Energy Markets Update

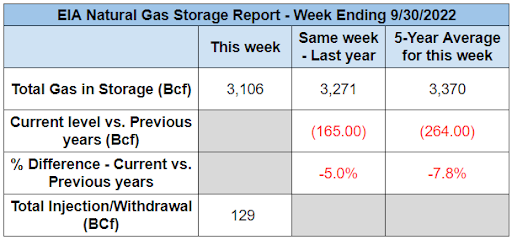

Weekly natural gas inventories

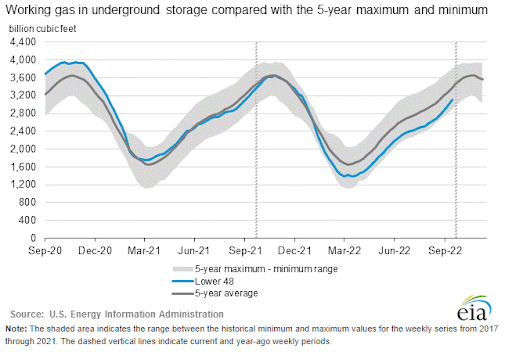

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 111 Bcf. The five-year average injection for October is about 67 Bcf. Total U.S. natural gas in storage stood at 3,342 Bcf last week, 3.1% less than last year and 5.2% lower than the five-year average.

US power & gas update

- NYMEX gas continued its downward slide over the past week and a half, primarily due to mild temperatures and consistently higher than expected gas injection numbers.

- Mild temperatures have led to a few consecutive weeks of triple digit storage injections that have also surpassed analyst expectations.

- Midcontinent gas prices have been mixed due to colder temperatures in the region.

- Freeport LNG is preparing to resume partial operations after a fire earlier this year. This reopening will expand US LNG export capacity for the remainder of the year, potentially putting the improving storage trajectory into jeopardy. Freeport has a capacity of 2.2 bcf/d, over 2% of daily production.

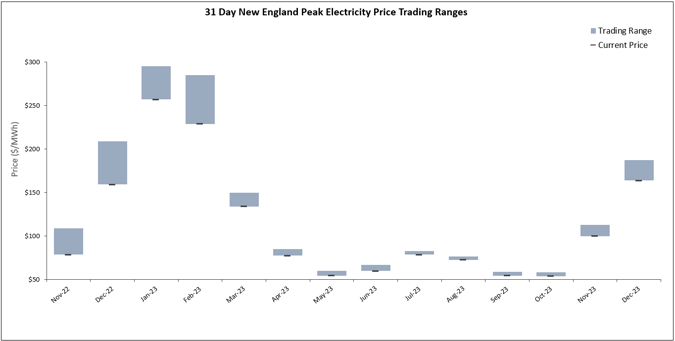

- Forward power prices in New England are at their lowest in a month as they follow recent dips in the broader gas market. For Jan-Feb 2023, this has precipitated a decrease of almost $50/MWh.

- Natural gas injections came in at 111 Bcf for the week ending October 14th, which beat analyst expectations of 104 Bcf.

- Our view is that near term buyers should consider locking a portion of thier contracts ahead of the heating season and re-entry of Freeport LNG. Bad news from Europe spook North American markets.

Source: S&P Global Commodity Insights

Europe Mulls Energy Market Reforms as Winter Looms

- Prior to the Russian invasion of Ukraine, Europe relied on Russia for 40% of its gas, 25% of its oil, and 45% of its coal. Most of those flows have been curtailed or drastically reduced.

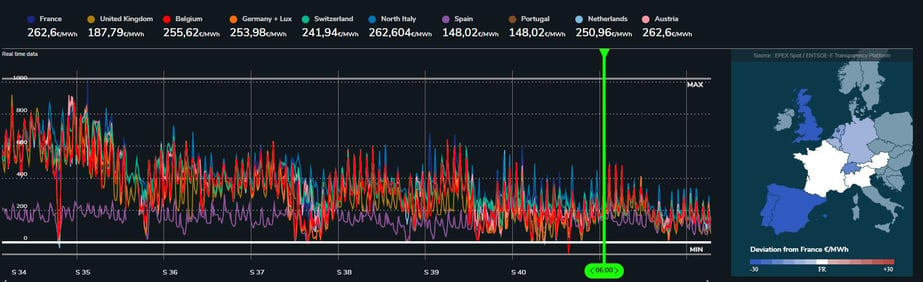

- While France imports 17% of its gas consumption from Russia, Germany accounted for 55%. Each country takes differing levels of raw energy imports but the European electricity grid operates a centralized clearing market, so net scarcity of gas results in higher clearing prices for the entire region, not just in the countries that are short.

- This of course is problematic under the current predicament because gas is the inframarginal generation resource across Europe, and therefore, all generation providers are getting paid at the same gas-indexed compensation rate. Electricity prices have soared to 5x prior year trading ranges and most European countries are grappling with tough decisions about how much the state should insulate consumers against price shocks, and to what extent market price signals can be preserved while also making efforts not to bankrupt industry and/or sovereign governments.

- Meanwhile, lower marginal cost units such as nuclear power plants, wind and solar, are making windfall profits due to the higher clearing prices. Even the most unabashed supporters of the marginal clearing market are likely to blush at its current result in Europe.

- Europe is considering a few different alternatives:

- Mandatory restrictions on private consumption of electricity.

- Cap natural gas prices. Because high electricity prices are a direct result of the price of gas being used by the marginal gas-fired power plants, another approach is to cap the price of gas purchased by these plants. Spain has already implemented this approach with the permission of the European Commission.

Wholesale electricity prices reflecting cap on gas prices in Spain, Aug 31, 2022 to Sep 9, 2022 Source: RTE France

Source: RTE France

The difference between the international price of gas and the price charged to the gas-fired generation is covered by the state. Unless this policy were adopted throughout all of Europe, the measure only makes sense for a country that is not well connected to its neighbors or to the Union as a whole. Otherwise there is a profit motive to use subsidized gas to export electricity into a higher European market. It is conceivable to create a European solidarity fund to subsidize the use of gas in power plants within the EU. By reducing the cost of fuel for these marginal power plants, the equilibrium price on the wholesale market would also be reduced. - Replace marginal cost pricing with average cost pricing. As an example, imagine a fleet with 3 power plants where marginal costs are 10, 20 et 60 $/MWh. Traditionally, if all plants are needed, they will each receive 60$/MWh and the two lower cost plants would realize $50/MWh and $30/MWh profits respectively. Under the marginal cost mean pricing, the price would be established at $30/MWh and the difference between the clearing price and the marginal unit plant would be paid by the state. Consumers are winners in this scheme: the price is lower and inframarginal is also reduced. A disadvantage is that it does not give you a good price signal because it represents an average, not the actual price of electricity.

- Set-up “pay as bid” scheme. Each generator is paid at its variable cost and customers pay an average of all costs.

- Nationalization of industry. One can also opt for a private monopoly with a public service concession. While there is a high degree of support for this move, it seems unlikely that all or most of Europe could pull it off and the debt burden may be too large to bear.

- At the moment, a cap on gas prices seems to be the most likely path.

- While the state may absorb the difference in the market price for gas and the cap, there has also been discussion of capping the price of gas that can be paid to Russia. Just this week however, the head of Russia’s Gazprom stated that if such caps were implemented, it would retaliate by cutting all remaining gas flows to Europe.

- Above all, two measures have become unavoidable, regardless of the scenario chosen. First, Europe needs to institutionalize conservation, which means controlling electricity demand as much as possible, and second, it must invest massively in both dispatchable as well as decarbonized production capacities. In a sector where the risk of failure is collectively unbearable because electricity cannot be stored on a large scale, it is better to have excess capacity than to be in a just-in-time system. In all likelihood, this probably means prolonging the lives of traditional generation assets.This is the insurance premium that the consumer must pay. Overconfidence in market mechanisms has obfuscated this obvious fact. Insurance is simply not something that energy markets, or in fact any markets, are particularly adept at providing over any meaningful time horizon.

FERC plans interconnection reform

- FERC’s proposed rule RM22-14 for interconnection reform aims to ease the challenges posed by clogged interconnection queues that add cost, time and uncertainty to bringing renewable and storage projects to market.

- With over 8,000 projects in the pipeline totaling well over 1,400 GW of capacity, FERC desperately needs to shorten times for review and approval.

- FERC’s proposal includes reviewing interconnection upgrades in groups rather than on a case-by-case basis (ie Cluster Studies), as well as requiring a larger financial commitment to deprioritize more speculative projects.

- There has been tons of interest in this draft rulemaking, with commentary from utilities, RTOs, developers, and consumers. Generally, most parties are supportive of the measures, at least in their objectives.

- Advanced Energy Economy, a clean energy trade group, recommended that FERC harmonize its interconnection rulemaking with a separate proposed rule (RM21-17), which focuses on long-range transmission planning and cost allocation. Under current rules, new projects often pay substantial interconnection costs while others free ride behind them. This docket would address that.

- Companies such as Apple, Google, and Amazon Energy, strongly support the FERC proposal. Amazon Energy, which aims to offset its entire business with renewables by 2025, also suggested that transmission providers should be required to examine alternative transmission technologies.

- The Clean Energy Buyers Association (CEBA), which includes 89 Fortune 500 companies, supports the idea of “first-ready, first-served” encouraged by FERC when it comes to interconnection queues. The CEBA does, however, see issues with other aspects of the FERC proposal. For example, the organization is concerned with over-burdening transmission providers by allowing more study requests and enforcing fines when study deadlines are not met.

Incremental US LNG growth

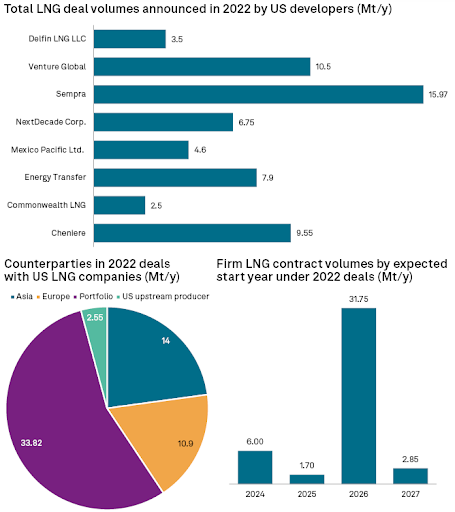

- U.S. LNG exports averaged about 11.2 Bcf/d during the first six months of 2022, making the U.S. the world leader in LNG exports. S&P Global Commodity Insights recently forecast that U.S. LNG exports will exceed 22 Bcf/d by 2027.

- Despite growing momentum in LNG contracting, just two new U.S. LNG projects have been commercially sanctioned in 2022: an expansion of Cheniere Energy Inc.'s Corpus Christi LNG export facility in Texas that will be capable of producing roughly 10 million tonnes of LNG per year and Venture Global LNG's up to 20-Mt/y Plaquemines LNG facility in Louisiana.

- More than 42 Mt/y worth of binding long-term agreements tied to U.S. LNG projects have been signed since Russia invaded Ukraine. U.S. developers have also secured nearly 19 Mt/y worth of preliminary deals in 2022.

- The direct supply impacts and the heightened security of supply concerns arising from the conflict have further supported the already-strong contracting momentum from international buyers. Most off-take contracts are linked to the U.S. Henry Hub natural gas price in a reflection of the favorable price differential between the U.S. wholesale natural gas market and markets overseas, according to Anusha de Silva, an associate director for global LNG at IHS Markit.

- de Silva went on to mention "We expect U.S. LNG export capacity to increase during the coming years and broadly double by the 2030s. And given the current supply-side competition and sense of urgency among developers, it is possible that more projects will reach a positive FID than are in our forecast."

- Contracts signed in 2022 are expected to yield a small incremental send out by 2024 (<0.8 bcf/d), primarily from upgrades at existing facilities, and a more material growth in 2026 (>4.cf/d). The bottom line is that impacts to the US gas market from the Russian conflict are largely going to be felt in 2026 and after.

Source: S&P Global Commodity Insights

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.