Energy Markets Update

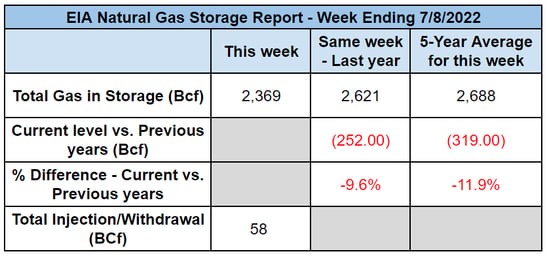

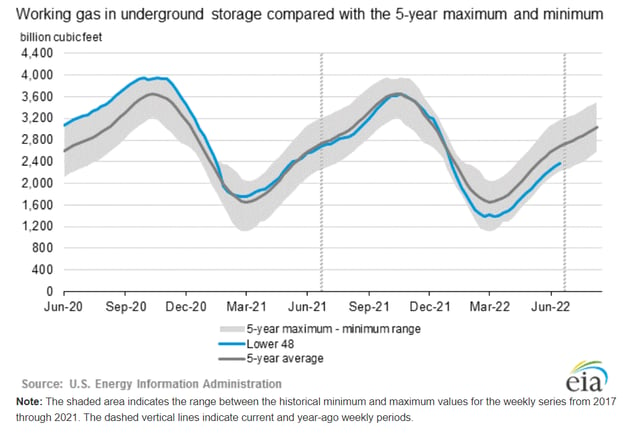

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 58 Bcf. The five-year average injection for July is about 44.2 Bcf. Total U.S. natural gas in storage stood at 2,369 Bcf last week, 9.6% less than last year and 11.9% lower than the five-year average.

US power & gas update

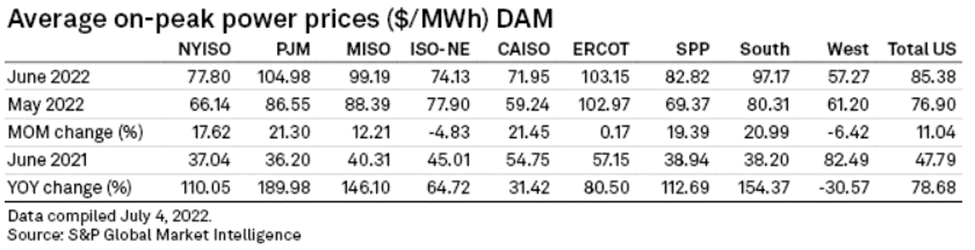

- National average prices for on-peak power rose 11% in June over the prior month, with both PJM and Texas ERCOT surpassing $100 per MWh.

- This represents a nearly 200% year-over-year increase in PJM.

Excessive heat in the South and Midwest have result in strong gas demand from power generators, which have been gobbling up any spare molecules in the system - Another major factor is that 34 coal plants have been retired in the US over the past year, totaling 12.9GW of capacity that must be made up by other sources, but primarily natural gas fired units.

- We anticipate strong pricing throughout the remainder of the summer, with premiums in regions suffering extreme heat such as Texas and the Midwest.

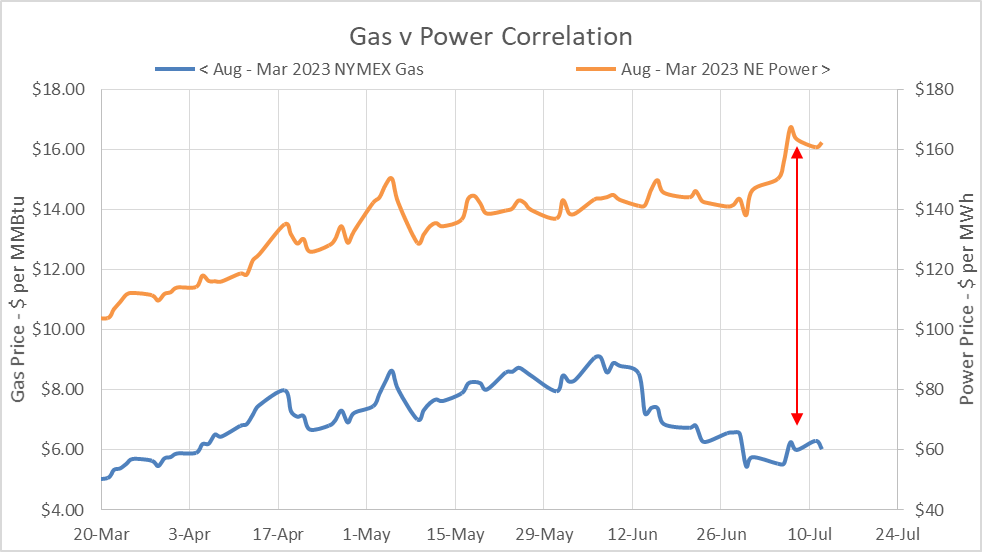

- Thus far, Northeast markets have avoided prolonged heat waves and spot prices have more closely tracked broader national movements in the price of NYMEX gas.

- Futures markets look more grim for the Northeast however, particularly in New York and New England.

- Jan – Feb 2023 peak power in New England is now trading in excess of $300 per MWh, now a 50% premium OVER the polar vortex settled values of Jan-Feb 2014. New York trades around $250 per MWh.

- Also noteworthy is that New England winter power is starting to diverge from movements in NYMEX and is now also being driven by movements in the European price (see chart).

- We find it hard to rationalize this presumed correlation when the region’s only tie to global LNG, the Constellation LNG terminal in Everette, MA, only received about 8 Bcf of gas in Jan-Feb 2022. This represents about 2 days of consumption for the region (3.3%) and little more than 2X Everett’s storage capacity of 3.4 Bcf.

- Even a $30 dollar spread between pipeline gas and LNG would only justify a < 5% premium wherein the market has manifested a ~20% premium.

Big heat in Texas: ERCOT struggles under extreme temps

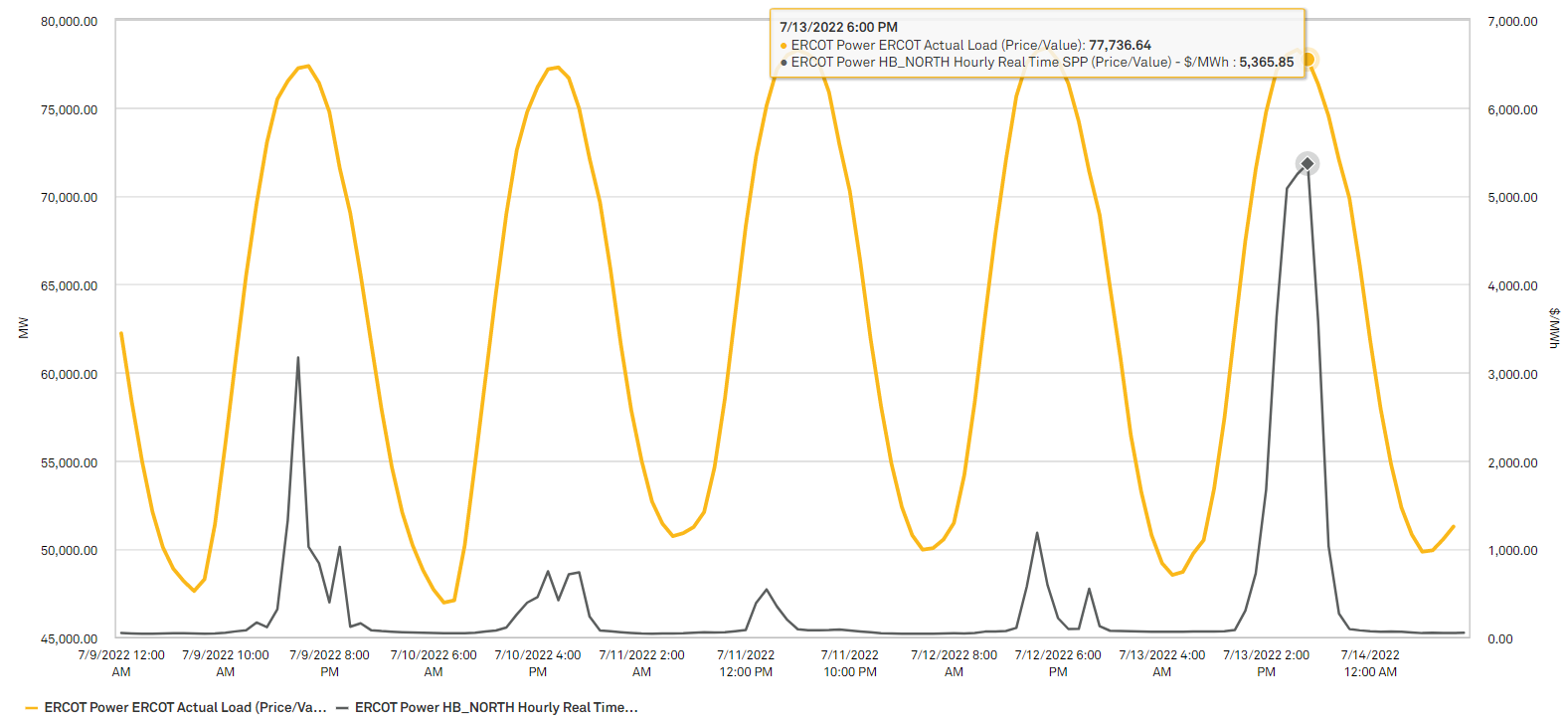

- ERCOT Texas has established multiple record-setting peak demands this week, with likely more to come due to extreme temperatures forecast for the rest of July. The system typically peaks in August.

Large commercial users have been asked to minimize demand in recent days ERCOT, the grid operator, has warned of rolling brownouts. - The grid has approached the 80,000 MW demand threshold this week and prices have surpassed $5000 per MWh, inclusive of scarcity pricing.

- Higher than average temperatures throughout the US this summer have contributed to unprecedented levels of gas-fired power burn, averaging 43 Bcf/d through July and helping to prolong the national storage deficit position.

- Unlike other electric grids, ERCOT Texas operates an energy-only market to meet customer demand. It does not use a capacity market to ensure necessary resources will be available but rather relies on the promise of higher hourly prices to incentivize generation.

- The energy-only market design has already been under reconsideration in the wake of winter storm Uri in February 2021, when many Texans spent days in frigid temperatures without power, and were then saddled with massive energy bills to boot.

- We believe that some form of capacity market probably makes sense, but a full fledged redesign like PJM or NEISO seems unlikely and probably not appropriate either.

- There have been discussions about a resource adequacy model to be implemented on Load Serving Entities, however the details of the proposals have yet to be flushed out.

- ERCOT will also need to consider other important challenges, e.g., how to prioritize winter vs summer generator availability, how to avoid perverse incentives and free ridership experienced in other markets, whether price or peak-sensitive demand can play a larger role in the summer, and whether a handful of other quasi assurance mechanisms may be for successful.

Massachusetts lawmakers mull existence of residential deregulation

- BillS 2842 introduced in the Massachusetts legislature in April would remove the competitive electricity market for residential customers.

- The bill draws on analysis from the MA Attorney General that found residential customers invariably paid more for electricity supply than they would have had they simply remained with their incumbent utility supply plan.

- Veolia’s analysis and past public comments on the issue (filed with the MA DPU) are that the benefits of deregulation to residential customers have been meager at best and that generally, only larger customers have the tools, pricing power, and expertise to achieve financial savings.

- Despite this view, we also recognize that analysis by various Attorneys General over the years have often tended to ignore periods when residential customers have fared better or when they solicit renewable products that cannot be provided by the incumbent utilities.

- A petition with over 1000 signatures from citizens concerned about this bill was shared with lawmakers on July 11.

- Many feel that abolishing the competitive electricity market would take away the option for customers to shop for a plan that fits their needs such as 100% clean energy plans and plans that are favorable for EV owners.

- The number of households that had a supplier that was different from their utility in Massachusetts has been growing and reached about 500,000 customers last year (~20%).

- Out of those that have chosen competitive supply, more than 75% of them chose a 100% renewable option. If this bill were to be passed, about 20% of renewable generation that is purchased by residential customers would be removed from the market.

- A SurveyUSA poll in 2021 found that 83% of Massachusetts residents wanted the power to choose clean energy for their home if they so desired.

New York energizes 3.7-GW clean transmission line

- A new 20-mile 345-kv transmission line is now operational in New York, allowing the integration of 3,700 MW of upstate clean energy onto the NY power grid.

- The Empire State Line is New York’s first competitively-bid transmission project. It will help the state reach an intermediate goal of consuming 70% renewable electricity by 2030

- The Empire State Line was completed by NextEra Energy Transmission New York in June and site restoration efforts will continue into the fall. The new line will allow the state to access additional energy from the Robert Moses Niagara Hydroelectric Power and electricity imports from Canada.

- Reliability margins on New York’s electric grid are shrinking, and the state’s grid operator says new transmission capacity will be one key to maintaining reliability while meeting the state's decarbonization goals, which include a net-zero emissions electricity sector by 2040.

- New York is pursuing other transmission projects to move additional clean electricity from upstate generation sources and Canada into the state’s largest demand center of New York City; the Clean Path NY project as well as the Champlain Hudson Power Express.

- The New York Public Service Commission in April approved contracts necessary to advance the two transmission projects. The COD for the Clean Path NY project is expected in 2027. The Champlain Hudson project, developed by Blackstone Group’s Transmission Developers Inc., is expected to begin delivering power from Canada in 2025. Officials say that by 2030, the two projects will cut in half New York City’s need for fossil fuel generation.

Renewable energy supplied over a quarter of US power in April

- Renewable energy supplied over 85 million MWh of energy for the US in April, making up a new record of approximately 28% of total generation.

- From April 2021 to April 2022, renewable output has increased 19%.

- Pressure has been mounting on operators to ensure that a primarily renewable grid will be effective, as power demand for heating electrification and electric vehicles is expected to skyrocket within the next ten years.

- ISO-NE is preparing for wind to make up ⅔ of its 30GW interconnection queue, with the rest being made up of an assortment of other renewable options.

- Many New England states have enacted strict legislation surrounding commitments to clean energy in the near future, requiring a transition to a greener grid by ISO-NE. However, this will create a cascade of new challenges including more significant weather risk, capacity planning, and reserves (see e.g., “duck curve” risks showing up in CA and TX).

- ISO-NE emphasized the need for a reliable energy supply chain as well as transmission that can support the integration of renewables into the grid.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.