Energy Markets Update

Editor’s Note: In this update, we cover heightened volatility in gas markets as winter forecasts and surging LNG exports reshape supply-demand dynamics. Storage levels near five-year averages face pressure from record production and rising global competition for U.S. gas. Policy shifts, including China’s battery export restrictions and new FEOC sourcing rules, add cost and compliance challenges for clean energy developers. Federal transmission funding cuts contrast with targeted upgrades like AEP’s project, signaling a preference for lower-risk investments. In NYC, looming capacity shortfalls hinge on timely completion of major transmission and renewable projects, with demand response emerging as a critical reliability tool.

Table of Contents

- Energy Market Update

- Heating Season Outlook

- Lost in Transmission: Federal Support for Transmission

- Trade Policy Pushback: The FEOC Factor

- STAR-Crossed: The Future of NYC’s Grid

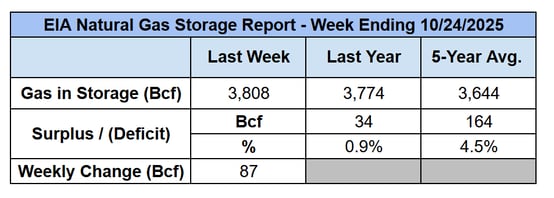

Weekly Natural Gas Inventories

Source: EIA

Energy Market Update

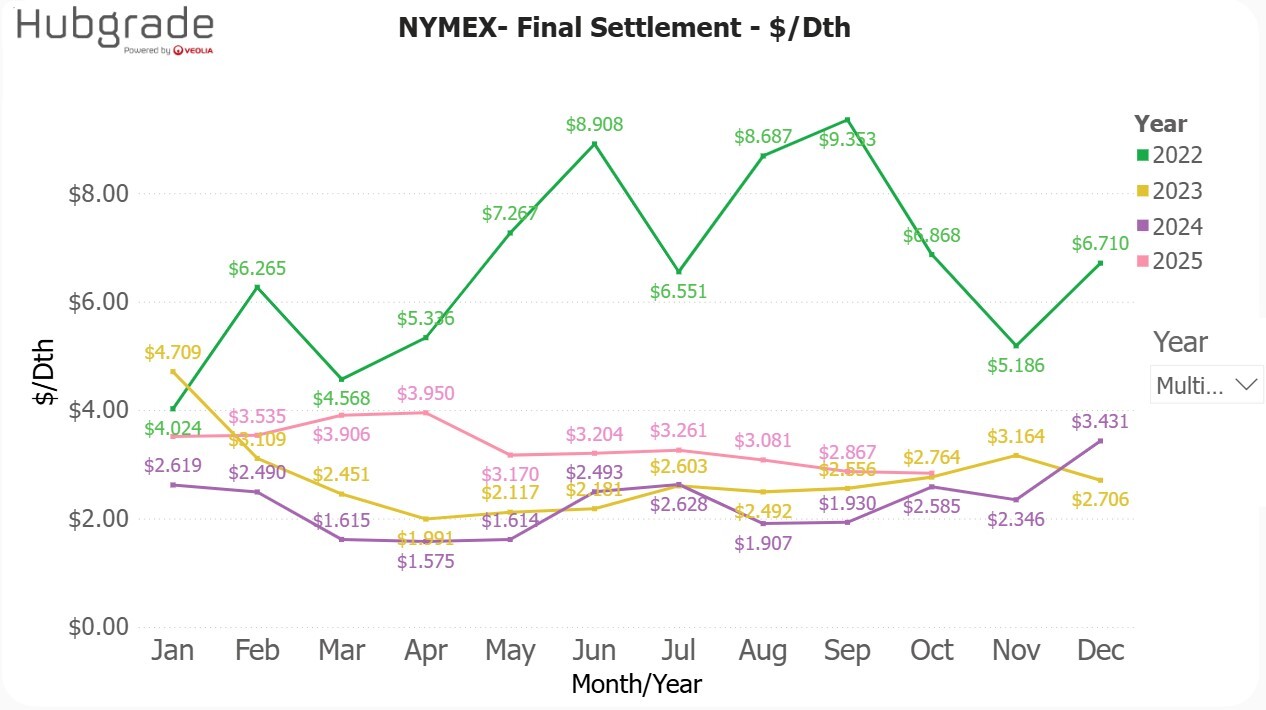

- This week began with a 13% surge in prompt month NYMEX gas futures, as the recently anemic gas market found support at $3.00 and rallied $0.39 to close at $3.39/MMBtu. The move came on the back of preliminary winter forecasts, which were only slightly colder than prior forecasts. However, as we noted in our last market update, the “shoulder season” is often characterized by high volatility as market participants speculate on early winter weather forecasts and their potential impact on the broader market balance. In other words, brace yourself for volatility.

- The 2026 NYMEX Calendar strip looms large as LNG exports are positioned to deliver 7.5 Bcf per day of new exports in the new year. The downward pressure typically exerted on forward prices with storage remaining above the 5 year average and production climbing by 4% to new highs in 2025, has been offset by expectations of rising LNG exports coupled with a normal winter.

- Expectations for a quick ramp up in LNG exports are being bolstered by news that Golden Pass will come online at the end of this year and that Plaquemines has received the nod to start its remaining trains. On-time development from these projects further strengthens the projections that US LNG export capacity will more than double, adding 13.9 Bcf/d by 2029. For more information on how recent weather forecasts and LNG export developments impact the market outlook, please refer to the 'Heating Season Outlook' section below.

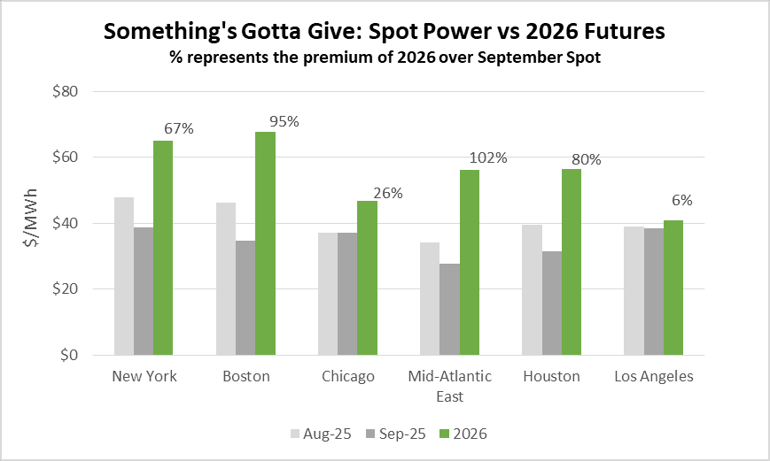

- On the other hand, spot prices have thus far come in well below expectations through the end of summer and fall. Both gas and power markets are presenting a wide gulf between spot rates and 2026 forward, e.g., ‘Something’s Gotta Give”

Source: Argus Forwards & Veolia Analysis

- Entering the fourth week of the government shutdown, the EIA continues to collect energy data for surveys and publish all of its publications according to its established schedules. With supply reports sourced from the EIA and weather-driven demand expectations from NOAA continuing to hobble along, further energy market volatility surges stemming from the disrupted flow of intelligence are curbed for now.

- Project Updates: The Bureau of Land Management has canceled the nearly complete programmatic NEPA review of the gargantuan 6.2 GW solar farm in the Nevada desert, Esmeralda 7. Currently, the US’s largest power plant is the Grand Coulee Dam at 6.8 GW, and Esmeralda 7 was set to be the second largest, smashing solar records. To advance the project, the developers will have to submit individual project proposals to the BLM, which would be a harsher permitting regime especially given the Trump administration’s actions to oppose solar and wind development. Should the project fail, the consequences will be felt first in Nevada where the project was projected to cover the region’s 373% rise in electricity consumption due to data centers. Instead the state will have to meet the demand with more gas-fired generation. With the levelized cost of utility-scale solar coming in lower than fossil fuel projects, even without subsidies, these higher costs are going to be passed onto the Nevada consumers.

Heating Season Outlook

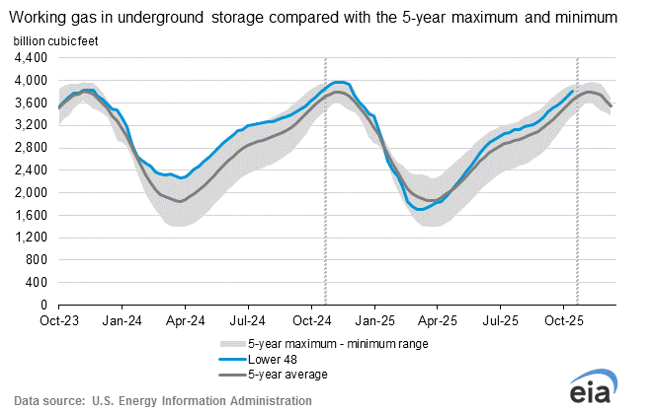

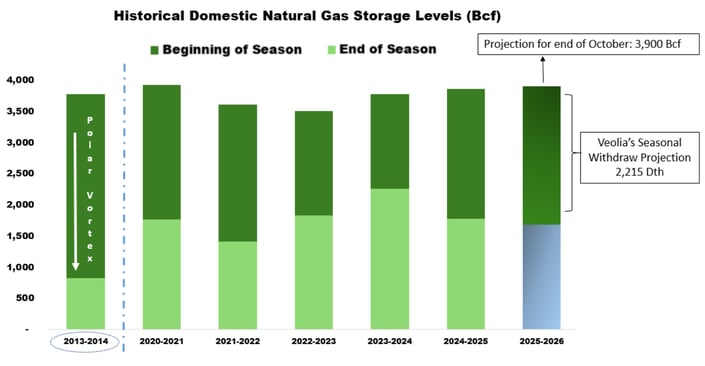

As injection season closes with storage near five-year averages, surging LNG exports coupled with upticks in domestic demand driven by new data centers and EVs are fundamentally reshaping the natural gas market heading into this winter, and all those to follow. With these structural demand shifts now underway, we're entering winter on shakier footing than the Q2-Q3 ‘25 production and storage numbers suggest. With NOAA’s seasonal winter temperature report released last week, we’re now ready to provide our outlook on the winter 25-'26 setup and where we believe storage levels will be entering Spring.

- Natural gas inventories remain the market's most reliable supply-demand gauge, with positioning relative to five-year averages directly dictating price action. When storage is tight, increased heating demand sends prices soaring; when inventories are perceived as oversupplied, driven by warmer-than-average seasonal temperatures in the first half of the season (Nov - Dec), NYMEX prices begin to fall. Though producers continue to extract gas year-round, net withdrawals from the system continue into March. Noting that this period represents 60-70% of annual residential and commercial consumption in cold states, where we stand today matters enormously.

- Weather remains the wild card. Cold snaps tend to make the spot market quite expensive in the immediate month of the snap, and can also create a ripple or wave further down the forward cost curve until the heating season has finished. According to the Energy Information Administration (EIA), each degree below normal adds 2-4 Bcf/d to national demand, accelerating inventory draws and tightening supply. During extreme weather events like the polar vortex, a multi-week cold snap, inventories drain faster, creating genuine supply scares when inventories are already lean (see our 2013-2014 chart further below when the extended polar vortex affected a large swatch of the lower 48 states).

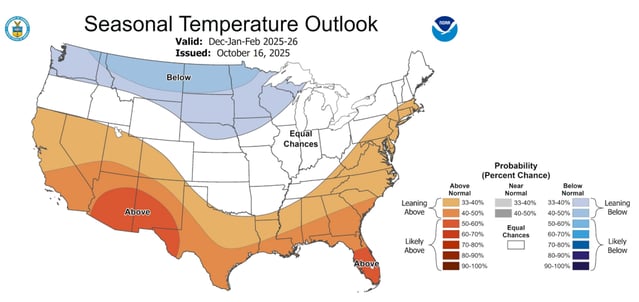

- NOAA's winter 2025-2026 outlook calls for warmer temperatures across the South and along much of the Eastern coast, with near-to-below normal projections in the Midwest (See NOAA’s latest forecast map below). Though this sounds benign, it masks real risk in key consumption zones if their projection is off, as many will recall was the case last year. Given we're starting this winter without the usual cushion, any sustained cold in major demand centers could trigger outsized price volatility and test the market's ability to balance.

Source: NOAA

- This winter also sets up differently, as we’ve previously reported that increased LNG export demand is now putting US buyers into unprecedented global competition for molecules that historically stayed domestic. New LNG export facilities have fundamentally altered the supply-demand equation, adding 12-14 Bcf/d in demand and supporting a higher price floor. While Plaquemines' rapid and successful ramp-up captured our analysts' attention last winter, Golden Pass will be taking center stage in 2026. The new Texas terminal is expected to reach full capacity in 2026, adding ~2.1 Bcf/d of new export demand. This incremental volume will further tighten the domestic market in the second half of this upcoming heating season and compete directly with storage injections during shoulder seasons, compressing the traditional seasonal price differentials.

- Given elevated LNG export demand, we forecast withdrawals running 8-12% above five-year norms - even with record-breaking production levels and average winter temperature projections, potentially leaving storage 150-250 Bcf light by season's end compared to the five year. This structural deficit would keep prices elevated through winter and provide strong support well into next year's injection cycle. The far right side of the chart below shows our withdrawal forecast against historical patterns.

Source: EIA, Veolia

Veolia's Director of Energy Markets, Alexey Cherniack, observed that "In this new paradigm, storage levels probably need to be up near 4,000 Bcf by this time of the year for the market not to panic. We just suck down inventories a lot faster than we used to." Using BP's projection last Friday for an end-of-season level of ~3,900 Bcf, we're falling just short of that threshold. Our team will continue to closely monitor these key fundamentals throughout the winter months and provide timely recommendations to energy buyers as market conditions evolve in the chilly months ahead.

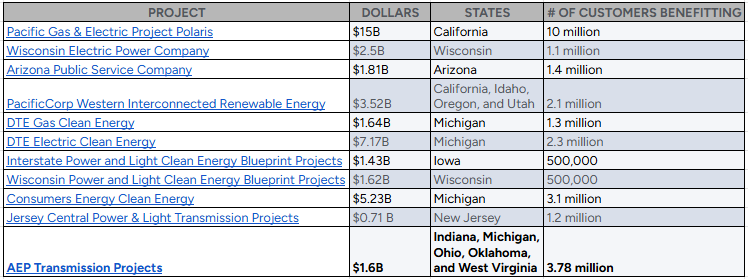

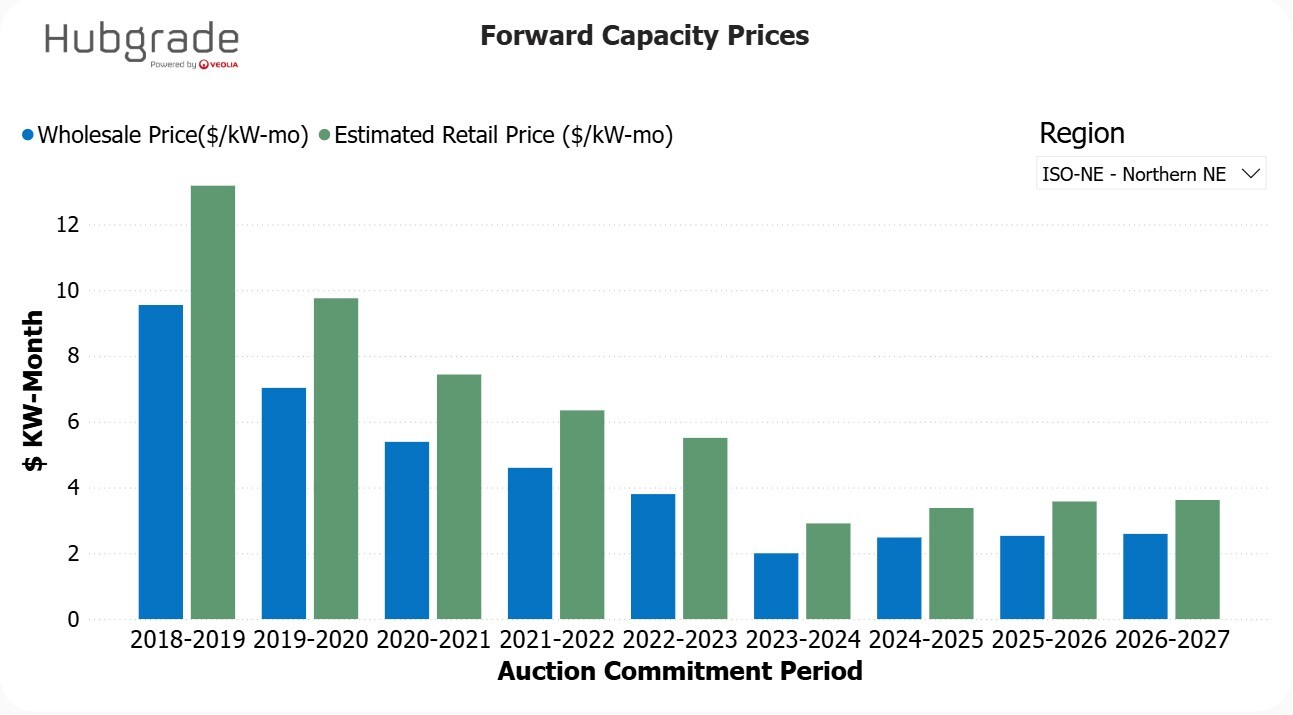

Lost in Transmission: Federal Support for Transmission

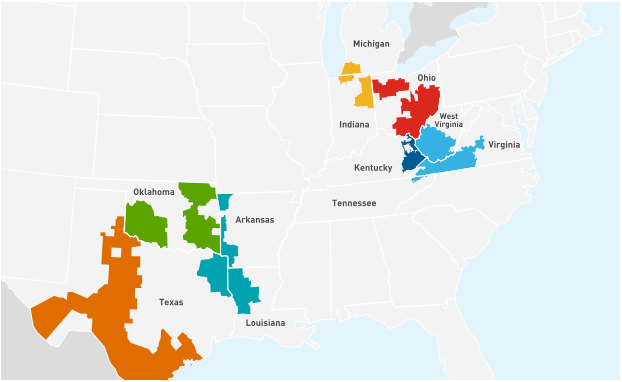

At the beginning of October, the Department of Energy terminated $7.56 billion in financial awards for energy projects, mostly in the clean tech sector. The move followed the termination of a $4.9 billion loan guarantee for a large Midwest wind transmission project in July 2025, the Grain Belt Express. The moves raised questions about how the current administration’s DOE would address energy price inflation and grid reliability concerns. With the more recent finalization of a $1.6 billion loan guarantee for American Electric Power (AEP) to replace 5,000 miles of transmission lines, we have a more concrete example of how the administration will prioritize its efforts to rein in rising electricity prices.

- AEP’s transmission line upgrades are slated to occur in Indiana, Michigan, Ohio, Oklahoma, and West Virginia. The project is estimated to save customers $275 million in financing costs over the life of the loan thanks to the advantageous interest rate provided by the DOE’s Loan Programs Office (LPO). The transmission upgrades are expected to increase regional transmission by around 70%.

Source: AEP Service Territory

- The completed loan guarantee marks the first loan granted under the LPO’s rebranding as the Energy Dominance Financing Office (EDF). The rebranding continues the program's requirement that loan recipients provide assurance that financial benefits will be passed on to utility customers, but removes any requirement for projects to reduce emissions. AEP’s loan is a somewhat rare example of energy policy from the Biden administration being upheld by the current administration; the loan was announced at the beginning of 2025 by the Biden administration.

- When asked why the AEP project was approved while others like Grain Belt Express were cancelled, Wright cited higher per-mile costs of alternatives. However, AEP upgrades existing lines while Grain Belt Express builds new ones—and 70% of existing transmission infrastructure nears the end of its life, requiring replacement anyway. Grain Belt Express qualified for DOE's "Innovation Focused Program" for higher-risk projects banks avoid, while AEP falls under a program for mature technologies aimed at reducing ratepayer costs. This signals Wright's DOE will prioritize lower-risk grid upgrades. Whether this approach will control rising electricity prices remains uncertain.

- Following the AEP transmission project, there remain nine additional projects in the LPO/EDF queue to close conditional loans. While the DOE’s recent slashing of funding for projects shrinks the likelihood of all these loans closing, the increasing role that electricity prices are playing in political races like NJ’s governor race may help kick-start the EDF’s granting of loans.

Source: DOE Energy Infrastructure Reinvestment Loans by Borrower Type

Trade Policy Pushback: The FEOC Factor

- China recently announced new export restrictions on lithium battery materials and manufacturing equipment, set to take effect on November 8, 2025.

- The directive from China’s Ministry of Commerce comes just weeks before a planned trade summit in South Korea, where Presidents Trump and Xi are expected to negotiate a bilateral trade deal amid an increasingly confrontational posture.

- Under the new regulations, battery manufacturers must obtain specialized export licences before shipping key materials such as lithium-ion batteries, cathode and anode components, and production machinery. The move is viewed as part of China’s broader strategy to tighten control over the global battery supply chain, in which it commands an estimated 85% market share.

- The licensing process could lengthen production timelines and spark short-term price volatility– particularly for U.S. manufacturers reliant on Chinese imports. In the near term, developers are expected to pivot toward domestic suppliers or expand sourcing from Southeast Asia, where production capacity has increased recently.

Trade Policy Pushback: The FEOC Factor

China’s move follows Washington’s escalating efforts to reduce dependency on China for solar and battery technology. In July 2025, President Trump’s OBBBA legislation introduced new FEOC (“Foreign Entity of Concern”) rules that jeopardise tax credit eligibility if project materials originate from China, Russia, Iran, or North Korea – e.g., prohibited foreign entities (PFEs) – starting in 2026.

Under the FEOC framework, any power plants, battery storage, or solar projects breaking ground in 2026 or later that utilize FEOC-linked components or services risk forfeiting access to key federal incentives, including the Investment Tax Credit (ITC) and Production Tax Credit (PTC). Many developers rely on federal tax credits, which can offset 30-50% of upfront project costs, to make their projects pencil.

New Sourcing Thresholds for Developers

To qualify for these incentives, components sourced from PFE’s must remain below specific percentage thresholds that escalate annually. Beginning in January 2026:

Solar projects: At least 40% of manufactured components must originate from non-PFE sources, with the requirement increasing by 5% annually to reach 60% for projects commencing after 2029.

Battery projects: At least 55% of manufactured components must originate from non-PFE sources, increasing 5% annually to reach 75% for projects commencing after 2029.

For many developers already racing to complete projects before the ITC’s scheduled expiry in 2027, these requirements introduce new cost pressures, procurement delays, and documentation challenges. Verifying FEOC compliance will also add additional administrative costs, placing a large burden on smaller developers in particular.

The Fine Print: Recapture Risk and Market Ambiguity

Under the OBBBA, ITC credits, which are typically realized the year after a project is placed into service, can be clawed back if FEOC violations are discovered (up to ten years later). That provision, combined with an ambiguous definition of 'indirect ownership or influence,' is creating pause for investors and developers who are already racing against the clock.

Currently, any entity with more than 50% direct or indirect control may be classified as an FEOC, but without clear Treasury guidance, developers risk retroactive disqualification. Additional clarification on FEOC rules is expected from the Treasury and IRS before the end of 2025. Veolia will be closely monitoring these developments, as well as the developing battery export restrictions from China in the coming weeks.

STAR-Crossed: The Future of NYC’s Grid

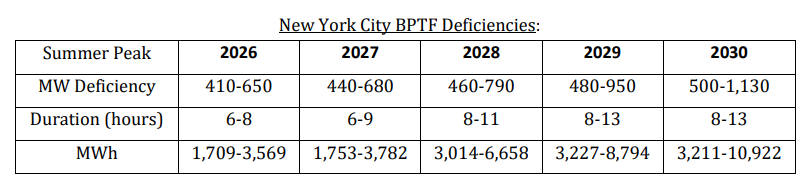

Last week, NYISO published its quarterly Short-Term Assessment of Reliability (STAR), highlighting concerns about meeting NYC’s electric capacity needs over the next five years (July 2025 to July 2030). This comes as no surprise to close observers, as New York has taken key measures this year to retreat from ambitious climate targets in favor of bolstering grid reliability and protecting ratepayers. As NYC’s reliability issues stare the city in the face and shortfalls are expected as soon as next summer, several factors will make or break the grid over the next few years.

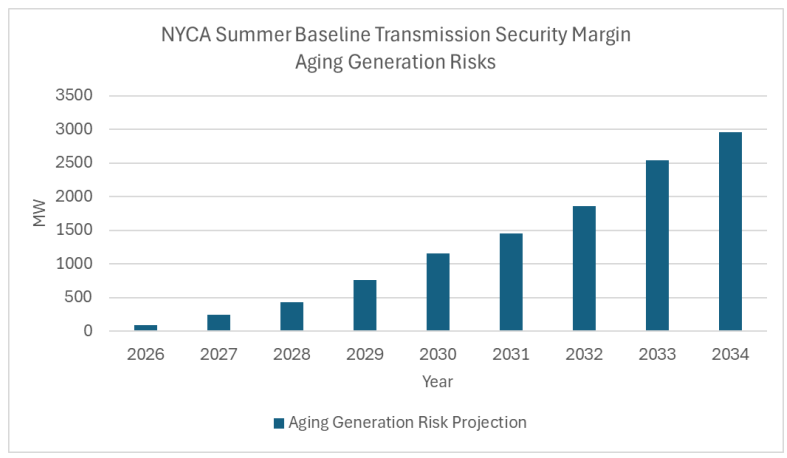

The Quarter 3 STAR found that Zone J, which peaks in the summer at roughly 11,000 MW, will be 4-10% deficient in meeting peak demand over the next 5 years if operations continue at the status quo. The chart below illustrates how both the total MW deficiency and the time when peak demand cannot be met will increase each year if a solution isn’t found.

Source: NYISO

Source: NYISOFocusing on the positives first, these figures don’t currently factor in the transmission projects scheduled to be completed and operational within the next few years. Until these projects can demonstrate their planned power capabilities, they cannot be part of the STAR assessment. However, if they operate as expected, the following projects could significantly improve the anticipated deficit.

- The Champlain Hudson Power Express (CHPE) is scheduled to be completed in May 2026 and plans to bring 1,250 MWs of zero-emission hydro directly to NYC. The project has remained on track and within budget, looking more and more like a sure thing as it approaches completion - a huge win for NYC at a time when reliability is at a premium.

- Empire Wind, being built off the coast of Long Island, will provide 816 MW of offshore wind generation capacity once completed in July 2027. This timeline assumes there will be no further delays, despite the federal government temporarily freezing progress in the spring.

- Propel NY Public Policy Transmission Project, being built by NYPA and New York Transco, promises to reduce bottlenecks on existing transmission lines and increase the flow of clean and efficient power.

Source: NYISO

NYC is relying on the success of CHPE, Empire Wind, and the Propel NY Public Policy Transmission Project to bridge the gap. Should any experience further delays or fall short of the increased capacity they promise, especially on peak demand days, the consequences could be dire. From our view, that’s a lot of weight to put on untested assets. Even if they are all carried out successfully, there remains a risk of deficiency in summer 2029, following the then-necessary deactivation of Gowanus and Narrows.

Given the riskiness of the path ahead, there seems to be one other backstop that could provide some relief: Demand Response. NYISO’s 2025-2034 Comprehensive Reliability Plan found that demand response reduced the peak load during the June 2025 heat wave by 995 MW across the entire state. From 2024 to 2025, New York saw a 16% increase in its demand response capacity. This trend is expected to continue as more organizations are seeing the financial benefits to reducing their peak loads. Given that NYISO experiences peak demand for only a few hours a year, optimizing dispatchable energy resources could play a significant role in providing capacity relief during those periods.

Over the next few years, the issue of grid reliability in NYC will hang in a delicate balance, with NYISO having to pull out all the stops to ensure grid reliability. We’ll continue to follow this story to see if the relationship between NYISO and New Yorkers works out, or if they’re two star-crossed lovers doomed by fate.

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.