Energy Markets Update

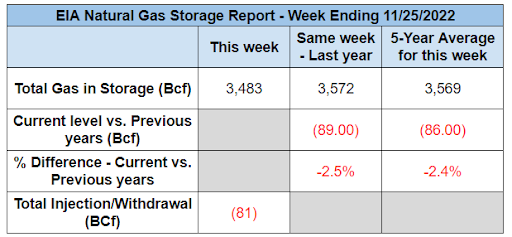

Weekly natural gas inventories

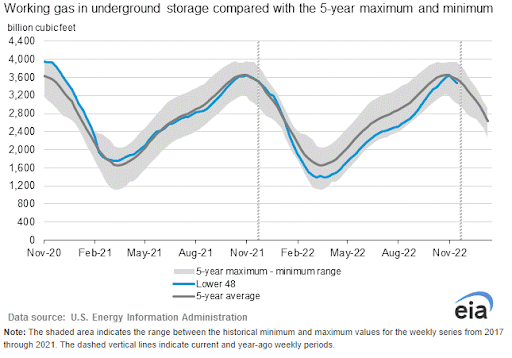

The U.S. Energy Information Administration reported last week that natural gas in storage decreased by 81 Bcf. The five-year average withdrawal for November is about 17 Bcf. Total U.S. natural gas in storage stood at 3,483 Bcf last week, 2.5% lower than last year and 2.4% lower than the five-year average.

US power & gas update

- Markets rallied into the Thanksgiving holiday weekend, taking back some of the ground lost over the preceding weeks. The 2023 NYMEX strip stands at $5.70 per MMBtu, up about 10% over the past 2 weeks but more or less at par with its average traded value from Q2 onward.

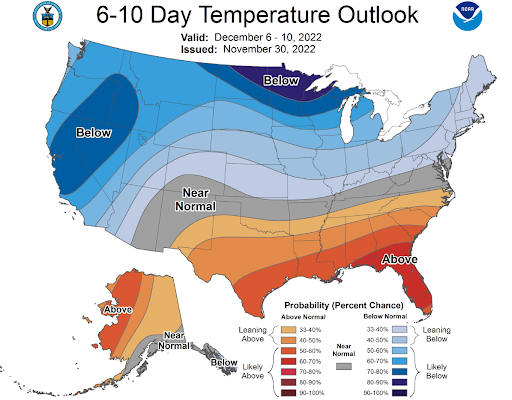

- A major contributor has been mid-December temperature forecasts that have trended cooler over the past week. Forecasts indicate a warm up over the next week and then some potentially fierce cold in the middle of the month that will test regional constraints for the first time since Q1.

- Today we logged the second week of natural gas net withdrawals, we pulled 81 bcf for the week ending November 25 and 80 bcf for the prior week, fairly large drawdowns for this time of year. Natural gas in storage ended the injection season with 3644 bcf in stock. This is a fairly middle of the road position, historically speaking, but much more comfortable than the outlook this summer.

- The out-of-commission 2.1 bcf/d LNG export terminal Freeport LNG is expected to resume 80% of its export capacity in mid-December and 100% in March, according to the CEO of Japanese utility JERA, which has a 25% stake in the Texas-based liquefaction terminal.

- From a macro perspective, the economy continues to send mixed signals. The inverted yield curve basis differential, historically a recession harbinger, is about as large as it has been. Labor participation, prices, and profits continue to show strength. Oil on the hand has dipped 10% over the past month.

- We continue to see downside opportunities in the market, particularly in NYMEX gas, over the coming weeks. Our view is the storage is sufficiently robust and that gas production will remain strong throughout 2023. The risks of recession, warm weather, or even further delays at Freeport could send the market into territory we haven’t seen since early in the year.

Source: NOAA

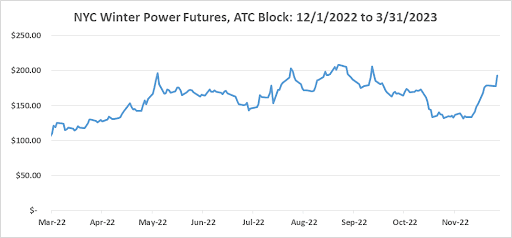

NYISO winter update

- On Monday, NYISO reported that it expects electricity supply to sufficiently meet demand this winter, with an expected 23,893 MW peak demand based on current winter forecasts.

- NYISO’s extreme weather scenario predicts demand could top 26,000 MW, though this load would also be adequately covered by energy supplies within the ISO.

- NYISO has reiterated its warning of elevated power prices across the board through the winter, citing lingering effects of the pandemic as well as the ongoing Russian-Ukrainian conflict.

- All in all, the price of natural gas for delivery to electric generators will remain high through this winter.

- Stricter guidelines were implemented in NYISO in recent years, requiring electric generators to report fuel inventory metrics weekly.

- NYISO’s release included data from the EIA illustrating below-average historical oil inventories for the start of winter, though they are expected to be sufficient.

Source: CME Group

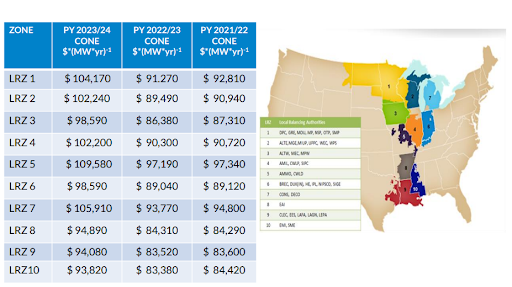

Higher prices in MISO

- At a conference hosted by demand response company Voltus, panelists expressed concerns that elevated power prices in MISO are not a short-term issue, even suggesting that they could soar higher in coming years.

- Neil Chatterjee, former chairman of FERC, explained MISO’s issue in simple terms: there just isn’t enough generation to match demand. Natural gas generation will become a marginal resource as it is displaced by lower-cost coal.

- MISO’s last planning resource auction saw an increase of $5/MW-day to nearly $237/MW-day in capacity clearing price.

- After decades of oversupply, the lack of generation capacity has resulted in new found relevance of capacity market price caps referred to as the cost of new entry (CONE). CONE is an administrative value representative of the cost of building a new power plant, and it will represent the maximum clearing price for the upcoming planning resource auction.

- Currently, the CONE for MISO’s next auction ranges from approximately $270 to $300/MW-day across the Central and Northern ISO zones.

Source: MISO - Chatterjee explains that load-serving entities across MISO have relied on low-cost capacity through ISO auctions rather than building up generation. Consequently, much-needed generation has been retired and “the entire region is going to be at an elevated risk of load loss for the foreseeable future.” In other words, this was to some degree a market failure.

- Additionally, MISO is considering shifting to a sloped demand curve rather than the current vertical demand curve used to determine capacity prices. Vertical demand curves keep capacity prices low until a shortfall, while sloped demand curves allow for gradually increasing capacity prices before a shortfall.

Utilities undeterred by big money moving into RNG

- The Renewable Natural Gas (RNG) market was shaken up earlier this year after BlackRock Assets acquired RNG project developer Vanguard Renewables LLC for a whopping $700 million. Concerns persisted after BP PLC announced plans to purchase Archaea Energy Inc. for $4.1 billion.

- The major concern for utility analysts was that competition for RNG assets, which have thus far been dominated by regional utility players, will drive up the cost of acquiring supply projects and lead to lower rates of return on the investments.

- Despite these concerns, utility executives remain confident they still have plenty of opportunity ahead.

- RNG is processed from methane waste at farms, landfills and other sites, and they remain a strategic play for gas utilities that operate the infrastructure to transport RNG. Producing the fuel can be considered carbon-negative because RNG projects use methane that would otherwise escape into the atmosphere and preserve a role for their infrastructure through the energy transition.

- State and federal legislation has also provided opportunities for utilities. A new federal investment tax credit for RNG has made those projects more economic, meaning utilities can invest less capital while still seeing the same returns.

- Local knowledge and a broad tax base to apply tax credits also make utilities ideal developers of the projects, which can generate massive returns for their unregulated businesses.

- Utilities can also take diverse approaches to the value chain. New Jersey Resources Corp, is pursuing opportunities to off-take RNG supplies for blending and delivery to its utility customers, as well as to build, own and operate RNG infrastructure. Companies like WEC Energy Group Inc. plan to focus on procuring RNG to meet climate goals and provide customers with lower-carbon options.

Source: S&P Global Commodity Insights

ConEd steam utility files rate increase

- Con Edison operates the largest steam distribution system in the U.S. The 100+ year old system heats more than 1,300 buildings and dozens of MTA subway stations across Manhattan.

- Last week Con Edison filed its first steam rate case with the NYS PSC in almost 10 years. ConEd is seeking a $136.7 million steam rate increase, in Case No. 22-S-0659.

Source: ConEdison Steam Long-Range Plan - The rate filing includes financial data for a multiyear rate plan to be explored as part of settlement negotiations. Efforts noted in the Steam Long-Range Plan include targeting new customers in their network zone looking to transition from more carbon-intensive heating sources, like fuel oil and natural gas, and decarbonizing the generation of the steam itself.

- The commission is expected to issue a final decision in October 2023, with new rates to become effective Nov. 1, 2023.

- Con Edison has a history of securing multi year rate settlements. The company is currently in the settlement discussion stage for multi year electric, Case 22-E-0064, and gas, Case 22-G-0065, rate cases.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.