Energy Markets Update

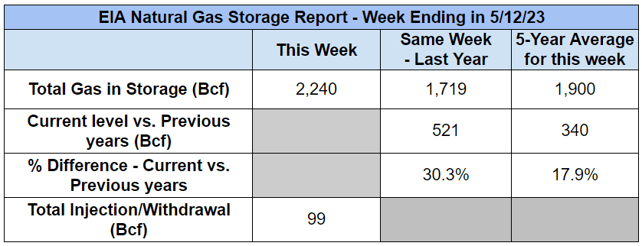

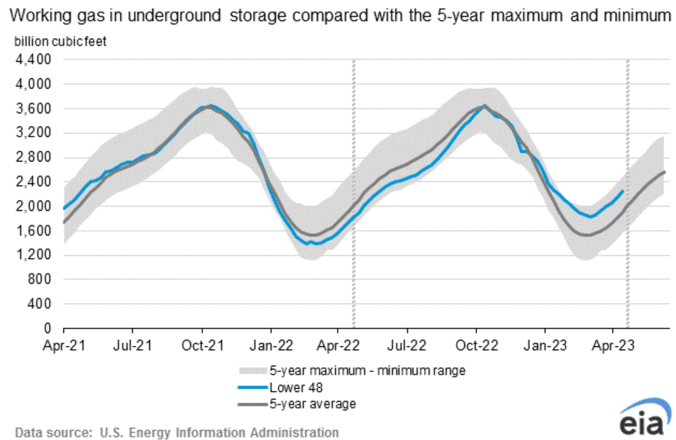

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 99 Bcf. The five-year average injection for May is about 93.8 Bcf. Total U.S. natural gas in storage stood at 2,240 Bcf last week, 30.3% higher than last year and 17.9% higher than the five-year average.

US power & gas update

- Spot prices remain exceptionally low as generators continue to gobble up cheap natural gas. The average price of wholesale power along the east coast from ME to Virginia was at or below $30 in April.

- Forward NYMEX gas markets have moved mostly sideways over the past 2 weeks. Power markets have shown some strength in 2024 and 2025, adding about $1-2/MWh over the same period. Today's storage numbers were lighter than expected however, sending the 2023 strip up 3-5% this morning.

- Gas rigs fell sharply in the first couple weeks of May (160 > 140), the most clear cut reaction to the bearish turn in prices we have seen yet. This will feed bullish sentiments in support of gas & power prices in 2024.

- Production remains at 100.5 Bcf/d, basically unchanged from the highwater marks set in Q4 of 2022, another sign that the supply side of the equation is unlikely to increase over the next 12+ months.

- West coast gas and power spot prices have absolutely cratered over the past 2 weeks (averaging < $15 MWh) as hydroelectric resources brim from a record snowpack. This should allow for utilities to make progress replenishing gas storage capacity. Recall that Western markets were brutalized this past winter as storage reached record lows.

- SDG&E and SoCalGas filed paperwork with the CAPUC in April to increase storage capacity at the Aliso Canyon, from the current limit of 41.16 Bcf to 68.6 Bcf. This may be approved late summer, and could do a lot to normalize winter markets.

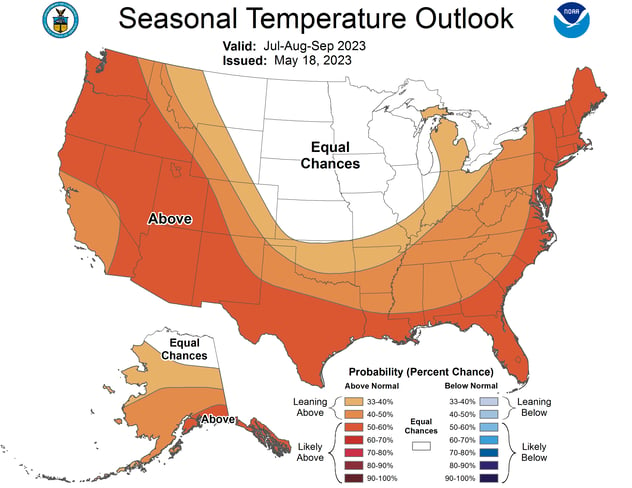

- Preliminary summer forecasts from NOAA show warmer temps for most of the country, particularly in New England. There is now a very high likelihood of an El Nino pattern this year. El Niño causes the Pacific jet stream to move south and spread further east. This primarily impacts North American winters, leading to wetter conditions in the Southern U.S. and warmer and drier conditions in the North. Overall bearish on energy.

Source: NOAA

- The US is seeking offers to add 3M barrels (bbl) to its Strategic Petroleum Reserve. Reserves currently stand at 362M bbl, its lowest point since 1983 and down from 638M bbl in Q1 2021.

- The annualized rate of inflation dipped to a two-year low of 4.9% in April. However prices remained strong and turmoil in the banking sector precipitated a large increase in recession expectations in April. The 12 month recession outlook likelihood is approximately 68%, according to the NY FED. Mild recession is expected by many forecasters in H2 2023, but there’s also more talk of a possible “soft landing.”

- This week the Maine Department of Environmental Protection lifted its suspension of a permit for Avangrid Inc.'s 145-mile 1,200 MW New England Clean Energy Connect hydropower transmission project. This clears the way for construction to resume though the ME SJC will likely have final say on the project later this year in appeal. The project was killed by referendum before being resurrected in the courts. It may be needed to keep the lights on in New England.

Proposed EPA rule would require fossil fuel plants to slash GHG emissions by 90% or shut down operations

- On May 11th, President Biden’s EPA published a Notice of Proposed Rulemaking for fossil fuel plants that would require them to cut GHG emissions 90% by 2040, or shut down.

- The proposed rule is part of Biden’s continued push to “green-ify” the US economy, which has seen flack from Republicans and Democrats in coal states, as well as large swaths of the power sector overall.

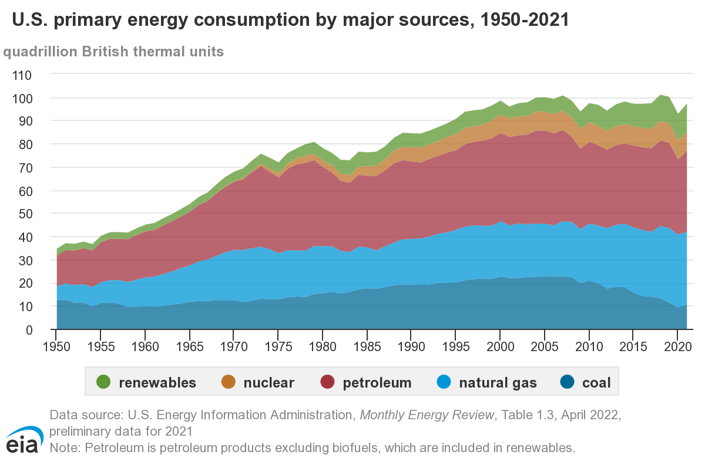

- The mandate would apply to all power plants that generate electricity through burning natural gas or coal, resources that power the majority of the US grid (a collective ~742GW of total capacity). The regulation proposed stricter guidelines for large plants (over 300 MW) that run more often (>50% capacity factor), and emissions limitations would be phased in from 2030 to 2042.

- Smaller plants would have a larger range of compliance options, including heat rate improvements.

- Large gas-fired plants would have two options to comply with the regulation: carbon capture and storage with 90% carbon capture by 2035, or co-firing of 30% low-GHG hydrogen beginning in 2032 and co-firing 96% starting in 2038.

- The most sobering aspect of the bill is the breadth of the impacted plants: coal and gas plants produce over 60% of all electricity in America. The implications on future retirements is staggering (EPA says 22 GW of coal).

Source: EIA

- The second most sobering aspect is the EPA’s eyebrow raising proposals for these assets may survive. The EPA says the best way to achieve these standards is to utilize carbon capture technology or hydrogen, neither of which is currently used at scale by any power plant in the US. In fact there is only one power plant in the world, the Boundary Dam Power Station in Canada, that actually uses this controversial carbon capture technology at the scale President Biden is proposing.

- In the US, the W.A. Parish Generating Station in the Houston area has a small project utilizing carbon capture, which is the only use of this technology in a US power plant. There are a number of proposed and failed projects around the country, but none that have come to fruition…and potentially this solution would need to be applied to the majority of the nation’s power plants starting in just about five years from now.

- Carbon capture presents a challenge since implementation of this scale would require the rapid buildout of a new and already-controversial industry, and construction of infrastructure to move these captured emissions.

- The EPA insists this new rule would positively impact all citizens by significantly reducing the emissions we breathe in daily, especially those who live near a power plant.

- The other option is for fossil fuel plants to shut down completely. This has become more common, especially for coal plants in recent years. The rule would allow plants to avoid these mandates if they agree to shut down by 2032, or by 2035 if they have a load factor < 20%.

- This mandate will likely face some legal challenges from coal states, Republicans, and the Supreme Court who just last year constrained the EPA’s authority over the power sector.

Summer capacity planning (part 2)

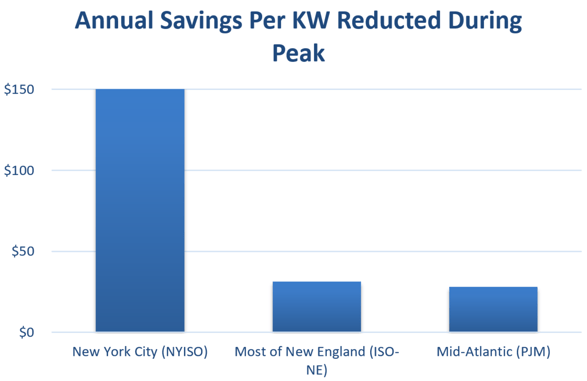

- In our last newsletter we provided an overview of a handful of different Peak Load Contribution (PLC) programs organized by independent system operators (ISOs) and regional transmission organizers (RTOs) around the country. Summer is typically the critical period for determination of annual capacity costs, and cost savings.

- Depending on your contract structure and location, a brief reduction in electric use may translate into an avoided annual cost beginning next June. The estimated value for a 1 kW reduction in your coincident peak demand (“PLC” tag) this summer is provided in the table below. Outside of New York, capacity is generally less expensive next year. Hence, savings from demand management will be less significant.

Source: Veolia and RTO data

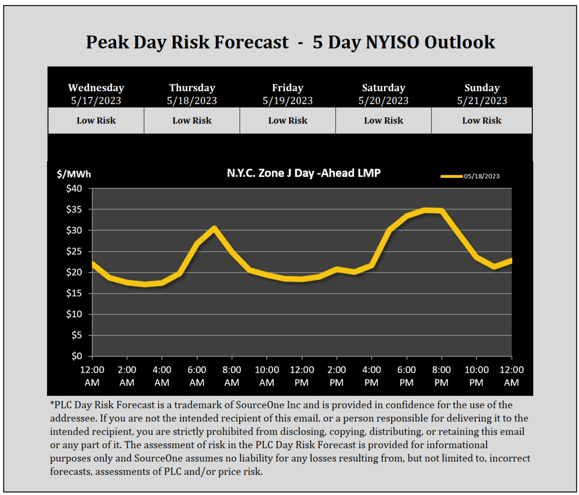

- Throughout the summer, Veolia monitors weather conditions and load forecasts from various ISO’s to anticipate when a coincident peak event is reasonably likely to occur, and notifies customers in New York and New England on the mornings of these so-called “moderate” or “high risk” days.

Example of a Veolia peak day forecast for NYISO customers

Source: Veolia

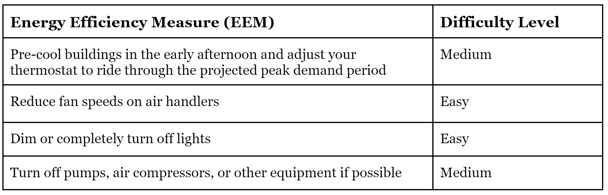

- Upon receiving a notification for potential peak setting days, a building management team can consider some or all of the following adjustments during the operational hours to reduce their electric load, typically between 2:00 PM and 6:00 PM on the hottest of summer days.

Source: Veolia

Source: Veolia

- Peak load reduction strategies may also include participation in formal Demand Response programs, which compensate businesses that can reduce electricity usage on high-demand days. Veolia also offers annual working sessions for clients actively engaged in peak management to review the prior year’s performance while also planning for the year ahead.

- Our Peak Day Risk Forecast program is a voluntary program provided for informational purposes only.

Georgia Power Co tells its customers to expect to receive nuclear power and another rate increase this summer

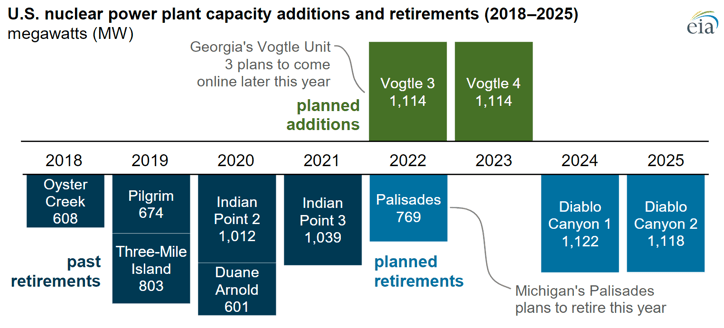

- Georgia Power Co, operator of the Vogtle Electric Generating Plant, a two-reactor facility in Georgia, announced that the plant finally “went critical,” the term for when a nuclear reactor sustains a chain fission reaction using uranium fuel.

- Vogtle’s progress toward coming online is a major win for nuclear power on the heels of countless US plant shutdowns in recent years.

- With the inclusion of Unit 4 in the second half of this year, the facility will become the nation’s second-largest power plant, supplying millions of homes and a growing number of manufacturing industries in the region. The announcement came almost 14 years after Vogtle received its first permits for new units at a cost that is close to double the original projection of $14B.

- The plant will now hold the title for newest in the US, with the rest of the remaining 92 nuclear reactors operating across 28 states celebrating birthdays of 30 years or more in 2023. Vogtle boasts 2 × 1117 MW AP1000 Westinghouse pressurized water reactors, with combined capacity of 2234 MW.

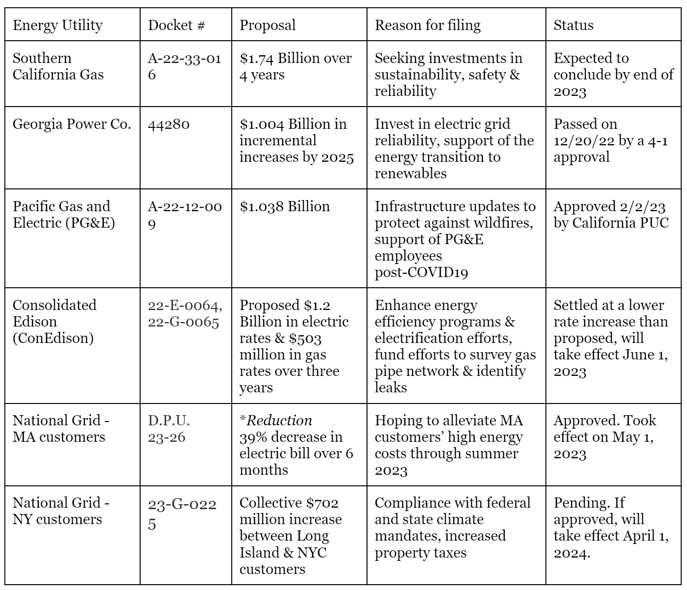

- In another recent announcement from Georgia Power, the utility says that it needs to raise rates to make up for a deficit in energy costs as of late. The utility will use a fuel cost recovery proceeding to reconcile the true cost of the fuel used to generate electricity with the amount customers have paid to date, which is set every two years based in part on projected costs.

- Georgia Power says it’s fallen about $2.6B short during this recent cycle due to elevated natural gas prices in 2022. Under the proposed agreement with Georgia commission’s Public Interest Advocacy staff, the utility will be seeking to collect nearly all of that shortfall from the rate base over a three year period.

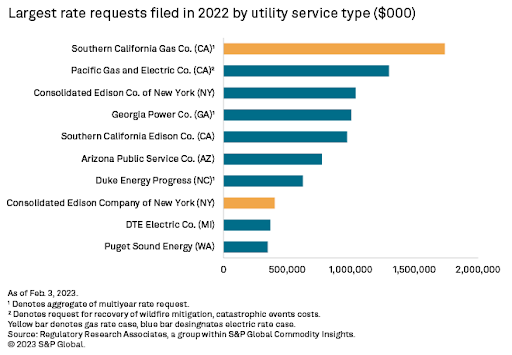

- Georgia Power is not the only utility pining for a major rate case. In fact many energy utilities proposed even steeper hikes last year, much to consumers’ dismay. So far this year, a collective $600 billion of rate increases have been proposed by utilities across the US and the numbers just keep climbing.

Energy markets brace for the impact of this summer’s El Niño & an update on the EU supply situation

- The imminent arrival of the El Niño weather phenomenon is expected to bring warmer temperatures this summer. Its counterpart, La Niña, has finally waned after three years of colder-than-normal weather (though, with climate change heating things up across the board, who really felt it?)

- Elevated temperatures brought by El Niño could create new volatility in energy markets, though most of these impacts originate outside of North America. For instance;

- Increased demand for liquefied natural gas (LNG) in Asia as countries seek additional LNG for power generation and cooling purposes. The surge in LNG demand may have broader implications for global energy markets and prices.

- In India, El Niño’s impact on wind power generation is cause for concern. The historically wind-rich months from June-September could experience decreased wind speeds due to the impending El Niño weather pattern. This reduction in wind speeds poses challenges for India's wind power sector and could potentially hinder the country's renewable energy goals.

- El Niño's disruptive nature extends to food commodities as well. Extreme weather conditions such as droughts and heavy rainfall may disrupt the production of key cooking oil crops like palm oil and soybeans. The resultant reduced supply of cooking oils could foster market volatility and increased prices.

- El Niño could also exacerbate the European Union (EU)’s energy supply struggles currently driven by increasing demand and supply constraints (i.e. Russian gas).

- This summer, demand for electricity is expected to surge with rising temperatures. The EU's power grids could become strained and increased cooling demand may lead to supply shortages or heightened reliance on imports.

- In 2022 for example, Europe experienced a heatwave that resulted in record-high electricity demand. To address this, the EU is implementing measures such as demand response programs and energy efficiency initiatives to manage electricity consumption and ensure stable supply.

- Looking ahead to winter, the EU is bracing for gas supply constraints, as natural gas is a crucial source of heating but its price is now heavily influenced by highly volatile global LNG spot prices. Disruptions in gas supply pose a significant risk, with factors such as geopolitical tensions, changes in gas flows, and maintenance issues in gas infrastructure contributing to the uncertainty.

- In recent years, Europe has experienced gas supply disruptions with incidents like the Russia-Ukraine gas disputes, which resulted in many temporary shortages before being cut altogether in 2022. To mitigate such risks, the EU aims to enhance energy diversification and reduce dependence on a single gas supplier. Going forward the EU plans to build interconnections between member states to improve energy security.

- To address long-term energy challenges, the EU is actively promoting renewable energy sources. The goal is to reduce dependence on fossil fuels and accelerate the transition to sustainable energy. The EU aims to increase the share of renewable sources in the energy mix, with a target of 32% by 2030. Additionally, investment in renewable infrastructure and energy storage technologies is being encouraged. For instance, in 2021, renewable energy accounted for 38% of the EU's electricity generation capacity.

Update: major US rate cases

Source: Veolia

Source: S&P

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.