Energy Markets Update

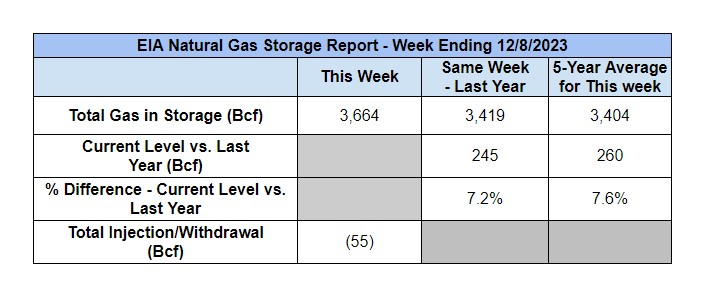

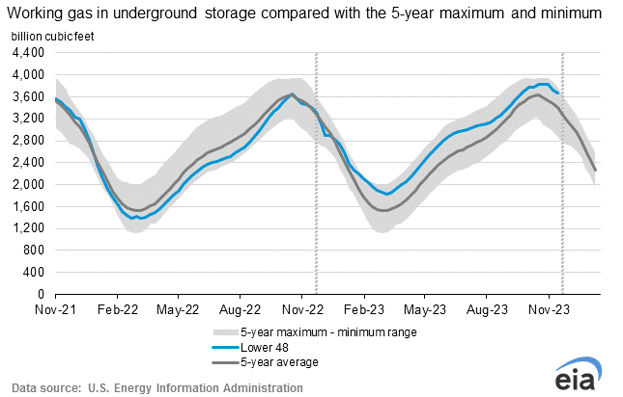

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage decreased by 55 Bcf. The five-year average withdrawal for December is about 91.2 Bcf. Total U.S. natural gas in storage stood at 3,664 Bcf last week, 7.2% higher than last year and 7.6% higher than the five-year average.

US Energy Market Update

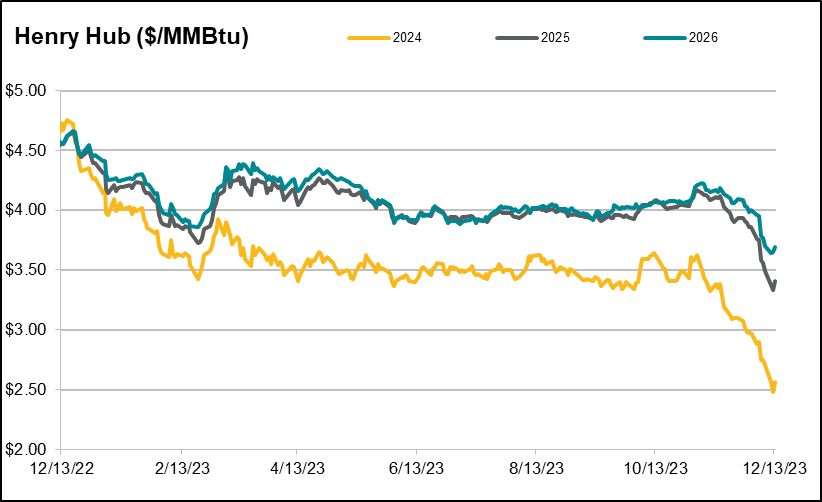

- We’ve opined for months now that strong supply side fundamentals in the gas market did not support hefty price premiums in 2024, and that something had to give in order to make sense of near term price weakness with longer term strength.

- The last month has proved this out. The 2024, 2025, and 2026 calendar year strips for NYMEX gas are down 23%, 17%, and 11% respectively.

Source: S&P

- This is the largest move of the year and really the first time we have seen any material change in the 2025+ market since February 2023.

- For buyers, we think this represents the best opportunity to hedge baseline energy costs in over 2 years.

- Some of the key drivers behind the lower price movement include bearish weather reports, slowly increasing production, and anticipated delays of major LNG export projects currently under construction.

- NOAA’s 2 week and month out forecasts are considerably warmer than average and the El Niño Nino pattern remains intact – typically indicating warmer temps and more precipitation.

- Owners of the Golden Pass LNG export project in Texas recently announced that Train 1 of that facility (~0.7 Bcf/d) would be pushed from late 2024 to the first half of 2025.

- In general, our assessment is that spot prices will invariably remain depressed over the next year. However, there are still credible risks to the supply side in late 2025 and 2026. First, LNG export capacity is expected to increase between 4-5 Bcf over this timeframe. Second, price suppression now could result in a stronger price correction in the future if it pulls producers out of the field.

Source: NOAA

Key Takeaways from COP 28

- COP28 is a United Nations conference that meets yearly to discuss climate change and global coordination to address its impacts for the upcoming years. This year’s conference, which was held in Dubai, wrapped up this week.

- The conference was attended by Veolia’s CEO, Estelle Brachlianoff. She attended the opening conversation on Partnerships for Climate Resilience and called for the collaboration between the private and public sectors to accelerate the clean energy and water transition. Read more about Veolia’s work on climate change here.

- A major highlight of the conference was an agreement reached by participating countries to reduce global consumption of fossil fuels. The agreement calls for the “[transition] away from fossil fuels in energy systems, in a just, orderly and equitable manner...so as to achieve net zero by 2050 in keeping with the science.”

- An earlier draft calling for the “phase-out” of these fuels was met by opposition from countries representing OPEC.

- While this does represent the first consensus on restrictions of fossil fuels, there is well-placed skepticism around the overall impact of the language. What makes this policy different however, is that nations are called to accelerate the implementation of such policies to triple renewable generation by 2030 while embracing carbon capture and energy storage.

- Other meaningful resolutions include:

- A nuclear agreement signed by 22 countries (including the US) to triple nuclear capacity by 2050. This is a meaningful shift as it acknowledges the elephant in the room for the first time at COP, i.e., the huge role that nuclear must play in any solution.

- Implementation of a “loss-and-damage” fund aimed at compelling large economies to finance renewable projects in developing economies.

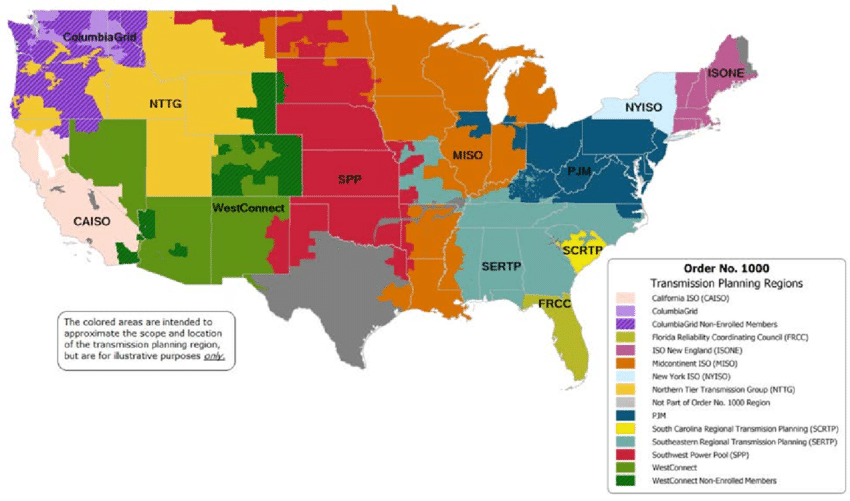

PJM Capacity Market Changes Approved

- A Federal appeals court accepted an overhaul to PJM’s capacity market after months of deadlock at FERC. The ruling is generally supportive of renewable energy’s participation in the capacity market. The court also ruled that the absence of an official order of PJM’s tariff proposal from September 2021, which automatically became law after FERC’s deadlock, are an official agency action that a court can rule upon. This precedent will likely streamline legal consensus in a divided FERC.

- FERC has been in deadlock due to disagreement on whether or not the previous market rules caused price suppression due to favoritism of renewable resources over fossil fuel generators.

- The disputed rule changes replaced a previous construct that came from a FERC order in December 2019, known as the minimum price offer rule (MOPR). In response to FERC’s order, Dominion Energy’s Virgina subsidiary left PJM and New Jersey and Maryland threatened to follow suit. The disputed overhaul, referred to as the focused MOPR, is meant to address concerns from New Jersey and Maryland about the previous system.

- To come to its ruling, the court relied on a joint statement from former FERC Chairman Richard Glick and Commissioner Allison Clements, which gave a reasonable legal basis for PJM’s changes to FERC’s 2019 order. Some argued that since the joint statement was not an official FERC order it should not hold precedent, but the three judges ruled that the statement highlighted why there was deadlock which led to the order becoming law.

- Some have lauded this ruling as paving the way for judicial review of tariffs moving forward, which could be helpful since a four member FERC in deadlock is not a rare occurrence.

An Update of FERC’s Overhaul of Transmission Planning Rules

Source: FERC

Source: FERC- There is general consensus that transmission infrastructure needs to grow considerably and that the planning and development process needs to be shortened.

- The US Department of Energy (DOE) published a draft needs study in March, indicating a potential doubling of transmission capacity by 2040. Princeton University and the Massachusetts Institute of Technology researchers estimated that capacity may need to double or triple by 2050.

- The DOE also received funding for transmission programs through the bipartisan infrastructure law and the Inflation Reduction Act, launching new rulemakings for faster project approvals.

- In August, the DOE proposed a rule to expedite permitting for high-voltage transmission lines, potentially reducing the process from 17 to 4 years.

- Sometime over the coming months, FERC is expected to release a landmark transmission planning overhaul that could accelerate the permitting and approval process for transmission build outs.

- April 2022 saw FERC propose a comprehensive overhaul of regional transmission planning rules and cost allocation. The proposal allows incumbent owners to build facilities with unaffiliated partners without a bidding process. This is supported by utilities but opposed by consumer-oriented groups, the US Department of Justice, and the Federal Trade Commission.

- FERC's proposed rule highlights potential benefits like reduced outages, lower congestion charges, and access to cost-effective generation. In a December 7 letter, Exelon, Pacific Gas & Electric, Xcel Energy, labor unions, and environmental groups expressed their support for FERC's proposal, urging the adoption of transmission planning rules that grant incumbent owners a right of first refusal.

- The group emphasized the need for dispute resolution processes, consideration of advanced technologies in planning, and transparent procedures for those affected by transmission projects. Acting FERC Chairman Willie Phillips aims to advance a final transmission planning rule promptly, potentially strengthened by the expected departure of FERC Commissioner James Danly, who opposed the proposed rule.

Massachusetts Regulator Rebuffs Hydrogen and RNG As Long Term Solution

- Massachusetts regulators issued an order shifting focus away from renewable natural gas (RNG) and hydrogen as primary alternatives for reducing greenhouse gas emissions, instead emphasizing electrification, demand-side gas reductions, and networked geothermal districts.

- While RNG and green hydrogen are allowed to help gas utilities meet climate goals, the Department of Public Utilities (DPU) mandated that these options be supplemented with additional efforts to achieve decarbonization targets, rejecting the inclusion of RNG in gas supply procurement plans due to concerns about cost, availability, and its uncertain status as a zero-emissions fuel.

- The DPU reviewed eight potential decarbonization pathways for gas utilities aiming for a 90% reduction in greenhouse gas emissions from 1990 levels by 2050 with interim targets of 50% by 2030 and 75% by 2040, emphasizing flexibility and a regulatory framework that protects consumers and promotes equity.

- The DPU expressed support for network geothermal projects and targeted electrification and noted that green hydrogen may have a role in specific sectors and isolated applications. The order emphasizes the need for utility investments to align with state climate goals and discourages further expansion of the natural gas distribution system. It also emphasizes the need to consider ratepayer impacts.

- The order established considerations for future proceedings on environmental justice and equity, suggesting that legislative changes may be necessary for regulators to take a more assertive approach in meeting state climate goals. It specifically applies to investor-owned gas utilities, excluding municipal ones, with Eversource Energy expressing gratitude for the open, transparent process and environmental groups applauding the focus on electrification for achieving climate goals while emphasizing affordability and equity during the transition.

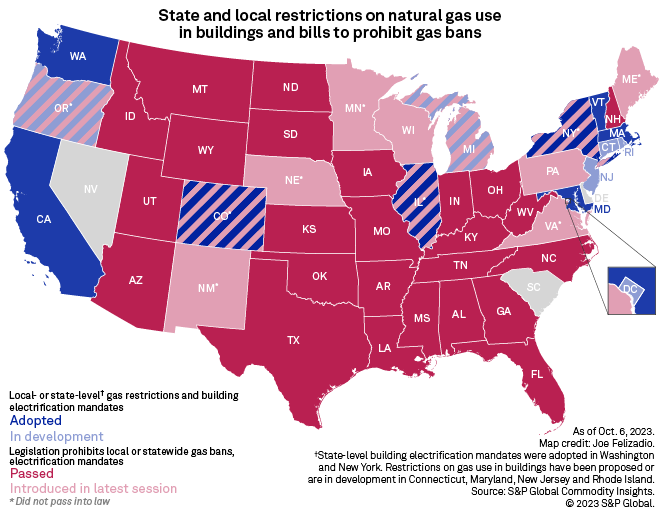

Washington State All-in On Heat Pumps

Source: S&P

Source: S&P- The Washington State Building Code Council (SBCC) adopted building code changes on Nov. 28, making electric heat pumps the baseline technology for new residential and commercial buildings. Developers using fossil fuel heating systems must incorporate additional energy-saving measures to match heat pump efficiency, if they chose not to use heat pumps.

- In September, the SBCC modified building code updates in response to a US Court of Appeals opinion that deemed the federal Energy Policy and Conservation Act (EPCA) preempted a 2019 gas ban in Berkley, Calif. This jeopardized the SBCC's original mandates due to their location in the 9th Circuit.

- To comply with EPCA, the revised SBCC proposals allowed fossil fuel heating but strongly discouraged its use. The adopted code changes require buildings with fossil fuel heating to earn additional credits for code compliance through weatherization and energy efficiency interventions, not required in electrically heated buildings.

- Opponents argued that the revised proposals did not address EPCA preemption. Some stakeholders urged the SBCC to skip the 2021 code update and adopt the regularly updated 2024 International Energy Conservation Code instead. Concerns were also raised about the policy's impact on small businesses.

- The gas industry, housing-related sectors, and labor unions have filed lawsuits to block gas use restrictions across the US. They argue that gas bans and electrification mandates conflict with federal-level EPCA regulations on energy efficiency and appliance use.

New York Expedites Request for Renewables

- In light of recent headwinds in the offshore wind industry, the New York State Energy Research and Development Authority (NYSERDA) has released an accelerated request for proposals in an effort to bolster the state’s renewable energy action plan.

- The solicitation is open to both onshore and offshore renewable generation projects, not just offshore wind. All developers are encouraged to bid, even if they have petitioned the state to raise offtake prices from previously approved projects.

- This procurement comes on the heels of the state’s approval of 6.4 GW of renewable generation in October. NYSERDA hopes that this expedited procurement will harness the momentum of the renewable approvals.

- Fortifying the renewable generation capacity in New York offers greater assurance that the state will be able to meet its goals of having a 70% renewable resource mix by 2030 and 9,000 MW of offshore generation by 2035.

Natural Gas Storage Data

Source : US EIA

Source: US EIA

Market Data

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.