Energy Markets Update

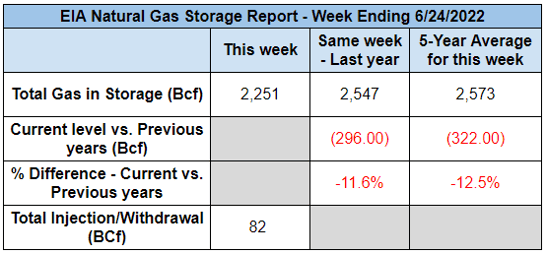

Weekly natural gas inventories

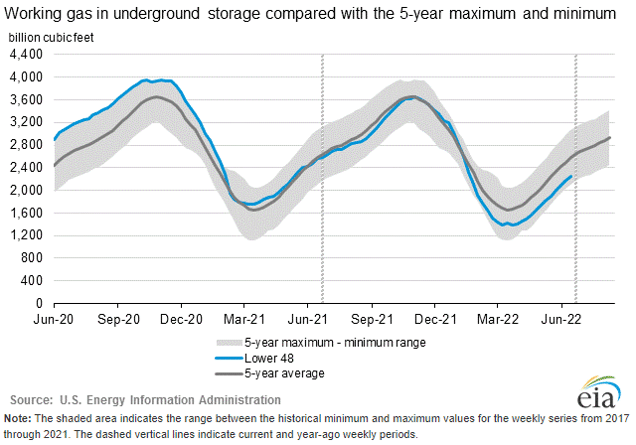

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 82 Bcf. The five-year average injection for June is about 83.5 Bcf. Total U.S. natural gas in storage stood at 2,251 Bcf last week, 11.6% less than last year and 12.5% lower than the five-year average.

US power & gas update

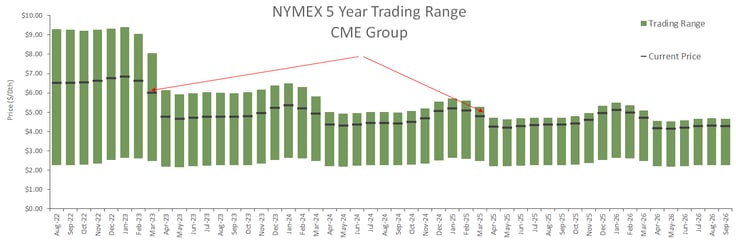

- Natural gas prices have continued to retreat. As of yesterday’s close, both the balance of 2022 and 2023 NYMEX futures have dropped 12-15% over the past 2 weeks and about 25% from the highs established during the first week of June.

- The forward 8 month strip was down another 10%+ as of publication today, on the heels of a bearish gas storage report (82 Bcf injection vs industry expectation of 74 Bcf).

- This week the July NYMEX contract expired at $6.55 per MMBtu compared to June’s settle at $8.91.

- Dry gas production increased to 95.4 Bcf/d last week, the highest since early 2019. If the trend continues towards 90 Bcf/d, this could lay the foundation for a bearish turn.

- Total oil and gas rigs increased by 13 to 753, a slow but positive sign that industry is responding to high prices

- Temps across the West and South were higher than average and have helped to maintain high short term prices.

- The outer years (2024 -2027) picked up steam in early June and have remained elevated.

- Generally, this is the first batch of bearish energy news in some time. We see some value emerging over the next 12 months and it is probably a reasonable place to add some certainty to open positions.

Over the barrel: an energy crisis in Europe

- As the war in Ukraine rages into its 5th month, Europe and its allies struggle to enact meaningful financial repercussions on Russia due to a massive strategic disadvantage in energy and commodity flows.

- Russia has been financing the war effort and maintaining the value of its currency from sales of gas and oil, both of which are at trading at significantly higher prices.

- The initial Western strategy of shunning and sanctioning purchases of Russian oil appear to have been an abject failure; removing supplies from Western nations simply put upward pressure on price and both China and India have absorbed any stranded Russian oil, albeit at about a $30 discount to the global clearing price (Brent Crude @$113 per bbl).

- The latest proposal being discussed is to impose a price cap on transactions of Russian oil, imposed by insurance waivers on oil shipping companies. Most Russian oil is exported on foreign vessels (Greek-owned tankers take away about half), and the thinking is that regulation of the price cap could be imposed on these entities so as to curtail Russia's revenues and not its supply.

- There are serious questions about the efficacy of this scheme, e.g., what control do Greek shippers actually have over bilateral transactions? How do you confirm validity of price cap adherence vs fake contracts? Most importantly, what are the various ways in which Russia can retaliate?

- Ultimately, Russia’s leverage over the entire situation is a function of Western dependence on gas, and to a lesser extent oil, and the fact that curtailment of supply will upend markets, let alone lead to physical shortages in times of dire need.

- Russia’s leverage will increase in the winter when its ability to abruptly cut flows of natural gas could have catastrophic consequences for Europe. European countries are already discussing the possibility of having to manage 30% reductions in natural gas supply.

- Despite some apparent stagnation in the war’s arc, this winter could be a disaster for Europe and its allies.

- It is imperative that Europe start implementing efficiency mandates as it will likely be put in the position of shutting down industry in order to conserve gas for heating purposes. Better to prepare for that possibility now than under necessity imposed by freezing temperatures.

- We view the likelihood of a European recession as almost inevitable under current circumstances.

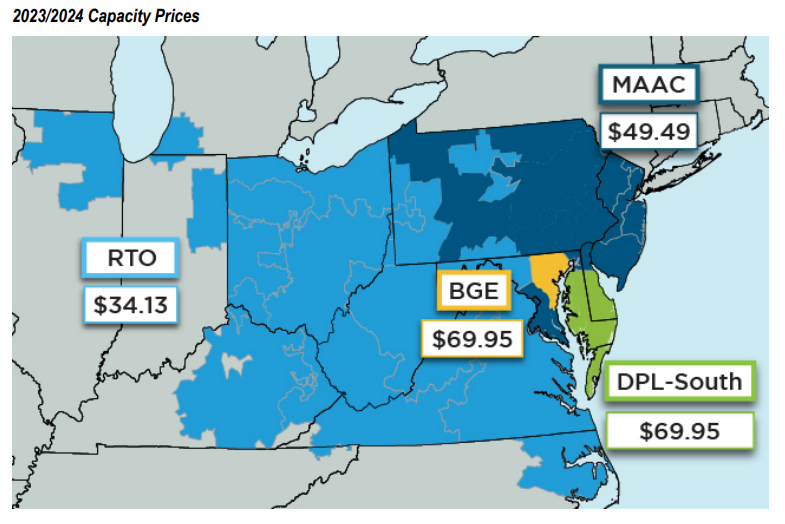

PJM capacity prices sink as more nuclear, solar capacity clear the latest auction

- Capacity prices across most of the PJM Interconnection (the MidAtlantic grid operator) fell 32% to a 10-year low of $34.13/MW-day from $50/MW-day in the previous auction.

- This auction covers the commitment period from June 1, 2023 to May 31, 2024. PJM typically holds annual capacity auctions three years in advance but has been delayed in recent years due to litigation and FERC directives.

- The auction featured a surge in cleared nuclear (uprated, not new) and new gas-fired generation, with a drop in coal-fired generation.

- The failure to win capacity obligations can be a factor in power plant owners deciding to retire generating units. PJM has compressed its auction calendar to return to a three-year-forward basis. The next annual Base Residual Auction, for the 2024/2025 Delivery Year, will be held in December.

- Prices were slightly higher in some regions due to constraints, however contributing factors leading to the low price include:

- The phased-out application of the Minimum Offer Price Rule, which was previously regarded as bullish for capacity, applied to only seven resources representing 76 MW

- A revised, lower unit-specific Market Seller Offer Cap

- Less lead time to the delivery year (one year instead of three)

- Stronger energy and ancillary services prices have diminished short term economic “need” for capacity for some resources

- PJM bought 144,871 MW of capacity for the capacity year that starts June 1, 2023, for $2.2 billion, down from $4 billion in the last auction. About 160,874 MW was offered in the auction, a decrease from last year’s auction of about 11,333 MW

- About 3,735 MW of new generation cleared in the auction, including about 405 MW of uprates. The new generation likely included the Jackson and Three Rivers gas-fired power plants under development in Illinois

- When combined with capacity utilities procured outside the auction, PJM expects it will have a 20.3% reserve margin — a buffer of additional capacity above forecast peak load to handle unexpected events — compared with a 14.8% target margin

US utilities: the summer of exogenous risks

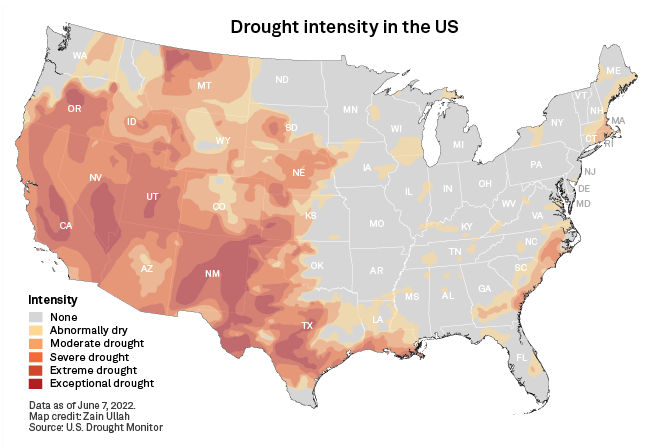

- Large portions of the US are in drought, limiting hydroelectric capacity.

- Other risks include severe heat waves, wildfires, supply chain issues, Russian cyberattacks and equipment failures at generation plants.

- RTOs such as MISO in the Midwest have recently confirmed capacity deficits, a result of growing supply and retiring generation due to economic and environmental reasons…and in our view, poor long-term planning protocols.

- Droughts are making water more scarce, which means it’s hard to split the resource between civilian use, hydroelectric generators, and nuclear plants, which need consistent water flows to cool reactors.

- Extreme weather events have already knocked out power for many around the country, which could get worse as temperatures get even warmer throughout the summer.

- There is now a delicate balance between keeping the lights on and carbon emissions where conditions are worst. Evening hours present a risk as solar generation diminishes but demand is high as people come home, cook and turn on appliances.

- California ISO is one of the areas most at risk with about 18 GW of solar related generation going offline in the evening. Hydroelectric generation in the region may be less than half of average this summer due to intense drought conditions.

- “Once in a century” storms are also becoming more common due to global climate change, something that is changing almost every aspect of the utility model.

- A coalition of 18 utilities are coming together to create a science-based standard for evaluating future climate risks. The initiative, named Climate READi, is being led by the Electric Power Research Institute and will create a platform over the next 3 years that companies can use to help focus investments where they are most needed.

RI legislators work to expand offshore wind procurement

- This week legislators in Rhode Island increased the required amount of new offshore wind capacity for utilities from 600 MW to 1000 MW.

- Utilities may receive an incentive of up to 1% of the contract total at the discretion of regulators

- Utility companies now have until October 15, 2022 to issue procurements.

- The legislation now heads to Governor Daniel J. McKee’s desk, the last hurdle to be signed into law.

New gas hookups face hurdles in Mass. energy code proposals

- New draft energy codes from the Massachusetts Department of Energy Resources (DOER) may require all new buildings to have electric heating and appliances.

- Lawmakers have been frustrated over the lack of gas bans by towns and cities, so they ordered the DOER to update electric codes to help accelerate the process.

- Advocates of the proposal estimate that it will save approximately 500,000 tons of emissions by 2030 and could save building developers and owners over $21 billion in lifetime costs.

- The DOER has also proposed more stringent requirements for larger homes by requiring a minimum energy rating. This can be achieved through electrification of heating and appliances or mixed-fuel construction, which would make allowances for emitting equipment if paired with green resources.

- Three public hearings about the draft code will take place throughout August alongside a review from a technical advisory committee.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.