Energy Markets Update

In this newsletter, we cover key factors impacting US energy markets. This week, we'll cover the outlook for renewables in ERCOT and the operator's future plans for grid resilience, the harsh reality of NYISO's struggling power grid, the EPA's rollback of GHG emissions standards, and an update on Amazon's nuclear PPA progress.

Editor's Note: Summer has arrived in style this week with soaring temperatures and peak demand days on regional utility grids. We thank our readers for continued support and interest in our newsletter. We will be skipping our next bi-weekly publication to accommodate staff vacations but we plan to publish again at the end of July. You can stay in touch with the Veolia commodity team at commodity@veolia.com, and please reach out if you would like to join our Peak Alert notification listserve. Happy Summer!

Table of Contents

- Market Update

- Don't Mess With Texas: Could the Lonestar State Offer a Roadmap to Solving Overloaded Interconnection Queues?

- NYC's Power Grid: Running on Borrowed Time

- EPA's Time Machine: Bringing Back the Good Old Days of Smog and Mercury

- Going Nuclear Update: Amazon Signs PPA with Talen’s Susquehanna Nuclear Plant

Weekly Natural Gas Inventories

Source: EIA

Market Update

- Amidst another wild news cycle, we first remind our readers that record temperatures are expected across large swaths of the eastern USA this week–Missouri and east–and that grid operators are preparing for emergency conditions. Some of the hottest temperatures are expected in eastern PJM but we are anticipating coincident peak events (i.e. capacity tag days) in PJM, New England ISO, and MISO. Recall that NYISO restricts its capacity tag obligation season to July and August. As of now, grid demand in PJM is expected to exceed last year’s peaks Monday through Thursday. Buyers with capacity exposure and/or energy market exposure should be prepared to shed load Monday through Wednesday, if possible. This is a good time to review curtailment procedures and contact lists.

- The highly volatile conflict between Israel, Iran, and now the USA, has thrown a wrench into the global oil market. Brent crude surged about 20% from $63 to $75 per barrel in the days following the initial Israeli attacks on Iranian nuclear enrichment infrastructure, and while it has increased modestly today, the market is largely discounting the most extreme scenario in which rising escalations disrupt energy flows through the strait of Hormuz. Hormuz is the passageway between the Persian Gulf and the Indian Ocean, through which roughly 30% of the world’s seaborne oil trade and 20% of the world’s LNG supply flow. Global LNG markets also moved up on the news. Iran is a key gas supplier to Turkey but potential impacts on the Israeli supply or even LNG flows through Hormuz weigh on the market.

- There is little direct correlation between global oil and North American gas and power markets. US LNG exports are constrained by physical capacity.

- Somewhat counterintuitively, the conflict in the Middle East is mostly bearish news for gas and power markets, at least fundamentally. A stronger oil price will be supportive for US investment in oil exploration, which itself is supportive for gas production due to associated gas extraction. In fact, cheap oil has been a prominent bullish indicator for gas and power prices in 2026 and 2027.

- Power and gas markets traded modestly higher through the first few weeks of June. The calendar strips for NYMEX gas in 2026 and 2027 have quietly added 6% and 3% since the start of the month, however they’ve moved up 12% and 8% since the trough in mid April.

- News from the renewable energy sector was mixed last week, with many focused on the Senate committee reconciliation process of the House’s budget bill, which was far more draconian for the sector.

- Some of the major winners out of the Senate committee are nuclear power, the hydroelectric sector, and batteries–the House’s phaseout of tax incentives for these technologies were largely removed, and would remain until 2033 under the Senate proposal.

Don't Mess With Texas: Could the Lonestar State Offer a Roadmap to Solving Overloaded Interconnection Queues?

As many ISOs and RTOs are growing increasingly concerned about reserve margins, ERCOT has reportedly cut its summer blackout risk to less than 1%. Texas continues to set solar and wind output records which, coupled with battery storage records, have been the main drivers of this success. We will take a look at how ERCOT is preparing for the future of their grid and how future legislation may play a key role.

-

ERCOT’s power grid is grappling with rapid demand increases due to Texas’ growth in manufacturing and the fact that it’s become a prime location for the rapid buildout of datacenters. While many ISOs and RTOs are facing similar challenges, ERCOT appears to be meeting the challenge and may offer some useful insights. A recent highlight is that just last week, ERCOT cut its summer blackout risk to 0.3%, a sharp decline from 12% last year.

Records Being Set

-

Much of the improved forecast can be attributed to the increased output from renewables. On May 12th, ERCOT solar output hit a new record of 27,036 MW, according to Constellation. On April 13th, ERCOT achieved a record in combined solar and wind output at 41,675 MW and surpassed it just four days later with a 41,916 MW output. These production numbers have coincided with record battery storage discharge levels, with a maximum of 5,970 MW of storage around the same timeframe. See chart below for ERCOT Power Capacity:

Source: S&P Data, 2015-2030 Assessment Period

- Batteries play a key role in increasing reliability of a renewables-dominated grid by bridging the gap when the sun’s not shining and the wind’s not blowing. Looking at the amount of battery storage in the interconnection queue, it’s clear that ERCOT is doubling down on the technology.

Source: Freepoint Solutions

- ERCOT’s renewable infrastructure was developed in part due to a 2005 Texas legislature which implemented a 18,500 MW Competitive Renewable Energy Zone (CREZ) transmission complex. The legislation was grounded in the economic opportunity to bring cheap and abundant wind energy in West Texas to the major load centers in the East. This forward thinking and opportunistic development model led to immediate low cost wind generation and eventually solar interconnections to the CREZ lines at a pace that far exceeded even the most rosy expectations. Battery storage is next in line to benefit from this legislature as it’s needed to stabilize renewable output and improve loading of the transmission lines.

Regulatory Outlook

- While CREZ is an example of highly supportive renewable energy policy, Texas has recently flirted with more suppressive policies. A series of bills that were passed by the Senate earlier this year would have, among other things, imposed “firming” requirements on new and existing renewables installations and required additional permitting for renewable projects. Furthermore, they would have required new wind and solar installations to pair with equivalent non-battery dispatchable capacity (i.e., natural gas). The Texas House ultimately killed the bills before going on recess, but the support for the legislation was significant, despite most industry analysts agreeing it would have reduced investment and reliability while increasing cost.

-

ERCOT is known for its unique and fast-paced connect-and-manage (C&M) approach to generation interconnections. While other ISOs complete detailed studies of all generators seeking interconnection, including capacity deliverability, ERCOT sees an "absence of rules” as its primary advantage. It inherently shifts deliverability and congestion risk to the generators, which cuts down on the engineering and “need-based” assessments. The main negative to this process is that generators assume a large risk of curtailment if the transmission system can’t absorb their output. This aspect of the ERCOT market has played a huge role in the success of renewable energy projects in the region. There are of course some other supportive factors; a streamlined environmental permitting process, cheap land, and plentiful wind and solar potential.

NYC's Power Grid: Running on Borrowed Time

As Zone J faces a critical shortage of in-city generation, policy dreams are colliding with harsh reality in the Big Apple. The latest band-aid - extending four aging peaker plants past May 2025 - only underscores the desperation. Two recent developments might shift the landscape: a surge in demand response commitments and the pending ownership change of a major Queens power plant. While offshore wind stalls and new plant permits gather dust, keeping the lights on is getting more expensive by the day. It's a stark reminder that in the end, grid physics outweighs good intentions, and ratepayers will continue footing the bill.

- June 2025 kicks off the first month of a 24-month extension for the operation of four NYC peaker plants beyond their planned 2025 retirement date, responding to surging capacity costs and reliability concerns. The Gowanus 2 & 3 and Narrows 1 & 2 barge-mounted generators will continue operating for an additional two years to address a projected 446 MW deficit in the city's reliability margin.

- This decision came amid several challenges facing New York's power grid. The implementation of stricter emission rules had already led to the deactivation or reduced operation of over 1,000 MW of capacity, with another 590 MW expected to retire by spring 2025. The requirement is particularly critical because New York City is a load pocket, meaning it has limited transmission capability to import power from outside areas.

- Since then, several developments have emerged to address the long-term capacity challenges. Demand response capacity increased by 16% in summer 2025, reaching 1,487 MW. Our napkin math suggests this will not be enough on its own.

- Developments like increased Demand Response participation are countered by the eventual generation retirement of the Gowanus 2 & 3 and Narrows 1 & 2 barge-mounted generators are now only 23 months away. See NYISO’s high level summary chart below, where every uncertainty is going to be meaningful to the future energy costs to the downstate rate base.

Source: NYISO, 2024

- A significant deal between NRG Energy and LS Power, valued at $12 billion, would transfer a combined 13 GW of gas-fired generation to NRG in both PJM and NYISO. On Thursday, June 12, NRG Energy and LS Power submitted a request to the Federal Energy Regulatory Commission (FERC) seeking approvals. Allowing NRG to operate assets in Zone J after the shutdown and sale Astoria Power plant in 2023 may give the producer revived confidence and standing room to develop, build, and operate needed new thermal generation in Zone J. Other prominent NYC generators like Alpha Generation have been holding back on new projects due to the regulatory uncertainty for long-term development projects.

- Looking ahead, the New York rate base will continue to face challenges with declining reliability margins and increasing demand. The Brattle Group projects that electric vehicles and other distributed energy resources could provide 8.5 GW of grid flexibility by 2040, addressing approximately 25% of the expected peak load. However, with generator deactivations outpacing new supply additions and growing electrification demands, the state continues to grapple with maintaining an adequate power supply for its future needs (see NYISO’s 2025 deficiency outlook projections below).

Source: NYISO, 2024

- NYISO reviews these resource requirements annually and notes the fundamental challenge that our analysts and customers should all be aware of by now: keeping the lights on in the city that never sleeps isn't getting less expensive in the near term.

EPA's Time Machine: Rolling Back Emissions and Mercury Standards

On June 11, the EPA announced plans to remove greenhouse gas (GHG) emissions limits for power plants as well as roll back mercury standards for coal and oil-fired plants. Proponents of the cut argued that these emissions standards were causing the premature retirement of one-third of the US’ 2024 coal capacity, threatening grid reliability.

- The EPA’s authority to regulate GHG emissions from new and existing fossil fueled power plants stems from section 111 of the Clean Air Act (CAA). The EPA’s proposal would remove all GHG emission standards set forth under this section as well as repeal amendments made in 2024 to the Mercury and Air Toxics Standards (MATS). The repeal of CAA section 111 would eliminate the 2015 New Source Performance Standards (NSPS) and 2024 Carbon Pollution Standards (CPS), effectively removing federal GHG emission limits for power plants entirely. The EPA estimates this proposal will save the power sector $1.2 billion per year in regulatory costs.

- The EPA’s ability to regulate power plant GHG emissions are anchored by GHG’s designation as "significantly" contributing to the endangerment of public health. A reclassification of these emissions as insignificant contributors to public health endangerment could revoke the EPA’s ability to regulate this class of emissions under the CAA.

- Power plant GHG and mercury emissions standards were last updated for stricter limits in April 2024. Please refer to our May 2024 newsletter for more details on the previous iteration of the EPA’s carbon and mercury emissions regulations for power plants. These updates were highly controversial due to their requirements for coal and gas plants to install carbon capture technologies or shut down. The high costs and low commercial availability of carbon capture retrofits made utility and plant operators question the overbearing nature of the ruling and its impact on grid reliability.

- MATS was initially issued in 2012 and established limits on the emissions of air toxins like mercury, nickel, lead, and chromium from coal and oil fired power plants. Under the MATS 2024 update, filterable particulate matter standards for coal plants were updated from 0.030 lb/MMBtu to 0.010 lb/MMBtu and lignite fueled plants were required to meet the same emission standards as other types of coal. In 2024, 93% of US coal plant capacity without retirement plans were already in compliance with the updated fine particulate emission standards. The EPA estimates that reverting MATS to its 2012 standards will save the power sector $120 million per year.

- Regulations like National Ambient Air Quality Standards and Hazardous Air Pollutant Standards also regulate power plant emissions and are not currently on the chopping block. Their focus is on protecting human health from localized air quality pollutants and not GHG emissions.

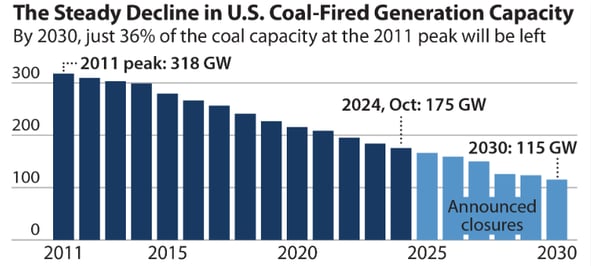

- The US’ coal fired generation capacity peaked back in 2011 which was the last year it accounted for more than 40% of annual electricity generation. Coal power plant capacity in the US has been declining steadily at around 10 GW per year, primarily due to economic pressures posed by gas plants. Prior to the EPA’s announcement, 68.8 GW of coal was slated to retire by 2030.

Source: IEEFA; "Nowhere to go but down for U.S. coal capacity, generation" (Oct 2024).

-

2025 was staged to retire 12.3 GW of power generating capacity with 8.1 GW being sourced from coal retirements, a 65% increase compared to 2024 capacity retirements. With the majority of this year’s US coal retirements planned for the back half of 2025, the rollback of emission regulations could postpone or defer some of this exodus.

Source: EIA; "Preliminary Monthly Electric Generator Inventory" (Dec 2024)

Source: EIA; "Preliminary Monthly Electric Generator Inventory" (Dec 2024)

Going Nuclear Update: Amazon Signs PPA with Talen’s Susquehanna Nuclear Plant

- In our “More Power Captain!” newsletter, we noted the challenges Amazon Web Services (AWS) had faced in securing nuclear energy from Talen’s Susquehanna nuclear plant. The original procurement proposal outlined a “behind the meter” connection between Susquehanna and a co-located AWS data center. The plan was struck down by PJM last November due to concerns over its impact on grid reliability, but it was also met with hesitancy at FERC where stakeholders questioned the fairness of datacenters bypassing transmission and delivery costs, potentially passing them on to other customers.

- Last week, AWS and Talen found a solution to this issue by entering into a 1.9 GW power purchase agreement to secure emissions free Susquehanna energy for its Pennsylvania data centers. By pursuing this “front of the meter” approach, AWS and Talen no longer need to build transmission wires directly connecting its data centers to the nuclear plant. This solution also allowed the deal to occur without Federal Energy Regulatory Commission approval according to Talen.

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.