Energy Markets Update

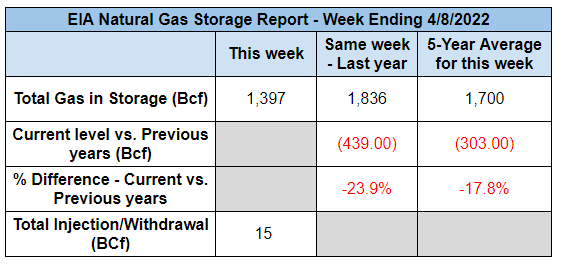

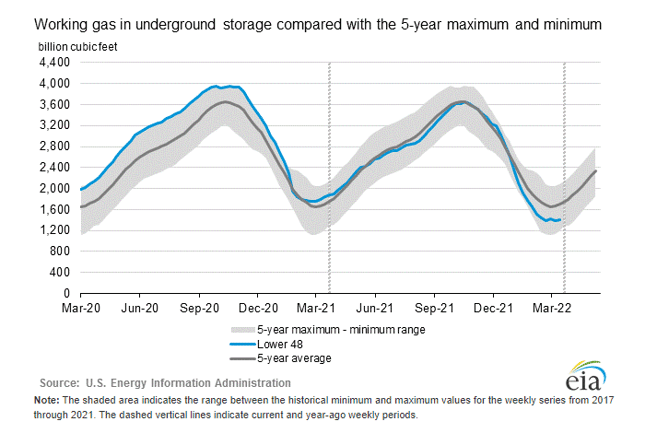

Weekly natural gas inventories

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 15 Bcf. The five-year average injection for April is about 42 Bcf. Total U.S. natural gas in storage stood at 1,397 Bcf last week, 23.9% less than last year and 17.8% lower than the five-year average.

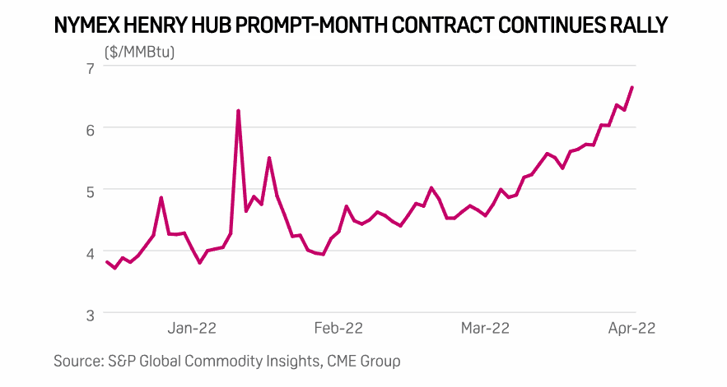

Prompt gas prices hit their highest levels since Nov 2008

- Prompt month prices for Henry Hub gas settled at $7.051/MMBtu on April 13

- This marks the highest prompt month price since November 2008 when markets were coming off of a historic rally (briefly surpassing $13/MMBtu the prior summer) after the bankruptcy of Bear Sterns and leading into a subsequent recession

- May's prompt month price has increased more than $1.50/MMBtu in the past two weeks alone. It has more than doubled in the past year

- Experts feel this may signal a return to high market volatility and supply driven pricing last seen in the early 2000's. We tend to agree that suppliers/marketers will drive the market in the near term, however the logevity of this market power will depends on how quickly producers can or choose to increase supply

- Coal has historically taken some pressure away from gas pricing, however stockpiles are low and delivered coal prices are also at a decade high. Many coal plants have also been retired over the past 5 years, leaving the sector less prepared to take the pressure off gas prices

- Strong LNG exports diminish the US supply and continue to contribute to increasing prices, although these are capped by a peak export capacity currently around 13 bcf/d. European gas prices are still significantly higher than the US, which should result in ongoing LNG exports at or near US peak export capacity for the foreseeable future

- Warmer weather and steady gas flows from Russia have seen European gas prices back off a bit in the past week

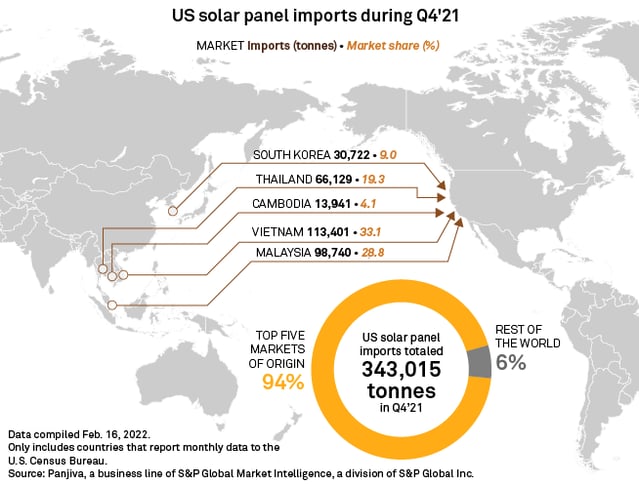

US solar industry reels after 'disastrous decision' to open tariff probe

- American solar companies are experiencing delays and cancellations in panel imports since the U.S. Commerce Department launched an investigation into tariff evasion by Chinese manufacturing companies

- The department is looking into whether Chinese manufacturers are assembling products in Southeast Asian countries such as Cambodia and Malaysia, using Chinese parts, in order to avoid import taxes

- Roughly 80% of panels installed in the United States are imported

- SEA countries counted for 85% of solar panel imports in the fourth quarter of 2021

- More than 90% of U.S. solar companies stated the investigation will have an overwhelmingly negative effect on domestic business in 2022

Pa. court blocks Gov. Wolf’s plans to join cap and trade program

- A Pennsylvania court blocked a key component of Gov. Tom Wolf’s plan to cut state carbon emissions by joining the Regional Greenhouse Gas Initiative (RGGI)

- RGGI is a cooperative, market-based effort among Northeast states to decrease carbon emissions from power plants via a cap and trade program

- The regulation would have required large fossil fuel-based power plants to pay a price for every ton of emitted carbon dioxide

- Republicans in the Pennsylvania legislature claim that the rule is considered a tax, and legally is unconstitutional as only the legislature can enact taxes

- The courts sided with the legislature who had failed to block it by parliamentary means, and stated that official publication of the regulation will be “pending further order of the court”

Talen Energy, Hit by Surging Gas Prices, in Talks for $750 Million Bankruptcy Loan

- Talen Energy is reportedly seeking loans for a potential bankruptcy as it discloses $4 billion debt

- Talen, owned by Riverstone Holdings LLC, struggled with added hedging costs from rising natural-gas prices, with the problem increasing due to Russia’s invasion of Ukraine

- The Texas-based company’s business is centered around power generation and distribution, but has also diversified into battery storage, data centers, and renewable power generation. It has also operated as a retail supplier in recent years.

- Talen power plant ownership is focused in central Pennsylvania, New Jersey, and southeast Texas.

- Talen Energy is in talks with lenders to take a loan of at least $750 million to carry the power producer through a planned chapter 11 filing

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.