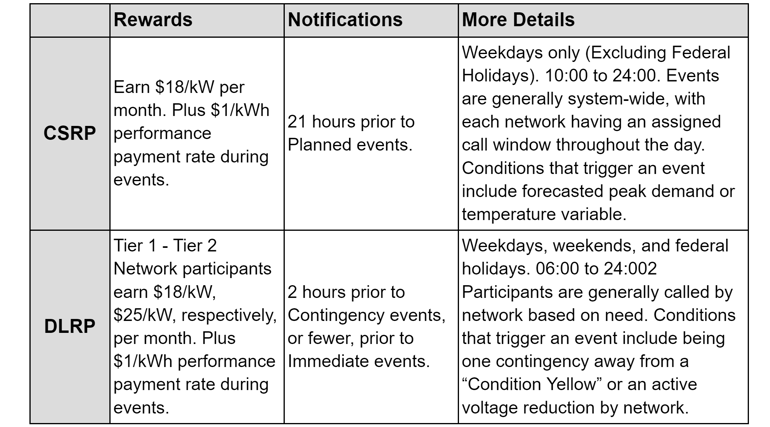

- With the summer demand season around the corner, Con Edison's CSRP (Commercial System Relief Program) and DSRP (Distribution System Relief Program) demand response portal has opened and is accepting enrollments.

- The programs are aimed at reducing strain on the power grid during periods of high electricity demand, offering financial incentives to customers who meet the requirements and successfully reduce electricity consumption. There are some differences between the two program structures.

Con Edison's Demand Response Programs

Source: Con Edison

- Customers interested in enrolling can reach out to their account manager at Veolia, or commodity@veolia.com, to discuss eligibility, program commitments, and how to quantify the reward value for enrolling this season. If your business is interested in participating deadlines to apply are March 31st for CSRP and April 30 for DLRP and the capability period starts on Monday, May 1, 2024.

ISO New England Forward Capacity Auction Results

ISO New England's 18th Forward Capacity Auction secures future resource commitments and reveals an increase in clearing price.

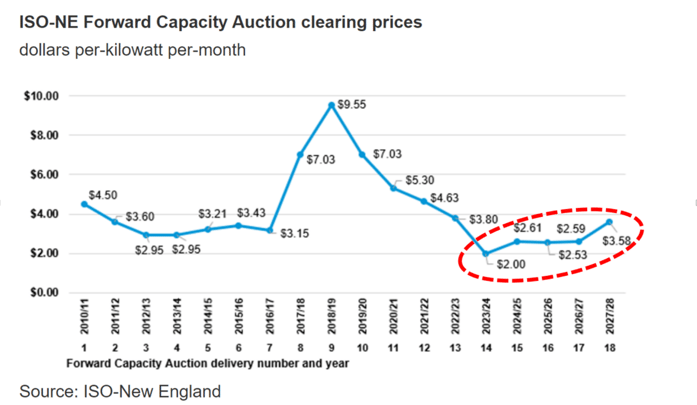

- ISO New England held its 18th Forward Capacity Auction (FCA) on February 5th and filed its results with FERC two weeks ago. This year’s auction secured generation commitment spanning from June 2027 to May 2028 and helps ensure that the ISO meets rising demand and clean energy targets.

- The FCA #18 settled at a clearing pricing of $3.58/KW-month, which is nearly $1 higher than the previous four years (FCA #14-17). For this current 2023-2024 auction, FCA #14, ISO New England generators receive $2/KW-month, the lowest price since the creation of the FCA.

Source: EIA

Source: EIA

- The auction secured a capacity of 31,566 MW, a 186 MW increase in resource commitments from this previous year, but 2,400 MW less than the current delivery year. Many years of low prices are generally an indication of supply excess, however it seems likely that the region will grow tighter around 2030, particularly if offshore wind projects are further delayed.

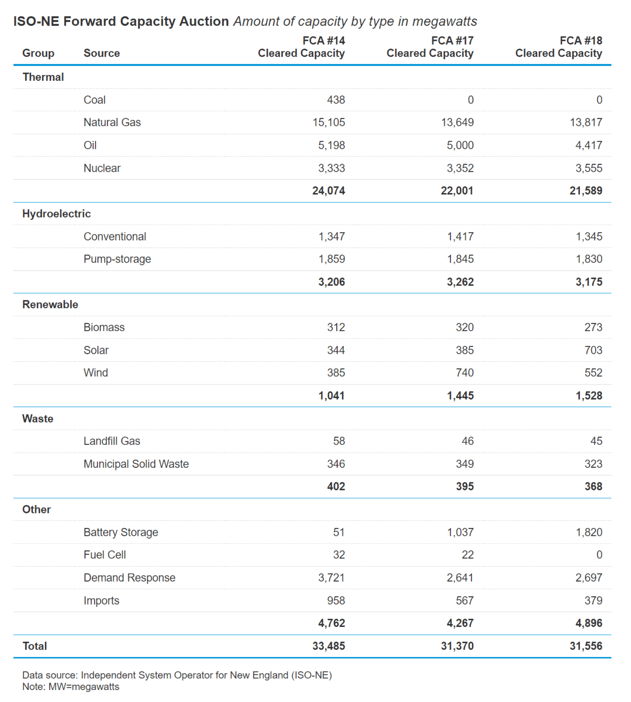

- Notable trends in this auction’s energy mix include a significant increase in battery storage commitment to more than 1800 MW, nearly 6% of the total resource commitment. Additionally, no coal plants cleared the auction and nearly 40% of the secured capacity came from non-carbon emitting resources. The chart below highlights the resource mix for commitments in FCA #14 and the most recent auctions.

ISO-NE FCA #18 Resource Commitment Mix

Source: EIA

MA Passes Solar Net Metering Reforms

Massachusetts has changed its Net Metering Program to spur more distributed solar and energy generation growth.

- The Massachusetts Department of Public Utilities (MA DPU) has announced significant changes to the state’s pioneering Net Metering Program in an order issued on February 15th.

- The program provides financial credits to utility customers that provide excess monthly power to the grid, typically from behind-the-meter solar installations. Customers may reduce their electric bills and earn credits if they provide more energy for the grid than they consume. Credits earned in high-production months can be used to offset utility charges accrued during the winter.

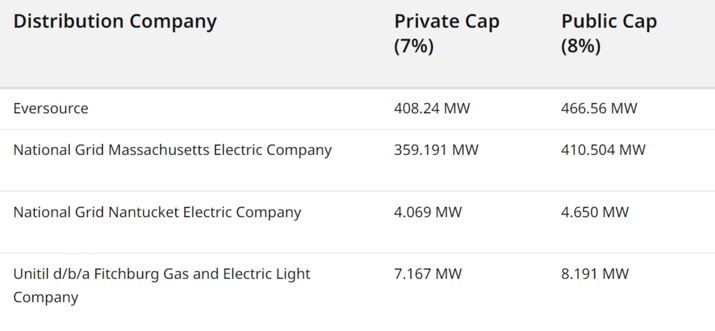

- The most meaningful revisions to the rule include the expansion of net metering cap exemptions. Before these revisions, the Net Metering Program only permitted exemptions to net metering caps for small facilities, generally 10kW or less. Now, private facilities between 60 kW and 2,000 kW and public facilities generating between 60 kW and 10,000 kW, are exempt from the cap. In other words, this is a significant expansion in the projects that will qualify for net metering credits.

- The Net Metering Program’s cap is determined as a percentage of each Massachusetts Utilities' historical peak loads: 7% for private facilities and 8% for public. Although these caps will remain the same, the new exemptions have the potential to significantly increase the amount of distributed energy generation.

MA Net Metering Program Private Versus Public Caps

Source: Mass.gov

Source: Mass.gov

- The new program will permit municipal and state-owned facilities that generate 60 KW or less to qualify for the public cap, instead of the private cap previously used, which had previously been exhausted in some utilities.

- Additionally, the DPU will allow customers to transfer net metering credits between the state's three utilities (National Grid, Eversource, and Unitil). Currently, credits can only be transferred within the same utility service territory and ISO New England load zone. This credit transfer deregulation is the first occurrence of its kind within any U.S. power market.

- Lastly, the DPU made alterations to the Net Metering Recovery Surcharge. The roughly $10MM per year charge will be excluded as a component of net metering credits and introduced as a new line item on all customers’ electric utility bills, to help lower costs for program participants. The DPU stated that these significant changes are part of a critical initiative "toward an equitable clean energy transition.”

Biden Administration Proposes 3 New FERC Nominees

The White House nominates three candidates to fill the two open FERC positions and replace another at the end of the calendar year.

- The Federal Energy Regulatory Committee (FERC), which is designed to seat up to 5 commissioners, is currently seating three, one of whom will vacate their seat at the end of 2024.

- The Biden Administration has nominated three names to fill this void. Two of the nominees are Democrats while the third is a Republican. The Administration also announced that it plans to keep current chairman Willie Philips in his current position.

- Judy Chang, a Democrat and former undersecretary of energy and climate solutions for Massachusetts, had been mentioned as a potential nominee in 2023, but did not advance. The White House sees Chang as a strong candidate due to her work in Massachusetts to create policies and align strategies to mitigate climate change. She is credited as driving Massachusetts towards a clean energy transition during the Baker Administration, who served as Governor from 2015-2023.

- David Rosner, an energy analyst with FERC since 2017, has been on an assignment with the Senate Energy and Natural Resources Committee (SENRC) and is endorsed by its chairman, Joe Manchin. Rosner, a Democrat, has been involved in SENRC’s efforts to create infrastructure permitting legislation. Rosner has experience with clean energy, transmission, and fuel security. He led a FERC technical conference about offshore wind, has provided technical assistance to India, and has also worked at the Department of Energy’s Office of Climate and Environmental Analysis and the Bipartisan Policy Center.

- Lindsay See, a Republican solicitor general of West Virginia, has been heavily involved in climate cases with the West Virginia Supreme Court. One case, EPA v. W. VA restricted the EPA’s ability to drastically change the energy resource mix in the US.

- It is important that the White House fills these seats since a two person committee would not be able to rule on important issues of infrastructure and policy. The White House has already sent the nominations to the Senate.

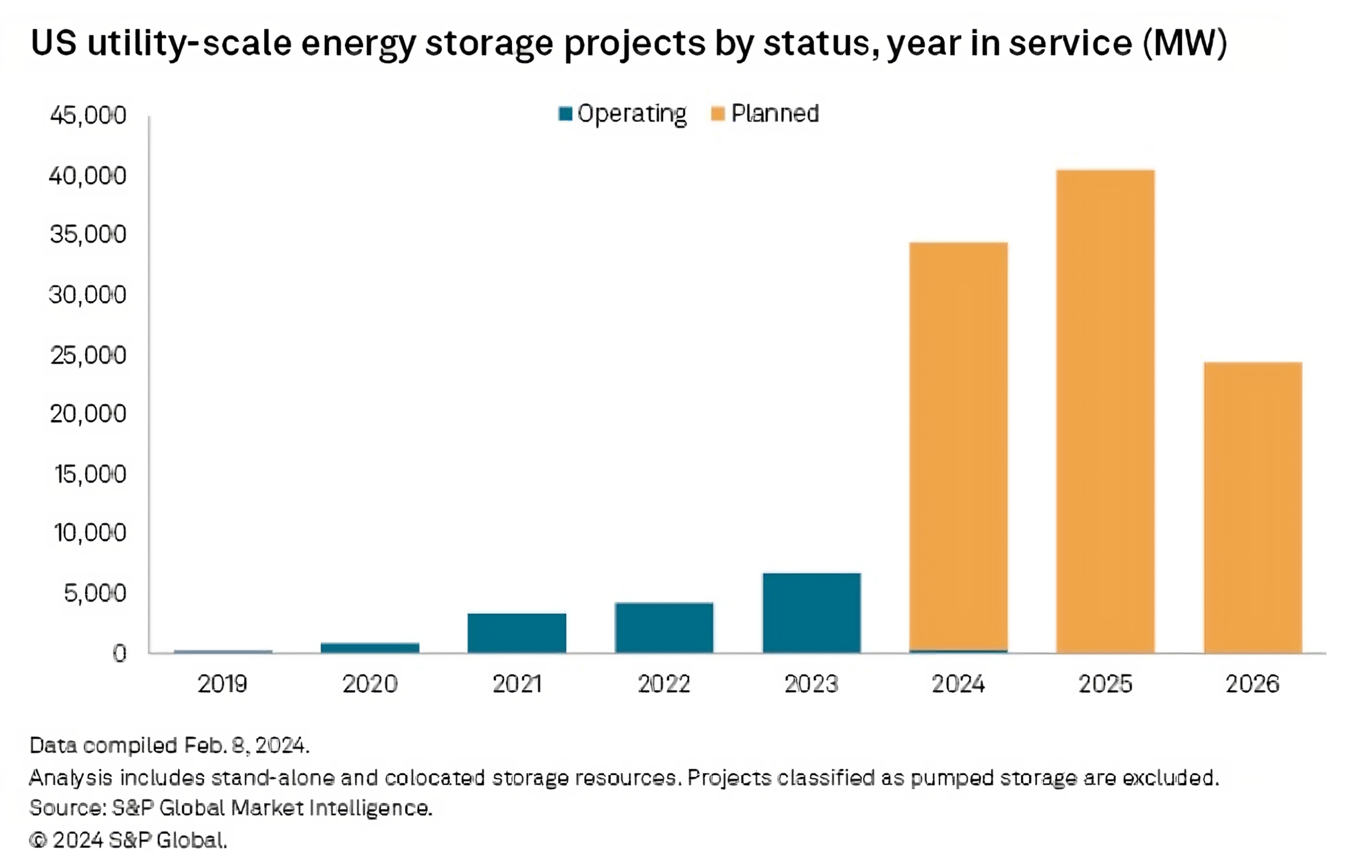

US Battery Storage Capacity Surges in 2023, Pipeline Set to Reach 128 GW

Battery storage has seen rapid utility-scale expansion and is expected to continue growing at even greater rates.

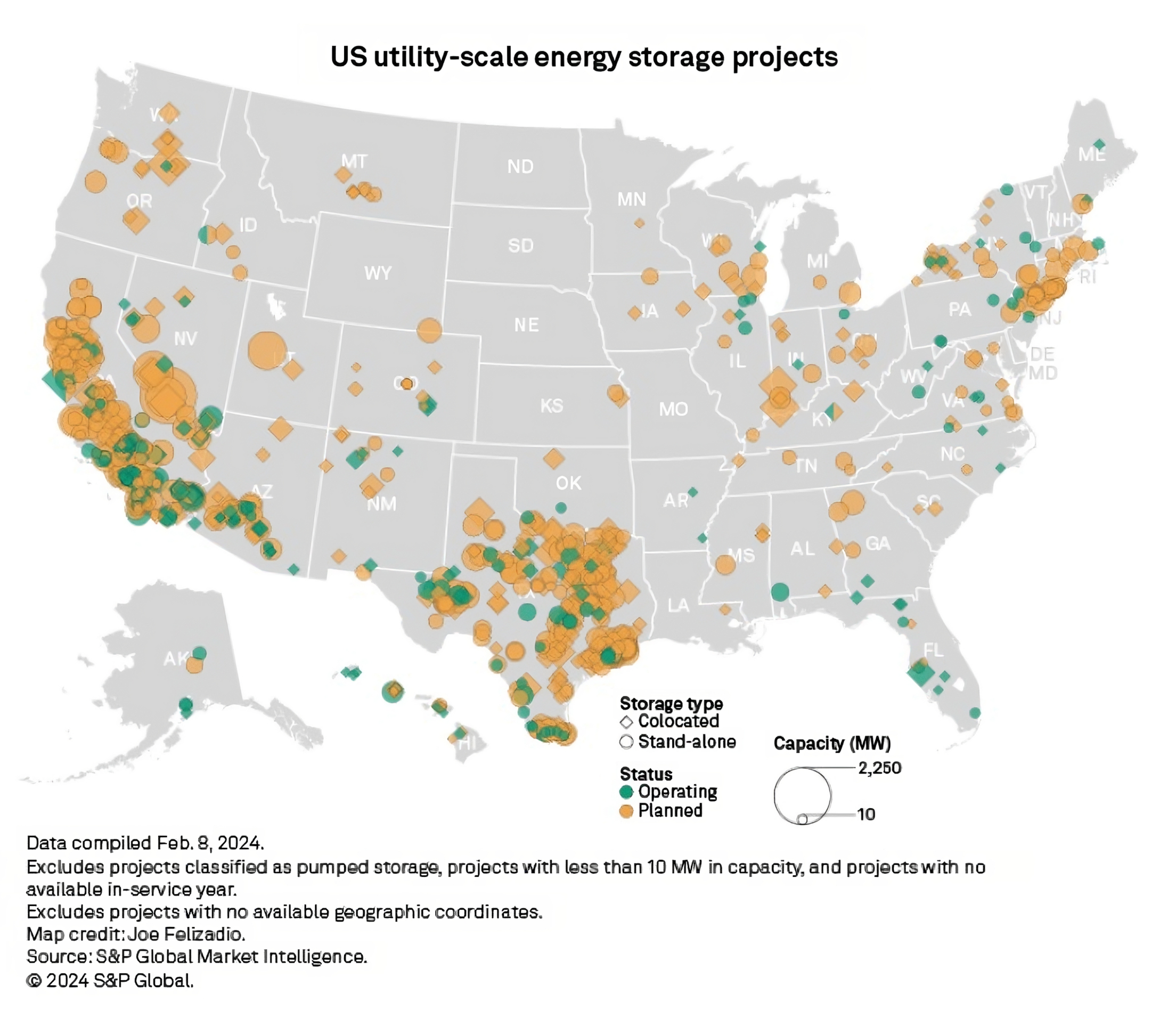

- The US added 6.8 GW of new large-scale battery power storage capacity in 2023, a 59% increase from the previous year. This includes more than 120 installations with an even mix of stand-alone projects and those colocated with other energy plants.

- California, Texas, and the greater Southwest region lead in the installation of non-hydroelectric storage resources, with a total of approximately 17 GW (see US installation map below).

Source: S&P

- Utility-scale battery storage is an important emerging energy asset class because it can help to balance and stabilize the bulk energy system by storing excess electricity during times of low demand and releasing it during times of high demand. In half the new developments last year, its colocation allowed for the integration of more renewable energy sources, such as solar and wind, by providing a way to store and dispatch their intermittent power output. Colocation better allows for the smoothing of renewable power output, which can have hyper regional benefits on lines that are nearing full capacity.

- The largest project completed last year was Terra-Gen LLC's Edwards & Sanborn solar-plus-storage complex in Southern California, with 971 MW / 3,287 MWh of energy storage resources and about 800 MW of adjacent solar capacity. It is currently the largest hybrid facility of its kind in the US.

- The US battery storage pipeline is expected to reach 128 GW, with over 110 GW planned through 2030 (see chart below).

Source: S&P

- Development timelines often lag behind installations. In early 2023 for example, developers had planned to add about 22 GW of battery power storage during the year, but only 31% of that target was achieved.

- According to S&P Global Commodity Insight, there are firm projects totaling 4.2 GW expected to be completed in 2024 and forecasts for another 23 GW of total installed battery power storage capacity by the end of 2025.

Natural Gas Storage Data

Source: EIA

Source: EIA

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.