Energy Markets Update

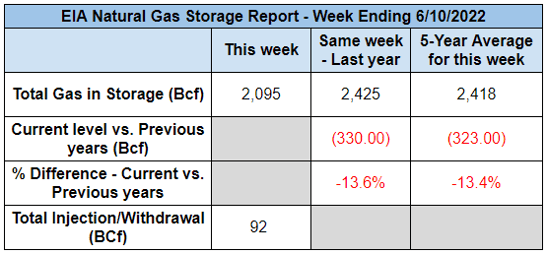

Weekly natural gas inventories

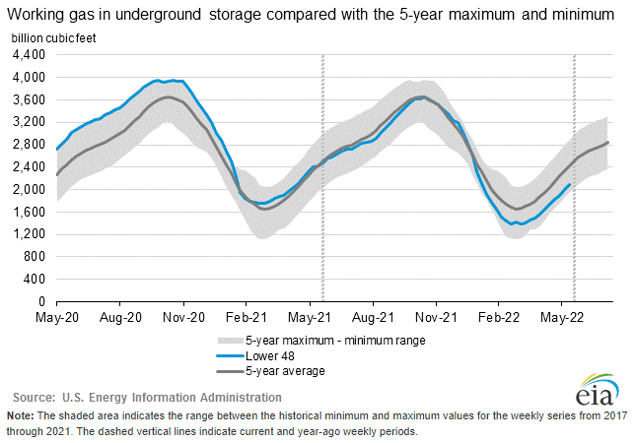

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 92 Bcf. The five-year average injection for May is about 83.5 Bcf. Total U.S. natural gas in storage stood at 2,095 Bcf last week, 13.6% less than last year and 13.1% lower than the five-year average.

Gas & Power Market Update

- Large daily movements in the price of NYMEX natural gas continue to drive US markets for gas and power across the country

- After setting a new high mark last week ($9.29/MMbtu), the price of forward NYMEX gas for the remainder of 2022 plummeted by more than 15% ($7.23/MMbtu) in Tuesday trading upon news of an extended outage at one of the nation’s largest LNG export terminals (more below)

- Prices had recovered about one third of Tuesday’s losses as of this publication

- The first couple of weeks of June have otherwise been bullish for energy commodities, with notable advances in NYMEX gas taking hold in 2024 and 2025. Both years were up about $0.60/MMbtu (+14%) and have accordingly lifted baseline power prices nationally by approximately $6/MWh

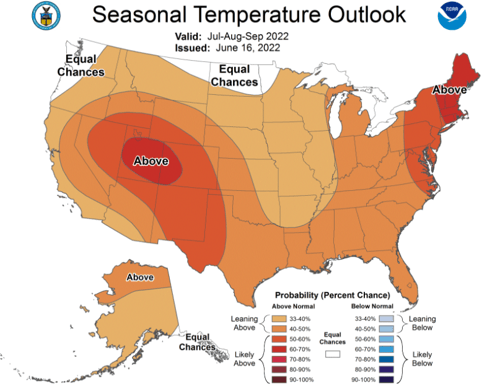

- Today the National Oceanographic and Atmospheric Administration (NOAA) issued its most recent seasonal forecast guidance and it is predicting a scorcher of a summer

- Led by persistence of La Nina-related heating and drying effects, NOAA is forecasting a 50-70% chance of higher than normal temperatures in Northeast load centers and in the Midwest and Rockies

- With relatively stagnant production and strong power demand from the generation and industrial sectors, most of this is fairly bullish for summer prices, but for the temporary LNG export curtailment

- Despite the unfolding narrative at Freeport LNG, industry consensus is building around the continuation of a tight energy supply balance for the next 10 months, with differing views of 2023. Yesterday, investment bank Goldman Sachs published a summer 2023 NYMEX gas forecast at $3.80/MMbtu. The EIA’s latest forecast published on June 2 calls for summer 2023 NYMEX at approximately $5.10/MMbtu

Freeport LNG Outage

- Texas-based LNG exporter Freeport LNG has been offline since reporting of an explosion and fire on June 8

- Initial guidance was that the facility would resume operation in a matter of weeks but on Monday Freeport reported that it would not return to full service until late 2022

- Freeport LNG has 2 liquefaction trains that withdraw 2 Bcf/day from the Gulf Coast supplies, all of which will now remain in that market where regional generators are thirsty for additional supply

- The announcement simultaneously lifted European gas futures and torpedoed domestic prices

- Before the fire at Freeport, the Energy Information Administration had forecasted an end of season storage position of just over 3,300 Bcf, about 9% below the five-year average

- In the aggregate, the impact of Freeport’s curtailment could reasonably reincorporate an additional 250 Bcf of US gas, which would bring the US back to the approximate “normal” range

Actions by Biden Administration to Help Boost Domestic Solar Installations

- In late March, the US Commerce Department had ordered a federal trade probe of overseas solar panel manufacturers to help determine if Chinese components were being included in these products to circumvent US tariffs. The probe was initiated after a complaint from a small domestic manufacturer. This order along with other market factors was predicted to decrease 2022 installations in the US by as much as 50%

- In response to fever-pitch lobbying from the solar industry, on June 6, President Biden released an order to the US Commerce Department to freeze antidumping duties on solar cells and panels imported from Malaysia, Vietnam, Thailand, and Cambodia for two years. This was done to help nullify the impact of the probe and ramp up solar installations

- The solar industry was grateful for the change, but expected installations to still be down from projections earlier this year

- Many holding companies have already moved funding into next year, which will impact installations

- Solar industry members would like to see more legislation addressing solar cell and panel manufacturing, which President Biden committed to doing with the Defense Production Act. Many are still skeptical and said they will do what they have to do to procure the necessary materials to meet demand

- Solar advocates are still hoping Congress will take further action such as extending the tax credit for domestic renewable energy development and manufacturing

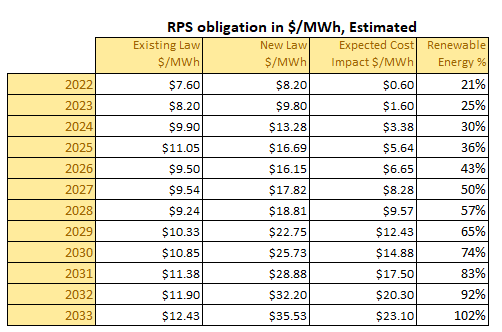

Rhode Island Passes Most Stringent Renewable Energy Targets in the US

- A bill to require Rhode Island to procure 100% of its electricity from renewable sources by 2033 passed through both chambers as of this week and now awaits the Governor’s signature

- The current Renewable Energy Standard law, passed in its original form in 2004, requires utilities to provide at least 38.5% of their electricity supply from renewable resources by 2035 via annual increases of 1.5%

- The new law will dramatically accelerate this rate of increase, adding an additional estimated $14-20 per MWh to customer bills by the end of the decade

- Passage of this bill or any similar legislation would not entirely eliminate fossil fueled power, which would still be kept online to improve grid reliability. Most of the target would be met by making additional purchases of regional Renewable Energy Credits (RECs). This is a bullish indicator for New England REC prices

- Another bill currently being reviewed would procure an additional 600 MW of offshore wind power.

- Yet another bill under consideration would require all new cars in Rhode Island to be electric vehicles by 2035

- All of these bills are measures to help meet the Act on Climate law that was passed in 2021. This law requires the state to reduce its carbon emissions from its 1990 baseline by 45% in 2035. If Rhode Island doesn’t meet this requirement, the law permits anyone to sue the state to force compliance

Delaware House Reviewing Bill to Cut Emission by 50% by 2035

- The state Senate passed a bill to create goals to reduce greenhouse gas emissions using 2005 as a baseline. The bill would reduce emissions by 50% by 2030 and 90% by 2050

- This bill is meant to bolster Delaware’s Climate Action Plan, which was released by Governor John Carney in November 2021 and is a follow-up to a law Carney recently implemented to increase the Delaware Renewable Portfolio Standards to 40% by 2035

- Under this proposed law, state agencies would be required to incorporate greenhouse gas emission reductions into future regulations

- Governor Carney has previously announced that Delaware will adopt California’s Zero Emission Vehicle regulations, which would mandate a certain percentage of new vehicles in Delaware to have zero emissions

US Government Accountability Office Criticizes DOE’s Disaster Relief Planning

- A new report from the Government Accountability Office notes that the DOE’s approach for coordinating disaster response, grid recovery, and technical assistance efforts was subpar. To be more specific, when transitioning from the response to recovery phase, the roles and responsibilities are unclear with no lessons learned or improvements from previous disasters noted

- This is especially relevant with an increase in the intensity and frequency of severe weather events. In 2021, costs associated with these events topped $145 billion and killed nearly 700 people according to NOAA's January report from the National Centers for Environmental Information

- This trend is expected to continue as the effects of global climate change accumulate, and without a proper procedure in place, the impact of poor preparedness could result in greater costs and loss of life

- The DOE acknowledged that its response plan is not where it should be and said that it was a goal to improve this. It did note that many of its procedures exceed the response time and that the emergency response function is carried out by trained volunteers who are not “typically available to support long-term recovery”

- Expanding the Catastrophic Incident Response Team will “further assist impacted states and utilities” and will help provide resources to those utilities that may lack the resources to restore the system in a timely manner

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.