Energy Markets Update

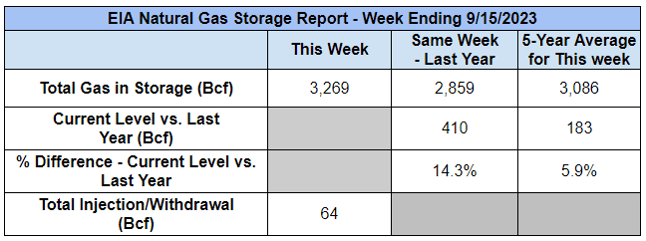

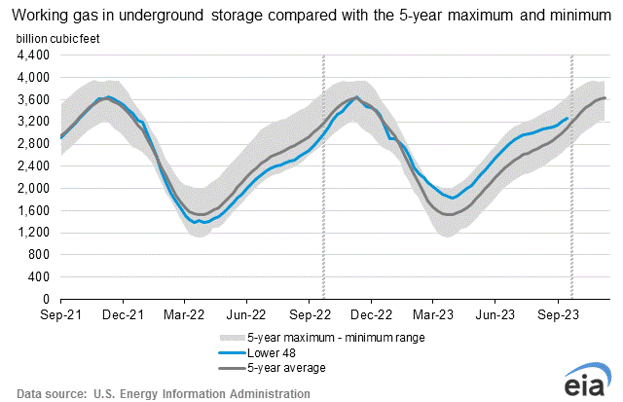

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 64 Bcf. The five-year average injection for September is about 81.4 Bcf. Total U.S. natural gas in storage stood at 3,269 Bcf last week, 14.3% higher than last year and 5.9% higher than the five-year average.

US power & gas update

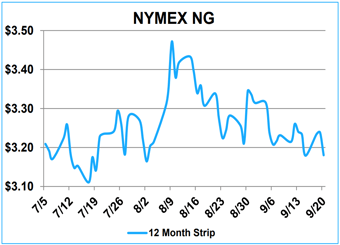

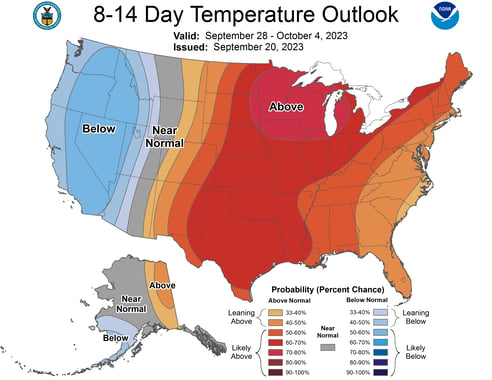

- Forward markets for winter power and gas are down slightly month over month, reflecting steady gas production and expectations of a healthy end-of-year storage inventory.

- NYMEX gas for Q1 2024 is off about $0.37 per MMBtu, or 10%, from its $3.77 per MMBtu settlement on August 21st.

Source: NRG

Source: NRG

- However, in most Eastern US markets, spot prices for natural gas have increased about $1 per MMBtu in September as compared to August. This represents a convergence towards the winter premium and is largely price supportive as we head into the shoulder season.

- Oil prices have increased 20% since July and are now closing in on $100/b. The Fed shrugged this trend off in yesterday’s OMC meeting, deciding to keep interest rates unchanged, but this is likely to keep upward pressure on interest rates if it continues.

- Governors from Connecticut, Massachusetts, New York, and New Jersey appealed to President Biden to intervene in the hemorrhaging offshore wind business. The Governors have allied for the Treasury Department to develop a bonus tax credit for domestically manufactured equipment and for revenue sharing from offshore wind leasing that currently flows into federal funds.

- Last week, the California PUC gave SoCalGas more leeway to use its large storage capacity to balance the gas generation market (note Aliso Canyon facility was authorized to increase from 41 to 68 Bcf on Aug 31st). Previous protocols had restricted use of the asset to emergencies specific to supplying the utilities heating customers. The new rules could help mitigate runaway gas and power prices this winter.

Source: NOAA

CA's Emissions Disclosure Law

- On Monday, Governor Newsom of California announced his intention to sign SB 253, a groundbreaking climate bill passed by the state's legislature on 9/12. The legislation will compel major companies, both public and private, making over $1 billion annually and operating in California, to publicly disclose their greenhouse gas emissions.

- The new law will mandate approximately 5,000 companies to report not only direct emissions from their operations, but also indirect emissions stemming from activities like employee travel, waste disposal, and supply chains. Reporting must be in conformance with the Greenhouse Gas Protocol, a set of reporting standards developed by the World Resources Institute and the World Business Council for Sustainable Development.

- Given California's status as the world's fifth-largest economy, this law could set a precedent for similar measures nationally and globally. It is seen as a significant step in aligning financial markets with efforts to combat climate change by informing investors about a company's environmental impact.

- The legislation faces opposition from groups like the California Chamber of Commerce, which argues that it will impose significant compliance costs. Critics are particularly concerned about the challenges of accurately tracking and reporting emissions.

- However, proponents believe this move will provide invaluable insights into corporate climate emissions and financial climate risks, setting a potential precedent for other states and the federal government to follow suit.

Temporary Reprieve from Local Law 97?

- With less than four months before the “penalty phase” of the local ordinance that drives NYC buildings >25,000 square feet toward net zero emissions by 2050, the Department of Buildings (DOB) has proposed updates which would allow owners who demonstrate a "good faith effort" to meet emissions caps but don't achieve them by the 2024 deadline, receive a two-year extension before fines are imposed.

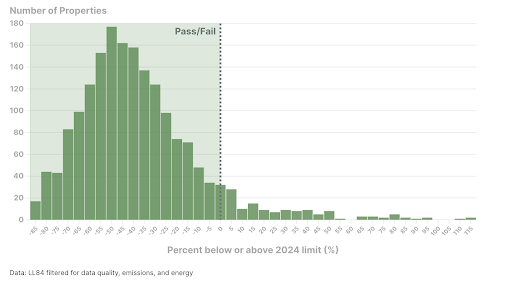

- This provision aims to provide relief to about 1,500 buildings that are out of compliance with the law’s 2024 standards (about 11% of buildings). It is estimated that about 8,800 will be out of compliance with the stricter 2030 standards.

Source: Urban Green Council

- The above chart highlights the number of office buildings compliant with the 2024 Local Law 97 limits. With only a few months left until 2024, the scores of office buildings to the right of the dotted line are likely to face noncompliance penalties if emissions mitigation measures aren’t implemented soon.

- As expected, there are divided opinions regarding this extension. Some believe it eases the transition to greener buildings, while others view it as an attempt to delay emissions reductions and weaken the law's impact.

- The Adams administration is actively seeking federal and state funding sources, including tax credits, to assist building owners in achieving their emissions reduction targets under Local Law 97. The proposed rules also encourage buildings to transition from fossil fuel-based heating to electrified space or water heating before stricter emissions limits come into effect by 2030.

Summer Peak Load Recap

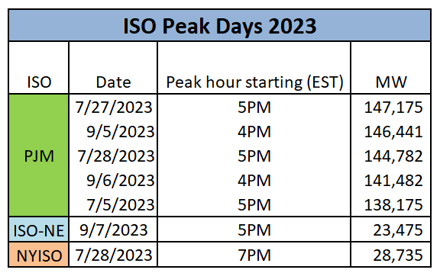

Source: FERC

Source: FERC

- During this year’s summer capacity season, Mother Nature favored the outer summer months, with no peaks being set in the month of August, which is atypical.

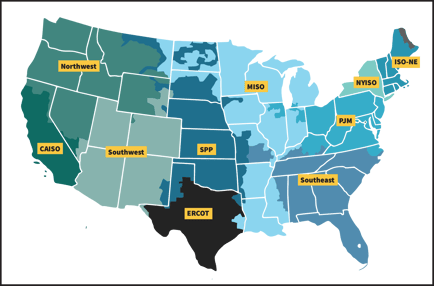

- For reference, most regional grid operators (called ISOs) operate capacity markets that fund grid infrastructure and expansion necessary to support growing demand on the grid. These are fixed price payments to generators that operate in the market. An ISO’s peak demand assessment, along with capacity markets, are intended to provide planners and market participants with information on future needs to maintain grid reliability.

- A given customer’s capacity cost allocation is determined by the market rate for capacity and the customer’s share of load during the grid’s peak hour(s). Specifics on how each ISO that Veolia tracks calculates PLC (Peak Load Contribution) tag(s) are highlighted below:

- PJM: Average usage during the 5 non-weekend, non-holiday peak hours set on different days. Tags can be set between June 1st and September 30th and are effective between the following June 1 - May 31 period.

- NYISO: Usage during the highest non-weekend, non-holiday peak hour across the NYISO grid. Tags can be set in the months of July and August and are effective between the following May 1 - April 30 period.

- ISO-NE: Usage during the highest peak hour across the ISO-NE grid. Tags are effective between the following June 1 - May 31 period.

Source: Veolia

Source: Veolia

- The above table summarizes the preliminary peak hour(s) for this season in each ISO tracked by Veolia.

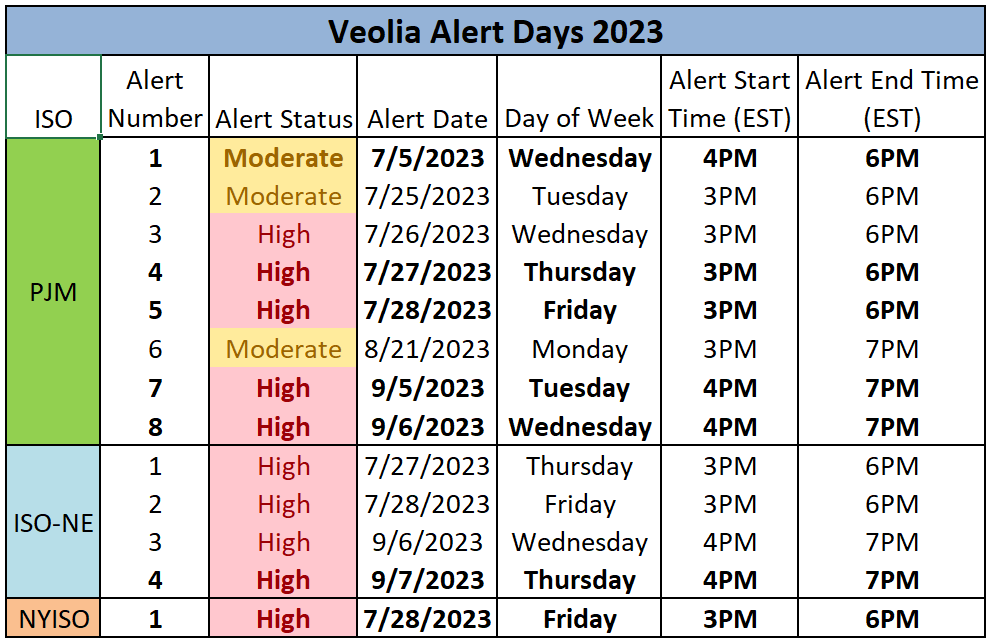

Source: Veolia

- The above table summarizes peak load risk alerts that were administered by Veolia. Our initial assessment is that we correctly predicted and notified customers ahead of all critical hours (hooray for us!). Bolded entries reflect actual peaks set, revealing highly accurate predictions of peak load tag(s) this season. Advance warning provided by Veolia allows customers to plan for voluntary load curtailment in an effort to minimize bill impacts. If you are not subscribed to this service and are interested in learning more, please reach out to commodity@veolia.com

NY's Shiny New Battery

Source: NYPA

- New York governor Kathy Hochul announced in late August that the The Northern New York Energy Storage Project is now operational.

- This 20-MW nameplate storage facility is the first utility-scale energy storage facility in the state, and the first storage facility to be built by the state.

- The project is located in Chateaugay, Franklin County, New York, only a few miles from the Canadian border. Its location is strategically placed to source generation from mostly renewable projects, namely hydroelectric and wind power.

- The storage facility is intended to relieve transmission congestion and balance the grid, especially during periods of peak load. This comes at a perfect time as New York signs-on more renewable generation projects.

- The project is an important step for the state in reaching its goal of 6,000 MW of energy storage capacity by 2030. This represents 20% of the state’s peak load, however NY currently only has 300 MW of capacity installed, so the odds of getting there appear slim. The state is also working towards its goal of 70% renewable generation supply by 2030.

Settlement Reached on PJM Fines from Winter Storm Elliot

- PJM and generators were saddled with approximately $1.8 billion in penalties after a late-2022 winter storm left 24 percent of the ISO’s generating capacity offline on Christmas Eve.

- During the height of the storm, natural gas plant outages accounted for over seventy percent of outages across the ISO. Freezing temperatures and mechanical failures were largely to blame.

- The parties have now reached a settlement, the details of which are to be made public in a FERC decision before the end of this month. Generation owners expected to be included in the decision include Calpine, Energy Harbor, and LS Power, among others.

- Suppliers from Constellation to Vistra have urged FERC to reject motions to dismiss the complaints and uphold the fines.

- Days-long outages occurred in parts of PJM despite their pre-winter analysis stating their preparedness for such extreme weather events.

- Elliott revealed that old metrics for grid preparedness may no longer be applicable under changing resource mixes.

- This event also underscores the importance of coordinated transmission networks that could have saved customers from outages and LMP spikes during the storm.

- Finally, the event also highlighted many problems with PJMs Capacity Performance market. Despite the high cost of non-performance penalties, the fact that Capacity Performance events were so rare led market participants to discount them in their planning and operating procedures. Markets are notoriously bad at internalizing high cost, low probability events.

- We will update on this situation when the details of the FERC report are released.

Natural Gas Storage Data

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.