Energy Markets Update

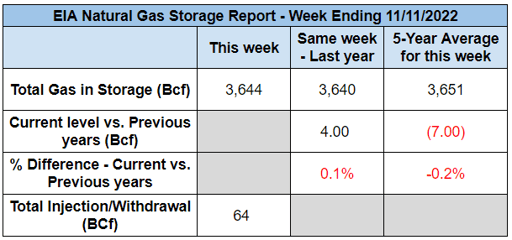

Weekly natural gas inventories

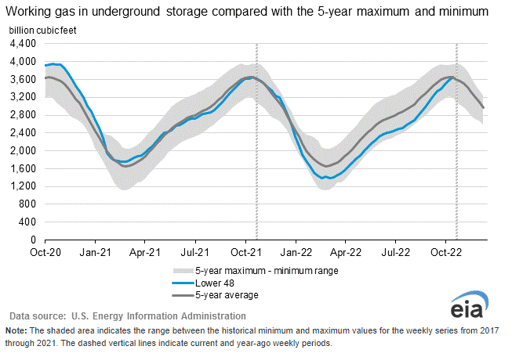

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 64 Bcf. The five-year average withdrawal for November is about 17 Bcf. Total U.S. natural gas in storage stood at 3,644 Bcf last week, 0.1% more than last year and 0.2% lower than the five-year average.

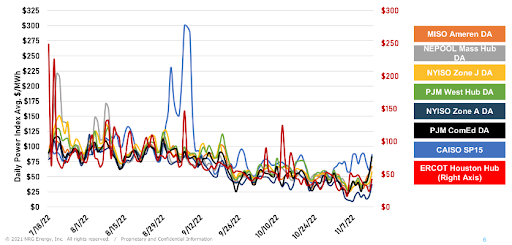

US power & gas update

- Markets are mostly unchanged over the past two weeks but with choppy trading in a highly reactive market

- NOAA’s Nov 10 forecast for a cooler back half of the month sent markets up, but that was negated the very next day by news that Freeport LNG, the Louisiana export terminal that has been offline since June, will not return in November as previously planned.

- Freeport has since disclosed that it canceled shipments in November and December, casting doubt around its exact return date, a bearish indicator for US gas.

- The additional 2 Bcf/d of gas that Freeport LNG has kept in the US is largely responsible for the moderation of prices over the past 5 months. This will be an important factor as the % of gas exports increases in 2024 and thereafter. Europe’s draw on US gas will only increase.

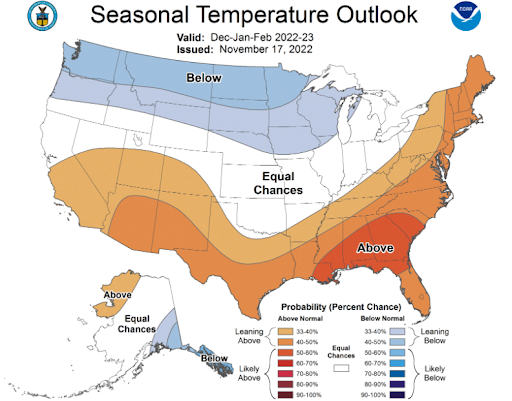

- NOAA’s most recent guidance maintains expectations for a moderate winter across eastern load centers (see map next section).

- Residential and Industrial gas demand tapered some over the past month, while gas demand from the electric generation sector continues at a record pace.

- All told, the US has erased its gas in storage deficit, both year-over-year and compared to the 5-year average. The US gas inventory picture is currently looking quite robust and we see this as a strong bearish signal for near term pricing.

- The Pacific and East regions remain slightly short of pre-winter inventory targets however.

- Utilities in the Northeast continue to print eye-watering rates for this upcoming winter; the latest is Eversource Massachusetts at 50 cents per kWh in January and February 2023. Utilities in CT and NH are balking at contract commitments and seeking assurances from regulators.

Source: NRG, Spot / Daily Wholesale Power Prices

NERC Offers Sobering Assessment of Winter Preparedness

- Just a few weeks after FERC’s concerning winter reliability assessment, NERC, the North American Electric Reliability Corporation, is set to release their own “sobering assessment” of winter preparedness.

- The winter season is not, as of now, predicted to bring about especially cold winter weather, however any extended cold spell could easily expose the fragility of the grid in many parts of the US according to NERC.

- ERCOT, MISO, and ISONE are all listed as vulnerable regions set to face challenges this winter. Similar to FERC’s assessment, NERC expresses concern with New England’s reliance on natural gas imports.

- Tank capacities at New England’s oil-fire plants are entering the winter 40% full as compared to 54% last year, indicating potentially problems with market incentives in the region. Although they are few, oil-fired and dual fuel plants are a last line of defense against rolling outages during long cold spells.

- Parts of Canada are mentioned as newly at-risk regions due to either losses in generation capacity or the inability of new generation to meet increased demand.

- On the positive side, water levels behind hydroelectric generation in the Pacific Northwest are well positioned to support power demand in the region, and the Southwest has seen positive additions to natural gas and wind generation.

Source: NOAA

Europe considers long-term reforms to energy market

- Since the beginning of the war in Ukraine, we have witnessed the quick unraveling of Europe's dependence on Russian fossil fuels.

- Energy prices have increased dramatically as a result. Belgian trade unions say gas prices have increased by 130% in just one year, electricity by 85% and fuel oil by 57%. Prices for food and other staples have also surged.

- Various EU countries have set up temporary back-up solutions to protect consumers from the rate impact associated with higher wholesale prices, such as by absorbing a portion of the price increases into sovereign debt.

- Over the long term however, two measures remain under discussion at the European Commission.

- The first is to cap the cost of wholesale gas: Spain and Portugal have already pursued this strategy, with a cap on gas prices for electricians at 40$/MWh and the state subsidizes the difference.

- Unfortunately, this solution appears to be having some perverse effects. First, it creates an incentive to sell power from Spain to neighboring European countries that are indexed to the actual / unsubsidized cost of gas. The Spanish taxpayer is ultimately on the hook for subsidization of other European countries. Second, it broadly incentivizes investment in more gas generation over the long run, which is a distortion of the market and misaligned with carbon reduction goals.

- Establish a dual day-ahead market: Proposed by Greece in July, this proposal would dramatically change the power market design to create two markets: one for low or zero marginal cost resources, and another for dispatchable variable cost resources such as traditional fossil plants.

- The goal would be to decouple the whole of electricity prices from soaring fuel prices.

- They start from the fact that more than half of European power plants have practically no OPEX (e.g., renewables and nuclear). Moreover, net zero by 2050 goals from IEA and other serious reports shows the expansion of nuclear and renewables in the future whereas coal and gas for electricity will be shutting down.

- It seems more logical to compensate these power plants on their fixed costs (CAPEX) and not on their variable costs (OPEX). The rest of the plants - only the thermal plants - would continue to be financed on their variable costs as it is the case today.

- The wholesale market would thus be split into two compartments and would operate in two stages. In the first stage, the grid operator would calculate the share of demand that would be met by the relatively stable price offer of the CAPEX resources. In a second step, the residual demand would be met by a call for tenders from thermal power plants selected according to the logic of a merit order based on their variable costs (fuel costs or OPEX).

- The price paid by the consumer would be a weighted average of the two equilibrium prices. It is conceivable that the offer price of power plants with a high proportion of fixed costs could be set via CfD (Contracts for Differences) type contracts, after auctions on this market segment or on the basis of OTC (Over the Counter) contracts, i.e. outside the market.

- As the share of renewable and nuclear power plants in the European electricity mix increases, the market share of "predominantly CAPEX" power plants will also increase. Eventually, the wholesale price of the MWh could be based on the fixed cost alone with an additional variable cost of renewable and nuclear power plants. In this case and according to France's supreme audit institution, fuel nuclear prices count for less than 10$/MWh that should be taken into account and added to the new wholesale market based on CAPEX.

- The merit of this dual market system is that it responds both to the urgency of the situation, which is to lower the equilibrium price of electricity, and to the longer term transition from fossil fuel plants to renewables and nuclear.

- Aside from lowering costs, this concept has some rather significant benefits and would be evaluated with much interest by other Western countries, including the US, that have struggled with how to maintain a single market price for electricity as more intermittent renewables and low marginal cost resources are added to the grid.

- A consensus seems to be emerging in the short term on the need to tax windfall profits, regardless of the market design solution that is ultimately chosen.The first solution is undoubtedly faster and less complex to implement than the second, but the second has the merit of being able to sustainably accompany the transition to a low-carbon mix.

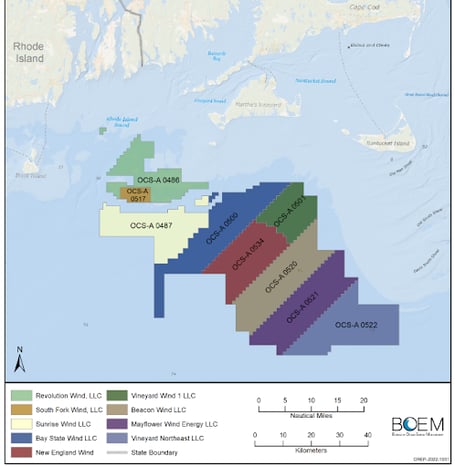

Inflation and Supply Chain Issues Weigh on Offshore Wind Projects

- Last May, Massachusetts electric companies entered into contracts with developer Avangrid for a 1,200-megawatt offshore wind project called Commonwealth Wind. Contracts were signed at 7.2 cents per kWh, PPAs were filed with the Department of Public Utilities, and Massachusetts got incrementally closer to its 2030 carbon goals.

- Last month however, Commonwealth Wind filed a motion for a one-month delay in the DPU’s review stating the project “is no longer viable because of recent global commodity price increases “due to” the war in Ukraine, interest rates, supply chain constraints, and persistent inflation.”

- The DPU rejected the request and gave the wind developers a Monday deadline to either commit to their contracts or pull them from DPU review. Commonwealth Wind said late Monday, it will move forward with the PPAs currently under review with the DPU.

- In its own filling Monday, Commonwealth Wind stated the DPU “should not dismiss the proceedings as to the the power purchase agreements” but went on to mention they “strongly believe that it is the public interest to allow the parties to negotiate PPA contract amendments that allow Commonwealth Wind’s offshore wind generation project…to be economically viable, to obtain financing and to proceed to construction and, finally, deliver Massachusetts customers cost-effective renewable energy at prices that would be lower than alternatives.”

- There are additional issues with the contract amendments Commonwealth Wind is seeking. Most notably, power becoming more expensive increasing from the initial 7.2 cents per kWh price point, a potential project operational start date pushed from 2027 to 2028 and utility companies stating “they do not intend to renegotiate” with the wind developer.

- However, Beth Card, the Energy and Environmental Affairs Secretary has expressed her support in a letter explaining that the federal and state government have taken actions to “directly address” the kinds of macroeconomic challenges that Avangrid says have complicated Commonwealth Wind. One example is the Federal Inflation Reduction Act expanding tax credits for offshore wind developers. Card also stated, “I encourage Commonwealth Wind to devote every resource at its disposal and consider all opportunities available so this project can proceed under the current contracts and I will encourage all pertinent parties to meet to understand the specifics of the financial challenges.”

- If completed, Commonwealth Wind would deliver 1,232MW of clean and affordable energy and cut greenhouse gas emissions by over 2.35 million tons per year, the equivalent of taking more than 460,000 cars off the road. Commonwealth Wind aims to provide power to 700,000 homes in Massachusetts and create approximately 11,000 full-time equivalent jobs.

- Commonwealth Wind is one of four offshore wind projects under contract in Massachusetts. Altogether, they have a capacity of 3200 MW and the first project is expected to come online in 2023.

Source: BOEM, Offshore Wind Developments

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.