Energy Markets Update

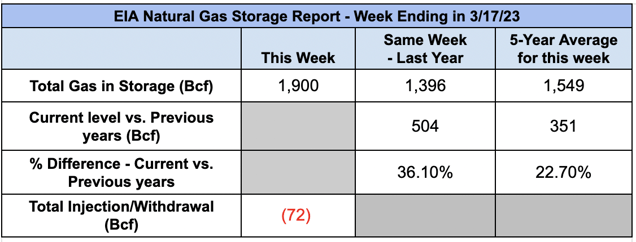

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage decreased by 72 Bcf. The five-year average withdrawal for March is about 48 Bcf. Total U.S. natural gas in storage stood at 1,900 Bcf last week, 36.1% higher than last year and 22.7% higher than the five-year average.

US power & gas update

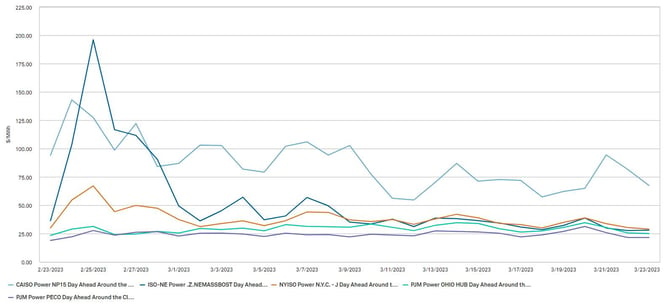

-

Markets have mostly traded sideways over the past couple weeks as traders try to reconcile a few competing trends: rock-bottom spot gas prices, strengthening fundamentals in 2-3 year outlook, and a potential recession unfolding later this year.

- Most of the price strength is seen in 2025/2026+ contracts, which have added about 10% so far in March. The logic here seems to point to the expectation of price strength correlated with the emergence of new LNG export capacity in that timeframe.

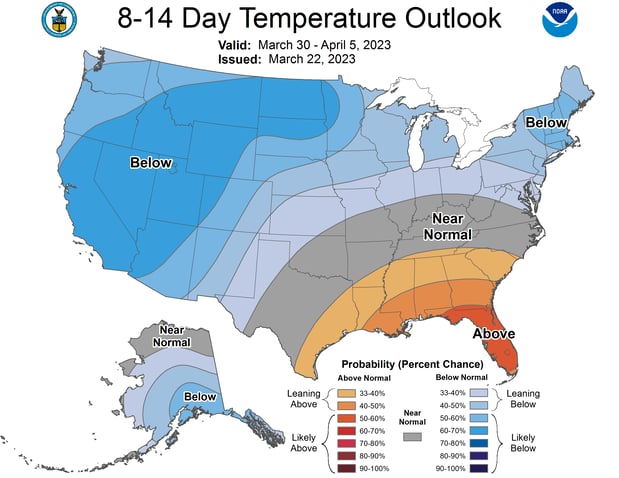

- Short term weather forecasts some lingering cold over the next couple weeks, which seems to be the only thing supporting the spot market for the time being – we expect a very low spot market costs of Q2.

Source: NOAA

- Fallout from the Silicon Valley Bank collapse is casting some continued uncertainty across the green-tech / startup space. While deposits are for the time being safe due to Federal backstop, various outlets report a lack of buyers willing to take on SVB’s long term loan book. This has resulted in some less-established firms scrambling to find alternative lenders.

- Sempra, in combination with ConocoPhillips and KKR, has committed to the Port Arthur LNG export project. The FID this week is a critical step to financing the $13B capital project that would export 13.5 million Mt/year of gas with a target date of 2027/2028. This is the second new export project that reached FID this year. Venture Global announced FID on the second phase of its ~20 million Mt Plaquemines LNG project (Louisiana) just a couple weeks ago.

Source: S&P Global

FERC opens dialogue on the role of capacity markets and grid reliability

- The Federal Energy Regulatory Commission (FERC) plans to hold discussions about grid reliability and the capacity market in PJM and ISONE after expressing some serious concerns at its most recent monthly open meeting on March 16th.

- FERC has questioned whether capacity markets in PJM and ISONE are properly suited to ensure reliability amidst trends of fossil fuel generator asset retirements and large swatches of small scale renewable projects scheduled to join each grid. The independent monitor of these two ISOs as well as the monitors for MISO, ERCOT, and NYISO also expressed concern with forward capacity markets, which procure energy for the future, even going so far as to call them a failure.

- FERC is also investigating some reforms for ISO transmission queues and regional transmission planning. These reforms should help, but not in the short term due to the sheer number of intermittent renewables in the queue. FERC is particularly worried about ISONE, whose gas supply hinges on the Mystic facility in Everett, MA. This facility will be retired without out-of-market payments that regional customers currently pay. The system has not run into any significant reliability issues yet, but the post-Mystic world will introduce additional challenges.

- While New England’s last remaining coal plant appears likely to exit the market in a few years, the region has banked heavily on the ability of offshore wind to fill the gaps. Those projects are significantly delayed, some of them may not get built, and their ability to add resilience during cold winter stretches is still under question.

- FERC also recently released their 2022 State of the Markets report, which discussed energy markets in 2022 and factors that influenced them. This report highlighted high commodity pricing, backed up interconnection queues, and extreme weather as high influences to USA energy markets. There were a number of coal generation retirements totaling 12.6 GW of capacity, while a number of wind, solar, battery, and natural gas resources were added.

New EPA rule will further disincent coal plant operation

-

A new rule issued by the EPA intends to restrict emissions from power plants and other large polluters from polluting neighbors. The so-called “good neighbor” rule is intended to decrease sickness and save lives for people who live close to these facilities. This rule will start in May for power plants and in 2026 for industrial facilities.

- Part of this ruling makes sure that states don’t send pollution from their generators and facilities to other states, and each state where this is a concern will be required to submit a plan to mitigate emissions.

- Many have hailed this as a win for communities who will be able to breathe safer, less harmful air. Others in the coal industry feel this is a direct attack on their industry and feel that this rule, along with a number of others passed by the Biden administration’s EPA, are meant to shut down a number of coal plants. They say that this rule will cost Americans more on their energy bills without solving many of the reliability concerns FERC is currently trying to resolve.

Investor-owned utilities Eversource (MA) and Con Edison (NYC) seek significant delivery rate increases, citing State-mandated clean energy investment as a key driver

- Rates for utility distribution charges (i.e. lines and wires) are regulated by state utility commissions through an adjudicated process called a Rate Case. Massachusetts and New York are currently in the midst of significant Rate Cases through which the utilities are seeking to dramatically raise rates to address the higher cost of operating and maintaining the utility systems.

-

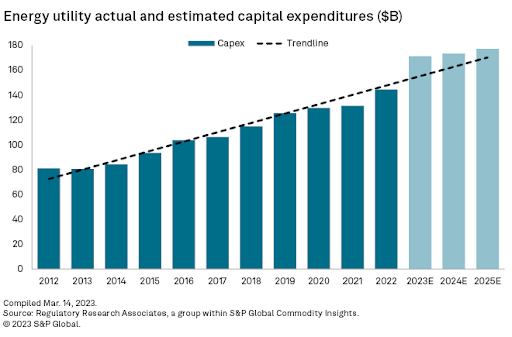

Both utilities operate in states that have aggressive renewable energy targets and since 2022 both have cited the need to significantly increase capital investments in both clean energy generation and upgrades to their transmission & distribution systems to meet the mandates.

- The most recent example in Massachusetts was an Eversource rate increase that sent distribution charges higher by about 10%, on top of a 30%+ increase in commodity rates, though the commodity rates will reset lower after June 2023. Noted prominently on Eversource’s web page on the Rate Case, Eversource provided details that in addition to improving reliability, investments would be made in various segments of their clean energy infrastructure.

- In downstate New York, Con Edison has two cases currently in final stages for approval for multi year electric and gas increases. The settlements come in the form of a document called a Joint Proposal (JP) which was settled on after months of negotiations with various intervenors and staff of New York’s Department of Public Service.

- Similar to Eversource in MA, Con Edison cited the need for significant additional investment to meet the clean energy requirements of the Community and Leadership Protection Act (CLCPA) as a driving factor for the substantial increases.

- The JP, if approved by the Public Service Commission (PSC), will equate to electric delivery rates increasing 4.2% in 2023, 4% in 2024 and 3.8% in 2025. Gas delivery will increase by about 6.7% this year, 6.3% in 2024 and 5.9% in 2025.

- The increased capital expenditure by utilities to meet new clean energy requirements in states like Massachusetts and New York appear to be part of a continuing trend. Available data and projections from the Regulatory Research Associates' broad sample of publicly traded electric, gas and multi-utilities illustrates this.

Source: S&P Global

What's the deal with heat pumps? Pros, cons, and what the future holds

- With the built environment currently accounting for 40% of annual global CO2 emissions, the transition toward high-performance, energy-efficient buildings will be crucial to mitigating the climate crisis.

- Heat pumps, a hyper-efficient and climate friendly heating solution, have grown in popularity and adoption over the past decade. Global heat pump sales increased 15% in 2021 alone and are expected to boom for years to come, with the potential to cut 500 tonnes of global CO2 emissions by 2030. In 2022, heat pump sales in the US even bested gas furnaces for the first time:

.png?width=1220&height=1020&name=canary-mediaheat-pump-sales-in-u.s.-surged-past-gas-furnaces-in-2022%20(1).png)

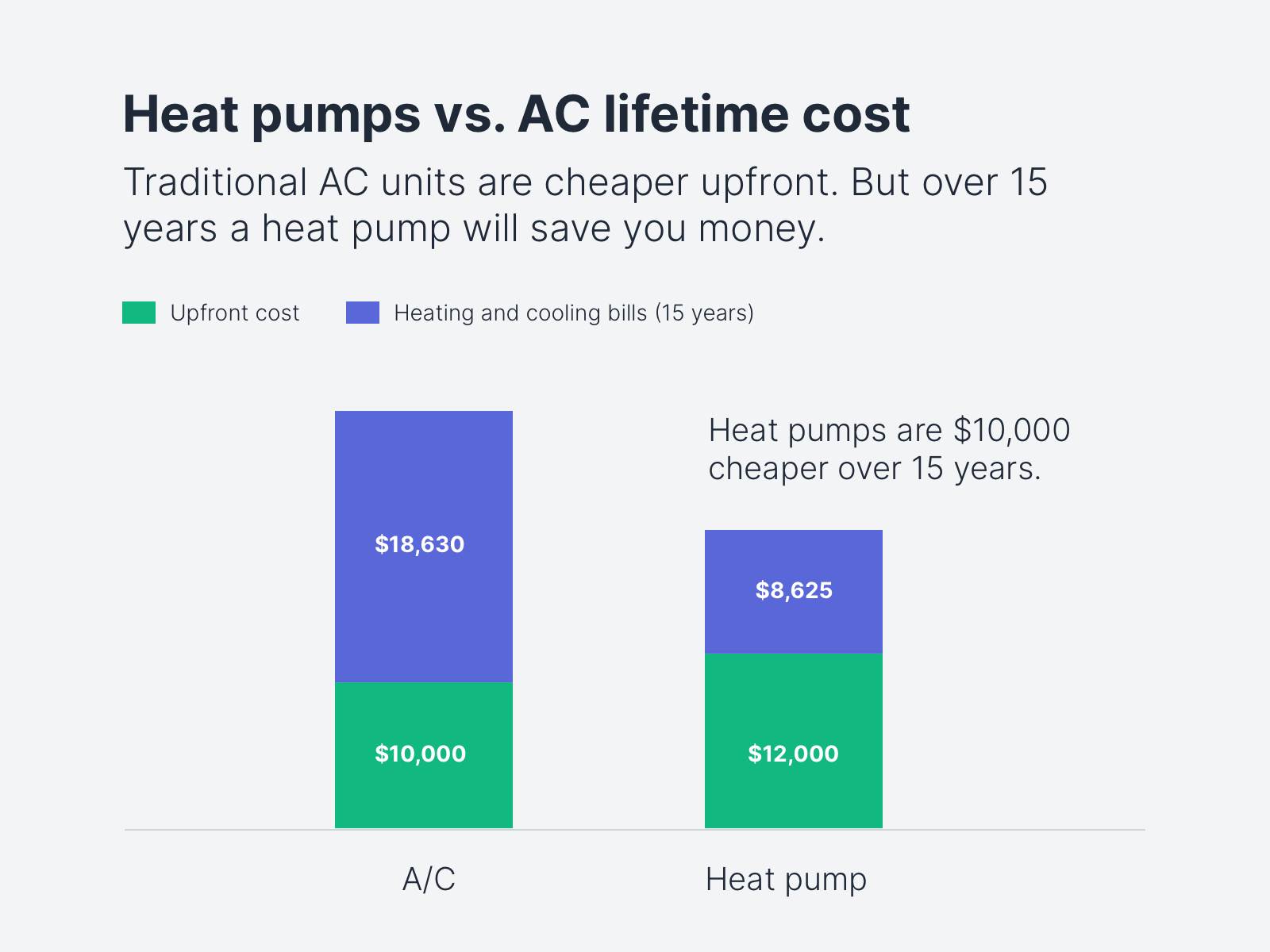

- While it’s true that the majority of residential and commercial buildings still rely on fossil fuels for heating today, heat pumps have the potential to be scaled and cheaper than fossil fuel boilers in the long term, making them an appealing choice to sustainability advocates and climate denialists alike. In fact, an average household’s energy savings from switching to heat pumps can reach up to $1,000 in the near term, and up to $10,000 in the long run.

Source: Carbon Switch

- Despite the longterm benefits, skeptics argue the steep up-front cost of installing heat pumps – which can be ~20% more expensive than a traditional gas system – is a major deterrent to scaling this technology up. Heat pumps have even been dubbed “expensive clean tech that’s only for do-gooders.” There have also been concerns about efficiency reductions in very cold weather, however improvements in the technology and installer knowledge, as well as positive performance in the field have alleviated these concerns in recent years.

- So, they can be much more cost-effective than people think. Heat pumps recover their cost during their lifetime, leading to long term savings and shielding owners from price shocks.

- Many governments also offer financial incentives for making the transition that softens the blow of this hefty price tag. Robust subsidies are already available in 30 countries, which combined account for 70% of the world’s heating demand.

- In the US, these incentives exist at both the state and federal levels. For instance, MA offers a $10,000 rebate for installing air source heat pumps, and the federal government offers a 26% tax credit.

- Hoping to address concerns regarding cold weather compatibility, the DOE launched a manufacturers’ challenge in 2022 that tasked Mitsubishi, Lennox, and others with creating heat pump technology designed for freezing temperatures. The commercialization of this new technology will be key to addressing heat pumps’ shortfalls, scale up, and ultimately curb emissions.

- Looking ahead, leading heat pump manufacturers recently announced plans to invest ~$4B into expanding production capacity globally. With this ambitious trajectory, the number of heat pumps installed in the next four years will be equivalent to the amount installed over the last decade.

Changes in store for voluntary carbon markets?

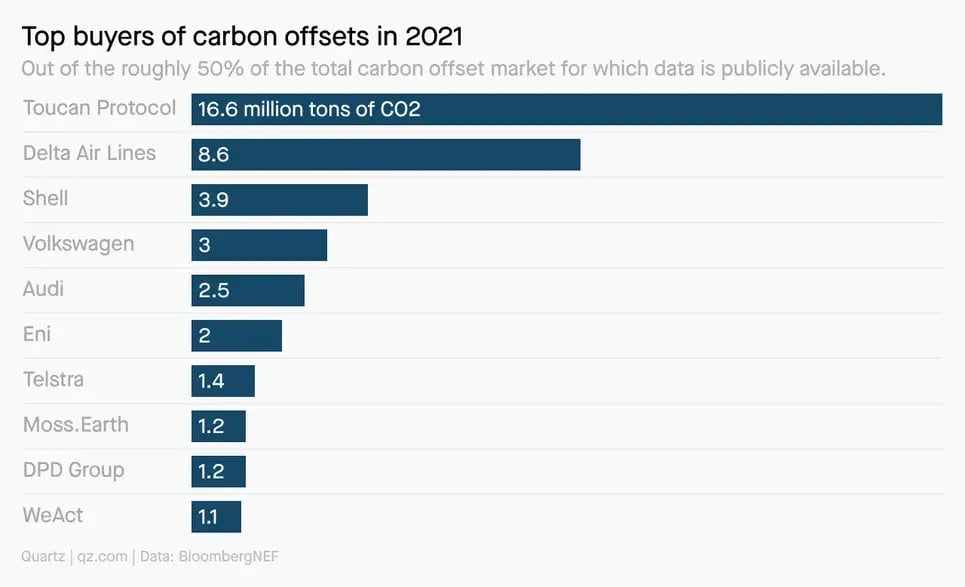

- The voluntary carbon market – worth $2B in 2021 and projected to increase fivefold in value by 2030 – has skyrocketed over the last decade as corporate polluters (dominated by the Global North) have become interested and accountable for offsetting their emissions.

Source: Bloomberg

Source: Bloomberg

- In an effort to diversify buyers and sellers, the Rockefeller Foundation and Bezos Earth Fund revealed a new VCM initiative during last year’s COP27 Summit, which seeks to expand these markets beyond the developed world and funnel investments into renewables, clean technology, etc within poorer nations.

- This approach, dubbed the “Energy Transition Accelerator,” will encourage state and regional bodies in the developing world to earn carbon credits and sell them to the Global North’s corporate polluters.

- The ETA initiative will combine carbon market money, government subsidies, and philanthropic money to further work already being done under Just Energy Transition Partnership (JETP) deals.

- Supporters of the ETA are rejoicing, as leaders of developing nations have historically struggled to raise money for sustainable initiatives, spurring a need for private investment.

- Critics argue that voluntary carbon markets are inherently flawed, as they allow corporations to continue polluting without tangible cuts to emissions and even enable them to undermine human rights.

- For instance many activists argue that the African VCM initiative, which encourages corporations in the Global North purchase carbon credits from a consortium of African countries, falls short of delivering the climate finance needed to genuinely mitigate climate change, and is really just a form of neocolonialism.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.