Energy Markets Update

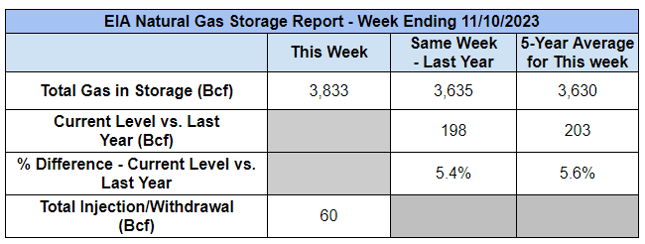

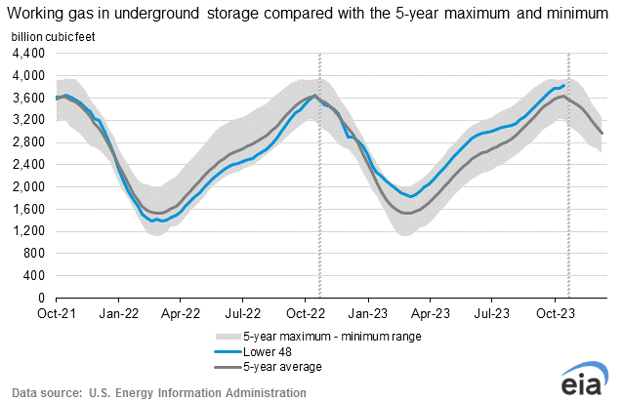

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 60 Bcf. The five-year average withdrawal for November is about 10.3 Bcf. Total U.S. natural gas in storage stood at 3,833 Bcf last week, 5.4% higher than last year and 5.6% higher than the five-year average.

US Energy Market Update

- Power and gas futures for calendar year 2024 retreated during the first 2 weeks of November. This week, NYMEX gas for 2024 delivery tested support at $3.30 per MMBtu. This is roughly the lowest benchmark of the year, previously tested in the first week of October.

- Much of the Northeast flirted with the first wave of near freezing temperatures over the last week. Prices for spot gas and power weren’t noticeably affected. It takes prolonged cold, typically below 27°F for constraints to emerge in New England.

- West Coast markets continue to be an outlier, and not in a good way. The price of gas delivered to CA utilities has averaged about $6.50 per MMBtu over the past 6 weeks, more than double the national average. Futures don’t look terrible, about $7 for the winter strip, so strong spot prices could reflect a combination of robust demand from the power sector and gas utility pulls into storage inventory.

- The most recent inflation report from the Federal Government showed a decline in the annualized rate from 3.7% in September to 3.2% in October. A reduction in energy prices was a leading culprit as the price of gasoline dropped 5% in the month.

- Last week, the Connecticut Public Utilities Regulatory Authority (PURA) lifted its stay on a 2020 decision that that, among other things, limits voluntary renewable electricity supply offers from retail electric suppliers to using only RECs sourced from NEISO, NYISO, or PJM, and which prohibits the use of the term "renewable energy" to market a REC product. We see this as potentially restricting VPPAs from RTOs such as Texas or MISO.

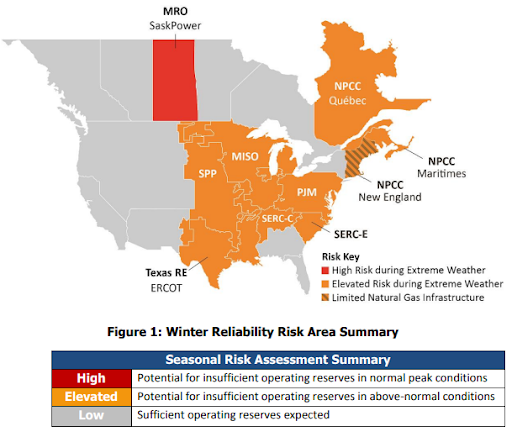

- The North American Reliability Corporation released its Dec-Feb Winter Assessment, which concluded that a “ large portion of the North American BPS is at risk of insufficient electricity supplies during peak winter conditions”. It called out challenges with fuel supplies, growing complexity of load and generation forecasting, and coordination challenges between neighboring RTOs and jurisdictions.

Source: NERC

Update on November 7 Ballot Initiatives

Texas Voters Approve $10B Energy Fund

- On Tuesday, November 7th, Texas voters, by about a two-thirds margin, approved a constitutional amendment authorizing a new $10 billion Texas Energy Fund to provide low-interest loans to build gas-fired power plants, develop microgrids and modernize portions of the state’s electric grid. The assets would effectively operate outside the market, only when needed for reliability.

- In April, the Texas Senate approved the $10 billion “energy insurance program” that aimed to improve grid reliability through development of 10,000 MW of new gas-fired generation. That measure did not find support in the House, leading to the proposal voters approved on November 7th.

- The Texas Energy Fund will be administered by the Public Utility Commission of Texas (PUCT), with a total pot of $7.2 billion available to support any new construction or upgrade that results in at least 100 MW of dispatchable generation coming online and interconnecting to the Electric Reliability Council of Texas grid before June 1, 2029. $1.8 billion will support the development of microgrids and backup power for critical facilities across the state, and $1 billion will go to grid modernization, weatherization, and other efforts in the non-ERCOT portions of Texas.

- Texas has been working to bolster its electric grid since Winter Storm Uri in 2021 resulted in widespread blackouts and led to the death of almost 250 people in the state. Regulators spent much of 2022 considering market enhancements and incentives for power generation facilities.

- With approximately 1,000 people a day moving into the state, supporters of the fund claim new power generation is needed to maintain electric reliability and support the state’s expanding economy. Opponents of Proposition 7 believe it amounts to a giveaway to fossil fuel power plant developers at a time when Texas should be investing more in energy efficiency or alternative market mechanisms.

Maine Voters Reject Public Takeover of CMP

- Maine voters on Tuesday rejected a ballot initiative that would have paved the way for takeover of the state’s investor-owned utilities, potentially costing up to $13.5 billion. Question 3 had proposed the state form a non-profit, consumer-owned utility called Pine Tree Power to purchase the assets of Central Maine Power and Versant Power via eminent domain. Voters rejected the idea by a roughly 2-to-1 margin.

- With high rates, frequent outages, and reportedly terrible customer service, the grassroots campaign connected with thousands of Maine voters. However, the complexity and uncertainty of how such a maneuver would play out caused most voters to stick with the devil they know.

- Both utilities funded political action committees to fight the ballot initiative. CMP’s owner, Avangrid, backed the group Maine Affordable Energy with about $18 million. Maine Energy Progress, the PAC supported by Versant, received about $8 million from the utility’s parent.

FERC Releases Final Report on Winter Storm Elliott

- Although Winter Storm Elliott lasted for just a few days in late December 2022, there were widespread, albeit disparate, outages across two thirds of the US and multiple electrical grids came dangerously close to failure.

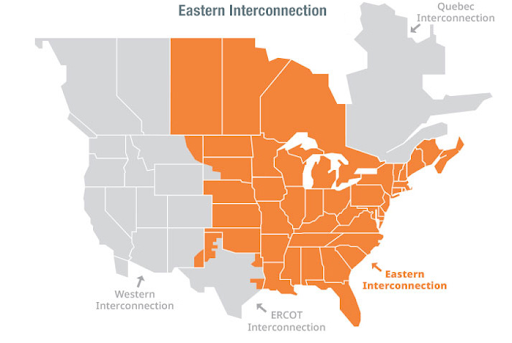

- Last week FERC and the North American Electric Reliability Corp (NERC) released their final report focusing on the challenges to bulk electric and natural gas infrastructure during the storm and also the need for increased reliability of the US’ Eastern Interconnection network (See zonal map below).

Source: ISO-NE

Source: ISO-NE

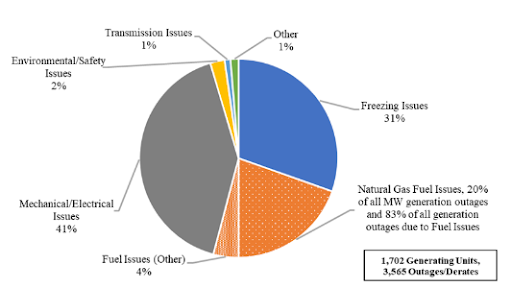

- According to the report, the storm resulted in 3,565 unplanned generator outages, derates, or failures to start across 1,702 individual electric units. At the worst point of the event, there were 90,500 MW of coincident unplanned generating units out, or about 13% of the total generating capacity available in the entire Eastern Interconnection.

- Contemporaneous with the unplanned power outages were the failures of the natural gas delivery system due to wellhead freeze-offs and other frozen equipment. Poor road conditions during the storm also prevented necessary maintenance, which also led to significant natural gas production decreases.

Source: FERC

Source: FERC

- FERC states that this was the fifth event in 11 years in which unplanned outages during cold weather jeopardized grid reliability.

- FERC Chairman, Willie Phillips, and NERC President and CEO, Jim Robb, both emphasized the need for someone to have the authority to establish and enforce gas reliability and winterization standards for the system. In a different report from NERC, the analysis of the cold-weather event listed 11 recommended actions to mitigate future risks, several of which were initially identified after 2021’s Winter Storm Uri in Texas.

- Categories of recommendations spanned generator hardening, natural gas infrastructure hardening, gas-electric coordination, and electric grid hardening.

- In September of this year, Sen. Hickenlooper, D-Colorado introduced legislation called the Building Integrated Grids With Inter-Regional Energy Supply Act, or BIG WIRES. The bill would tell the FERC to update their requirements for grid operators to be able to transfer 30% of peak electrical loads to an adjacent region. The requirement is currently set to 15%.

- BIG WIRES also calls for a process to speed up permitting. Estimates from the Council on Environmental Quality’s (CEQ) 2020 report found that across all Federal agencies, the average time was 4.5 years to complete environmental impact statements and other related approvals.

- If the bill moves forward as currently written, regional plans to reach the 30% transfer requirement would likely be due from the grid operators to FERC by mid-2027 with the upgrades completed by 2035.

ISO-NE Mulls Over Future Capacity Portfolio, Seeks to Delay Auction

- ISO-NE and NEPOOL are seeking to delay the February 2025 forward capacity auction (which would procure capacity for the 2028/2029 delivery year) until February 2026.

- The sought delay comes as ISO-NE wades through its second year of re-evaluating how it calculates the availability of generation capacity. It was determined that the existing method of calculation overstates the reliability of natural gas, leading to a disproportionate firing of natural gas generation during periods of peak winter demand.

- Recent publications by FERC draw attention to the potential underperformance of gas-fired generation during cold weather events (see e.g. Winter Storm Elliot assessment) as well as the risk associated with the anticipated closure of the Everett Marine LNG Import Terminal.

- More specifically, a joint statement released by FERC and NERC on November 6, uses evidence from previous winter storms to highlight the pressures put on the electric and natural gas grids even with the terminal operational. Without Everett, the New England grid could face severe reliability and affordability threats.

- Postponing the 2025 auction would give stakeholders time to finalize the capacity calculations and ensure the auction occurs with an accurate understanding of the regional grid’s capacity needs, resource availability, and stakeholder input.

- A modeling issue is also to blame for the slowdown in the new calculation and implementation. Additionally, dozens of clean generation and storage projects in the interconnection queue add a layer of complexity to finalizing the capacity calculation.

Boston Drops Its Gas Ban Ambitions, For Now

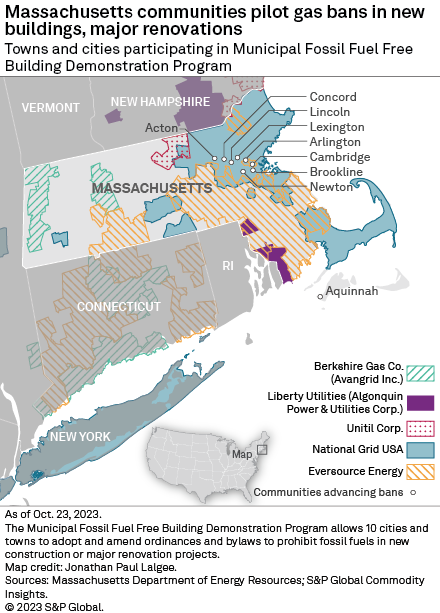

Source: S&P

Source: S&P

- Earlier this year, Massachusetts finalized a pilot program allowing several municipalities across the state to spearhead gas bans. Some of the state’s largest municipalities, from Boston to Cambridge to Brookline, were included in the ten chosen municipalities to lead the effort. (image above reflects participating towns as of 10/23/2023)

- This week, one of those municipalities dropped from the list, and it might be the one you least expect: Boston.

- Michelle Wu, the mayor of Massachusetts’s largest city, withdrew the city from the program over concerns it would not be approved by state regulators as stakeholders and REITs voiced their concerns over the ban increasing upfront development costs and restricting development overall.

- Advocates of gas bans warn that Boston’s withdrawal from the program is a step backwards. Participation from such a large city would have sent a strong message and produced valuable economic data about the policy–what that data would suggest is under much debate of course.

- Other stakeholders (mainly REITs) praised Wu’s decision and hope to go back to the drawing board on negotiating these types of bans, which are appearing inevitable.

- Earlier this year, Wu signed an executive order banning fossil fuel use in new municipal buildings and major municipal building renovations.

On Our Radar - New York State Cap-and-Invest Plan

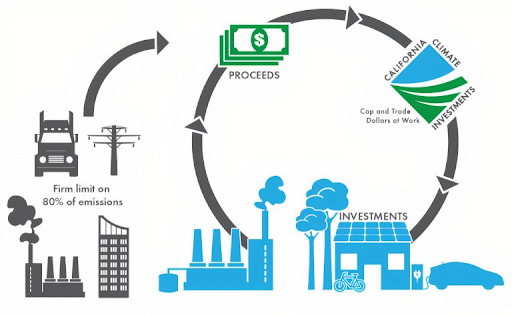

- NYS policymakers are developing a Cap-and-Invest Program to reduce greenhouse gas (GHG) emissions across all sectors of the State’s economy. Following in the recent footsteps of California, Washington State, and Quebec (CA), NYS will establish an annual declining cap on emissions produced by large-scale GHG emissions sources and distributors of heating and transportation fuels to align with the state's GHG reduction requirements set forth in the Climate Leadership and Community Protection Act of 2019.

- The most significant unknown for New York’s large-scale GHG emissions sources and distributors of heating and transportation fuels right now is whether their operations will be defined as Obligated or Non-obligated sources in the new scheme. Although participants in both source classes will likely be required to report their emissions in the near future, the Obligated facilities will also be required to obtain allowances equivalent to their GHG emissions through an auction or potentially GHG credits or offsets.

- The NYS Department of Environmental Conservation (DEC) and New York State Energy Research and Development Authority (NYSERDA) are currently taking public comment and studying the implementation strategies and lessons learned by other States that have similar schemes in place.

- We can look to California’s program to help predict how many GHG emitters in NYS will be folded into the program or how the State may determine the emission thresholds for Obligated buildings. CA’s program extends to over 350 businesses representing 600 facilities, accounting for about 85% of CA’s GHG emissions.

Source: California Air Resources Board

Source: California Air Resources Board

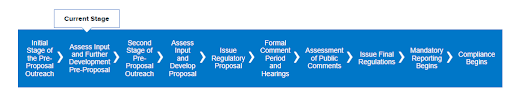

- The timeline for implementation is provided on the landing page for NYS’s C&I program without dates at the time of writing.

Source: New York State Cap and Invest

Source: New York State Cap and Invest

- Veolia will continue to track this program’s design development and keep our readers informed when there are key developments and ahead of actionable activities for compliance.

Natural Gas Storage Data

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.