Energy Markets Update

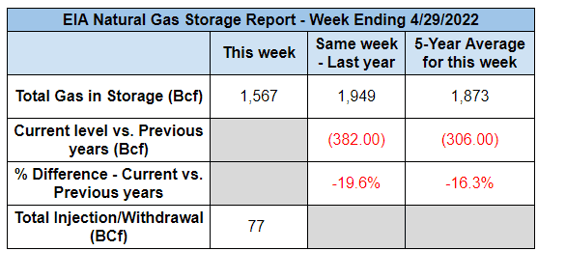

Weekly natural gas inventories

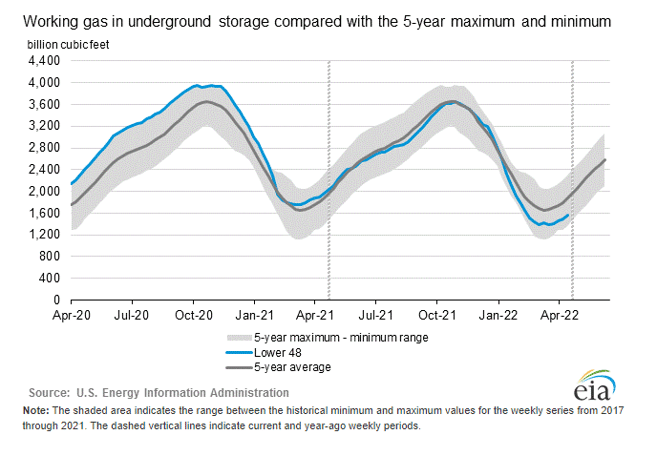

The U.S. Energy Information Administration reported last week that natural gas in storage increased by 77 Bcf. The five-year average injection for April is about 42 Bcf. Total U.S. natural gas in storage stood at 1,567 Bcf last week, 19.6% less than last year and 16.3% lower than the five-year average.

Eastern Power Markets

- Average spot prices in April settled at $64 per MWh in New England, $56 in PJM East, and $24 to $65 in New York State (North v South), all comparatively high for this time of year

- Spot prices over the past two weeks has been much more volatile as wholesale fuel inputs have seen daily changes of 15% and the generation market has been in constant flux around the margin

- The more troubling dynamic for those with short positions is that the balance of the 2022 forward ATC strip surged by about $25-30 per MWh over the past 5 weeks due to the increase in national gas prices (i.e., NYMEX) over the same period. The anticipated base cost of wholesale electricity has materially shifted up

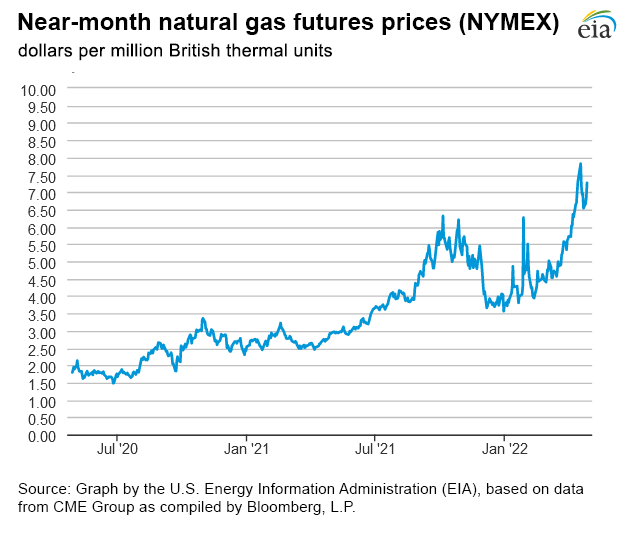

NYMEX Gas

- NYMEX gas has undergone unprecedented volatility in recent weeks with daily moves as much as $1.00 per MMBtu

- The forward 9 months are currently averaging $8.40/MMBtu, a 13-year high, but have dipped to lows in the $6.50/MMBtu range as recently as 4/22

- The U.S. added three rigs week on the week (+0.7% for the week), according to Baker Hughes’ latest rotary rig count, which was published on April 29

- Storage is currently 17% (345 Bcf) below the 5-year average

- U.S. gas production is surprisingly lackluster despite high prices; extraction rates in the first months of 2022 appear to have flat lined

- Between 2017 and 2018, natural gas production rose 12%, but between 2020 and 2021, production increased only 2%. The slowdown comes primarily from the Appalachia region, where gas production recoiled after the 2019 glut, but has also slowed due to infrastructure issues and diminishing returns on many wells

- The coal industry is booming. Delivered coal prices have more than doubled over the past 6 months, limiting the prospects of gas-to-coal switching, and stock prices of some of the major besieged mining units are up between 200% and 400% in the past 5 months

- Still, demand for US gas continues to rise. In fact, industrial gas demand is at an all-time high. Spreads between the US price ($7 per MMBtu) and Europe ($20-40 per MMBtu) have made US manufacturing extremely competitive despite high prices. The competitive advantage is quite apparent in industries such as fertilizer, which has tripled in price and for which natural gas is a primary feedstock.

Brent Crude

- Prices have been hovering between $100/bbl and $110/bbl over the past month, which appears to be the psychological balancing point awaiting the drop of the second shoe

- Oil has continued to be high and volatile since the war in Ukraine started and Russian oil was shunned

- The EU has proposed a complete import ban on Russian oil by the end of 2022

Propane

- Prices have recently been hovering around $1.30/gal over the past two weeks, down from $1.60/gal in March but considerably higher than the $0.50 -$1.00 trading range realized over most of the past 5 years.

- Delivered prices can be considerably higher due to transportation constraints

- Propane is an input into some crop prices as it is the primary fuel used by farmers for drying grain

Russia Cuts Gas Flows to Bulgaria and Poland

- Russia's largest gas company Gazprom cut off Poland and Bulgaria last Wednesday for refusing to pay in roubles. Russia needs the rouble-based payments to support its currency and ongoing war ambitions. It has threatened to follow suit with other nations

- Global LNG paused their post winter decline on fears that more countries could be hit, notably Germany, which last year bought more than half its gas from Russia and has thus far refused to pay in roubles

- The European Commission issued an advisory to EU countries last week outlining options that could allow EU buyers to continue paying for Russian gas without breaching sanctions

- EU Energy Commissioner Kadri Simson said on Wednesday that Brussels was still advising companies to stick to the terms of their contracts, which usually specify payment in euros or dollars, not roubles

- With global supply extremely tight, Europe is unlikely to be able to replace its Russian gas fully in the short term so much of Europe finds itself in a game of (frozen?) chicken

- Germany warned that it could go into recession if it were cut off from all Russian energy in the short term. In March, Germany cited legal and practical uncertainties for concluding not to extend licenses for roughly half of its 9.5 GW nuclear fleet, which it shuttering over the past year...a highly controversial decision

- JPMorgan reports that the next round of major payments are due in mid May, which could trigger additional actions from Gazprom.

- The largest gas importers of Russian gas are Germany (52 Bcm/yr), Italy (28.7), Turkey (26.3), and Netherlands (18.1), however from that list, only Germany and Italy have agreed to a phased ban on gas imports

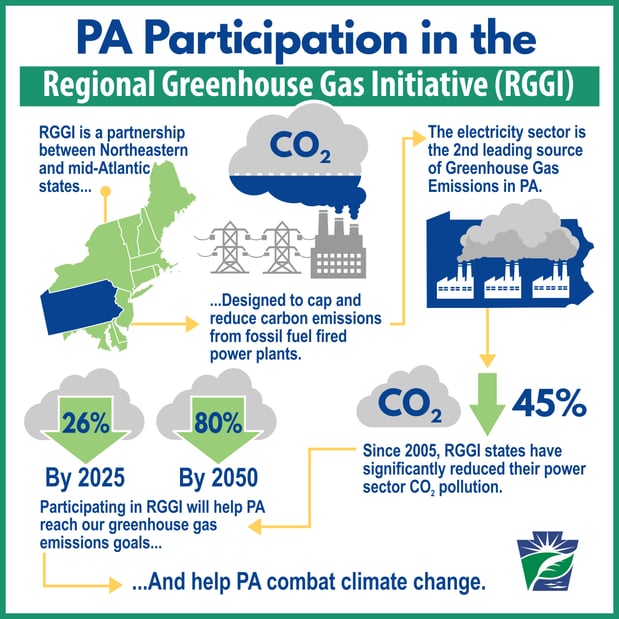

PA Integrates into RGGI Climate Initiative

- A rule allowing Pennsylvania to join the Regional Greenhouse Gas Initiative's cap-and-trade program was published on April 22 following months of delay and debate

- The state is now planning to join the market on July 1

- Pennsylvania's carbon trading program has stalled since November 2021 after Republican state lawmakers unsuccessfully attempted to strike down the plan through legislation and even legal routes

- Under the RGGI, power plants with a capacity of 25 MW+ must buy carbon dioxide allowances for each ton of carbon they release

- As the program's largest fossil fuel state by far, Pennsylvania will increase the impact of the program immensely

- The states participating in the RGGI market are Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia

Mass Municipalities Relying on Nuclear Contracts to Meet State Climate Goals

- A report from the Massachusetts Climate Action Network found that 33 municipal electricity providers had less than 1 percent of clean energy sources such as wind and solar in their 2020 mix

- Municipal light plants combined had about 420,000 customers as of 2019, providing roughly 14 percent of the state’s energy supply. They are exempt from the more stringent Renewable Portfolio Standards that public utilities must adhere to, however, they are required to comply with a Massachusetts GHG limits due to a law passed in 2021

- Despite the slow progress on cleaning their energy mix, many municipalities are still on track to reach emission goals, primarly due to contracts with nucelar plants

- The report found that 38 percent of the energy mix from municipal light plants is considered “non-emitting”, with the majority of this coming from nuclear plants based in New England, i.e. Seabrook

- The use of nuclear power is controversial, with some environmental organizations claiming that the danger of nuclear energy and nuclear waste should not be overlooked, while others see it as a pivot resource that is unfairly ostracized by the "solar and wind only" community

Natural Gas Storage Data

Market Data

Use the filters to sort by region

Market data disclaimer: Data provided in the "Market Data" section is for the newsletter recipient only, and should not be shared with outside parties.