Energy Markets Update

Editor’s Note: In this update, we track rising volatility in gas and power markets as cooler temperatures and LNG project milestones push 2026–2027 gas strips above $4.00/MMBtu and lift forward power curves across major ISOs. Federal policy shifts—from DOE’s proposal to expand FERC oversight of large-load interconnections to the EPA’s reversal on ending Energy Star—signal evolving regulatory priorities. State-level debates over Renewable Portfolio Standards and RGGI participation highlight growing tensions between climate goals and affordability. Meanwhile, nuclear power is regaining policy and capital support, and DOE’s emergency orders to extend aging thermal plants raise questions about cost-effectiveness and long-term grid strategy.

Table of Contents

- Energy Market Update

- To Renew, or Not to Renew: The RPS Sequel

- Nuclear’s Second Act: Governments Rediscover Their Favorite Base Load

- DOE Proposes Federal Oversight of Your Neighborhood Data Center

- When Old Power Plants Overstay Their Welcome

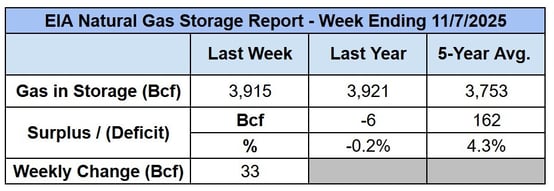

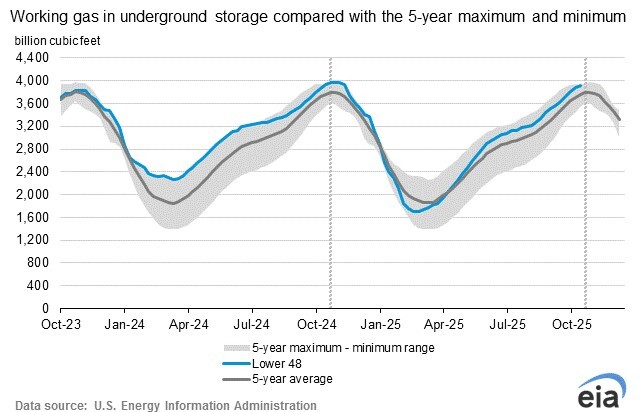

Weekly Natural Gas Inventories

Source: EIA

Energy Market Update

- Henry Hub natural gas prices have found some support in recent weeks with modest gains (1-4%) that pushed the 2026 and 2027 calendar strips back above $4.00 earlier this week. The biggest moves this week were in the December 2025 contract, which rocketed from $3.80 to $4.28 today (+12%).

- The broader US gas market remains adequately supplied – inventories and production are robust – however the onset of cooler temperatures, particularly in the Northeast, and positive guidance on the scheduled commercial operations of the Golden Pass LNG (TX) project early in 2026, are injecting some anxiety into the market. This time of year is notoriously volatile.

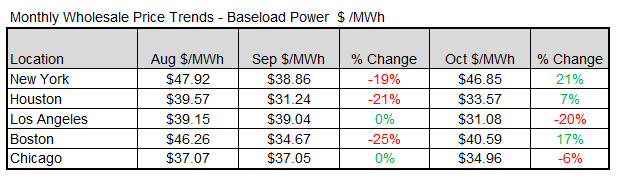

- Futures trends in the power market are markedly more bullish. Since early September, the forward curves for 2026 and 2027 have risen by about 10% in PJM, MISO, and NYISO and by approximately 5% in ISO-NE and ERCOT.

- Spot price power trends:

- In positive news for spot buyers, the New England Energy Connect, a 1,200 MW hydroelectric + transmission project from Hydro Quebec into New England, is expected to enter into commercial operations by the end of the year. For those of us who have history wintering through tight conditions, it could not come soon enough.

- The government shutdown, now at 37 days, is the longest in US history. Everyday Americans are starting to see the impacts in longer airport queues and reductions in food benefits such as SNAP, alongside more diverse acute impacts across various programs and workers.

- Federal Reserve officials voted last week to lower their benchmark lending rate by another quarter-point, bringing it to a range of 3.75% to 4%, the lowest in three years. It was also the first time officials set monetary policy without an entire month of crucial government employment figures in the modern era

- The Environmental Protection Agency (EPA) has quietly walked back its plans to dismantle the Energy Star program. Federal records confirm this shift, showing the agency renewed four contracts with ICF, the consulting firm that assists in managing the program. One of these renewed contracts extends through September 2030.

- A memo from Bill Gates is sparking discussion about the future of climate change mitigation. Mr. Gates has suggested that more resources should be allocated to harm reduction and minimizing human suffering. He has clarified that clean tech remains critical but the broader industry should focus on technologies that reduce “green premiums” so that sustainability becomes more entrenched in economic decisions.

- Commercial Updates

- SM Energy and Civitas Resources announced a $14B merger this week, combining two US shale drillers in the Permian. M&A is picking up in the gas sector as players make longer-term bets on continued demand from datacenters.

- Hecate cancels 650MW Staten Island, New York BESS project.

- ME & CT collaborate to procure renewable energy.

- According to data from the LevelTen Energy PPA marketplace, wind power purchase agreements have risen faster than solar since the election of President Donald Trump, rising ~$9/MWh since 3Q24 vs. an average $3.19/MWh increase for solar. Wind power purchase agreement prices in North America rose nearly +5% q/q in 3Q25 (nearly +14%since last year), while solar PPA prices rose +4% q/q.3.

To Renew, or Not to Renew: The RPS Sequel

Renewable energy mandates and their associated costs are facing new scrutiny amid broader affordability concerns. The Arizona Corporation Commission's (ACC) unanimous vote earlier this year to eliminate its Renewable Portfolio Standard (RPS) signals a potential shift. We'll take a closer look at how RPS requirements and complementary programs like the Regional Greenhouse Gas Initiative (RGGI) have driven state energy policy, the mounting financial challenges to continue building out renewable infrastructure, and the critical decisions regulators face to balance climate goals and ratepayer costs.

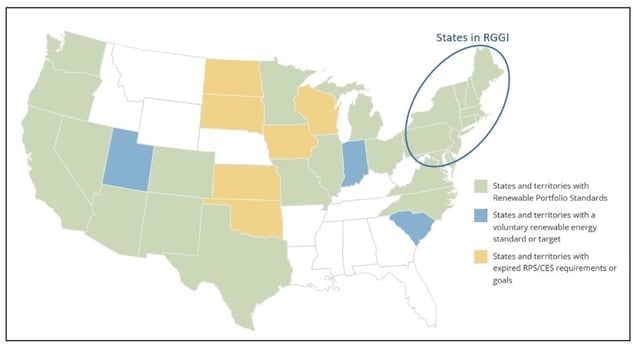

- Currently, 29 states administer renewable energy purchase obligations, typically promulgated under a state Renewable Portfolio Standard (RPS) law requiring energy suppliers to source specified percentages of Renewable Energy Credits (RECs) from renewable producers. These costs are passed through to ratepayers and there are penalties for non-compliance.

- Recent headlines from Arizona and Pennsylvania suggest there may be growing interest among lawmakers to do away with the RPS due to affordability concerns and shifting political priorities, which could garner support in future elections.

- In August, the Arizona Corporation Commission (ACC) voted unanimously to repeal the state's renewable energy mandates after exceeding its 15% renewables requirement for 2025. Though this was a relatively modest RPS target compared to those established by states like New York or California, it has cost ratepayers $2.3 billion since its inception, according to the ACC. This raises questions about whether other states may follow suit once initial RPS goals are met, or how they may restructure RPS markets if and when they come up short of targets. See our coverage of these scenarios in New York’s Green New Deal-Emma.

- RPS programs were never intended to remain in place indefinitely, and it makes sense that they phase out as targets are met. Even Bill Gates would wholeheartedly agree (see our Market Update section) however, what states do with respect to subsequent target setting is very much up in the air, and it should be noted that many states have terminal legislative RPS targets in 2030.

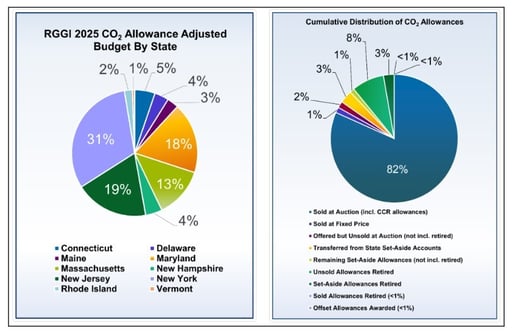

- Beyond traditional RPS frameworks, several states have implemented cap-and-trade mechanisms as alternative or complementary approaches to driving decarbonization. The Regional Greenhouse Gas Initiative (RGGI), a cooperative effort among 11 Northeast states established in 2005, caps CO2 emissions from the power sector and auctions allowances with revenues typically reinvested in clean energy and efficiency programs (see map below).

Source: NCSL

- Even though RGGI has achieved a ~50% reduction in regional power-sector emissions, the program remains vulnerable to affordability-driven policy reversals. For example, New Jersey exited in ‘11 (then rejoined in ‘20), Virginia passed legislation to withdraw in ‘23, and Pennsylvania remains in legal limbo as Pennsylvania Republicans passed a bill to reverse its previous commitments to the program. On Tuesday, both NJ and VA elected new Democratic Governors, with NJ staying blue and Virginia shifting away from the Republican incumbent. The governor-elects in both states promised to address rising energy costs throughout their campaigns, namely through bolstering the reliability of renewables.

- Highlighting some of the vulnerabilities last month Pennsylvania's Senate Bill 1068, passed a repeal vote by 33-17. PA’s October vote to exit RGGI underscores the economic tensions inherent in cap-and-trade systems, where states like PA, with its large coal fleet, face higher compliance costs purchasing additional allowances from cleaner states like Vermont, Maine, and Rhode Island. See RGGI’s trackers below, for more detail on the distribution of allowances, organized by allocation year.

Source: RGGI

With the recent added complexity of attaining financing and permitting for renewable energy projects, as we’ve covered in previous newsletters, some RGGI states are forging ahead. At the end of October, Maine and Connecticut announced a partnership to fast-track renewable projects, demonstrating the extension of regional cooperation beyond emissions trading to joint clean energy procurement. RGGI states will benefit from staying coordinated and sharing costs as they work to capture federal tax credits before the 2026 deadline.

Nuclear’s Second Act: Governments Rediscover Their Favorite Base Load

From Tokyo to Washington, nuclear power is making a comeback - this time with policy muscle and global capital to match.

Nuclear isn’t just back in the headlines; it’s back in budgets. Over the past month, governments and investors have been quietly rewriting the energy playbook, with Japan’s new $550 billion clean-energy partnership and a U.S. nuclear revival leading the way. The message is simple: after years of hesitation, policymakers are betting that fission, not just renewables, will anchor the next phase of grid reliability. This is something most Americans can agree on.

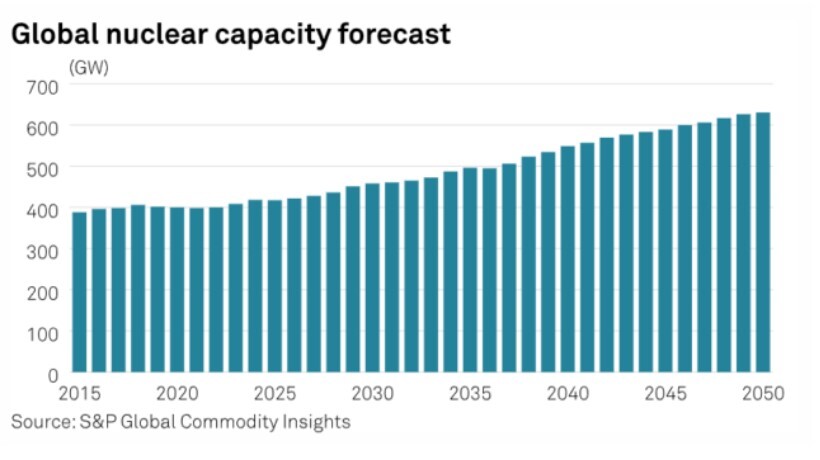

Source: S&P Global Commodity Insights

The Japan-U.S. Connection

Japan’s latest energy agreement with the U.S. isn’t just diplomatic choreography. It ties direct investment and technology exchange into an expanded nuclear and critical minerals supply chain—and signals that both countries see atomic energy as strategic infrastructure. Tokyo plans to reopen or repower several reactors and invest heavily in SMR technology, while the U.S. DOE is doubling down on credits for life-extension projects.

Private Capital Joins the Party

The policy tailwinds behind nuclear’s resurgence are now pulling in private capital. The Brookfield-Cameco-Westinghouse alliance, valued at roughly $80 billion, has positioned Westinghouse as a central player in the Western nuclear ecosystem. The company’s AP1000 technology is being adopted in new reactor projects across the U.S. and Europe, and the partnership aims to localize key parts of the fuel and component supply chain that have long depended on Russia and China.

For investors, this deal hints at a larger market pivot: life-extension work, reactor retrofits, and new builds now have the industrial backbone and capital backing to move forward. In short, government incentives lit the fuse - private money is finally walking through the door.

The New Economics of Fission

Nuclear’s biggest obstacle has always been its price tag—still hovering around $7,000–$8,000 per kW for new builds—but that is beginning to change. Cheap capital and targeted policy are easing financial pressure. In the U.S., the DOE’s Loan Programs Office is providing billions in loan guarantees to advanced reactor projects and plant life extensions, while Japan’s new GX Transition Bonds will channel roughly ¥20 trillion (~$130 billion) into long-duration, low-carbon infrastructure.

For investors, that kind of fiscal scaffolding reframes nuclear’s long-term timelines—once its greatest liability—as a stable, inflation-resistant cash-flow asset. In a volatile grid increasingly dependent on intermittent renewables, predictability is starting to look like profit.

The Bigger Picture

None of this means nuclear is risk-free. Uranium supply remains tight, construction delays are still common, and public opinion is uneven. But the policy winds have clearly shifted. From Tokyo’s nuclear restarts to Washington’s expanded nuclear credits, governments are no longer just allowing nuclear power; they’re actively promoting it.

The question now is whether this momentum will endure when budgets tighten again. But for the first time in decades, nuclear has what it’s long lacked: policy alignment, private capital, and public backing—all moving in the same direction.

DOE Proposes Federal Oversight of Your Neighborhood Data Center

Last week, the U.S. Department of Energy (DOE) made an unusual request to the Federal Energy Regulatory Commission (FERC). They want FERC to create new rules to speed up the process for connecting large electricity loads (20 megawatts or more) to the power grid. This request aims to expedite the process to meet the fast-growing demand from data centers and new manufacturing plants.

- FERC typically focuses on connecting power plants and managing electricity transmission between states. Connecting large electricity users has usually been handled by local authorities, utilities, and state governments; however, there are instances in which such activity falls under FERC jurisdiction when there are broader impacts on the wholesale market. The DOE’s proposal challenges this setup, arguing that a more standardized, transparent, and accelerated process for large-load interconnection will make the power system reliable. While FERC doesn’t have to follow DOE’s request, DOE believes streamlining this process nationally is in the public’s interest.

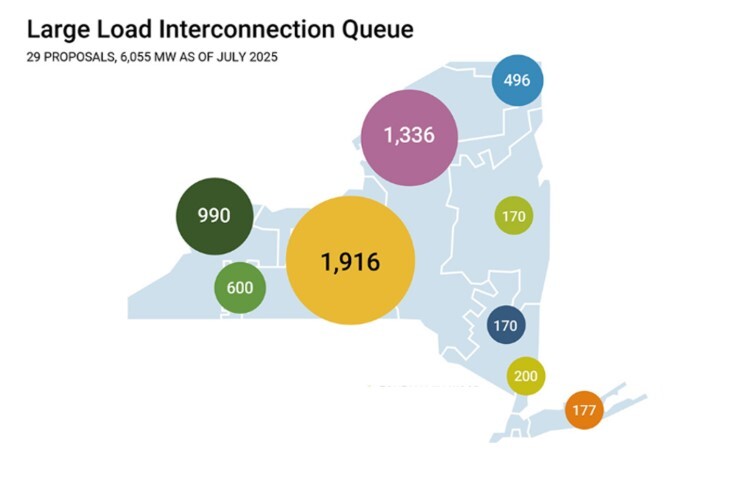

- In New York, the queue to connect large electricity users has jumped from ~1GW in 2022 to ~6GW in 2025. Many of these projects never get built. Approximately 30% have been canceled over the past 20 years, and there is growing evidence that this figure could be higher for data centers. Speculative projects, sometimes called “vaporwatts,” can clog up the system and make it harder to plan for actual electricity needs. In NY, grid planners think only 2.5-4GW of the proposed projects will actually happen.

Source: NYISO Energy-intensive Projects in NYISO’s Interconnection Queue

- The uncertainty from these “vaporwatts” makes it hard to predict future electricity demand. DOE believes that a faster, more organized process run by FERC could improve the accuracy of these forecasts, making it easier to plan for real demand and to have forward-looking market prices, such as capacity, reflect these values.

- We tend to agree that standardization is a positive for most stakeholders; however, it is hard not to be concerned about the balance between supply and demand in this age of frenetic data center development. The jurisdictional tradeoff lies in balancing the potential efficiency and forecasting benefits of expanded FERC jurisdiction against concerns over federal encroachment on state authority, even though DOE stated that smaller projects, local connections, and behind-the-meter systems would still be handled by states. The statement was meant to ease concerns that the federal government might be encroaching too much on the states’ authority.

When Old Power Plants Overstay Their Welcome

Across the U.S., many old coal and natural gas power plants are being used less and less, even though the Department of Energy (DOE) has ordered them to remain online past their retirement dates for emergency generation. These plants, which are often decades old, used to be a big part of meeting high electricity demand. Today, they are being displaced by cheaper gas plants, renewable energy, improved efficiency, and changing market conditions. The question is, when will they ever get to retire?

- The path towards retirement for older thermal plants plays out similarly across all markets: their energy market revenues dry up as they are only called upon during infrequent periods when high-cost power is needed to prevent blackouts. Cheaper natural gas plants and renewable energy gradually take market share, and they struggle to cover their fixed costs with unpredictable capacity-market revenues, if any are available at all.

- Retirement of thermal plants makes grid planners nervous, particularly in tight markets where reserves are modest. This becomes an even greater concern in the cold-prone and constrained markets where prolonged cold snaps can really put strain on supplies. It requires careful analysis, contingency planning, and scenario analysis to approve the retirement party in these markets.

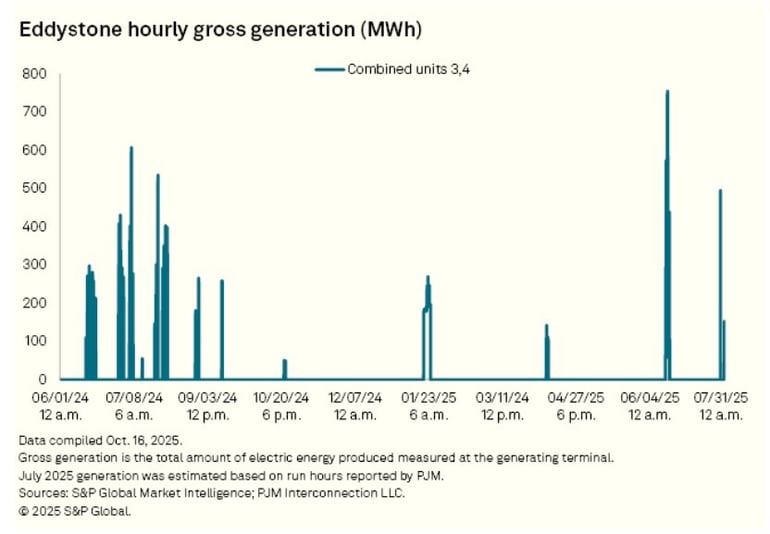

- Recent examples show the imbalance between the cost and value of their extension. In Pennsylvania, the natural gas-fired Eddystone plant was kept online past its retirement date but ran for only three days during the grid’s peak demand months of June and July this year. It sat idle for over a month before being called into service, despite PJM issuing four emergency generation alerts in July (see Eddystone’s generation profile over the last 12 months below).

Source: S&P Global

- Similarly, Michigan’s Campbell coal plant has been kept in service under DOE orders, but its limited operation is expected to leave ratepayers in its region with tens of millions of dollars in extra costs in 2025 alone.

- While the current administration is expected to extend the service life of these plants through emergency executive orders, initial results from these test cases show that the value they contribute by remaining in service is well below the costs of doing so.

- The initial emergency order to extend the retirement dates of several coal and natural gas plants came in May, arguing that they were needed to help stave off energy shortages amid summer demand threats in PJM and MISO. Yet, PJM and MISO both managed through the summer of 2025 without material shortages.

- Keeping these old, limited-use generators online comes with several knock-on effects. It's difficult for the plant owner to cover their operating costs; their extension slows down the move towards incorporating new generators, and scheduled plant upgrades like the move to battery storage and nuclear at Campbell have to be put on hold indefinitely.

- Michigan, Minnesota, Illinois, and Maryland have already voiced their concerns about these emergency energy declarations, pointing to billions of dollars in additional costs that would be passed on to their ratepayers should the DOE extend similar orders to the entire industry.

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.