Energy Markets Update

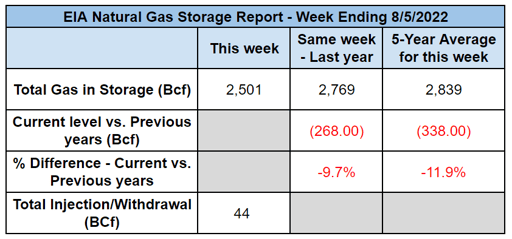

Weekly natural gas inventories

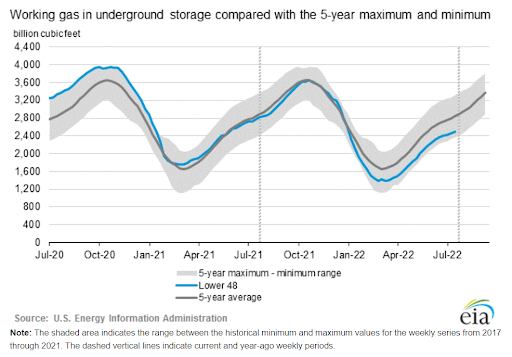

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 44 Bcf. The five-year average injection for August is about 46 Bcf. Total U.S. natural gas in storage stood at 2,501 Bcf last week, 9.7% less than last year and 11.9% lower than the five-year average.

US power & gas update

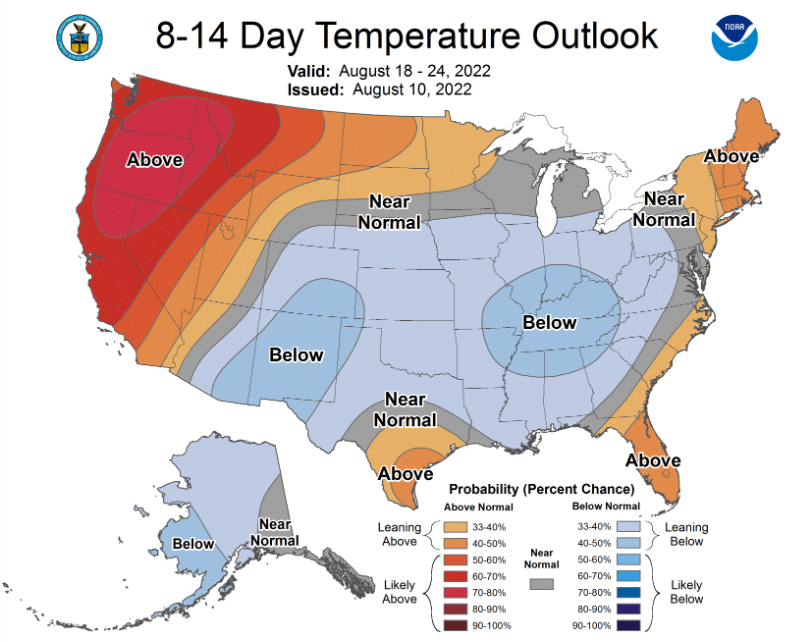

- Dips in forecasted temperatures across the country, particularly in the midcontinent region, have put downward pressure on the natural gas market.

Source: Climate Prediction Center - The Freeport LNG Terminal has reached an agreement with federal regulators to restart partial operations in early October. This means the natural gas market will lose approximately 2 Bcf per day that will be moved back to the LNG market. This has been pushing prices upward as traders price this supply loss into the market.

- Some forecasts show natural gas storage could possibly dip below 1 Tcf by the end of March 2023. 1 Tcf is widely considered the point where it will become more difficult to extract gas from the underground caves where it is stored due to a lack of pressure. The severity of the cold this winter will determine whether or not we reach this threshold.

- Gas storage numbers exceeded expectations for the second week in a row, coming in at 44 Bcf, 5 Bcf higher than the 39 Bcf expected by analysts.

US climate legislation expands clean energy incentives

- The Inflation Reduction Act, which was approved by the Senate on Sunday, pledges $369 billion in clean energy and climate funding over the next ten years. There are some stipulations to this funding depending on where materials are sourced from and where technologies are assembled.

- The bill increases federal tax credits for renewable energy initiatives for the next decade. For example, a solar project may receive a 30% investment tax credit (ITC) while meeting wage and apprenticeship requirements. Some projects could earn up to a 50% ITC.

- For solar development, production tax credits (PTCs) will be available for projects beginning this year. Geothermal and wind projects will receive an inflation-adjusted PTC of $26/MWh. These credits will phase out as greenhouse gas emissions in the US fall below 25% of 2022 levels.

- Hydrogen PTCs are also maintained from the Build Back Better bill, though these credits will phase out much more quickly depending upon the CO2 emissions from production.

Source: REPEAT Project, Princeton University - Energy storage systems will receive a 30% ITC. Rebates for purchases of used and new electric vehicles will range from $4,000 to $7,500, respectively. This will reinstate credits for manufacturers who have produced too many EVs to currently qualify for tax credits.

- Direct pay options for clean energy incentives will be available for tax-exempt and government agencies, an aspect of the legislation that has been heavily supported by many rural co-operative utilities.

- Commercial and residential buildings will see many energy efficiency tax credits. $9 billion is to be allocated to focus on the electrification of buildings that are currently reliant on fossil fuels. $4.5 billion will be allocated to an electric appliance rebate program for single and multi-family developments.

- A Princeton-led study called the REPEAT Project has predicted that the bill will cut up to $50 billion in energy expenditures by 2030. Minimization of fossil fuel use is expected to reduce the prices of crude oil by 5% and natural gas by 10 to 20% over this period.

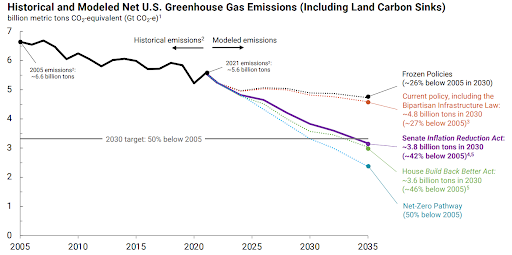

- The analysis foresees a reduction of 1 billion metric tons in greenhouse gas emissions by 2030, cutting emissions by 42% from 2005 levels. Other studies predict similar reductions in emissions.

Freeport LNG to be back online soon

- The Freeport LNG Terminal has agreed upon corrective measures to resume partial operations by October.

- The terminal, rendered temporarily inactive due to an explosion in June, is responsible for approximately 15% of US LNG exports. US LNG is vital to meet increasing European demand as a result of dwindling Russian gas supply.

- The agreement with the US Pipeline and Hazardous Materials Safety Administration (PHMSA) focuses on safety initiatives to restore full production capacity by the end of the year.

- Around 70 percent of Freeport LNG exports in the months preceding the accident went to the European Union. Restoration of the facility may have a large impact considering Europe’s desire to decrease their reliance on Russian gas.

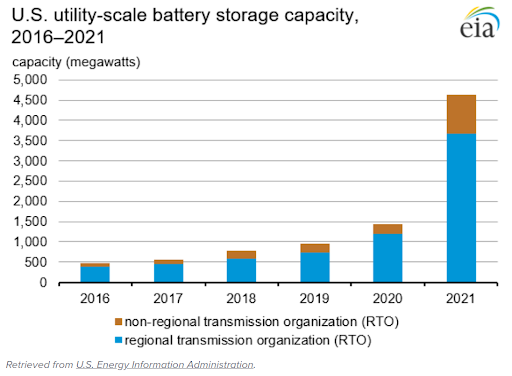

Energy storage to expand rapidly across the US

- Wood Mackenzie predicts that the US will add 54 GWh of installation annually to reach a total capacity of approximately 600 GWh by 2031.

- Energy storage installations are slowing in Europe, but have been ramping up in the US and China due to heavy incentives for energy storage systems. The US and China currently total 75% of global storage demand.

- US energy storage is expected to slow in the short term due to the ongoing solar panel dumping investigation since many storage systems are paired with solar installations.

- Wood Mackenzie estimates a 30% drop in US energy storage demand for 2022 and a 27% drop in 2023. This year, approximately 35% of hybrid installations (solar paired with storage) has been delayed.

- California and Texas make up half of the US energy storage market scheduled for installations over the next few years, with Nevada, Arizona, and New York as runner-ups in terms of states with the largest storage capacity.

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.