Energy Markets Update

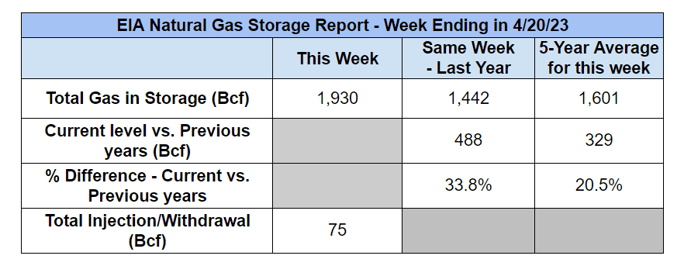

Weekly natural gas inventories

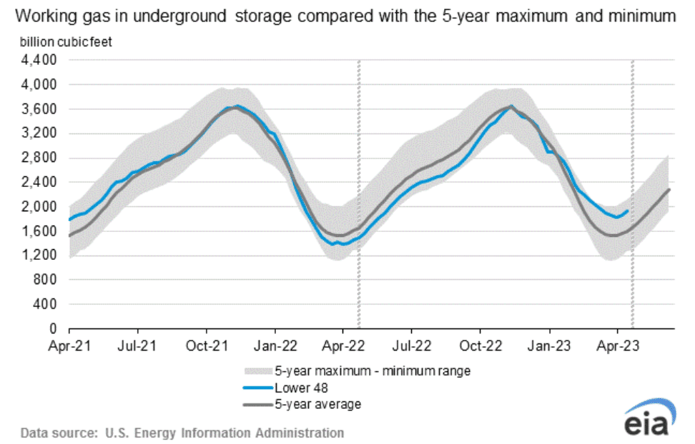

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 75 Bcf. The five-year average injection for April is about 47.5 Bcf. Total U.S. natural gas in storage stood at 1,930 Bcf last week, 33.8% higher than last year and 20.5% higher than the five-year average.

US power & gas update

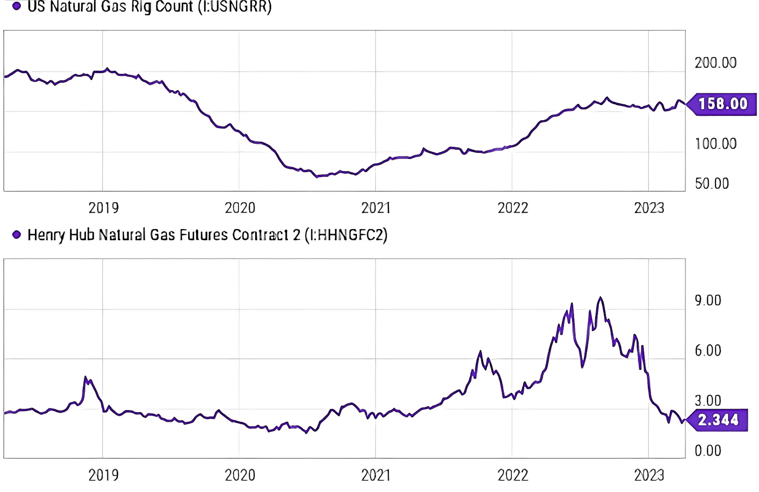

- Cooler temps and strength in the LNG export market have buoyed gas prices off their February lows, however the balance of 2023 remains extremely bearish. Spot prices continue to scrape the bottom.

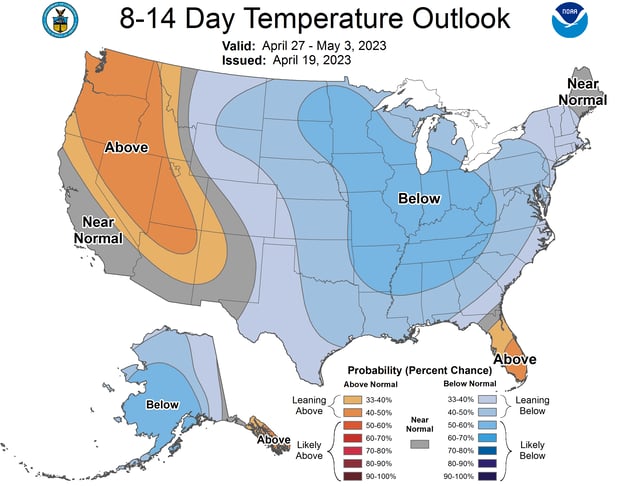

- Near-term temperatures forecasts show chilly weather keeping up through the end of April.

Source: NOAA

- After rallying back +10-15% at the end February, Calendar year strips for 2024 and beyond have remained mostly stable although with a modest downtrend.

- Power forwards remain especially stubborn and may break downwards in the coming weeks if gas prices remain range bound. We have seen this trend repetedly in 2023; power prices are not falling in lockstep with gas and can be delayed by weeks during a downturn.

- The market is still seeking the balancing point between some conflicting data; short term surplus of gas in storage vs relatively stagnant rig counts and production. The latter should result in tightening. The crucial question remains: when?

Source: Seeking Alpha

- There seems to be universal consensus that gas and power commodity benchmarks will broadly remain inexpensive over the next year. It is the 25% premium currently baked into Q4 2024 and after that is up to difference of opinion.

- PJM has again proposed to delay its capacity auction scheduled for June, which would have cleared capacity for the 2025/2026 year. PJM seeks additional time to make market reforms needed to better align with reliability goals.

- An interesting set of bills passed the Texas Senate last week (SB 6 & 7). The legislation would have taxpayers fund 10 GW of new gas-fired generation to provide power during scarcity and emergency conditions. The “free market” advocates are reliably up in arms but after watching the abject failure of the market mechanisms to provide sufficient reserves in just about every region over the past two years, many aspects of the proposal seem quite sensible.

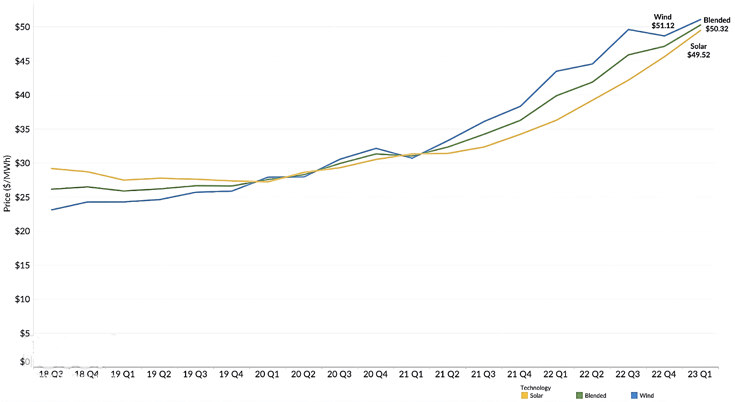

- According to data from LevelTen, reported on EvWind, the average cost of North American power purchase agreements (PPAs) for renewable energy rose 6.6% in Q1 2023. Solar PPA prices were up 8.5% and wind prices increased 4.9%.

North American P25 PPA Price Index

Source: Level Ten Energy

PJM plan to modify renewable energy capacity values approved by FERC

- FERC accepted a pending proposal from PJM to change the capacity values of renewable energy resources bidding into PJM capacity auctions.

- This proposal changed the allocation of capacity interconnection rights (CIRs) through a new framework coined effective load-carrying capacity (ELCC). ELCC is designed to better integrate renewables and storage into capacity markets as more of these resources are added every year.

- One of the biggest losers of the new rule would be distributed solar because the new capacity injection capability calculation would account for actual production during previous summer and winter periods whereas the previous paradigm was based on summer-only capability.

- PJM decided to make this change with the continual increase in intermittent renewable resources and the increased decarbonization goals of states under PJM’s purview. Changes mean that the CIRs for renewable resources will be increased to more accurately reflect their historical performance with adjustments for transmission constraints.

- FERC Commissioner Allison Clements was the sole dissenter claiming that the proposal left little time for resource owners to make a change to their CIR totals. She asserted that it also further clogs up the already well behind PJM interconnection queue. In addition, Clements stated that the way ELCC works assumes storage and similar resources will focus on grid reliability instead of local reliability, which is likely the reason they were installed in the first place.

California rule changes improve reliability while making solar more expensive

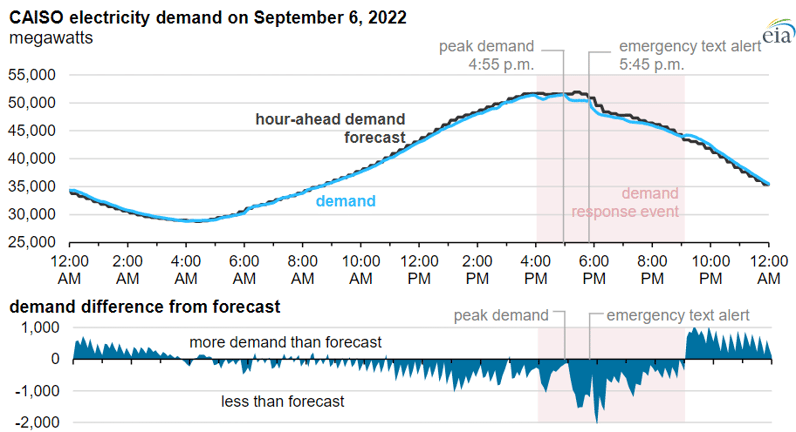

- Following a series of blistering heat waves and back-to-back rolling blackouts last September that pushed CA’s energy grid to the brink, the Golden State is taking strides to improve resource adequacy and overall grid resilience.

- Dubbed the “worst day” policy, CAISO passed a new rule in early April that requires CA’s load serving entities to demonstrate they have enough capacity to meet the highest peak load forecast on the worst day of every month (i.e. whichever day experiences the highest hour of energy demand). Take last September’s heat waves as an example – demand peaked at record-shattering highs on September 6th, which became the month’s so-called worst day.

Source: EIA

- To meet this requirement, the state has plans to ramp up its capacity in the coming years. The PUC has decided to tack on an additional 4 GW of clean energy to its goal of 11.5 GW by 2026, a necessary move as CA inches closer to its net-zero-by 2040 target. Going forward, weaving decarbonization efforts into resource adequacy policies will be key to building a clean and reliable grid.

- The CA PUC has also been taking aim at other policies to better align incentives for renewable energy with overall grid resilience. A good example are the recent revisions to the net metering billing tariff at the start of April – NEM 3.0 – This was highly controversial and sent CA homeowners and the solar industry into a frenzy.

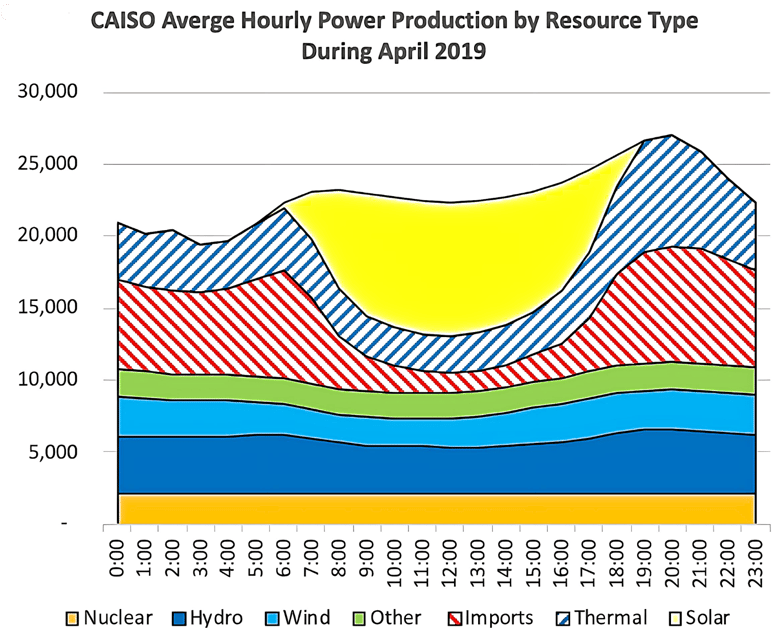

- Net metering has been fueling CA’s rooftop solar revolution for nearly three decades. The quantity of solar production on the CAISO grid is so significant that it weighs heavily into the state’s daily load forecast, planning, and overall reliability.

- The challenge is that solar generates an excess of energy in the middle of the day, but production abruptly collapses in the early evening, sometimes causing shortages that are difficult to plan around.

- The result: California subsidizes distributed solar high retail rates when the power is not needed or of low market value. In many hours it has a surplus that it sells to adjacent grids. It is then forced to buy back extremely expensive power later in the afternoon when solar is not available. This is bad policy and the rule changes could help correct the problem.

Source: Seeking Alpha

- Much to consumers’ dismay, the new NEM 3.0 policy features a major reduction in value for solar electricity, leading to less savings.

- Under the previous NEM 2.0 policy, solar owners were credited for the full retail value/kWh of electricity they contributed to the grid. Under NEM 3.0, export rates are closer to wholesale rates (as low as 3.32 cents per kWh recently).

- NEM 3.0 export rates are roughly 75% less than the rates under NEM 2.0, with the price of exports being much lower than the price of imports.

- These changes in net metering incentives reveal a new story in favor of paired solar and battery storage. The return for solar-only systems and paired solar/battery storage systems will be approximately the same under NEM 3.0., however.

- Even with NEM 3.0 taking effect, there are still energy cost savings to be had and although controversial, the revisions do control ratepayer cost and incentivize the industry to provide a more valuable product. Having a home solar system in CA still provides far better savings than most other states, and this could be a chance for utilities to pioneer a paired solar/battery storage revolution.

Germany moves to decommission last 3 nuclear reactors

- Last weekend Germany’s three remaining nuclear power stations shut down as the green party government followed through on plans that were a decade in the making.

- The closures stem from pressure on the government over safety concerns in the wake of the Fukushima disaster in Japan (March 2011) and the current and former German Chancellors, Scholz's and Merkel’s long-planned transition toward renewable energy.

- In the near term however, the shift takes 6.5% of the country’s emission free electricity generation offline bringing renewed attention to the country’s future plans for energy security and position as a leader in reducing carbon emissions in the region. Energy Policy makers in Germany will have to balance the growing electricity demands of Europe's largest industrial economy while still decarbonizing.

- In 2022 for example, coal still continued to account for the largest piece of Germany’s electricity generation mix at about 30%, followed by wind (22%), gas fired generation (13%), solar and biomass at (10%), and the remainder from hydro and nuclear. With the nuclear closures, these remaining resources will have to fill the gap.

- Many of Germany’s neighbors and allies had hoped that it would reverse its plans to decommission its remaining reactors in light of strategic supply risks brought upon by Russia’s invasion of Ukraine. However, dogma is dogma, and the loss of the reactors will invariably put the region at increased risk.

- Germany, like several other countries in the region including Italy, the Netherlands and France has created a push to develop more terminals to import liquefied natural gas.

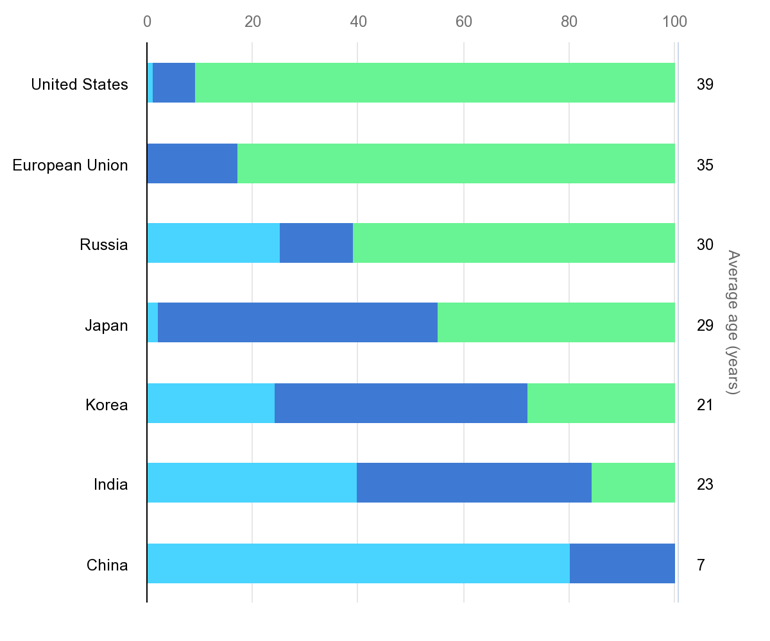

Age profile of nuclear power capacity in selected regions, 2019

Source: IEA

Source: IEA

- Beyond Germany’s closures the overall outlook for nuclear power seems bleak, even among other world leaders of nuclear production. Aging nuclear plants across the U.S. like Indian Point (NY) and Diablo Canyon (CA) are a challenge to decommission and replace. International disasters like Fukushima and Chernobyl have maintained a lasting impact on the safety perception for nuclear power as well, despite research showing that nuclear plants generate more reliable electricity than fossil fuels.

- Despite these trending plant closures across the globe, some promising advancements have been made both in the U.S. and abroad. For instance, earlier this year the Vogtle Plant in Georgia announced that Unit 3 successfully generated electricity and connected to the grid for the first time. Unit 4 is expected to be operational by the end of 2023, marking the U.S.’s first new nuclear openings in over 25 years.

- Meanwhile, across the pond in southwest England, the new Hinkley Point C plant is expected to come online in June 2027, albeit over-budget (by $3Bln) and behind schedule by over a decade. Taking a different tact in nuclear energy, British finance minister Jeremy Hunt announced last month that England would boost investment in nuclear power by launching a competition for small modular reactors (SMRs). SMR units like this are currently being developed by Rolls-Royce, one of England’s industrial jewels.

- Needless to say, it seems that Europe will increasingly turn toward nuclear, just not in Germany. Other nations such as India, China, and Saudi Arabia are clamoring for more reactors. The verdict in the US is still out.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.