Energy Markets Update

Editor’s Note: In this update, we track shifting forces across energy markets, regulation, and investment that are redefining the industry. Gas prices sit below $3.00/MMBtu with forward premiums under pressure, while Golden Pass LNG’s ramp-up could tighten storage and lift prices. The EPA’s proposal to end the Greenhouse Gas Reporting Program threatens environmental markets, and draft GHG Protocol changes could make REC procurement costlier and more complex. Wall Street’s push into power—via BlackRock’s utility bid and Blackstone’s gas generation investment—signals rising demand from AI and electrification, bringing both opportunity and new contracting challenges. Our 2025 Peak Demand recap shows modest but steady growth in summer peaks across PJM, NYISO, and ISO-NE, underscoring the value of proactive capacity management.

Table of Contents

- Energy Market Update

- EPA Proposes Elimination of Greenhouse Gas Reporting Program

- Asset Managers Perk Up on Power

- Untimely Adjustments: Proposed Rule Changes at the GHG Protocol

- Summer Peaks: Recap of 2025 Peak Demand Notification Program

Weekly Natural Gas Inventories

Source: EIA

Energy Market Update

- With NYMEX gas now comfortably in the bargain bin below $3.00/MMBtu, a game of chicken has begun between the prompt month and the December 2025 to Feb 2026 package, which is still priced above $3.80.

- At the current trajectory, the premium appears tenuous. However the imminent ramp-up of LNG liquefaction at Golden Pass in Louisiana is likely to provide fundamental support to the market beyond Q1. Golden Pass is yet another monster facility and the third to hit the market this year. Two of Golden Pass’ three LNG trains are expected to begin operations around the end of the year, and all three trains will have a total capacity of over 18 million metric tons of gas per year, equivalent to approximately 2.75 bcf/d.

- All said, these projects will consume virtually all of the gas added to the production side since the middle of the year.

- Many analysts now expect natural gas in storage to peak around 4 tcf in November, a very healthy inventory by historical standards, and up from expectations of around 3.6 bcf early in the year. However the drawdown potential from the additional LNG capacity means that the goalposts on “safe storage levels” have also moved considerably. End-of-season inventories well below 4 tcf will put more pressure on prices than in past years.

- In its September "Short-Term Energy Outlook," the Energy Information Agency forecasted higher gas prices, acknowledging "relatively flat natural gas production amid an increase in US liquefied natural gas exports." The Agency also increased its forecast for electricity generation in the US to 2.3% in 2025 and another 3% in 2026. At the start of the year, EIA had forecasted annual growth rates of 1.5% in 2025 and 2026.

- We still see value in the late 2027 and 2028 part of the curve as these tenors appear reasonably priced, given the bullish drivers in the market which are expected to arrive in 2027, including more LNG export capacity and increased native demand.

- Work resumed at Revolution Wind this week after a Federal Judge lifted the Trump Administration’s stay on the nearly completed project off the coast of Connecticut and Rhode Island. The 704 MW Orsted-owned project had cited daily losses exceeding $2M during its pause. The project had been targeting commercial operation early in 2026. More on Revolution Wind in our last newsletter.

EPA Proposes Elimination of Greenhouse Gas Reporting Program

On September 12, EPA Administrator Lee Zeldin announced a proposed rule to end the Greenhouse Gas Reporting Program (GHGRP), a program enforced by the EPA for the last 15 years. In the proposal, EPA says there is no Clean Air Act (CAA) requirement to collect GHG emission information and cites the costs to businesses of reporting as reason for ending the program. This proposal continues the administration's efforts to lessen GHG regulations stemming from the CAA. Earlier this year, we covered this administration's efforts to rollback GHG limits for power plants.

- The data collected by the GHGRP has been considered the gold standard for emissions reporting and has been utilized to develop policy. It has been crucial in creating policies such as the tax benefits for capturing carbon and producing clean hydrogen. The IRS relied on GHGRP to verify that captured carbon is secured for the required length of time and to determine the emissions rates associated with a hydrogen production facility, thereby setting its tax credit tier.

- Under the proposal, only natural gas systems covered by the Waste Emissions Charge (WEC) would be required to continue reporting. Sectors covered under this category are listed in the table below. With the passing of the One Big Beautiful Bill, the reporting requirements for these WEC systems are delayed until 2034. Under the proposal, 8,000 large facilities are no longer expected to report their GHG emissions.

Source: EPA GHGRP Report

- The Federal rollback removes CO2, CH4, N2O, HFCs, SF6, PFCs, and other fluorinated gases from required reporting, jeopardizing environmental offset markets and cross-state carbon credit values as demand for these products from the largest emitters will surely drop.

- While SO2 and NOX emissions reporting under CSAPR and ARP remain intact, the GHGRP update removes recordkeeping obligations for industrial sources, fostering pessimism about future emissions-focused regulations.

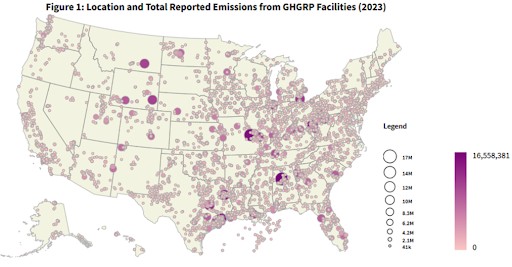

- The locations of these large emitting sources slated to stop reporting are depicted below, with a high concentration of sources in the Midwest and South.

Source: GHGRP Emissions by Location

EPA will initiate a public comment period to solicit input on the proposed rule. The decision is not expected until June 2026.

Asset Managers Perk Up on Power

Deal Spotlight: Minnesota Power in the Crosshairs

BlackRock’s infrastructure arm, Global Infrastructure Partners (GIP), is leading a $6.2 billion bid to acquire Allete - the parent company of Minnesota Power, which serves over 150,000 customers across the state. On paper, it’s a straightforward infrastructure play. In practice, the deal has already encountered headwinds: a Minnesota judge recommended denying the acquisition, arguing that it wasn’t clearly in the public interest and would raise the risk of higher customer rates. More on the recommendation here.

Blackstone, meanwhile, is making a different bet. The firm is backing a $1 billion, 1.7 GW gas-fired plant in Pennsylvania, positioned to meet the surging demand of AI-driven data centers. With hyperscalers demanding “always-on” megawatts, Blackstone’s play is less about climate headlines and more about cash flows that remain uninterrupted when the sun sets. More on Blackstone’s acquisition here.

From Deal to Trend: What This Signals for Power Markets

Taken together, these transactions highlight a broader pivot: Wall Street is treating power like infrastructure again, not just another commodity trade. The logic is straightforward:

- Data centers & AI: Hyperscalers are driving demand curves like never before. In some regions, a single campus can chew up as much electricity as a mid-sized city.

- Utilities as yield assets: Stable, regulated returns look increasingly attractive to asset managers who spent the last decade chasing toll roads, ports, or telecom towers. Assuming the dealmakers are comfortable with the variability of the datacenter, this is a fairly safe bet grounded with a predictable and credit-flush offtaker.

- Policy arbitrage: Private equity sees an opportunity in navigating state-level energy policies that both require new investment and promise a predictable recovery of costs.

Of course, the ESG elephant is still in the room. In Europe, several institutions have taken a step back from BlackRock over climate concerns. PFZW, a Dutch pension fund, pulled a $17 billion mandate in September 2025, while Danske Bank and Nordea faced criticism for marketing BlackRock funds tied to fossil fuels. These frictions won’t stop U.S. acquisitions, but they remind investors that “buying power” isn’t always the same as buying goodwill.

Why the Timing Matters

The timing of these moves is telling. Power demand in the U.S. is rising at its fastest pace in decades, driven not only by AI but also by the electrification of transportation, manufacturing reshoring, and population growth in high-demand regions such as Texas and the Southeast. Unlike speculative renewables or early-stage startups, utilities and gas assets come with the kind of certainty that appeals to investors under pressure to deliver quarterly returns.

Source: EIA

In short: Wall Street isn’t just power-curious anymore, it’s power-hungry.

What This Means for Veolia Clients

For C&I buyers, this trend matters in three key ways:

- Contracting dynamics are shifting. With utilities and generation portfolios in private equity hands, PPAs may come with tougher negotiation lines, escalators, or pass-through risks. Think of it as “Wall Street fine print” showing up in your energy contract.

- Competition for capital is intensifying. Smaller developers may struggle to compete for interconnection slots or financing against firms with trillion-dollar balance sheets leveraging them.

- Partnership opportunities expand. On the flip side, financial owners have strong incentives to squeeze efficiency and optimize operations. This creates opportunities for service providers to deliver value in dispatch optimization, O&M, or distributed solutions. Indeed, these are all services that Veolia can provide.

Bottom Line

BlackRock and Blackstone aren’t just making deals - they’re planting flags in the future of power. The AI boom has turned electricity into the ultimate growth commodity, and utilities are suddenly Wall Street’s new “safe bet.” For clients, this means more capital flowing into generation - but also more complexity in how contracts are structured and risks are shared.

In today’s market, power isn’t just king - it’s the crown jewel.

Untimely Adjustments: Proposed Rule Changes at the GHG Protocol

Last month, the Independent Standards Board (ISB) of the Greenhouse Gas Protocol (GHGP) released draft revisions to its Corporate Scope 2 standards. By untimely we really mean unrealistic timing expectation on REC procurement during a period of significant uncertainty in renewable energy markets. Scope 2 standards establish the framework for calculating the emissions associated with electricity use and clean energy purchases. Among other things, the proposal would require hourly matching of RECs with the user’s consumption profile. This could make clean energy procurement far more difficult and costly for the vast majority of stakeholders.

- While obscure, carbon accounting has been credited with supporting the development of over $150 billion in US clean energy infrastructure. Updates to its framework significantly change the amount of clean energy infrastructure constructed.

- The current GHGP framework, a preferred carbon accounting paradigm, allows corporations to meet their GHG reduction targets by acquiring RECs that match their annual emissions.

- The recent revisions require both the location and hour of the renewable generation to dictate the offset capabilities of the RECs. Long-term contracts, such as Power Purchase Agreements (PPAs) would no longer be sufficient devices for acquiring these RECs. Misalignment in when renewable energy is generated by a project and energy is consumed by the offtaker would make only a portion of these RECs usable. Furthermore, RECs would need to come from the same or adjacent electric grid as the consumer’s location.

- Moving the goal posts for RECs and PPAs couldn't come at a worse time. With wind and solar projects already struggling with financial woes caused by the sunsetting of federal tax credits, decreased interest in some PPA markets - notably in ERCOT and MISO - would further deflate an already unsettled market.

- With the GHG Protocol underpinning global government GHG reporting, updates to this framework not only make voluntary commitments to decarbonization infeasible but compliance-based thresholds as well.

- The locational requirement is problematic for other reasons as well; as grids are increasingly green, each incremental MWh of clean energy comes at a higher cost and with lower marginal carbon benefits. If location is to be incentivized, it should be done so with the goal of making the dirtiest grid cleaner.

- The hourly matching requirement disproportionately favors the procurement of RECs from established, firm energy sources such as hydro and nuclear, rather than encouraging investment in new renewable energy infrastructure. This shift could render RECs procured from emerging clean energy projects excessively costly, undermining the most effective method for reducing a grid's greenhouse gas emissions.

Summer Peaks: Recap of 2025 Peak Demand Notification Program

Veolia once again worked closely with clients this summer to track and predict system peak loads, helping reduce exposure to capacity costs while supporting reliability across the grid.

For newer readers, a quick refresher: each Independent System Operator (ISO) calculates capacity obligations through Peak Load Contribution (PLC) tags. These tags reflect a customer’s share of system demand during the highest-load hours of the season and drive capacity charges in future years.

Source: FERC

Here’s how each ISO sets tags:

- PJM: Average usage during the five non-weekend, non-holiday peak hours, each set on different days between June 1 and September 30. Tags take effect the following June 1.

- NYISO: Usage during the single highest non-weekend, non-holiday peak hour in July or August. Tags are set for the following May 1 to April 30.

- ISO-NE: Usage during the highest system peak hour of the year, effective for the following June 1 to May 31.

Preliminary Peak Hours

The 2025 season produced a fairly typical distribution of peaks across the three ISOs:

- PJM: Peaks fell on June 23–25 and July 28–29, with the season high occurring on June 23. System load reached 160,526 MW between 5:00–6:00 p.m. ET.

- NYISO: The annual system peak occurred on July 29, hitting 30,645 MW from 6:00–7:00 p.m. ET.

- ISO-NE: The peak landed on June 24, with load topping out at 26,184 MW between 6:00–7:00 p.m. ET.

Source: Gridstatus.io

Year-Over-Year Comparison

Compared to 2024, this year’s peaks were slightly higher across all three regions:

- PJM: 153,780 MW in 2025 vs. 152,554 MW in 2024 (+0.8%).

- NYISO: 31,045 MW vs. 30,687 MW (+1.2%).

- ISO-NE: 28,375 MW vs. 27,985 MW (+1.4%).

While these increases are modest, they extend a trend of incremental growth in summer peaks. Small percentage gains still translate into large absolute volumes when the system is already stretched.

Peak Load Risk Alerts

The table below summarizes Peak Load Risk Alerts sent by Veolia in 2025:

Source: Veolia

All final PLC-setting hours (shown in bold) were forecasted accurately by Veolia, with the exception of one NYISO July event where weather conditions shifted unexpectedly.

Closing

Overall, the 2025 PLC season reinforced the same themes as past years: PJM produced the most peak hours, NYISO operated with little margin during high heat, and ISO-NE saw fewer events but remained structurally tight.

Veolia continues to refine its Peak Load Notification program with the goal of maximum accuracy. Client feedback is always welcome. For those not currently receiving alerts but interested in better managing capacity charges, please reach out at commodity@veolia.com.

Summer peaks may come and go, but the impact on your bills lasts all year.

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.