Energy Markets Update

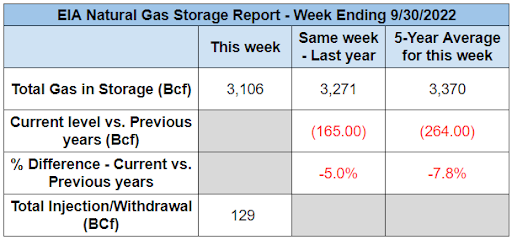

Weekly natural gas inventories

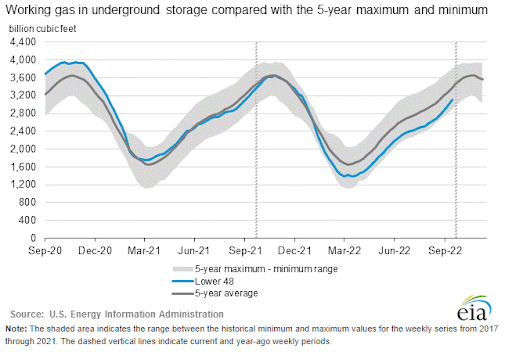

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 129 Bcf. The five-year average injection for October is about 67 Bcf. Total U.S. natural gas in storage stood at 3,106 Bcf last week, 5.0% less than last year and 7.8% lower than the five-year average.

US power & gas update

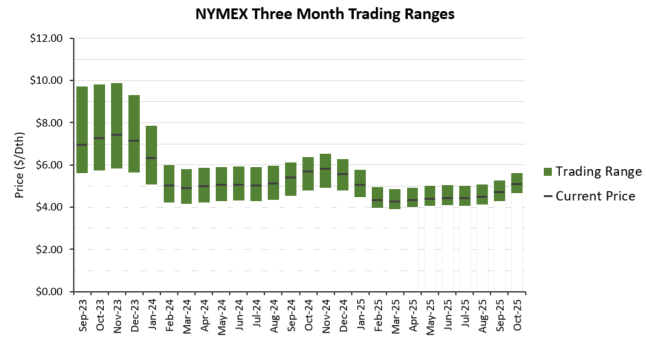

- Both energy spot prices and futures receded sharply in the back half of September. As compared to August, September spot power rates declined by about 15-20% in PJM and 25-33% in New York and New England.

- Moderating weather was a leading factor, however there was also a 10% reduction in the baseline cost of NYMEX gas month over month, and prompt month gas remains at a 12 week low.

- There are a few factors contributing to the bearish November: (1) weakening growth prospects, i.e. the recession trade, (2) reasonably strong storage numbers over the past few weeks, (3) a definitive uptrend in natural gas production, finally.

- Natural gas production exceeded 97.5 Bcf/d on October 3, its highest level ever.

- A total injection of 129 Bcf beat analyst expectations of 114 Bcf for the week ending September 30.

- Q1 2023 power in New England still remains the most expensive strip in the country, but it has declined from $290 per MWh in August to about $225 per MWh currently, finally showing some weakness in an otherwise stubborn and eye watering risk premium.

- Our view is that current price levels may be a good entry point for those looking to hedge the next 6 months, however our current thesis is that an oversupply situation could materialize in mid to late 2023 and we are holding out for further reductions in 2023 and 2024.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

- Our view is that current price levels may be a good entry point for those looking to hedge the next 6 months, however our current thesis is that an oversupply situation could materialize in mid to late 2023 and we are holding out for further reductions in 2023 and 2024.

OPEC vs. Fed

- On Wednesday October 5th, the OPEC+ group voted to cut global oil production by 2 million barrels per day, approximately 2% of global supply and the largest cut since early 2020.

- Although actualized cuts are likely to be closer to 1 million bpd, this was larger than expectations from the analyst community and comes at a challenging time whilst the world fends off impacts from higher interest rates and higher inflation, much of which is being driven by the energy sector.

- The White House has expressed its concern about the decision to lower production with the ongoing Ukrainian conflict, not least because of the impacts of inflation, but also because a higher oil price further greases the wheels of Vladmir Putin’s war machine.

- Russian production has been drastically reduced due to economic sanctions imposed after the Russian invasion of Ukraine. Production, estimated at 9.6 million bpd is currently 0.4 million bpd per day lower than before the conflict began.

- This also puts the US FED in a bind because it ups the ante associated with future interest rate increases. If OPEC is apparently willing to cut production to make up for any lost revenues due to FED rate-induced demand destruction, there may be diminishing returns and higher risks associated with FED rate increases. It’s understandable to raise the cost of money in order to control inflation, less so if efforts bear no fruit and destroy European economies in the process.

- The Biden administration will feel slighted by OPEC+ after much lobbying and offering of purchase commitments to maintain current levels, however didn’t they realize they were negotiating with a cartel after all?

- A key question for 2023 remains, who now has the most control over global inflation: the FED v OPEC and/or Russia? Furthemore, how much longer can European ecomoies bear to settle energy commodities (ie., primarily oil) in US dollars?

Global Markets and the Recession Trade

- Souring equity markets, persistent inflation, a decidedly aggressive FED, and the recent news of the OPEC+ production cut have all contributed to growing likelihood of a global recession over the next 6-12 months.

- This is likely to create some demand destruction, however the psychological impacts could create short term buying opportunities that buyers should be ready for.

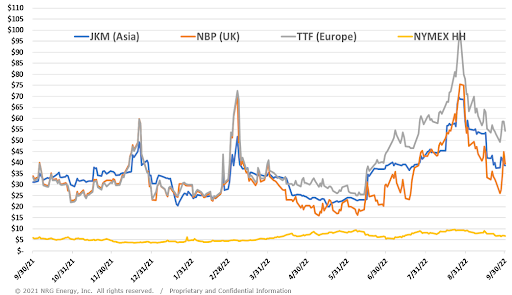

- On Monday, the International Energy Agency (IEA) reiterated ongoing volatility in global gas markets due to Russia’s invasion of Ukraine.

- The agency forecasted a 0.8% drop in gas demand in Asian markets, as well as a whopping 10% reduction in gas consumption in Europe. Industrial demand has been down approximately 15%, largely due to high prices.

- Leaders in the organization have placed blame on “Russia’s reckless and unpredictable conduct” when it comes to managing gas supply, which includes curtailment of gas flows to Europe.

- Furthermore, the IEA predicts a tight market will continue into 2023, even as European and Asian markets reached record high natural gas prices in the third quarter of 2022.

Prompt Month Global Natural Gas Prices

Source: NRG Energy, Inc.

- Desperation from European buyers has facilitated upgrades and additions to US LNG exporting capacity, notably with Cheniere Energy’s Texas LNG terminal and Venture Global LNG’s facility in Louisiana, though these will take years to develop.

- The recent apparent sabotage of the Nord Stream 1 & 2 pipelines last week have further heightened tensions around Europe’s energy future. Although the near term impacts are small (Nord Stream 2 never went into service and Russian cut all deliveries to Nordstream 1 in late summer), their destruction removes a potential offramp and steps up the geopolitical strife.

Hurricanes leave the lights out in Florida, Canada, and Puerto Rico

- Category 4 storm Hurricane Ian devastated Florida last week, initially leaving over 2.5 million people without power.

- Florida Power and Light (FPL), the state’s largest electric utility, has stated that parts of the grid in Southwest Florida will have to be rebuilt from scratch, paving the way for an extended statewide road to recovery.

- With the help of thousands of out-of-state utility workers, Florida utilities have been able to restore power to millions of customers, with 180,000 still waiting for power as of today, October 6.

- One silver lining claimed by FPL has been the structural integrity of the utility’s power plants, with no sustained damage reported at any site despite the severity of the hurricane.

- Net demand is lower due to both outages and curtailment of some Gulf Coast LNG exports. In the aggregate this is fairly minor, but there has been a material reduction in power generation since last week.

- Meanwhile, Puerto Rico is still feeling the effects of Hurricane Fiona two weeks after landfall, with over 100,000 still without power as of Tuesday.

- President Biden recently visited the island and pledged over $60 million of funding to be put towards power grid integrity.

- Hurricane Fiona hit Puerto Rico approximately five years after Hurricane Maria knocked out the island’s power grid and left some without power for almost a year.

- After devastating Puerto Rico, Fiona moved up the East Coast of the US and left about a third of Nova Scotia, Canada without power. About 25,000 were still without power on Monday, October 3.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.