Energy Markets Update

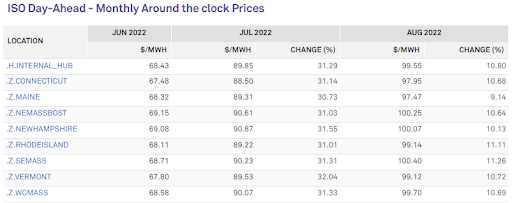

Weekly natural gas inventories

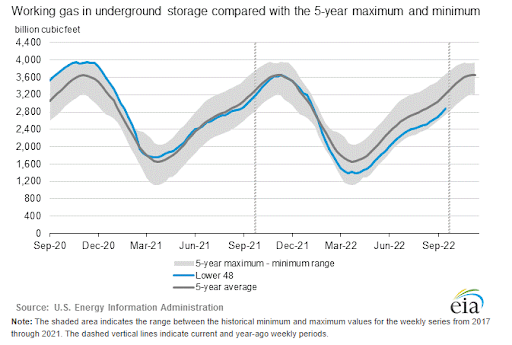

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 103 Bcf. The five-year average injection for September is about 78 Bcf. Total U.S. natural gas in storage stood at 2,874 Bcf last week, 6.4% less than last year and 10.4% lower than the five-year average.

US power & gas update

- Natural gas prices have tapered slightly over the past couple of weeks as temperatures begin to settle in most parts of the US, but for a brief (Sept. 14) rally related to the short-lived fear of an imminent rail workers strike.

- We’ve had two consecutive weeks of strong gas storage numbers, both beating analyst estimates.

- Utilities have entered the winter buying season across the northeast, many of them posting record high rates. The residential rates for January 2023 power in National Grid Massachusetts topped $0.40 per kWh ($0.60 delivered).

- NYISO issued a warning of high power prices through the upcoming winter due to continued upward market pressures concerning Russia’s invasion of Ukraine and lingering impacts of the Covid-19 pandemic.

- Hurricane Fiona left much of Puerto Rico without power at the beginning of the week as strong winds damaged transmission infrastructure across the island.

- Luma Energy, the (new) utility serving Puerto Rico, saw over 1.3 million customers out of 1.47 million total experiencing an outage.

- The utility mobilized nearly 2,000 field employees as of Monday in order to restore power on the island, despite continuing poor weather conditions.

- Hurricane Fiona hits just five years after Hurricane Maria wreaked havoc on Puerto Rico’s power grid, causing one of the longest outages in American history and bankrupting the local utility PREPA.

- Cheniere Energy’s LNG terminal in Corpus Christi, Texas plans to construct a new supply line by 2024 to further expand LNG capacity in their facility.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

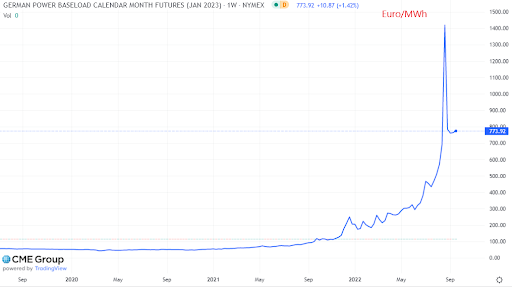

An Update on the European Energy Crisis

- We have been warning of a developing economic catastrophe in Europe since early in the Russian-Ukraine War. Since then, the threat has only increased and preparations have thus far been inadequate.

- In 2021, Russia supplied approximately 54% of Europe’s gas imports (184 of 341 bcm) and roughly 37% of all gas consumption (184 of 513 bcm) to EU countries.

- Germany and Italy account for a lion share of both EU gas consumption and imports from Russia. With as much as 30% of their supply cut, these two are principally exposed. Even with rebalancing of LNG cargoes, Germany may be facing an imbalance of 10-20 bcm over the next year. Assuming that residential heating demand is untouched, that could require cuts of 30-50% to industry. Some of this industrial demand could be and has been switched to oil, but cuts of this magnitude would be devastating.

- Equally alarming are the price impacts that can ultimately cause the same result. The landed rate for LNG in Europe is currently about $55 per MMBtu, down from $100 three weeks ago but just as likely to return. Electricity futures indicate that winter power is likely to exceed $1-1.50 per kWh retail across some regions of Europe, about 5-12x what was paid last year. The average price of electricity in the US in 2021 was $0.118 per kWh.

- These figures are not only forcing closure of energy intensive businesses (many have been idling already), but they are also driving massive increases in core inflation. Germany’s industrial producer price index was up 45% yoy. This will bleed into everything from manufactured products, to fertilizer and food.

- The energy price formation of these markets means that this pain will also be felt throughout much of Europe. Countries will pay increasing rates for wholesale power as the various sovereign actors cut off exports and bid up the price of imports.

- There are various price stabilization efforts in the works, from price caps to subsidization, to nationalization (see e.g., Germany's nationalization of gas distributor Uniper yesterday). Some of these could help and others look downright foolish, but regardless of the path Europe could ultimately be on the hook for hundreds of billions of Euros in order to backstop prices.

- To make matters worse, Germany has determined that it will proceed with the shutdown of its last three nuclear power plants in early 2023. It has proposed to keep two of them in “reserves” until then but was informed 2 weeks ago by their operator that that is not possible. France’s nuclear fleet has also been subject to maintenance outages and failures after years of intentional neglect. It raised eyebrows earlier this summer when it published plans to import power this winter, since France has been a reliable exporter for decades.

- German officials have stated that in the aggregate they have sufficient gas in storage to get them through the winter, however we have concerns that this view may understate the risks and impacts of both scarcity pricing, and physical congestion during design days. Pulling gas out of storage and distributing it to where and when it is needed is not the same function as aggregate reserves.

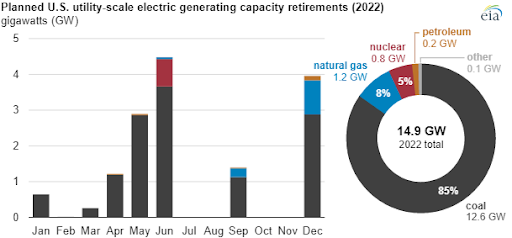

Retired coal sites viable for nuclear power

- About 80% of currently operational and retired coal facilities would be able to support an advanced nuclear reactor according to a recent report from the Department of Energy.

- Of the 315 coal plant sites that were viable for a nuclear project, 190 currently operational plants add on 200 GW of nuclear capacity. 125 recently retired coal plants could host an additional 65 GW of nuclear power. There is currently about 95 GW of nuclear capacity installed across the US, comprising 93 reactors across 55 sites.

Source: Energy Information Administration

- The report comes at a welcome time, as governments from the local to federal level look to make use of transmission lines and other infrastructure initially constructed to serve coal plants.

- The Department of Energy claims that the use of previously developed infrastructure for coal facilities is expected to reduce the cost of capital for a nuclear reactor by 15 to 35% less than a greenfield project.

- Proponents of conversion of coal sites to green energy also point out the economic benefit to communities that otherwise would lose a major source of economic activity when coal plants are shuttered. Nuclear plants have a relatively small footprint but personnel counts. The study predicts that replacing a coal plant with a similar sized nuclear reactor would add around 650 jobs to a region.

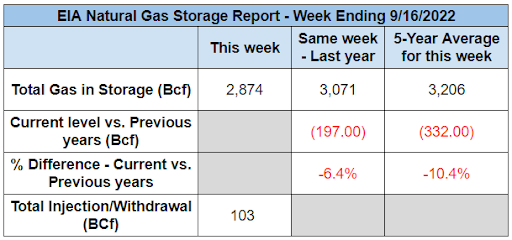

New England winter reliability concerns mount

- On September 8, the Federal Energy Regulatory Commission (FERC) held a forum to discuss New England’s ongoing struggles with winter power reliability. While we are not in panic mode quite yet, the dialogue should leave local stakeholders with an interest in reliable electricity, concerned about whether there is sufficient political will to solve the region’s problems. Very little has changed in 10 years.

- Pipeline constraints into the region have historically caused gas scarcity conditions when temperatures dip below 30F, adding substantial cost to customer bills and making the region more reliant on its single LNG import facility.

- Many panelists agreed the Everett LNG facility is necessary to ensure winter reliability in coming years, however it is also set to be retired in 2024 when its primary customer and neighboring power plant will be shuttered. Local politicians however, would prefer to give it (and actually give massive tax breaks to boot) to Robert Kraft who has proposed building a new stadium for the local MLS soccer team at the site.

Source: Getty Images

Source: Getty Images - Acquisition of LNG into New England will also be increasingly difficult this winter because the region must compete with strong European demand due to Russia’s invasion of Ukraine.

- Panelists talked about lifting the Federal Jones Act, which prohibits foreign vessels from transporting goods between US ports and prevents. Sound familiar? Yes, these are the same suggestions that were made 10 years ago and for most of the same reasons.

- There was some discussion of ratebasing gas reserve costs (i.e., LNG cargoes), however this is also something that was discussed 10 years ago with no resolution.

- Eversource recently advised that its New England customers could see an increase in electricity prices between 60 and 100% compared to last winter, which itself was the most expensive on record.

- Panelists discussed the possible advantages of expanding offshore wind generation in increasing energy storage capacity in New England. It is unclear how this would help in the near-term.

- Capacity accreditation methods are in progress to evaluate the reliability contributions of a variety of renewable energy sources, while taking into account diminishing levels of contribution depending on generation makeup.

Manchin’s energy bill revealed to the public

- On Wednesday, Senator Joe Manchin released a package of legislation meant to speed up energy infrastructure construction projects by reforming the permitting process.

- Current permitting laws slow down new developments significantly. This inconvenience is not only limited to untimely completion of projects but also has the potential to increase costs significantly depending on future market conditions.

- With the recent passing of the Inflation Reduction Act, emissions are expected to fall 30 to 45%. Permitting reform could help capture the higher end of that range while keeping project costs low. The backlog of projects before FERC, various ISOs, and various permitting authorities has become a huge impediment.

- The legislation aims to prioritize transmission planning by expediting siting of projects in development and allowing FERC the authority to oversee cost allocation for new transmission.

- Currently, over 1,000 GW of renewable energy projects are being held up in transmission interconnection queues, much of which is due to a lack of transmission capacity. Limited transmission capacity is a major challenge that stands in the way of reduced emissions.

- Several clean energy organizations have applauded the legislation, calling it essential to unlocking the full potential of the Inflation Reduction Act.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.