Energy Markets Update

Weekly natural gas inventories

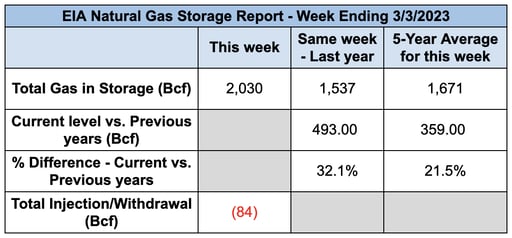

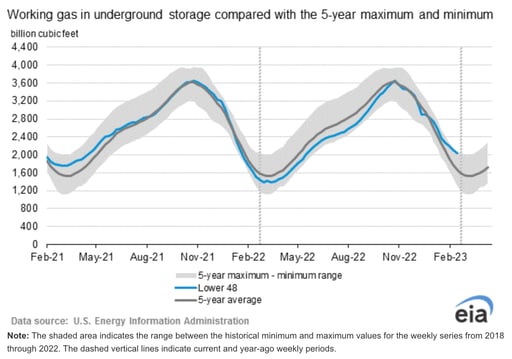

The U.S. Energy Information Administration reported last week that natural gas in storage decreased by 84 Bcf. The five-year average withdrawal for March is about 48 Bcf. Total U.S. natural gas in storage stood at 2030 Bcf last week, 32.1% higher than last year and 21.5% higher than the five-year average.

US power & gas update

-

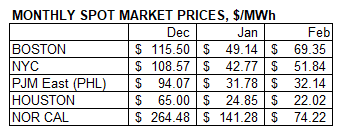

Power and gas futures markets traded up slightly over the past 2 weeks on expectations of a colder than average March, however spot prices continue to get battered as warm weather has stuck around through much of the East.

- Freeport LNG, the Texas-based export terminal that had remained idle since a fire in June 2022, has been ramping back up over the last 2 weeks. It has already tested daily feedstocks of 1.7 Bcf/d and yesterday received authorization to ramp to its full capacity just over 2 Bcf/d.

- Dry gas production has remained fairly stagnant at ~98 Bcf/d, so the interplay between gas and coal will be an important dynamic in balancing the market over the coming weeks.

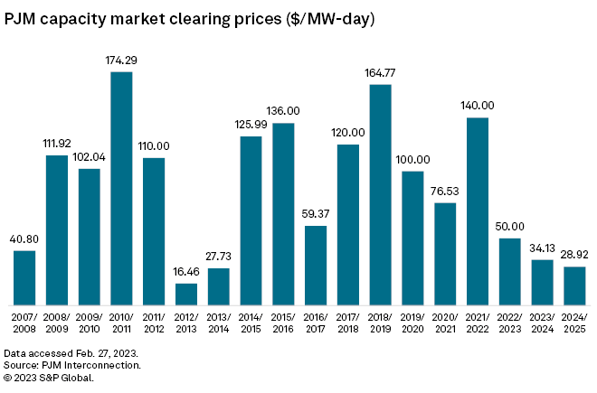

- In the Mid-Atlantic, PJM (finally) released the results of its much anticipated forward capacity auction for the period June 2024-May 2025. Prices trended down for the fourth year in a row, to a meager $28.92 per MWh-day. A few constrained regions such as Duke Ohio/Kentucky, Delmarva Power, and Baltimore Gas & Electric settled in the $75-96 range, which is still low by historical standards.

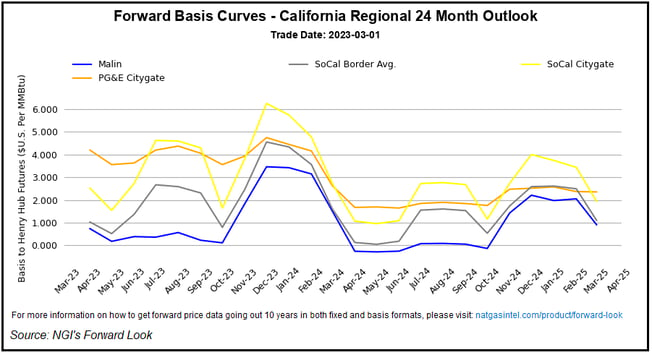

- As evident in the spot price chart above, the California market continues to get clobbered by a combination of lower-than-average temperatures and record snowfall. Gas prices have eased from the craziness in Nov-Feb, but the state is expected to endure excessive basis premiums for quite some time.

- Just this week the CA Public Utility Commission launched its own investigation into excessive spot gas prices this winter.

The Russia/Ukraine crisis, one year later: lasting impacts and the resiliency of global energy markets

- It has been one year since Russia’s invasion of Ukraine – a year of soaring energy prices, supply chain issues, and historic volatility within global energy markets. The consequences of this crisis are continuing to weigh heavy on people’s hearts and wallets.

- While the global market adapted relatively quickly to the shortage of Russian gas, and prices have stabilized since the onset of 2023, some of this was by the sheer luck of a mild winter and the risks remain. Ensuring energy security going forward will mean diversifying fuel sources and types.

- Pre-invasion, Russia was Europe’s foremost natural gas supplier, making up 1/3 of demand. By October 2022 the country’s contributions dropped dramatically to only ~12% of EU gas imports and mostly to adjacent allies such as Hungary and Belarus. Today, Russia’s NG exports to Europe have reached a forty year low.

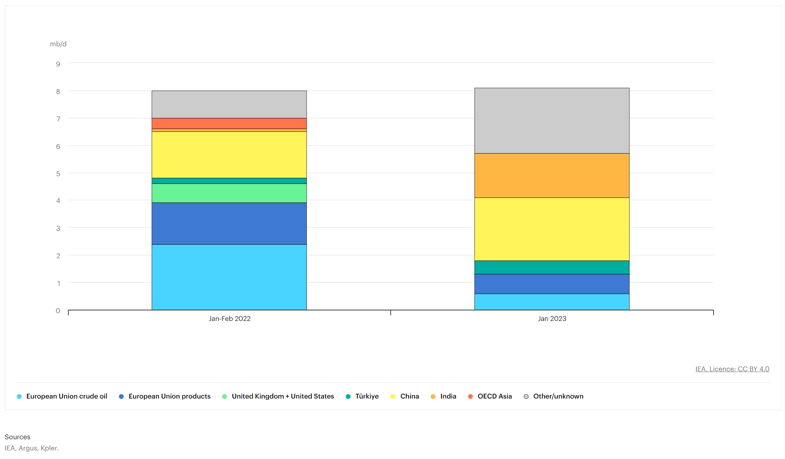

- While Moscow has taken a ~$30B hit to annual gas revenues, the country’s oil supply is holding up decently well. They’ve successfully re-routed shipments of crude to Asia and the G7 price caps are helping to keep the oil flowing.

- In January, total oil production stood at 11.2 Mb/d. By comparison, total oil output in the United States was 18.3 Mb/d while Saudi Arabia pumped 12.4 Mb/d. It seems that buyers who are unbothered by global sanctions are keeping Russia’s oil supply afloat.

Russian total oil exports, January 2022 - January 2023

- But Russia may actually be struggling since Deputy Prime Minister Alexander Novak revealed in early February that the country would curb output by 500 Kb/d in March, rather than sell to those who comply with the new G7 price caps.

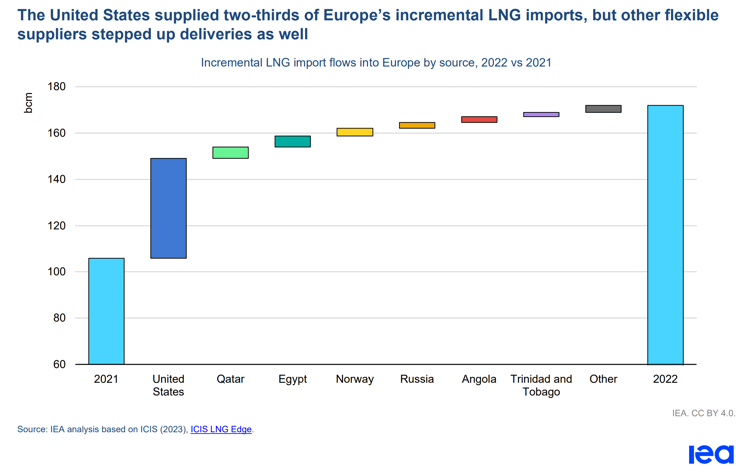

- In the absence of Russian gas Europe has become the focal point of global LNG supply (up 66 bcm last year), while Asia’s demand has fallen off. The United States supplied approximately two-thirds (43 bcm) of the incremental LNG inflows into Europe, and other “swing suppliers” were also able to redirect significant flexible volumes to the European market.

- Price premiums for onshore European hubs compared with prices for delivered LNG (upward of $20/MMBtu) proved attractive to LNG tankers, leading to a massive build-up of LNG on European shores. By Q4, 2 bcm of floating LNG storage (5x the 2020 volume) had piled up, and more than 30 LNG tankers were waiting for regasification opportunities in Europe instead of selling elsewhere. The build-up of floating storage overwhelmed European regasification facilities, causing a delay that drove down NG prices at the start of 2023.

- So, what’s next for European and global gas markets?

- By 2030, LNG supplied by the US and Norway could meet ~40% of the EU’s gas demand, up from 27% before the crisis.

- Perhaps a double-down on renewables, following in the US’s footsteps (via the recently passed Inflation Reduction Act).

- But these sources have a hefty price tag, particularly LNG. In the coming years, many fertilizer, steel, etc. manufacturers are likely to move production away from Europe and into locations with more advantageous fuel cost competition.

- As Europe ramps up its LNG imports in years to come, other countries are looking to shift away from imported fuels and instead toward cheaper, domestic-produced alternatives. Pakistan for instance is prioritizing domestic coal, nuclear, and renewable energy production going forward.

Coast to coast - existing nuclear plants are hard to replace

-

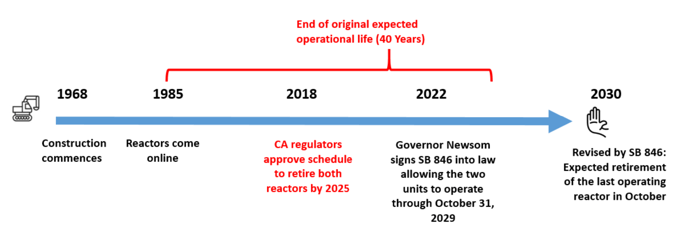

Last week the Nuclear Regulatory Commission granted an exemption to Pacific Gas & Electricity that will allow the Diablo Canyon nuclear power plant to continue operating under its current licenses while the agency considers its renewal application.

-

This is a significant pivot from the NRC, which just a few months ago indicated that the plant would have to restart its multi-year application process, drawing the future of the plant into serious question.

- Diablo’s Canyon currently has two reactors, the licenses for which are set to expire in November of 2024 and August 2025, respectively. If the license renewal is granted, as they are now expecting, both reactors could authorize the continued operation of the facility for up to 20 years.

- Politicians in favor of keeping the plant operating, like Governor Newsome and Senator Feinstein, have publicly commended the benefits of Diablo’s reliable and emission-free energy generation as the grid transitions to more renewable sources. On the other hand, environmental groups have criticized the plant’s extension beyond the 40-year legal threshold absent a comprehensive review.

Source: Veolia

- The reality is that most modern nuclear plants can last well beyond 40 years. With the NRC hurdle now seemingly cleared, the pressure will be back on state regulators to decide reasonably soon whether to offer another extension.

- Given the tightness in its natural gas markets, as demonstrated by record high prices this past winter, Diablo also plays a central role in maintaining system reliability.

- Diablo Canyon currently provides 10% of California’s electricity and about 30% of its carbon free power. Depending on how successful California is in building out its solar and wind resource, Diablo Canyon may be needed to meet stringent carbon goals.

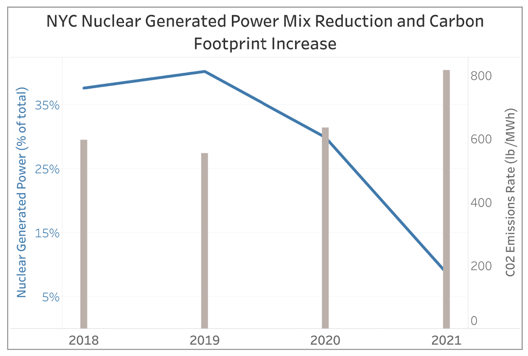

- The state of New York is a harbinger of this potential scenario. After the premature closure of its Indian Point Nuclear Station in April 2021, New York realized a 29% spike in year-over-year carbon emissions (see next article).

- Meanwhile, this past week Georgia Power fired up the first new nuclear reactor built in the US in the past 7 years. Vogtle is currently splitting atoms in 2 of its reactors as it prepares to begin exporting power this year.

NYC’s newest plan to create new clean energy wind hubs from existing fossil fuel power generation sites

- Several news outlets have recently published eye-catching headlines that New York City experienced a 29% spike in year-over-year carbon emissions from 2020 to 2021, according to the latest figures available from the EPA.

-

The largest contributor to this increase resulted from the closure of the Indian Point Nuclear Facility in Buchanan, NY. Entergy Corp retired the last two operating units, Unit 2 and Unit 3, in April of 2020 and April 2021, respectively. The closures diverted roughly 25% of the city’s emission free electricity supply to other available fossil fuel fired generation plants, primarily natural gas, in the region.

Sources: EPA, Veolia

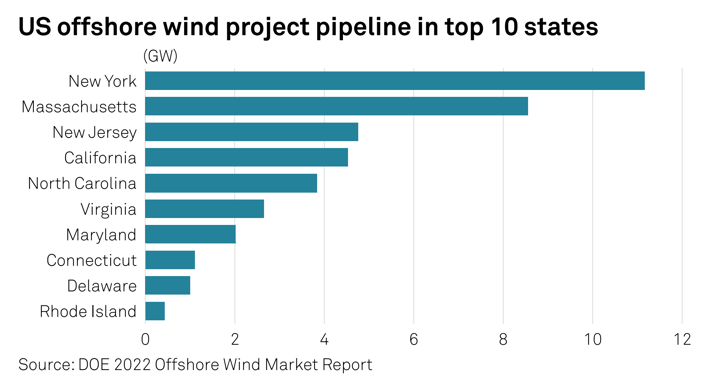

- The retirement of Indian Point has moved the state further away from its Climate Leadership and Community Protection Act (CLCPA) targets but there are new plans being developed to replace the natural gas electricity generation with 9 GW of offshore wind power capacity by 2035.

- Last week for example, wind energy developers Equinor and BP announced that they will purchase the Astoria Gas Turbines site in Queens, NY from NRG Energy and repurpose it as a converting station for offshore wind power to be brought directly onto the NYC grid. The revamped station will be called the Astoria Gateway for Renewable Energy (AGRE) and is expected to receive and convert 1,230 MW wind energy from the Beacon Wind project located 60 miles off the eastern tip of Long Island.

- The Beacon Wind Project is one of a handful of projects in the NYS offshore pipeline and will convert enough wind energy to power 1 million homes beginning in the late 2020s, according to Beacon Wind.

-

In January 2023 the operators of the Ravenswood Generating Facility, Rise Light and Power (also located in Queens, NY) announced a plan to convert their predominantly natural gas- fired plant to a wind energy conversion site as well.

- New York now has the largest offshore wind project pipeline in the U.S. that is paired with one of the most renewables aggressive laws in the county in the CLCPA. We anticipate that more gas fired power plants in the coastal New York area will announce they will be transitioning to wind hubs like AGRE and Ravenswood in the coming years to align with the law.

Grid reliability mechanism proposed in TX could do little to improve reliability

- Texas’ Public Utility Commission has been working to reform the state’s energy market in an effort to alleviate many of the recent grid calamities that have resulted in massive price increases and concerns about reliability.

- One of these changes the commission recently endorsed is the Performance Credit Mechanism (PCM), which regulators hope will firm the grid during high stress periods by ensuring that more generators are available to meet energy needs.

- In order for this change to be implemented, it will have to be approved by state legislators, but many parties have raised concerns about the program. The program could cost ERCOT customers up to $5.7 billion a year, but many are skeptical that it would actually improve the reliability of the Texas grid.

- The Texas Association of Manufacturers, Texas Oil & Gas Association, Texas Chemical Council, and Texas Industrial Energy Consumers hired Bates White, an economic consulting firm, to evaluate the PCM.

- Bates White found that there is “no current or imminent capacity shortage in ERCOT.” They did find that ERCOT needs to “ensure operational flexibility to accommodate expected large additions of intermittent renewable generation.”

- Through their modeling, Bates White concluded that a Dispatchable Reliability Reserve Service (DRRS) would appropriately incentivize the development of resources to fill in the gaps of intermittent renewable generation. A DRRS program would generate about $1.7 billion in revenue that would be put towards resources that can be dispatched during an event to meet the grid’s needs and would only cost ERCOT customers about $923 million.

- Texas Governor Greg Abbott has supported the PCM program, in part because a number of generators have already committed to building dispatchable resources totaling thousands of megawatts of capacity if the PCM were to be implemented.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.