Energy Markets Update

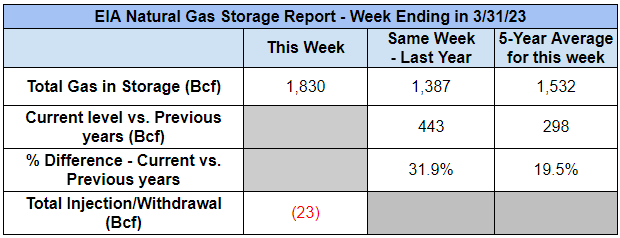

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage decreased by 23 Bcf. The five-year average withdrawal for March is about 48 Bcf. Total U.S. natural gas in storage stood at 1,830 Bcf last week, 31.9% higher than last year and 19.5% higher than the five-year average.

US power & gas update

-

Spot markets continued to bottom out as temperatures increased across the US. The notable exception is again the West Coast, which continues to wade through historic levels of precipitation, cooler temps and higher prices.

-

The one upside on the West Coast is that hydroelectric resources are now at peak capacity, which could help to stabilize prices over the next year.

-

Prices in 2024, 2025 and 2026 remain strong despite short term discounts.

-

With the Freeport LNG export facility back online, the US reached a daily LNG export record last week at slightly higher than 14 bcf. This level is not expected to increase materially for the next couple of years.

-

Fallout from the late December 2022 winter storm continues to roil the generator community, particularly in PJM which expects to dole out $2billion in penalties for a two day non-performance event. A few generators have recently sought bankruptcy protection and/or rate relief through FERC. The primary takeaway is that the “capacity performance” mechanisms developed by the grid operators simply failed to do what they were supposed to.

-

OPEC+ cuts oil production by 1M bbl/d. This could prompt growth in US production, further depressing natural gas prices in the near to mid-term.

Source: NOAA

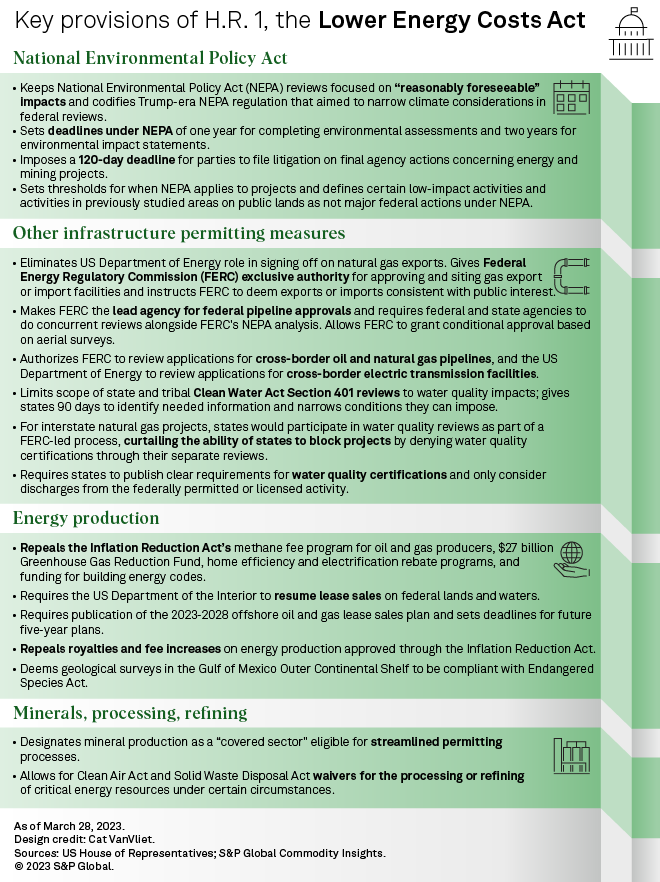

NEPA permitting updates and the Lower Energy Cost Act

- The GOP controlled US House of Representatives recently advanced the Lower Energy Costs Act, which aims to streamline infrastructure permitting and related regulatory policy in the US. Most House Democrats rejected the proposal, but four voted with Republicans to move the legislation to the Senate.

- This legislation takes similar measures to legislation Senate Democrats attempted to pass in the last Congress, but with the addition of stripping measures introduced in the Inflation Reduction Act (IRA). Most of these measures removed through the Lower Energy Costs Act repeal fees levied against oil and gas companies for emissions. It would also remove some incentives for residential upgrades to energy systems and electrification.

- Most fundamentally, the bill would change the process used for permitting created through the National Environmental Policy Act (NEPA). These changes include placing time limits on reviews for environmental impact and would implement deadlines for challenges to energy related projects including mining. NEPA is widely regarded as an administrative deathknell for many projects, even renewable energy projects.

- According to the Federal Highway Commission, the final reports average 742 pages and take 7.37 years to complete.

- This legislation is not likely to pass in the Senate and President Biden has stated that he will veto it if it makes it to his desk. This is mostly due to the repeal of the IRA measures and lack of measures to reduce emissions in the energy sector, so it is possible these will be negotiated.

- Senate Democrats and the President have said that they would like to reach a bipartisan agreement on permitting legislation, but the current form of this legislation is not that.

- Between federal and state permitting, transmission projects can take 15+ years to be approved before any construction takes place. There is purportedly as much as 1300 GWh of renewables and storage backlogged in regional interconnection queues as well.

- The Lower Energy Costs Act did not address transmission cost allocation and instead gave the Federal Energy Regulatory Commission more control over siting for these projects.

- Transmission development advocates have called for, amongst other things, an investment tax credit for large transmission projects, larger scale transmission planning, and support for the SITE Act that was introduced last congress that made transmission projects a national priority.

OPEC Surprise Cuts Causes Price Surge

-

Brent crude prices surged 6% following surprise production cuts by some of the world’s largest exporters – namely Saudi Arabia, Iraq, and Russia among other OPEC+ members.

-

The oil cartel, which currently accounts for ~40% of the world’s oil production, is collectively slashing their daily output by over 1,000,000 barrels starting in May. The cut accounts for about 1% of daily global production.

-

The move comes as a complete shock; until this point, Saudi Arabia and other Gulf states have maintained that their output would remain the same.

-

The move has compounded concerns over inflationary pressures, as well as the impact that a higher price of oil would have on supplementing Russian President Vladimir Putin’s war chest.

-

Going forward, legislation that limits OPEC’s influence on oil markets and gives the Justice Department tools for resiliency will be pushed back into the spotlight.

-

Just last month, the No Oil Producing and Exporting Cartels (“NOPEC”) bill – which would enable the US government to sue OPEC members manipulating the oil market – was reintroduced to the Senate Judiciary Committee.

-

Increased calls for this kind of legislation will be key to mitigating the consequences of OPEC’s unreliability and growing discooperation with US interests.

-

Standard Service Offer Rates Across Ohio Are Scheduled For Significant Increases in June

- Utilities in many parts of Ohio set their Standard Service Offer (SSO) rate for electricity through a two step annual auction process. The upcoming SSO (known as default service rate in other regions of the country) was recently established through two auctions held in November 2022 and March 2023. The new SSO will take effect in June 2023.

- During both of these auction rounds, wholesale electricity prices were elevated compared to where the wholesale forwards market is currently clearing. Prices during the November 2022 auction were especially notable due to their elevated pricing, which represents close to half of the newly weighted rate customers can expect to pay from June onward.

- A recent announcement on the upcoming SSO rate increase from AEP Ohio attributed the higher costs to global demand, global supply chain issues, economic uncertainty, and the continued war in Ukraine. AEP Ohio noted that customers should expect the supply portion of their bill to increase by 28% from aout 7.4¢/kWh to about 10.3¢/kWh.

- Customers of FirstEnergy Utilities, Ohio Edison, Toledo Edison, The Illuminating Company, and Duke Energy should all expect a similar if not more severe increase than AEP Ohio customers.

- Commercial customers are encouraged to consider competitive offers from third-party suppliers to take advantage of decreased market rates from when the SSO auctions were held.

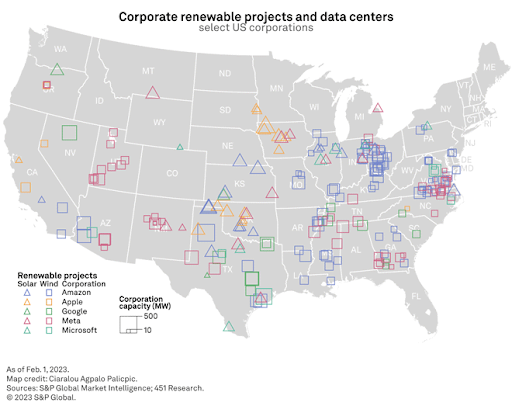

Datacenter Renewable Buying Spree

- US wind and solar capacity contracted to datacenter providers hopped over 50% to 40 GW (two thirds of the total US corp renewables markets).

- Hyperscalers, such as, Amazon, Apple, Google, Meta and Microsoft, rely on datacenters for commercial success. Accounting for over 45 GW of corporate renewable purchases globally.

- According to S&P Global Commodity Insights, hyperscalers have accumulated roughly 57% of the global corporate wind and solar capacity.

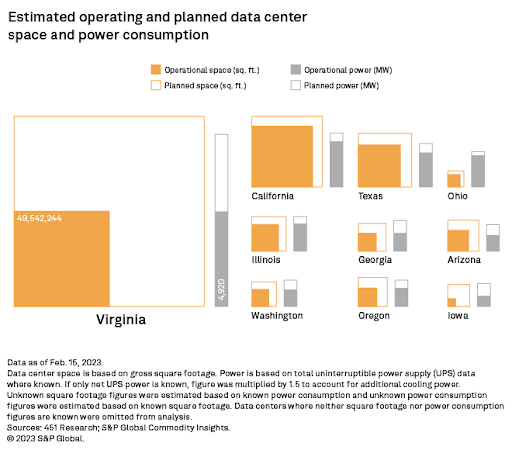

Datacenters by Market:

- Virginia remains the dominant datamarket hub with ~50 million square feet of gross operational space.

- California ranks second in operational datacenter power at 2.3 GW, though the state has a relatively moderate 1.3 GW of corporate renewable capacity currently contracted.

- Texas has 1.8 GW of operating datacenter capacity and another 500 MW planned.

- The Southeast is emerging as a major datacenter market. Georgia ranks second, behind Virginia, in planned datacenters by power consumption at 679 MW.

- Iowa ranks third in planned datacenter power capacity, with 666 MW. Meta, Google and Microsoft have an increasingly strong presence in the state, with a total of 19 facilities in development or online.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.