Energy Markets Update

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 98 Bcf. There was an injection for the same week last year of 103 Bcf while the five-year average injection is 96 Bcf. Total U.S. natural gas in storage stood at 2,313 Bcf last week, 14.3% less than last year and 2.6% lower than the five-year average for this time of year.

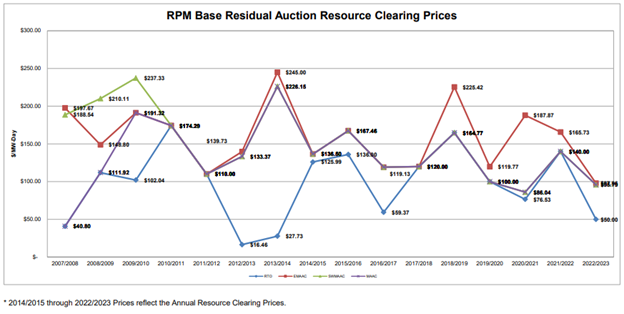

PJM’s capacity market auction results

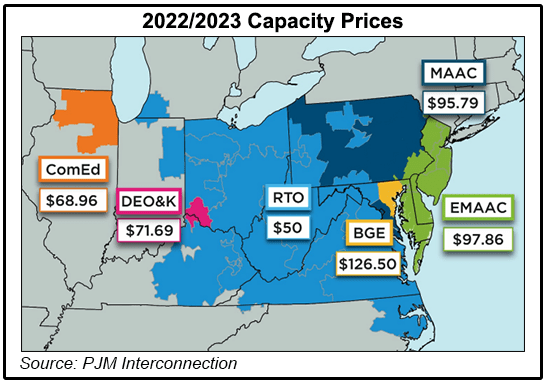

On June 2nd, the Mid-Atlantic power grid operator PJM announced the results of its long-awaited and long-delayed forward capacity auction results for the 2022-2023 commitment period. Capacity prices in New Jersey, eastern Pennsylvania, and Maryland cleared at approximately $98/MW-day and most of the remainder of PJM cleared at $50/MW-day, a 64% drop from the previous 2018 auction clearing price of $140/MW-day.

The 2022-2023 auction (officially called a “Base Residual Auction”) was originally scheduled for May 2019 but was postponed multiple times as PJM applied new capacity market rules enacted by the Federal Energy Regulatory Commission (FERC). The June 2nd auction saw the first application of FERC’s Minimum Offer Price Rule (MOPR), which requires state-subsidized resources to bid at their non-subsidized cost level. It was widely speculated that the MOPR rule would have significant upward pressure on the 2022-2023 clearing prices, yet the results show that other market factors heavily outweighed the rule’s impact.

The auction cleared 144,477 MW of capacity with a total of 1,728 MW of new wind and 1,512 MW of solar, increases of 22% and 165% from the previous auction, respectively. Similar growth was also demonstrated by efficient combined-cycle natural gas plants, adding more than 3,414 MW of capacity, and a 70% increase in Energy Efficiency programs from the 2018 BRA. Nuclear power had a stronger than expected showing; many of the plants were not expected to clear due to MOPR, but instead the sector added 4,460 MW from the last auction. Coal generators cleared 8,175 MW less than the previous auction, further indicating the gradual trend away from the maligned fuel source.

The material drop in the capacity prices resulted from varying factors including a lower load forecast and reliability requirement, which ultimately reduced the procurement requirement of the RTO. PJM also noted a 19% drop in net Cost of New Entry (CONE), a figure that estimates the cost of building new generators and entering the market. Thus, lower cost of entry enables generators to bid in at lower prices. Nonetheless, prices cleared well below analyst expectations and after an unprecedented 2-year delay, there was a lot riding on this auction. The results could very well push some marginal facilities out of the market in subsequent auctions—many older coal and nuclear plants will have a hard time justifying their financial existence at $50/MW-Day. They will need to adjust quickly; the schedule for “catch up” auctions anticipates 4 more over the next 2 years with the final 2026/2027 Delivery Year auction taking place in July 2023.

Five regions did yield capacity prices that were higher than the overall PJM price:

Source 2: PJM

NYISO modifies ICAP rules this summer

This summer, New York electricity customers will undergo the first application of a new methodology in calculating ICAP Tags under the New York Independent System Operator (NYISO), changes which were implemented to improve market efficiency and transparency. ICAP tags are a measurement of a customer’s coincident peak demand during the grid’s peak demand. They are a billing variable that drive the customer’s cost during the following year.

Historically, there was no restriction on what hour the coincidental peak may occur, with 80% of peaks typically occurring between July and August. However in 2019, the grid had set its peak on Saturday, July 20th between 4-5 PM at 30,397MW – the first time the overall New York system peaked on a non-weekday. With a lot of properties not operating at full occupancy over the weekend, this translated into a 20-40% decrease in ICAP values across commercial real estate in NYC. It resulted in markedly higher costs for the residential sector.

As a result, NYISO submitted a rule revision to FERC that would require ICAP tags only be measured during July and August, on non-holiday weekdays. Approved by FERC, the changes tighten the criteria for NY customers that manage their ICAP tag and they also better align with NYISO peak forecasting procedures, which also relies on July and August data. Customers that shed load during the peak hour, now reduced to a 2 month window on weekdays, can capture cost savings in their future capacity costs.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.