Energy Markets Update

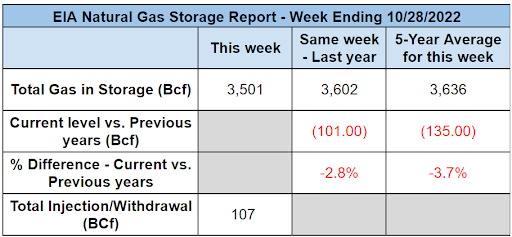

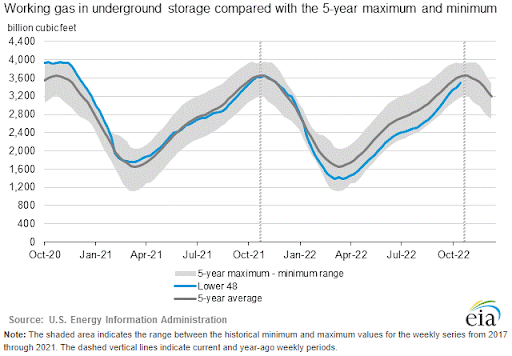

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 107 Bcf. The five-year average withdrawal for November is about 17 Bcf. Total U.S. natural gas in storage stood at 3,501 Bcf last week, 2.8% less than last year and 3.7% lower than the five-year average.

US power & gas update

- NYMEX futures have rebounded considerably over the past 10 days across a number of highly volatile sessions. Winter contracts are up between $0.50-$1.00 net from recent lows (e.g., prompt @ $5.22/Dth on October 21st).

- However, the market is clearly seeking direction as near term prices have fluctuated more than 50 cents in both directions a few times over the past two weeks.

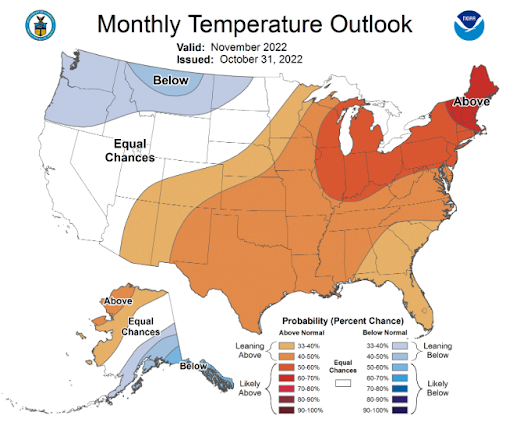

- High temperature forecasts predict a slow start to the heating season. The forecast for the next couple of days shows warm temperatures across much of the country except for the west coast, which will have abnormally cool temperatures. In its November forecast, NOAA predicts average temperatures for the eastern half of the country and the Southwest with below average temperatures in the Northwest and average temperatures in between the two regions.

- The Freeport LNG terminal is still aiming to resume partial operations in November, but Texas regulators are requesting more data to make sure operations would be safe.

- New England power pricing has remained fairly stable from recent lows in mid-to-late October. Prices have reflected recent volatility in the natural gas market.

- Natural gas injections came in at 107 Bcf for the week ending October 25th, which convincingly beat analyst expectations of 95 Bcf.

- Customers still have the opportunity to lock in a portion of their contracts with a slow start to the heating season.

Source: NOAA

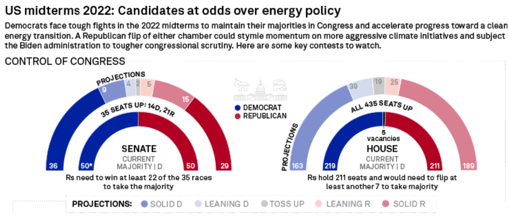

US midterms weigh on energy policy

- Midterms will have a large impact on the direction of climate and energy legislation and policy until 2024 elections. Some races will also determine membership in and leadership of key energy related committees.

- If a Democratic majority remains in the Senate, it will be much easier for President Biden to continue his energy and climate agenda in congress. Joe Manchin would also keep his current position as chair of the Senate Energy and Natural Resources committee. While Manchin has been a pariah for many in the environmental community, he is also moderating influence in the Senate and one of the few pathways to bipartisan legislative efforts.

- The GOP has a strong chance of taking the majority of the House of Representatives and the Senate as well.

- If Republicans were to seize control of either chamber of Congress, they would likely focus on an all-of-the-above energy approach which encompasses increasing oil and gas production, nuclear, carbon capture, and storage technologies as well as renewables development.

- The Senate races in Nevada and Georgia are being closely monitored due to their potential to shift the majority of either party in Congress.

- Raphael Warnock, the Democratic candidate for Senate in Georgia, has been a proponent of solar in Georgia and across the United States. His opponent, Herschel Walker, has criticized the IRA saying that “a lot of [that] money, it’s going to trees.”

- Another race to watch is New Mexico where GOP oil and gas proponent Rep. Yvette Herrell is facing Democratic challenger Gabe Vasquez. Vasquez wants to push New Mexico towards clean energy development and wants to “fight any effort to sell off our public lands to the highest bidder.” Herrell has been a vocal critic of the Biden administration for not holding leasing sales for oil and gas resources and holding up drilling permits.

- There are also races where redistricting has changed the demographic of voters. Democrat Katie Porter, the head of the House Natural Resources subcommittee on oversight and investigations, is running against Republican Scott Baugh. Porter has been a critic of oil companies when gas prices increased over the summer while Baugh has fought against aggressive climate related policies that endanger jobs and economic growth.

- There are other tight races in Pennsylvania and Montana pit Republicans endorsed by former President Donald Trump against Democratic clean energy proponents.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity InsightsNew projects could boost New England electric reliability

- The Maine Public Utilities Commission recently approved two contracts that could provide carbon reduction and reliability benefits to New England.

- Longroad Energy secured approval for a roughly $2 billion dollar wind farm in Maine. LS Power secured approval for a $2.9 billion power transmission line that would interconnect Longwood’s 1000 MW King Pine wind project, and deliver power to the ISONE grid.

- King Pine represents the largest remaining opportunity in New England for onshore wind power.

- The Commission is looking to gauge other New England States’ interest in the projects, primarily if they’re interested in buying power from King Pine to offset the impact to Maine’s rate payers. The most probable offtakers would be Massachusetts ratepayers, whose recent plans to take Quebec-based hydroelectric power were recently stymied at the Maine ballot box.

- The currently stalled project, the New England Clean Energy Connect (NECEC) transmission line, attracted criticism from some members of the public due to its potential impacts on the ecology of Maine. However, as we recently covered in this publication, much of this opposition was gaslighting organized by some of the region’s largest energy companies under the guise of grassroots environmentalism. The transmission line aimed to deliver hydropower from Quebec to the New England grid to decrease reliance on natural gas, improve reliability, but also lower energy prices for the region. Owners of existing generation in the region were therefore opposed to the project.

- The recently approved contracts may lend a hand to Massachusetts’ efforts to increase renewable capacity, most notably after the recent struggles with NECEC…if of course Massachusetts can get over the fact that its climate policies are being held hostage by Maine.

- Additionally, the transmission line and wind farm are avenues for New England to reduce its reliance on natural gas, which has been deemed a risk for this upcoming winter in the event of extreme winter weather.

Eversource seeks federal gas supply assistance

- The CEO of Eversource has petitioned President Joe Biden to use emergency powers to confirm sufficient gas supply for the upcoming New England winter.

- FERC’s Winter Reliability Assessment found that while New England has adequate power supply for a typical winter, the region is especially vulnerable to long spells of cold winter weather.

- New England is highly reliant on gas-fired power generation, but has limited pipeline infrastructure to import natural gas. Given the current price and scarcity of LNG, the struggle for natural gas supply in New England has become increasingly concerning.

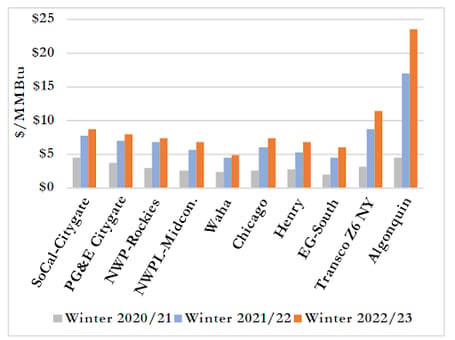

Algonquin Natural Gas Winter Price Compared to Other Benchmarks:

Source: FERC

- Pipeline deliveries of gas are supplemented by shipments to Everett Massachusetts’ LNG facility, though the obsolete Jones Act further complicates this process.

- The Jones Act is a 1920 law that requires that shipments between American ports must be carried out using American ships. Limited numbers of US LNG tankers make meeting this requirement difficult.

- Eversource CEO Joe Nolan Jr. referenced the Jones Act rules in his call-to-action for President Biden, suggesting that the requirement of domestic ships transporting LNG be waived. For the record, this simple concept has been suggested for more than 10 years, however stakeholders in New England have not yet presented it to FERC in any unified manner.

- The Department of Homeland Security recently waived Jones Act requirements for LNG shipments to Puerto Rico in an effort to ease the impacts of Hurricane Fiona.

- In FERC’s assessment, big-picture concerns about New England’s reliance on LNG imports were emphasized. FERC Chairman Richard Glick called New England’s LNG dependence “unsustainable.”

- The severe winter storm in February 2021 has put extreme winter weather on the radar for all energy stakeholders, and FERC does not believe that New England is alone in exposure to such risks. Midcontinent ISO regions, ERCOT, and parts of the Southeast were also named in FERC’s Winter Reliability Assessment as locations that could be at risk if extended periods of cold weather occur.

Solar microgrids in Puerto Rico

- The Puerto Rico Electric Power Authority (PREPA) has selected Sunrun to develop a 17-MW Virtual Power Plant (VPP). This VPP will lower energy costs for island residents and improve grid reliability by connecting 7,000 rooftop solar-plus-battery systems, the company announced Tuesday.

- If successful, the project could be a good solution for more remote areas that are prone to transmission outages.

- Sunrun said it intends to spend the next year enrolling customers into the program, with an eye toward launching operations in 2024.

- 5 years ago Hurricane Maria decimated the island’s grid and, in the wake of the storm, the Puerto Rico Energy Bureau directed PREPA to investigate how VPPs and distributed resources could improve grid resiliency. Sunrun claims this project will be the island’s first distributed, large-scale storage resource.

- Over the past 5 years residents have experienced many additional storms, including Hurricane Fiona in September, which left the majority of the island without power.

- PREPA tapped LUMA Energy to manage the electric system last year and, despite replacing thousands of poles, connecting tens of thousands of customers to solar, and improving customer service, critics say it has not improved the island’s electric service.

- Sunrun’s VPP will represent a new solution for the island, according to CEO Mary Powell. Powell explained, “we’re solving energy insecurity on the island by switching the model so that solar energy is generated on rooftops and stored in batteries to power each home, and then shared with neighbors.”

- Puerto Rico has received $4 million in federal funding to help make the power grid more resilient according to President Biden. Additionally, Biden has expressed “that number is going to go up.”

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.