Energy Markets Update

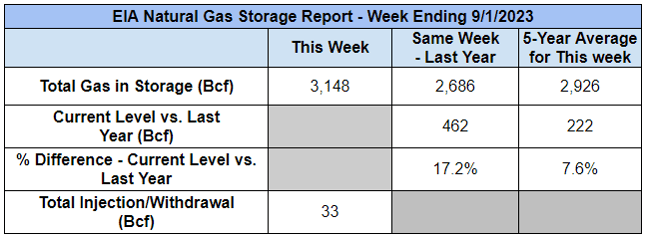

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 33 Bcf. The five-year average injection for September is about 81.4 Bcf. Total U.S. natural gas in storage stood at 3,148 Bcf last week, 17.2% higher than last year and 7.6% higher than the five-year average.

US power & gas update

- Power and gas markets were mostly unchanged over the final weeks of summer. NYMEX prompt gas trades around $2.55 per MMbtu while balance of 2023 hovers around $3.00 and 2024 trades at $3.40.

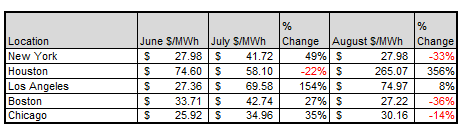

- ERCOT power prices were up 350% in August, to $270/MWh. Most other regions posted wholesale electricity price reductions in month over month. Here is a summary of monthly average prices for the summer:

Source: Veolia & RTO data

- Gas demand from the power sector continues to set records, making up for softening demand from commercial customers.

- The decline of gas drilling rigs appears to be tapering somewhat, but it’s too early to read much into it. Despite a rather stark reduction in the gas rig count however, production remains suprisingly flat. Producers are honing efficiencies in existing wells.

- On Thursday August 31, the California PUC approved a higher storage capacity for Aliso Canyon, increasing the allowable capacity from 41.16 Bcf to 68.6 Bcf. It’s worth noting that this resource is a backstop to California’s strategic gas supply. Its compromise in 2015 resulted in a lower allowed capacity and Californians paid dearly for having inadequate storage last winter; they paid premiums of > $8/MMbtu for much of last winter.

- In the second quarter, renewable energy developers connected 2,383 MW of solar power capacity to US electric grids, a 24% drop from the year-ago, but the pipeline remains strong.

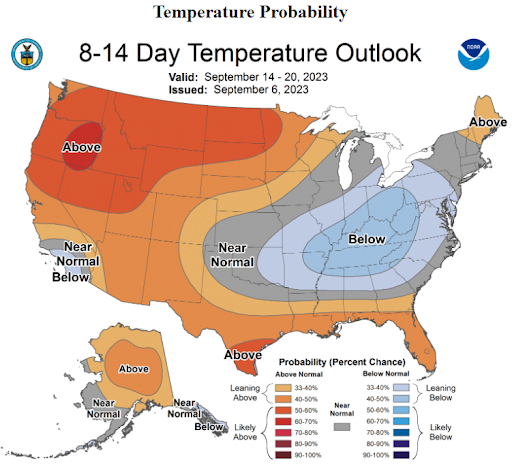

- A late season heatwave this week is expected to set annual peak loads in the Mid-Atlantic PJM region and New England ISO. By next week, the heat is expected to exit the Northeast and head west.

Source: NOAA

Source: NOAA

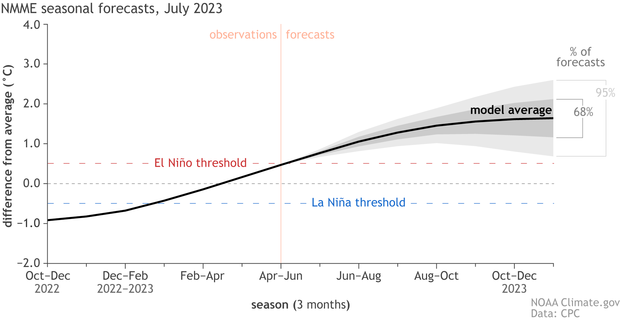

El Niño threatens higher temperatures, lower gas use this winter

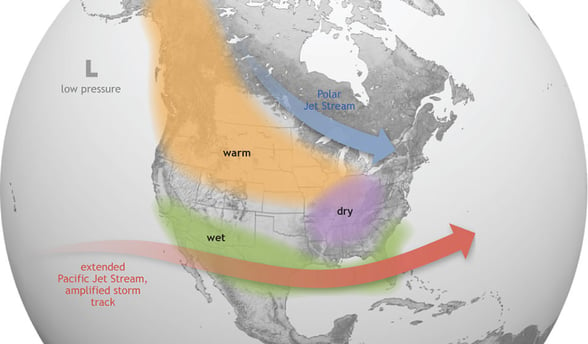

- What is El Niño? Normally, trade winds off the eastern coast of South America blow westward towards Asia, dragging with them warm coastal waters and allowing colder waters to rise to the surface. El Niño occurs when a weakening of those trade winds allows warm water to flow back east, leading to milder temperatures. Consequently, the Pacific jet stream moves southwards, pulling warm, humid conditions to the Southern United States and warm, dry conditions to the Northern United States.

- Predicting El Niño's impacts can be hard. No matter how often experts look back on previous occurrences of this weather pattern, the ultimate economic and geopolitical impacts are always up in the air…(get it?)

Source: NOAA

- The effects of this year’s El Niño pattern were observed notably early. NOAA predicts a 95% change that this strong El Niño pattern will continue through February 2024 and this is a pretty clear cut indicator compared to prior year forecasts with less confidence.

Source: NOAA

Source: NOAA

- Our May 18th newsletter release covered how El Niño could impact summer temperatures and global energy markets. As we look ahead, will a warmer winter impact energy markets in a similar way? How might it be different?

- With warmer temperatures, markets can expect lower demand for natural gas heating, a bearish indicator for winter prices.

- Historically, winters with strong El Niño conditions in North America have seen 7% fewer heating days (which is a measurement of the energy demand to heat homes and businesses over the winter).

- In electricity markets reliant on hydroelectric power such as the Pacific Northwest, El Niño threatens higher prices as altered rainfall patterns decrease electricity generation capacity and may necessitate power generation from gas and power plants (consequently raising gas prices).

- In northern Europe, El Niño years trend mild and wet to start to winter (Nov-Dec) and a colder, drier end to winter (Jan-Mar). In southern Europe, El Niño typically brings more precipitation over the winter months.

- Already this summer, the Danube River in Budapest is over 1 meter lower, threatening a grain crop transportation route to Ukraine. The Rhine in Germany is lower than 1 meter, making barge passes nearly impossible. Warmer water temperatures in France has resulted in less capacity to cool nuclear reactors, leading EDF to scale back generation and leading to an increase in electric prices.

- As the Northern hemisphere shifts into winter, the Southern hemisphere shifts into summer, when their crop seasons begin.

- Emerging economies (many of which exist in the global south and geographic south) are more vulnerable to the effects of El Niño. Particularly, the agricultural sectors of countries such as India, Egypt, and the Philippines may not have the fiscal backing of their governments should harvest seasons flop. As a result, decreased crop yields may impact worldwide food supply and pricing.

- This year’s El Niño has so far met experts’ expectations to be a strong one. With time, we will be able to tell how this expectation holds up through what looks to be a turbulent winter for global markets.

MA utilities publish ambitious plans for grid modernization

- The two largest utilities in Massachusetts filed draft plans this week outlining how they will expand and upgrade their electric grids to meet rising demand while remaining on track to achieve the state's net-zero emissions target by 2050.

- The grid modernization plans include building new substations and upgrading others, making system improvements to better withstand the impacts of major storms, flooding, and other threats increasing due to climate change, installing smart meters and other devices to improve grid monitoring and communication, converting overhead lines to underground cables and integrating renewable energy sources into the grid. The grid modernization plans are part of Massachusetts' efforts to achieve its clean energy and climate goals. The state has set a goal of achieving net-zero emissions by 2050.

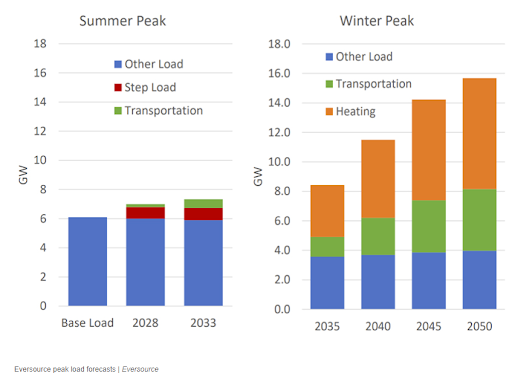

- Eversource expects the demand for electricity in its service area to increase by 20% in the next decade and by 150% by 2050. The growth over the next decade is anticipated from electrification of heating systems (50%) and transportation (25%), as well as normal load growth (25%). National Grid expects its peak demand to double by 2050, and the company says the $2 billion investment over the next five years will help it meet that demand while also reducing emissions.

- The investments are being made to improve the reliability and resilience of the grid, as well as to make it more efficient and sustainable. Indeed, Eversource’s plan is to increase its grid capacity by 180% (or 3.4 GW), which would permit the adoption of 2.5 million electric vehicles and 1 million heat pumps across the Eversource service territory in Massachusetts, as well as the connection of 2.2 GW of solar. This exceeds the state’s 2040 solar goal and brings the company up to 72% of the 2050 goal.

- National Grid plans to expand its grid capacity by 4 GW by 2035 to accommodate an additional 1.1 million electric vehicles and 750,000 electric heat pumps. The utility estimates that this will increase annual customer bills by about 2% over the initial investment period.

Source: Eversource

Source: Eversource

DOE announces grants for transmission & battery investments

- The Department of Energy knows that an upgraded transmission infrastructure is needed to support an ever-increasing demand for electricity, especially in the wake of a boom in renewable energy generation. Independent estimates point to a 60% increase in transmission capacity needed by 2030 and nearly 300% increase by 2050.

- The new Transmission Siting and Economic Development Program offers $100 million for transmission siting and permitting and $200 million for economic development of communities where transmission infrastructure is installed.

- Is this enough to make the multi-billions of dollars in transmission investment that are necessary? Of course not, but a guaranteed rate of return of 12% is a pretty good incentive, no?

- The Department’s aim is for funds to streamline permitting and public coordination processes.

- Siting and permitting applicants can be awarded funds towards study processes and hiring consultants. Economic development applicants can be awarded funds towards energy resilience projects such as battery storage, EV charging infrastructure, and microgrids/distributed generation.

- Additionally, the DOE announced $15.5 billion to support the EV transition. The funds support battery development facilities and retrofitting existing automobile manufacturing facilities to pivot to EV manufacturing.

- On a sourcing level, $3.5 billion of the funding supports materials sourcing for EV batteries to make the US less reliant on foreign supply chains for such materials.

- Preference is given to projects that demonstrate commitments to collective bargaining agreements.

- There is no doubt that the country is moving to an EV-dominated automobile industry. Such investments now are crucial to meeting decarbonization and EV-requirement goals in a timely manner.

EPA’s plan to cut emissions met with wide scale rebuke

- In May of this year, the U.S. Environmental Protection Agency (EPA) proposed new carbon pollution standards for coal and natural gas-fired power plants. The EPA' proposal has initial compliance requirements starting in 2030 for coal-fired generators and 2032 for gas-fired units.

- According to the the EPA, as required by section 111 of the Clean Air Act, the proposed carbon pollution standards consider a range of technologies including utilizing low-GHG hydrogen and Carbon Sequestration & Storage (CSS). Gas-fired combustion turbines larger that 300 MW and with at least a 50% capacity factor have two compliance options: CCS with 90% carbon capture by 2035, or co-firing of 30% low-GHG hydrogen beginning in 2032 and co-firing 96% starting in 2038.

- Reactions to the proposal have been a combination of rebuke and audible sighs. Utility and power sector trade groups, including the Edison Electric Institute (EEI) and others, are expressing concerns about the feasibility of complying with the proposed standards with hydrogen blending and CCS technology, which are not commercially available and generally untested outside of just a couple of demonstration projects. Some go as far as saying the emissions standards for power plants violate the Clean Air Act.

- The trade groups like the American Public Power Association (APPA) believe that the EPA downplays infrastructure challenges associated with deploying these technologies. Additionally, concerns are raised about the potential retirement of gas and coal-fired capacity due to the proposed standards, which could impact electricity supply.

- Most have called on the EPA to simply drop or entirely rework their proposal. Others such as APPA are calling for extending the proposal's deadlines by at least two years to provide utilities more time to build new generation capacity and address concerns about electric reliability and affordability.

Offshore wind updates

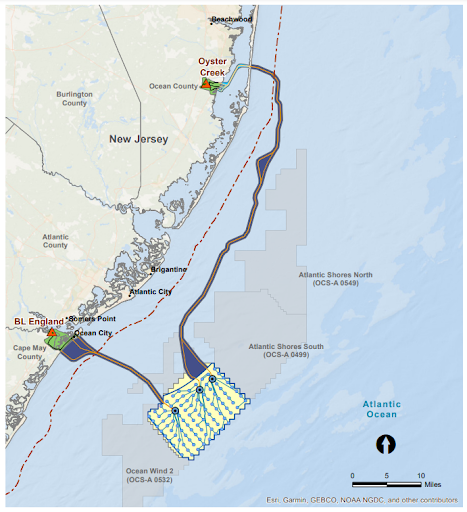

Ørsted

- Ørsted, the Danish renewable energy giant, has indicated that it may need to write off up to $2.12 billion due to supply chain problems and other issues at three major offshore wind installations along the U.S. East Coast. Delays in suppliers and contractors, including those providing wind turbine components and installation vessels, have contributed to these challenges.

- Ørsted’s Ocean Wind I project, scheduled to be developed off the southern New Jersey coast will be delayed until at least 2026. Although Orsted has gone as far as to say it is considering simply abandoning the Ocean Wind I project altogether.

Source: U.S. Department of the Interior

- The company's shares have fallen by 25 percent in response to this news.

New York

- The fallout from state-contracted renewable energy projects continues in the Northeast.

- The New York regulator is reviewing a barrage of price increase requests from previously contracted renewable energy developers. The NY PSC is considering petitions to adjust contract terms for 91 renewable energy projects totaling 13.5 GW. These projects would supply nearly 25% of New York’s load in 2030, according to NYSERDA.

- On average, offshore wind developers in NY are seeking a 48% increase in prices to $167.25/MWh. A petition from the Alliance for Clean Energy New York asked the PSC to increase onshore wind contract prices by 71% to $115.66/MWh and solar prices by 63% to $102.22/MWh, according to NYSERDA.

Massachusetts Procurement

- The Bay State has issued its fourth and largest offshore wind solicitation, aiming to select up to 3,600 MW of offshore wind generation.

- The request for proposals (RFP) provides flexibility, allows bids ranging from 200 MW to 2,400 MW, permits alternative indexed pricing proposals to mitigate risks, and welcomes bidders with a history of terminated contracts.

Natural Gas Storage Data

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.