Energy Markets Update

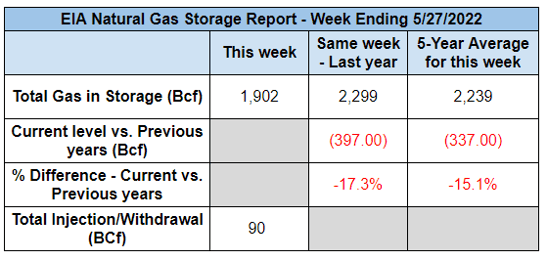

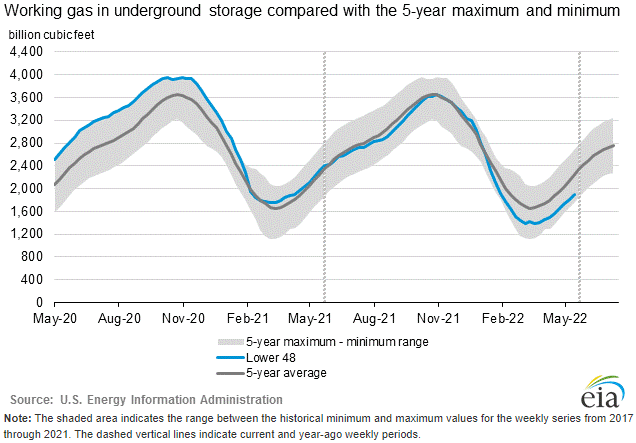

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 90 Bcf. The five-year average injection for May is about 91.5 Bcf. Total U.S. natural gas in storage stood at 1,902 Bcf last week, 17.3% less than last year and 15.1% lower than the five-year average.

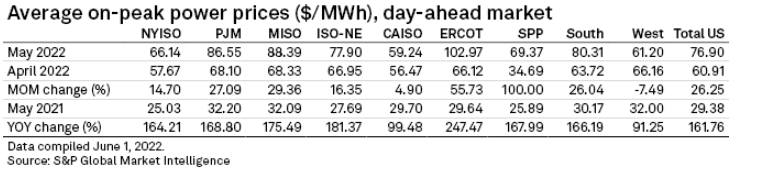

US Power & Gas Markets

- The average national price for day-ahead on-peak wholesale power surged 161.76% year over year in May. The largest increases occurred in Texas @ +247% yoy

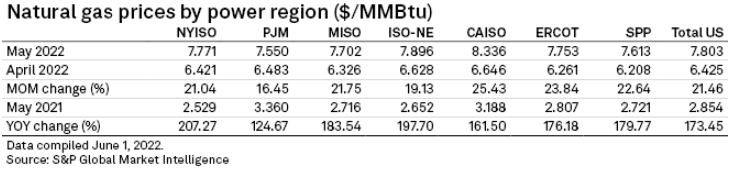

- If there were any doubts that the US power market is fully tied to natural gas, they have been trounced by the dramatic correlated jump in gas and power prices across just about every market in the nation

- With such a high reliance on gas-fired units at the margin, most restructured (aka clearing) markets will continue to settle rates that approximate the cost make power using natural gas

- NYMEX spot prices have been trading in proximity to $9 per MMbtu over the past week, their highest sustained levels during the latest short squeeze

- This can be expected to push most wholesale power markets to an average of around $90 per MWh in the final week of May and first week of June, a high-water mark in what would otherwise be considered a lower risk shoulder period

- There have been reports that the price of uranium, the fuel used in the nuclear power sector, has dropped 27% from its high in April due to a slowdown in investor buying and less concern over Russian and Ukranian supply sources. However, this lower cost will be captured by the owners of nuclear plants, which should have their strongest earnings in over decade

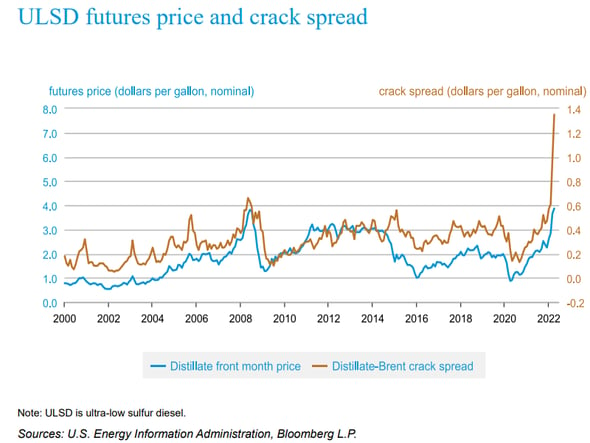

Gasoline, Diesel, and Runaway Crack Spreads

- Oil prices have maintained strength in the $100-$130 per barrel range since the start of the invasion of Ukraine on February 24. They are currently settling in the middle of that range

- Byproducts of crude oil such as gasoline and diesel are also lifted by high oil prices, but oil and derivative fuels are not always precisely correlated due to changes in refining capacity and other factors that influence the economics of converting or “cracking” a barrel of oil into refined derivatives

- In mid-May, the national average price for retail gasoline in the US retail broke $4.50/gallon for the first time ever

- US gasoline producers usually ramp up production ahead of the summer travel season, but this year inventories have fallen and are at their lowest levels since 2019

- Mexico and Latin America are also buying more US gasoline than usual and refineries are not able to close the gap due to lack of capacity and high input prices

- Some analysts predict that US gasoline inventories will fall to their lowest levels since the 1950s by the end of August if export and refining trends continue, which could buoy prices to more than $6/gallon

- Futures on CME indicate some relief in the refining premiums or “crack spread” after August, but this could easily change and the substantial crack spreads could be extended

- Diesel is in an even more dire situation with demand reaching an all-time high in Q4 of 2021 driven by explosive transportation demand looking to ease supply-chain woes

- Vehicles crucial to the global economy from trucks, trains, ships, excavators and other heavy machinery for construction need diesel to operate

- The war in Ukraine and subsequent embargoes on Russian exports are really squeezing the oil, gasoline, and diesel markets in Europe, which were already operating at a storage deficit

- The high price of natural gas, which is used in the diesel refining process, has also made it less economic for refineries to increase diesel production. Making matters worse, while gas prices have doubled from $4 to $8 per MMbtu in the US, they have traded from $30 to $70 per MMbtu in Europe. This makes European diesel more expensive (~$8+ per gal) than US diesel (~$5.50 gal) and further incentivizes imports from the US

- Many countries who could inject more oil into the market, such as China and Nigeria, are either unable to increase output or are attempting to save fuel at home by cutting exports

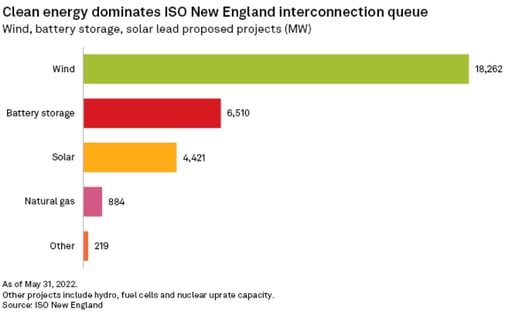

ISO-NE to Phase-Out Restrictive Capacity Market Rules

- The Federal Energy Regulatory Commission has approved an ISO New England proposal to eliminate a capacity market rule seen by critics as stymieing state clean energy policies

- ISO-NE operates a 3-year ahead auction to secure necessary capacity resources for the regional electric system. Generators that clear the auction received fixed reservation payments for capacity availability

- In 2018, FERC's Republican majority approved a two-step capacity market construct for ISO-NE that threatened to slow the integration of state-sponsored clean energy units. The existing policy in New England effectively blocks some renewable projects that receive state subsidies from clearing in annual capacity auctions

- After Democrat Richard Glick assumed the chairmanship in early 2021, he scheduled various technical conferences to explore a push forward for renewable energy

- FERC approved the ISO’s plan to eliminate the rule by 2025, which all else being equal should support growth of renewable generation and also have a bearish effect on capacity clearing prices

The Growing Pains of Utility-Scale Batteries

- Vistra Corp.'s Moss Landing Energy Storage Facility on California's Monterey Bay, the world's largest lithium-ion battery station, is set to resume commercial operations in June after distinct outages in February 2022 and September 2021

- The setback is one of more than 45 known failures at medium to large-scale battery storage projects across the globe over the past five years

- Advocates have touted battery technology as the panacea to the clean energy transition, specifically because of its ability to equilibrate the intermittent production of wind and solar, however it remains in its early stages. Deployed MWs are still quite minimal, the technology and its related supply chains have not yet proven that they are scalable from an operational or raw materials basis, and high profile failures do not help the cause. The cost of failure is high; the reliability of the future grid is at stake

- All players across the transportation and power sectors are exposed to the hazards of lithium-ion battery failure, from producers to product owners

- Battery safety experts say the string of failures is simply a law of numbers in an increasing technological sector

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.