Energy Markets Update

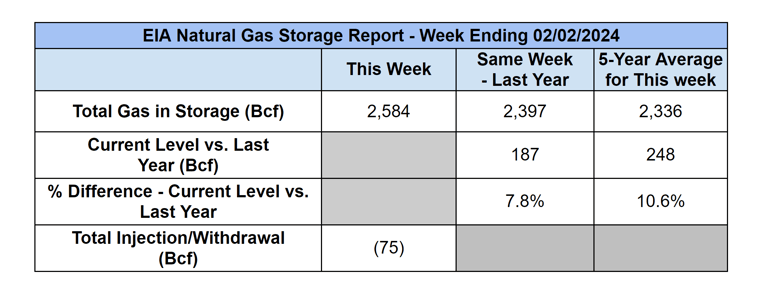

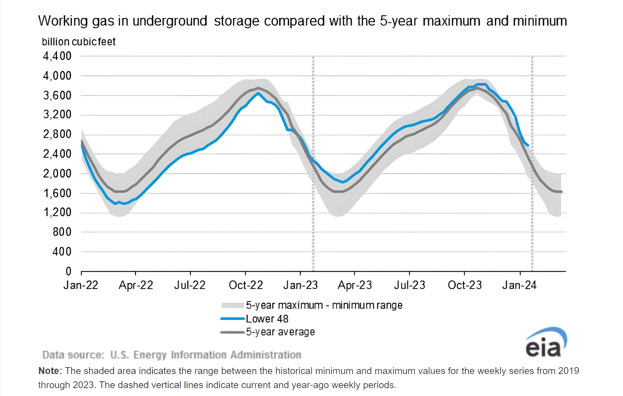

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage decreased by 75 Bcf. The five-year average withdrawal for January is about 163.3 Bcf. Total U.S. natural gas in storage stood at 2,584 Bcf last week, 7.8% higher than last year and 10.6% higher than the five-year average.

US Energy Market Update

- Unseasonably warm weather has returned to North America, putting the lid on any bullish sentiment coming out of the mid-January cold snap. Temperatures from Chicago to New York are expected to reach the 50s this week.

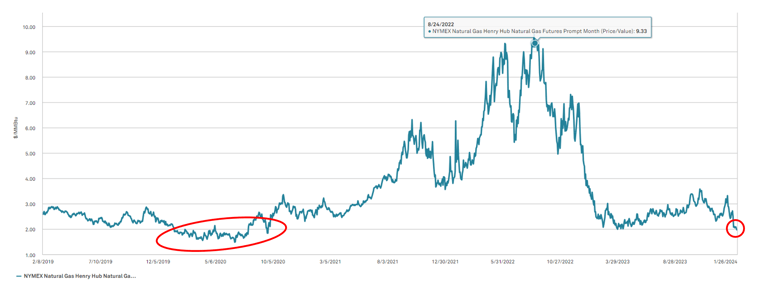

- The March contract for Henry Hub gas fell below $2/MMbtu this week. The last time prompt month gas traded below that threshold was October 2020.

Source: S&P and CME Group

- Global LNG prices are also the weakest they have been since the 2020 COVID trough, with Asian prices below $10 and landed cargoes in Europe approaching $8/MMbtu. Another mild winter in Europe has allowed the region to maintain healthy gas reserves.

- Prices along the West Coast have been notably stable, particularly in comparison to the past two years. California gas utilities are sitting on robust storage inventories, a bearish sign for spot prices leading into the Spring.

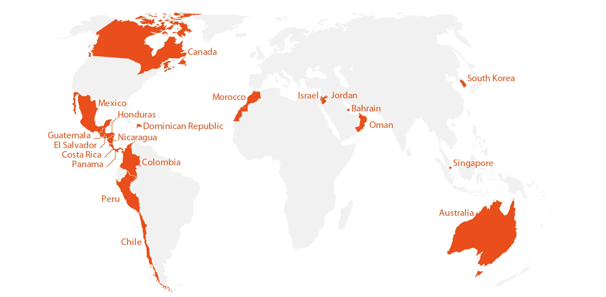

- While January prices for both power and gas were nearly doubled from the previous month, February seems likely to revert back, barring any late month cold.

Sources: ISO Data

- This does look like a good opportunity for budget conscious buyers that want to take risk off the board for the next 3+ years. While it is not unlikely that spot prices will remain anemic into 2025, there is a moderate risk of correction thereafter. There is only so much pain oil and gas producers can endure before growth in the sector slows down.

Biden Administration Pauses LNG Export Approvals

- On January 26, the Biden Administration announced a pause on issuing new liquid natural gas (LNG) export licenses. The pause will remain in place until the Department of Energy (DOE) has thoroughly assessed the impact of new LNG export terminals on the economy, climate change, and national security.

- Amidst environmentalist's pressure and an upcoming presidential election, Energy Secretary Jennifer Granholm stated how the review was needed given that the DOE's last full economic analysis was completed in 2018. The administration stated that the moratorium is expected to last until at least November 2024.

- This policy affects terminal projects that are yet to obtain DOE authorization. Granholm stated the pause will not affect already authorized projects or "current or near-term planned supply." She emphasized that the halt will not impact the US' ability to supply allies in Europe, Asia, or other recipients of already authorized exports.

- Since the Natural Gas Act, the DOE has taken the responsibility of making public interest determinations on any LNG export applications to countries where the U.S. does not have existing free trade agreements (FTA). The DOE's authorization is a critical step for LNG export projects and occurs after projects have received FERC approval and prior to a project’s final investment decision.

- The LNG sector is concerned that projects may stall and long-term contracting could significantly decrease amongst the uncertainty.

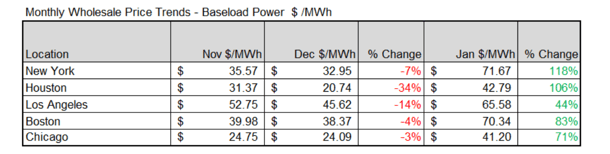

- Currently, the US has 14 free trade agreements with 20 countries, as depicted below. While LNG supply from authorized projects is not jeopardized, additional future LNG exports to many parts of Europe, Asia, and other non-FTA countries are threatened.

Source: European Parliamentary Research Service

- House Republicans were quick to oppose this policy. On February 1st, legislation was introduced that would strip the US Energy Department of having the authority to make LNG export determinations and transfer the role to FERC. Opposers of the LNG export halt highlighted its threat to international energy security as many countries may turn to Russian energy or coal as an energy source.

- The question over cost is a difficult one. On a net basis, removing gas from the US decreases supply and likely increases costs for domestic consumers. An argument can be made that LNG exports represent a constant source of demand for gas, however, which could serve to stabilize the US production market from severe swings of relative over and undersupply scenarios. All said, exports likely do more to increase domestic prices.

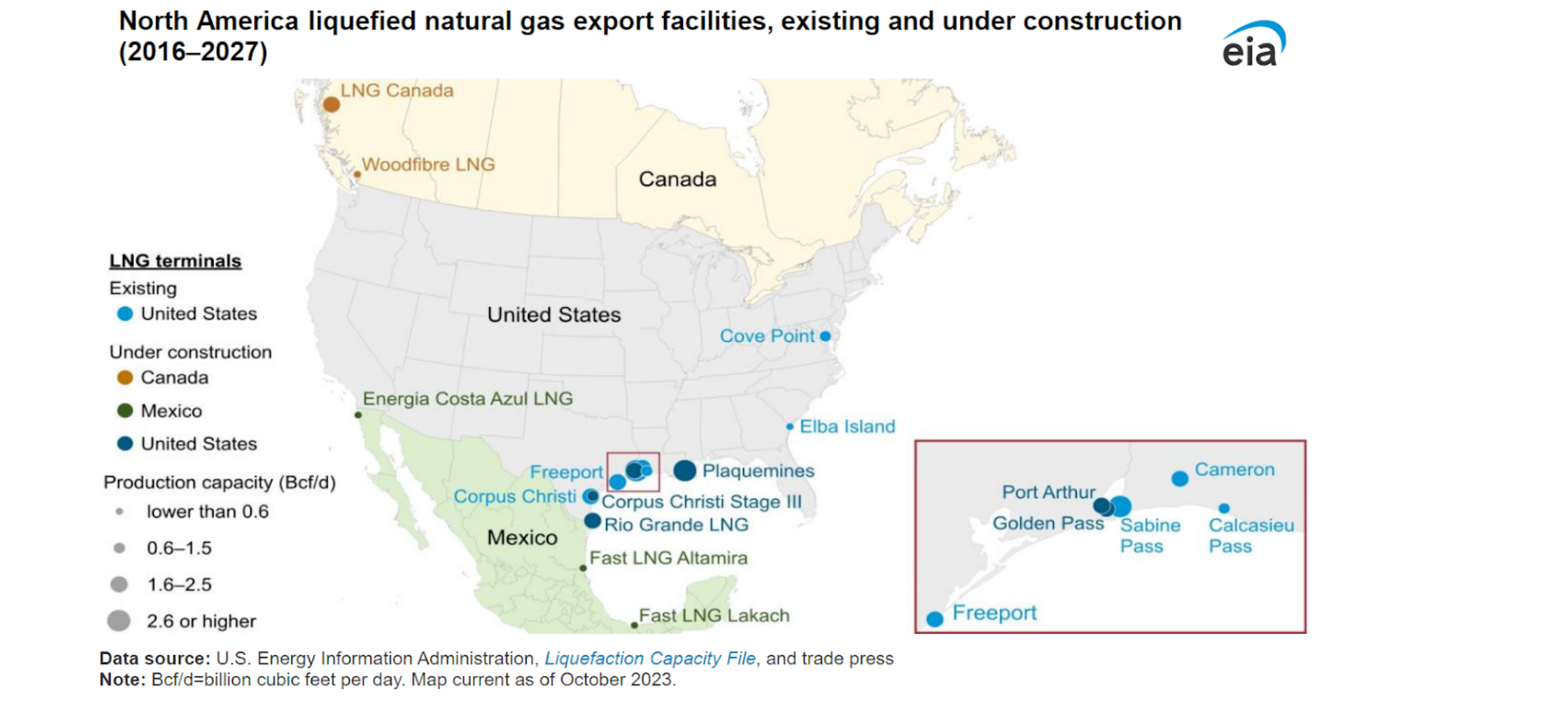

- While there are more than 170 LNG terminals in the US, there are currently only 8 LNG export facilities, with an additional 17 expected to be built in the next 5 years. LNG daily export capacity in North America is projected to reach 24.3 Bcf/d through 2027, more than doubling the region's current capacity of 11.4 Bcf/d. As of 2022, more than 10 percent of U.S. natural gas production was exported as LNG, but this is forecasted to grow to as much as 33 percent by 2035.

Source: EIA

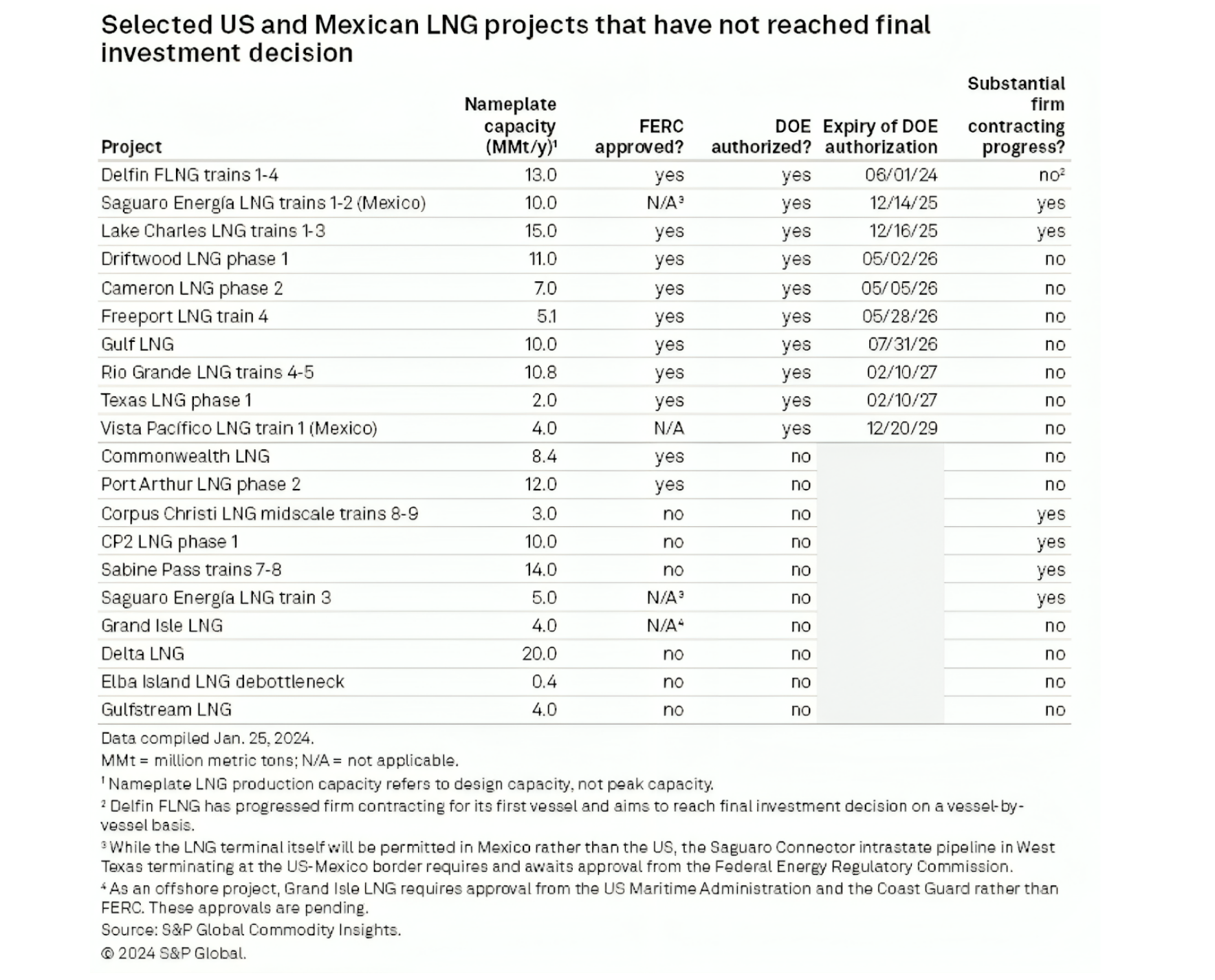

- Of the LNG export projects affected by this new halt and awaiting a final investment decision, several prominent projects exist. Those awaiting DOE approval include Sempra’s 12.0 MMt/y Port Arthur LNG terminal in Texas and Commonwealth LNG LLC’s 8.4 MMt/y terminal in Louisiana.

- The Largest US LNG exporter, Cheniere Energy Inc., is awaiting FERC and DOE approval for their extensions planned at their Sabine Pass LNG terminal in Louisiana (the largest terminal in the world) and the Corpus Christi terminal in Texas.

- NextDecade’s 10.8 MMt/y Rio Grande LNG project has already received both FERC and DOE approval, yet it faces resistance from environmental group Sierra Club and the City of Port Isabel. They asked a federal appeals court to halt further construction on the project, however, FERC defended its order on Feb. 5, citing the project’s 8-year environmental review does not need to be drawn out longer.

- While final investment decisions on US and Mexico projects were forecasted to total 23.7 MMt/y of new capacity in 2024, this number will likely be significantly lower until LNG export reviews resume.

Source: S&P

Potential Closure of a Massachusetts LNG Import Terminal Puts Region on Edge

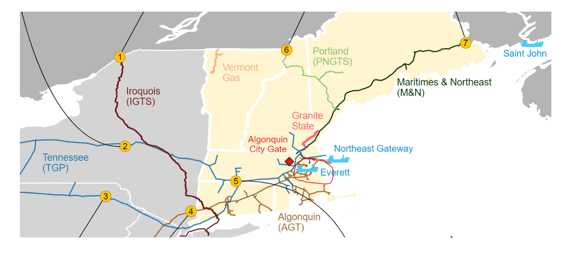

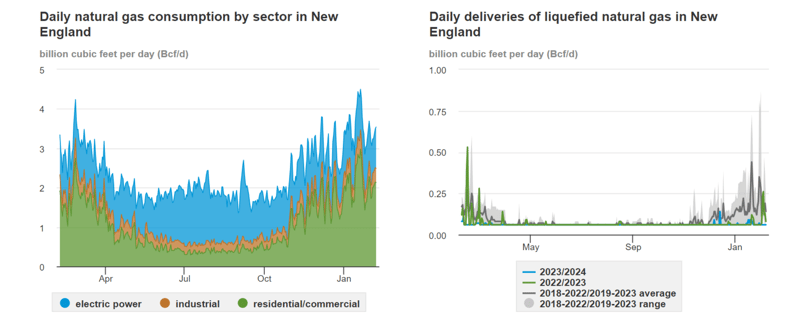

- The Everett LNG terminal located adjacent to downtown Boston is an important, dare say critical, piece of energy infrastructure that helps backfeed New England’s natural gas supply system on the coldest of winter days.

- With the pending closure of the adjacent power plant and the terminal’s biggest customer on May 31, 2024, the fate of the terminal beyond 2024 is highly questionable. Representatives from Constellation, its owner, have said the plant does not currently have the necessary agreements in place to keep it open beyond May.

Source: EIA

Source: EIA- Closure of the terminal could have profound impacts on winter power prices and regional reliability. Everett has a storage capacity of 3.4 Bcf compared to the peak winter pipeline demand in the region of approximately 4.5 Bcf/d. On the coldest of days, Everett provides about 10% of the region's gas demand.

Source: EIA

- Various regional utilities have been expressing their anxieties about the potential loss of the terminal. Some gas utilities currently rely on their contracts to meet peak demand. A joint statement by FERC and NERC expressed “serious concerns about certain local gas distribution systems’ ability to ensure reliability and affordability.”

- The electric grid operator, ISO-NE released an analysis in May 2023 stating that it could get by for two years without Everette, mostly due to oil reserves at dual-fuel plants and increased reliance on the St. John LNG in New Brunswick. However, the thresholds were exceptionally close, they did not account for contingencies, nor did they address gas utility reliability or potential price implications. Nonetheless, the CEO of ISO-NE also stated that it would be prudent to retain the terminal.

- In the absence of a long term peaking agreement, likely with regional gas utilities, the plant simply cannot justify itself economically. This was the gamble that Constellation made when it bought the power plant in 2010 and the terminal in 2018. The market value of both assets was inherently compromised due to the influx of cheap shale gas, however, they still carried strategic value to the region. This game of chicken is thus 5-10 years in the making.

- The Massachusetts Department of Public Utilities would be required to approve any contracts between Everette and the gas utilities. As of now, nothing has been filed.

FERC Approves New Ancillary Service Market in New England

- Last week FERC approved a new “day-ahead ancillary services initiative,” or DASI, that will bolster the grid operator’s use of quick response resources such as batteries and flexible generation resources.

- The new market will commence in May 2025 and is expected to increase net wholesale costs by approximately $104 million per year, or about 1.1%.

- NE-ISO says the new program design would compensate resources appropriately for actual availability, as opposed to long-term reserve payments, and that it will bring in the type of resources that can better regulate rapid changes in load.

- ISO-NE will run the new market jointly with the existing day-ahead energy market. It will procure 10- and 30-minute operating reserves from fast-ramping and fast-starting resources based on the anticipated real-time reserve requirements for the next day.

PJM Makes Progress On Capacity Reforms

- On Jan 30 Federal regulators approved fast-track reforms to the PJM Interconnection LLC's (PJM) capacity market in response to a severe weather event in December 2022 that nearly caused blackouts in the mid-Atlantic power grid.

- PJM filed proposed changes with the Federal Energy Regulatory Commission (FERC) in October 2023 to resolve potential nonperformance penalties related to the storm that could have otherwise amounted to $1.8B in nonperformance penalties tied to the storm.

- One new methodology called the effective load-carrying capability (ELCC) will be implemented for valuing different resource types' capacity contributions.

- FERC largely approved the proposed changes, including the ELCC methodology, which accounts for correlated generation outages and the diminishing reliability value of weather-dependent resources. The ELCC establishes marginal capacity availability ratings for resources such as wind, solar, and batteries, that are calibrated to changes in load and weather.

- FERC rejected arguments that the ELCC framework would favor gas-fired generators with firm fuel supply contracts but agreed that PJM should disclose the performance of gas plants with and without firm gas supply during tight supply conditions.

- FERC also approved PJM's proposal to expand its reserve requirement study and require physical testing for thermal generators in both summer and winter. The agency endorsed PJM's re-indexing of stop loss limits for nonperformance penalties and predicted that it would lead to fewer nonperformance charges.

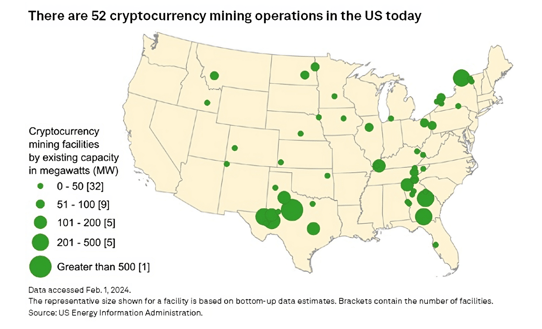

EIA Begins Tracking Energy Use in Crypto Mining

- Citing preliminary data, the US Energy Information Administration (EIA) estimates that the cryptocurrency mining industry accounts for between 0.6% and 2.3% of the country's energy consumption. There are currently 52 mining operations in 21 states. Texas leads the pack with Georgia and New York following second and third (see mining facility map below).

- For the unacquainted, crypto mining is the process by which transactions are authenticated and new bitcoins are entered into circulation. It requires extensive amounts of computing power, also known as “proof of work,” so the heavy power requirements are a native characteristic and purpose of these processes.

- In a delayed response to the uptick in mining centers, the EIA received emergency approval just this week to survey electricity consumption by these cryptocurrency operations.

Source: EIA

Source: EIA

- The massive power consumption from mining operations could hinder some states’ ability to meet climate goals.

- In response, New York for example, passed a two-year moratorium on fossil-fuel powered mining facilities that require “proof of work” authentication.

- While the EIA’s emergency authorization to survey crypto mining is for just six months and New York’s moratorium is set to expire at the end of 2024, it's likely that there will be efforts by regulators to extend or expand both.

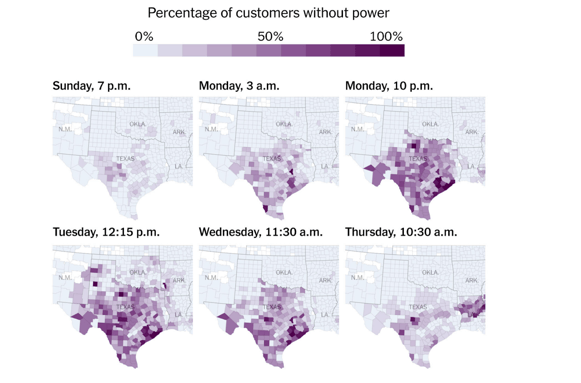

ERCOT & the Ghost of Winter Storm URI

- Following the 2021 Winter Storm Uri, Texas has made a series of electric grid improvements to prevent the extended blackouts and numerous deaths the state experienced during the extreme weather event. One significant weakness brought to attention is the grid's ability to come back online following power outages.

- The North American Electric Reliability Corp (NERC) released a report in December on the 2021 Storm URI in ERCOT and the effectiveness of their blackstart resources, a power source designed to restore electric service without connecting to the grid.

- NERC’s analysis highlighted how many of ECROT’s gas-fired generation units failed as blackstart resources; in total 82% of blackstart resources failed during Uri. The report also noted there were no batteries or renewable resources designated as blackstart resources.

- Texas RE, NERC’s regional entity for ERCOT, informed the Public Utility Commission of Texas of these findings on February 1st, 2024. They recommended greater collaboration between the electric and gas industries, required alternate fuel startup tests for blackstart resources, and to consider using inverter-based resources (sourced directly asynchronously connected to the grid) for blackstart applications.

- PUCT responded with several encouraging remarks, stating interest in batteries and adjacent interconnections for blackstart applications. The development of battery storage and renewable forms of energy as a blackstart resource is also likely to occur in other RTOs as similar blackstart failures were recorded in PJM.

Source: New York Times

Source: New York Times

- On a separate note relating to Winter Storm Uri, high tensions arose in the Texas Supreme Court over the Public Utility Commission of Texas’ setting of $9,000/MWH for four days during Winter Storm Uri.

- During the storm, PUCT set electricity prices at the systemwide cap to encourage additional generation to come online. ERCOT clearing prices were already at a staggering price of $1,200/MWh, about 10-20X their typical trading range, when the PUCT issued an emergency order to raise them to the maximum rate possible. Arguably this did very little to relieve the crisis as most generators were sidelined for physical reasons rather than financial reasons. Instead, it created a windfall for the generators that were available and extraordinary costs for ratepayers, many of whom simply didn’t pay their bills, sending suppliers into bankruptcy.

- Luminant Energy, the generation arm of Vistra Corp, is backing the lawsuit challenging the PUCT's orders, citing how the PUCT abused its administrative power by setting a non-competitive and unreasonable price. Raising prices to the $9,000/MWH cap cost Texas consumers approximately $16 billion.

Natural Gas Storage Data

Source: EIA

Source: EIA

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.