Energy Markets Update

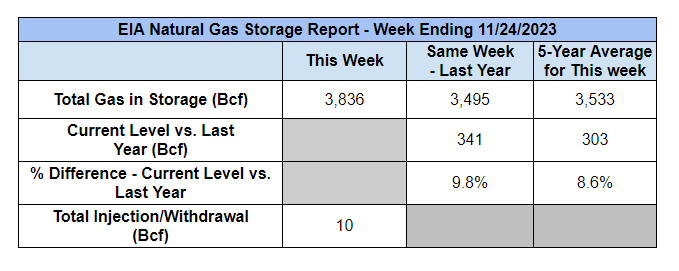

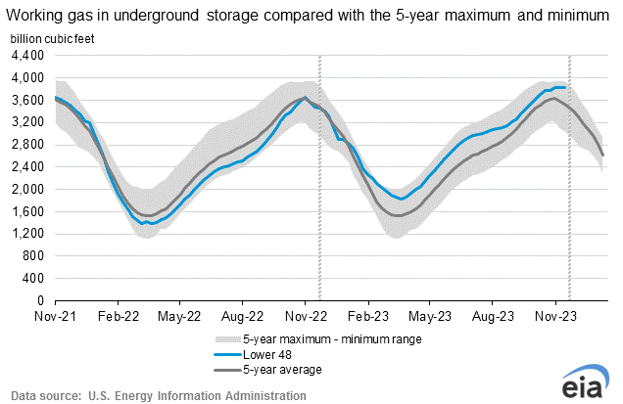

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 10 Bcf. The five-year average withdrawal for November is about 10.3 Bcf. Total U.S. natural gas in storage stood at 3,836 Bcf last week, 9.8% higher than last year and 8.6% higher than the five-year average.

US Energy Market Update

- A leading story in the final weeks of November is that the price of NYMEX natural gas for 2024 delivery has declined by over 15% since month start.

- The move from $3.60 per MMbtu in the first week of November to $3.00 today is notable because we’ve been range bound from $3.40-3.60 since mid March 2023. The disconnect between low spot prices and stubborn $3.50 gas in 2024 seemed destined for correction, but it’s interesting that it has only happened now.

- We have two takeaways: (1) Even the most risk tolerant buyers are likely to find some bargains for 2024 gas. You can’t go too wrong buying at $3.00 and you will avoid the possibility of surprises to the upside. (2) 2024-2027 forwards remain stuck at $4.00 where they have lingered since March 2023. If this year is any indication, it is possible that these contracts will remain range bound until the start of next winter, unless fundamentals change materially beforehand. Concerns about how the market will react to the growth in LNG exports in 2025 and beyond will likely be all the support the market needs to maintain these levels.

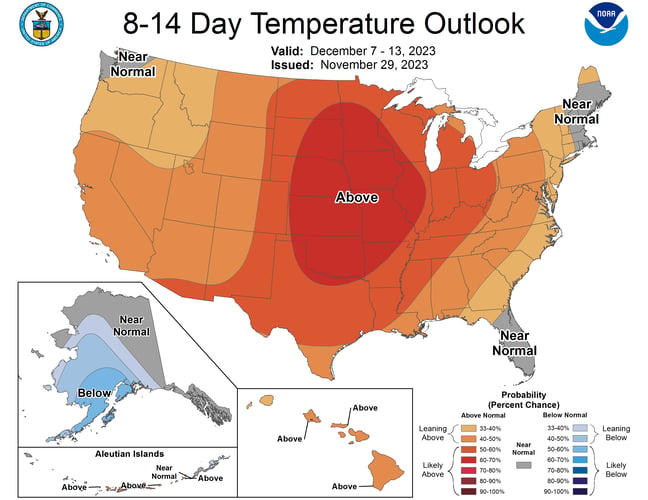

- The market is otherwise reasonably well balanced at the moment. Daily gas production now exceeds 104 bcf/d, up from about 101.5 in October where it flatlined for the prior year. Gas demand from the power burn has gobbled up any additional gas; demand from generators is +5bcf/d above the 5 year average, the highest ever annual run rate.

- European natural gas storage inventories are at full capacity. This has kept the landed price of LNG spot cargoes around $15 per MMbtu.

- U.S. crude oil prices remain weak at $77 per barrel as recessions in China and Europe weigh on demand.

- Next summer, New England’s largest fossil fuel power plant, Mystic Generating Station 8 & 9 (1700 MW), will be closing. The adjacent Everett LNG Terminal, which sends 80% of its fuel to Mystic and the rest to heating customers in New England, is also in jeopardy. With offshore wind looking increasingly shaky, the region is putting more stock on big infrastructure projects that will transport energy from outside the region. These include:

- The New England Energy Connect (1200 MW HVdc) with a commercial operation date around 2025, but this is highly subject to change;

- Enbridge’s Project Maple (0.25 bcf/d on AGT @ Salem), COD of November 2029;

- The Twin States Energy Link (1,200 MW hydro) with a COD TBD, but likely around 2030.

Source: NOAA

NYISO and PJM Sound Alarm on New Environmental Regulations

- Last week, the New York electric grid operator NYISO announced that four gas-fired powered generators (500 MW total) will remain online to ensure in-City resource adequacy, delaying a previously set retirement date of May 2025.

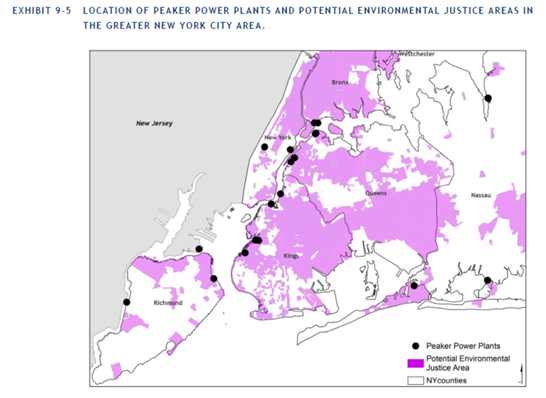

- The grid operator’s report identified the four generators as necessary for grid reliability during hours of peak demand. Such plants are often referred to as “peaker plants” as they only run when the grid is stressed. These NYC plants in particular only run a couple of days per year. They are actually located on barges off the Brooklyn waterfront.

Source: Gotham 360

Source: Gotham 360

- The newly set retirement date of these plants is May 2027, with the possibility of another two year extension upon the reevaluation of grid reliability in two years.

- The move represents a growing trend of direct opposition between grid operators tasked with maintaining reliability and environmental regulators tasked with decreasing fossil fuel-based emissions.

- In its report, NYISO called out new environmental regulations as the leading culprit behind the rapid retirements of peaker plants. The rules aim to reduce summertime nitrogen oxide emissions from peaker plants down to 3 pounds per MWh by 2023, eventually decreasing that number to between 1.5 and 2 pounds per MWh.

- NYISO had hoped to be able to bolster grid reliability by other means, including a 1,250 MW transmission line from Hydro Quebec but that won't be operational until 2026 at the earliest. A solicitation for other measures such as battery storage did not yield sufficient results.

- New York is not the only area facing this issue. In Maryland, PJM has sounded the alarm regarding plans to retire a coal-fired peaker plant in the Baltimore area by June 2025. PJM has regional reliability concerns until necessary transmission upgrades come online in 2028, meaning peakers may be here to stay until then. PJM and the state of Maryland are currently in negotiations about the future of the plants.

- The trouble with both the New York and the Maryland air regulations, in our view, is that they regulate power plants based on marginal emissions rates alone, not total emissions. So a plant that only operates 10 hours per year but provides an important reliability function may be forced to invest massive amounts of capital so that its emissions rate does not exceed the allowable threshold, or more likely seize operations. The fact that the actual emissions released from the plant may be miniscule is not considered. The Maryland regulators in particular were aware of this harsh fact, but chose to proceed anyway. We think this was bad policy and could result in considerable reliability challenges, and unfortunately with no discernable environmental benefit.

Pipeline Upgrades End Gas Moratorium in Westchester County, NY

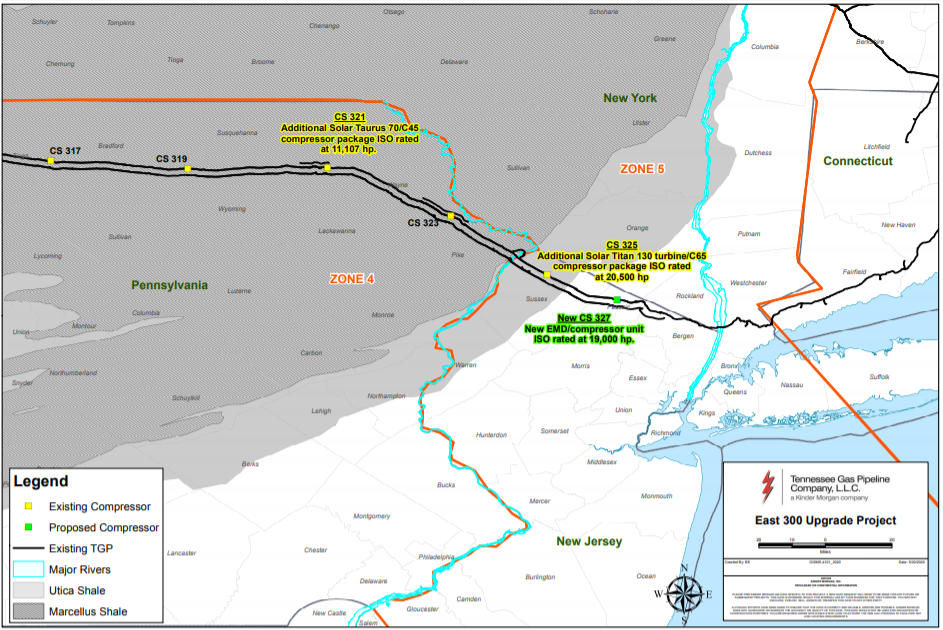

- Earlier this month, Tennessee Gas Pipeline Co. put the third compressor of its East 300 upgrade into service, adding a total of approximately 115 MMcf/day into eastern US gas supply as the US heads into the winter.

- The upgrade was originally approved by FERC in April 2022 and involved multiple compressor upgrades, allowing the operator to pack more gas into its transmission system.

- Prior to this upgrade and beginning in March 2019, the local gas utility had a moratorium on new gas connections in Westchester County, NY due to a lack of supply in the region.

- ConEd has now lifted that moratorium. However, new customers will be required to sign an acknowledgement of state clean energy goals.

- The addition of East 300 as well as the first piece of the Transco Regional Energy Access Expansion, which provides an additional 450 MMcf/day and came online October 20, should help ease historically volatile winter gas pricing in the Transco New York gas region, and alleviate concerns over regional gas pressure issues.

- The two projects are indicative of the struggle between the operation of existing utility infrastructure which plays an important role in reliability, and growth of clean energy in a state that has amongst the most aggressive clean energy targets in the country. Despite the aggressive clean energy targets–70% by 2030 and 100% by 20250–renewable energy implementation does not and will not occur along a predictable path. Technologies evolve, projects are delayed, and regulatory environments are subject to change. Difficult decisions will need to be made to balance the timeline of renewable integration and upkeep of existing infrastructure.

Source: Kinder Morgan

NY Aligns Regulatory Policy and Clean Energy Goals

- The New York Public Service Commission made three important decisions in November that will help integrate new transmission projects developed by New York Transco LLC, a transmission developer and subsidiary of local utilities.

- First, the NYPSC authorized New York Transco to transfer some of its interconnection facilities to Consolidated Edison Inc. subsidiary Orange and Rockland Utilities Inc. to help facilitate the interconnection and operation of the Rock Tavern-to-Sugarloaf transmission project, which will relieve congestion and increase transmission capacity to move power from northern New York to the southern metropolitan area. It was completed in September.

- Second, the commission authorized transfer of additional interconnection facilities to Consolidated Edison Co. of New York Inc. to help with the interconnection and operation of the New York Energy Solution project, a 55 mile transmission hardening project in the Hudson Valley that was energized in August.

- The commission’s third decision approved $1.4 billion in financing for New York Transco’s “Propel NY” energy transmission project, a proposed transmission solution that involves building and upgrading underground and submarine transmission lines and stations. This is a larger project with a COD of 2030 that will support offshore wind into NYC and improve reliability on Long Island, NY.

- On the Federal docket for November, the Biden-Harris administration announced its approval of the Empire Wind offshore wind project – the Administration’s sixth approval of a commercial-scale offshore wind energy project. The announcement supports the Administration’s goal of deploying 30 gigawatts of offshore wind energy capacity by 2030, which looks increasingly doubtful after a string of project cancellations this year.

- Empire Wind US LLC would develop two offshore wind facilities, Empire Wind 1 & 2 about 12 nautical miles (nm) south of Long Island, N.Y.. Together these projects would have up to 147 wind turbines with a total capacity of 2,076 MW.

- In a separate release earlier this week, Governor Kathy Hochul announced that New York has been awarded nearly $24 million in federal funding to strengthen and modernize the State’s electric grid. The New York State Energy Research and Development Authority (NYSERDA) plans to launch a competitive selection process in the the first quarter of 2024 for projects that address goals in compliance with the award, include:

- Storm Hardening: enhancing grid resilience against disruptive events like storm-related power outages that impact critical operations;

- Predictive Analytics: developing advanced data and metrics to detect electric system conditions before they become issues, supporting system reliability and resiliency;

- Climate Justice: reducing carbon emissions to ensure investment benefits reach underserved communities burdened by pollution;

- Energy Affordability: deploying tools and optimizing electricity grid assets to reduce costs and address inadequate distribution infrastructure burdens;

- Job Creation: expanding access to NYSERDA’s comprehensive workforce development services for skilled clean energy workers.

DOE Proposes Circumvention of Environmental Rules to Speed Grid Modernization

- In the presence of clogged interconnection queues that have been delaying new renewable energy projects by as much as five years, the DOE has submitted a plan that would speed up the completion of certain solar, storage, and transmission projects on federal lands.

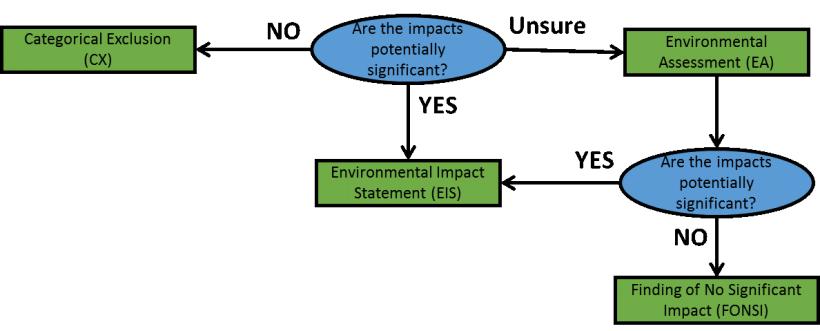

- Projects could qualify for a “categorical exclusion” from the National Environmental Policy Act, removing the requirement for projects to complete environmental impact statements. These exclusions are granted when the DOE determines that a project does not have a significant effect on the human environment. See below for a flowchart detailing the NEPA review process.

Source: US DOE

- The proposed plan would expand what falls under “excluded” to include certain types of energy storage systems, powerlines over 20 miles in length seeking upgrades, powerlines seeking relocation within existing disturbed lands, and solar PV systems seeking installation, modification, operation, or decommissioning in previously disturbed lands.

- As the United States incentivizes construction of renewable generation projects through programs such as the IRA, significant transmission upgrades will be required in a short amount of time if the Biden-Harris administration is to meet its goal of a decarbonized energy sector by 2035. Matching generation incentives with transmission incentives is necessary for transmission to keep up with its generation cousin.

- Lawmakers and regulators have been under increasing pressure to help free-up notoriously long interconnection queues. Renewable energy projects tend to be much smaller than conventional power plants, so they now represent 80% of projects in the interconnection queue. Environmental Impact Statements have long been the subject of complaints from the development community. On average, they now take about 2 years to complete and are over 1,000 pages in length. While addressing long-overdue modifications to this process is likely worthwhile, it's possible that doing so at the expense of the environment may be antithetical to the purpose of renewable generation in the first place. However, revisiting the cost vs. benefit of environmental impact reporting may bring worthwhile upgrades to the interconnection process that would expedite net reliability gains with what could, for small projects on existing disturbed land, end up causing little to no environmental harm.

A Major Rate Case in California

- The California PUC approved a $13.5 billion rate case for PG&E last Thursday, an 11% increase from PG&Es $12.2 billion revenue requirement in 2022.

- Some notable provisions of the settlement include:

- $1.3 billion partitioned to vegetation management (i.e., wildfire prevention)

- Undergrounding 1,230 miles and insulating 778 miles of transmission lines (in an effort to minimize wildfires)

- $2.5 billion of delivery system capacity upgrades to support electrification and EV charging

- The original proposal by PG&E sought a $15.4 billion revenue requirement (+26%), but the final agreement landed on the $13.5 billion figure (+11%) and customer bills can be expected to increase by a similar factor. PG&E officials highlight the plan’s balance between “affordability, feasibility, safety, and reliability.”

- The plan to underground transmission lines comes after the passing of California’s Senate Bill 884, which requires the CPUC to work with large utilities to expedite the undergrounding of distribution infrastructure.

- Additionally, under SB884, PG&E and other large utilities are required to submit a 10-year undergrounding plan to increase reliability and public safety in the wake of the 2018 Camp Fire, which resulted in the company’s $58 billion bankruptcy.

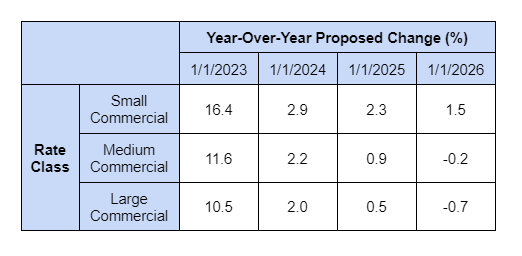

- See the proposed year-over-year bill impacts for commercial customers below:

Natural Gas Storage Data

Source: US EIA

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.