Energy Markets Update

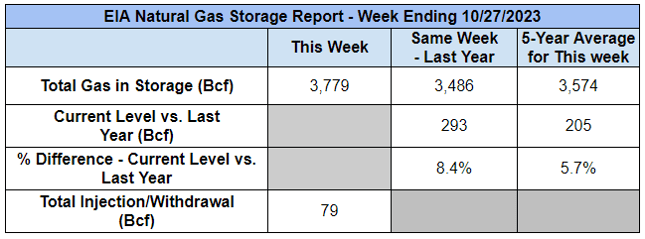

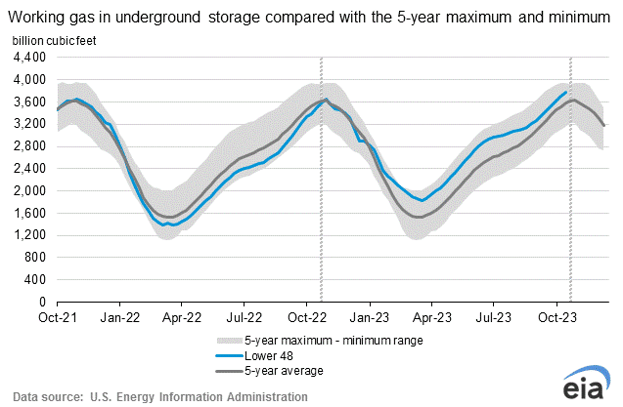

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 79 Bcf. The five-year average withdrawal for November is about 10.3 Bcf. Total U.S. natural gas in storage stood at 3,779 Bcf last week, 8.4% higher than last year and 5.7% higher than the five-year average.

Energy Market Update

- The contract for NYMEX gas in November 2023 closed at $3.164 per MMbtu last week, up about 15% from October. December flows are now trading around $3.45 per MMbtu, another 10% step increase as we enter peak heating season.

- Gas production set a new record of 103.6 bcf/d on October 23, about 1 bcf higher than the flatline run rate that was maintained throughout most of Q2 and Q3 of this year.

- The rig count does appear to have stabilized over the past month, following consistent losses from Q1 through Q3. This is a good sign for buyers who had been growing concerned about a short squeeze in 2024.

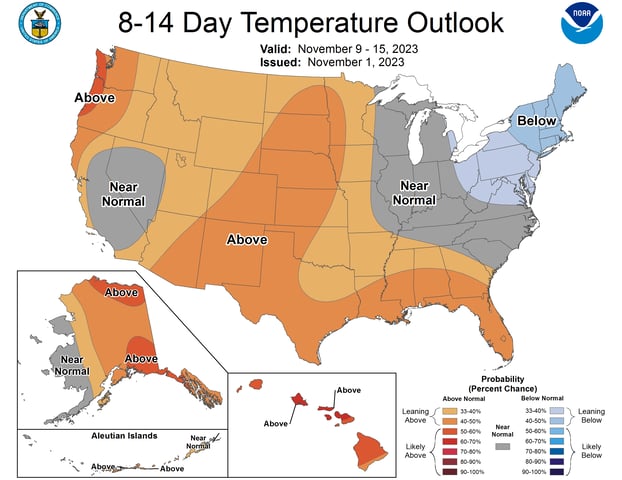

- NOAA temperature forecasts for November are slightly cooler in New England and generally warmer from the Rockies west. Longer term forecasts have called for slightly warmer than average temperatures due to a strong el nino pattern and warmer ocean temperatures. While we usually don’t take much stock in longer term weather forecasts, a strong el nino winter does provide context for a slightly warmer winter.

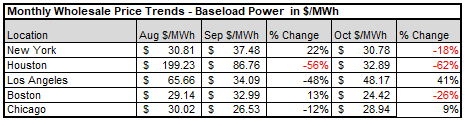

- Wholesale power prices were generally lower in October across North American, as compared to the prior month. Spot rates in New York and New England were particularly depressed, with New England clearing<$25/MWh. With Q1 futures still trading at $110/MWh however, it begs the question, “ how do we get there from here?” Cold weather events are always a possibility in New England, and while they can get expensive, we aren’t seeing much basis for buying into such expensive premiums while we sit on healthy national gas reserves.

Source: ISO Data

Source: ISO Data

- The offshore wind industry continues to get battered by the high interest rate environment; this week Orsted announced it would pull out of 2 projects in NJ (2,250 MW) citing an impairment now exceeding $4 billion (see offshore wind update below).

Source: NOAA

Source: NOAA

Power to the People: Maine’s Ballot Initiative to Seize Utility Assets

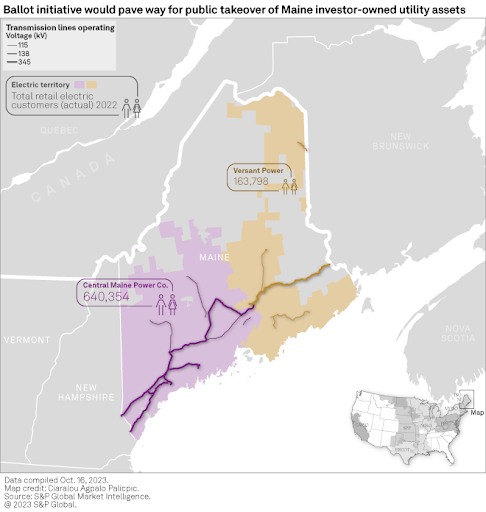

- On November 7th, Maine residents will vote on a ballot measure that could pave the way for a public takeover of investor owned utility transmission and distribution assets in the state.

- Question 3 on the Maine ballot asks voters to decide whether to establish a publicly owned electric utility called Pine Tree Power Co., using eminent domain, to take over the assets of Central Maine Power Co. (CMP) and Versant Power.

Source: S&P

- If voters approve the referendum, Maine will bring back local control from foreign corporations, one of the leading goals of the ballot’s proponents. CMP, which serves about 640,000 customers, is ultimately owned by Spain-headquartered Iberdrola SA. Versant serves about 164,000 customers in eastern and northern Maine. Its owner, Enmax, is owned by the city of Calgary, Alberta.

- According to consumer research firm J.D. Power’s most recent Electric Utility Residential Customer Satisfaction Study, CMP ranked last among 17 large utilities in the eastern US, and Versant ranked last among 11 midsize utilities in the eastern US.

- The utilities opposing the measure have estimated the transition from an investor-owned to a public utility could cost as much as $13.5 billion. The takeover would undoubtedly result in years of costly legal challenges as well.

- Referendum supporters have contested the $13.5 billion figure. The self-reported asset values of CMP and Versant in 2022 were "less than half" that amount for example. Additionally, proponents contend that no taxpayer or state debt will be used in the acquisition, which is expected to be financed through utility revenue bonds. Ultimately, its success or failure would manifest in either lower or higher rates, respectively.

- Political action committees Maine Affordable Energy and Maine Energy Progress have collectively spent more than $24.4 million to oppose the referendum. Maine Affordable Energy is funded almost entirely through Avangrid corporate donations. Maine Energy Progress is entirely funded through contributions from Enmax, according to public finance data.

- If approved, Question 3 would first create a governing board of seven individuals elected to six-year terms to oversee the newly formed public utility. That board would appoint six experts to serve with them, and this group would make an offer to CMP and Versant. The companies would have 30 days to come up with a counteroffer. If an agreement cannot be reached, the purchase price would be set through a refereed process in Maine court. The Board would also later be tasked with contracting an operator to run the transmission and utility assets on a day-to-day basis.

- The process could take anywhere from five to 10 years, according to a factsheet from the Maine Office of the Public Advocate, which included the statement: "It is not possible to predict with certainty whether reliability would improve or deteriorate following the acquisition."

- Our take: can we all agree that these ballot measures are an absurd way to make complex decisions about significant pieces of energy policy? Maine’s 2021 ballot initiative that struck down the 1200 MW “NE Clean Energy Connect” transmission project was an abject disaster. It was ultimately deemed unlawful and overturned, but it delayed an almost completed project, it cost ratepayers in Massachusetts another $1.5 billion, and its major proponents were large energy companies gaslighting as environmental groups. We don’t know if public takeover of Maine’s utilities would result in any real benefits. The evidence is spotty, the risks and unforeseen costs are great, and perhaps this is not something that should not be decided by an uninformed electorate.

Canadian Hydropower Finds its Footing in New England

- The US Department of Energy announced on October 30 that one of three interregional grid transmission projects to be awarded funding will be Twin States Clean Energy Link, owned by National Grid PLC.

- The 1,200 HVDC line will transmit electricity generated by hydroelectric power in Quebec to Vermont and New Hampshire. The line also has bidirectional capabilities that will allow New England to export power to Canada, and vice versa.

- This line alone will meet nearly 80% of New England’s interregional transmission needs by 2030, according to DOE.

- A report by the New Hampshire Department of Energy revealed that imports of Canadian hydroelectric power to the New England grid is one of the most cost-effective ways to reinforce the grid while transitioning to renewables.

- As noted in the previous article, earlier this year, Maine lifted the construction halt on the New England Clean Energy Connect transmission line brought about by a voter referendum. That project also has the capacity to transmit up to 1,200 MW of clean power to Massachusetts, helping the state stabilize electric rates and achieve its clean energy goals.

- Together, these projects will add 2,400 MW of clean baseload hydropower to New England’s electric grid, equivalent to about 8000 MW of annualized offshore wind generation capacity. Particularly in light of the shakiness throughout the offshore wind industry over the past year, it seems that New England is aware of the benefits and perhaps the necessity of Canadian hydro in the clean energy transition.

An Analysis of Energy Purchasing Strategies

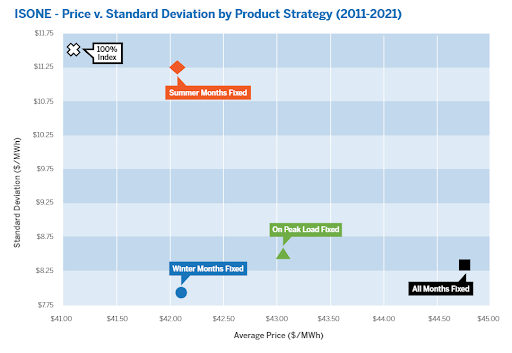

- Constellation Energy recently updated a report evaluating several purchasing strategies for power across four ISOs in the US.

- The purchasing strategies were applied to one baseline customer and tested under various market conditions over an 11-year period.

- The four ISOs tested were ISO-NE, ERCOT, NYISO, and PJM.

- A main takeaway from the study was that no power purchasing strategy consistently produces the lowest price outcome each year. Energy market conditions vary greatly depending on factors out of the control of customers, such as weather events and macroeconomic conditions.

- To no surprise, the 100% index strategy (i.e. no hedging) was found to produce the lowest price, on average, but also widest year-over-year variance.

- A fully-fixed strategy often ends up costing the most and does not shield buyers from the brunt of market volatility. This option is attractive for clients who appreciate certainty in knowing what their energy costs per unit will be.

- Fixing 50% of on-peak load and hedging the rest in ⅓ increments was found to produce a “goldilocks” scenario, avoiding the most market volatility across all ISOs.

Source: Constellation Energy

- A key takeaway from this report is that amongst the myriad options of energy purchasing strategies, there are plenty of options that offer differing balances of cost and volatility. There is not a one-size-fits-all approach; some clients may be willing to pay more to avoid market volatility while others may wish to pay less and expose themselves to more market risk.

- We aim to work with clients to understand their risk/reward profile and procure using a strategy that matches that profile.

Offshore Wind Updates

New York

- Last week, New York governor Kathy Hochul gave tentative approval to three offshore wind projects totalling 4,032 MW of new capacity, the largest solicitation and award ever in the US.

- These projects are a step towards New York’s goal of 70% renewable generation by 2030.

- This move contradicts the way tides have been turning in the struggling offshore industry as of late. In October, we reported that New York rejected bids by four offshore wind projects to renegotiate their prices. Some of these projects have already signaled they will back out of their commitments. Just a few short days later, the state has given three other projects the green light to begin contract negotiations.

- It appears that the state is aware of industry trends and sending a message to offshore generation developers that the state is not budging on prices. NYSERDA president told reporters on October 24th that “Those are the prices they bid, so that is what it will cost”.

- It is estimated that the projects will have a levelized cost of $96.72 per MWh, which would add approximately 2.73% to customer bills.

- Contradictory to supporting offshore generation development, though, Hochul vetoed a bill in October that would have placed a necessary transmission line under a public beach in Nassau County, citing opposition from local residents as the reason for her decision.

- We will continue to update you as this situation unfolds.

New Jersey

- This week, Danish offshore wind giant Ørsted officially terminated two projects off the coast of New Jersey totalling over 2 GW of nameplate capacity, Ocean Wind 1 and Ocean Wind 2. The company cites increased supply chain costs and increased costs of capital as reasons for the terminations.

New England

- A coordinated RFP process by Connectoicut, Massachusetts, and Rhode Island is underway. The states seek 6,800 MW of offshore wind. Connecticut launched its portion of the RFP last week, seeking 2,000 MW. It will entertain both fixed and indexed bid prices that can later be fixed against known benchmarks. Bids are due Jan 31, 2024.

Europe

- On October 24th, the European Commission detailed the European Wind Power Action Plan, which aims to support the ailing offshore wind industry by fast tracking project permitting and increasing access to capital.

- European developers, who dominate project developments worldwide, cite increased commodity costs and supply chain issues for threatening project economics.

- The commission will speed up permitting by digitizing some of the process and therefore clearing up the permitting backlog.

- Additionally, the commission is encouraging project developers to demonstrate good-faith efforts to construct by increasing schedule transparency. The commission announced that they will be launching a Grid Action Plan later this year.

- The Wind Power Action Plan will balance quantitative reviews with qualitative reviews that include “objective, non-discriminatory criteria” such as business conduct history and project delivery plans.

- The Wind Power Action Plan will increase the EU Innovation Fund that funds clean energy manufacturing projects and will implement a guaranteed return mechanism for creditors funding wind energy developers.

- Companies from Siemens to Vestas have praised the long-awaited plans that promise to support their bottom lines and improve the feasibility of all players in the offshore wind industry up and down the supply chain.

Natural Gas Storage Data

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.